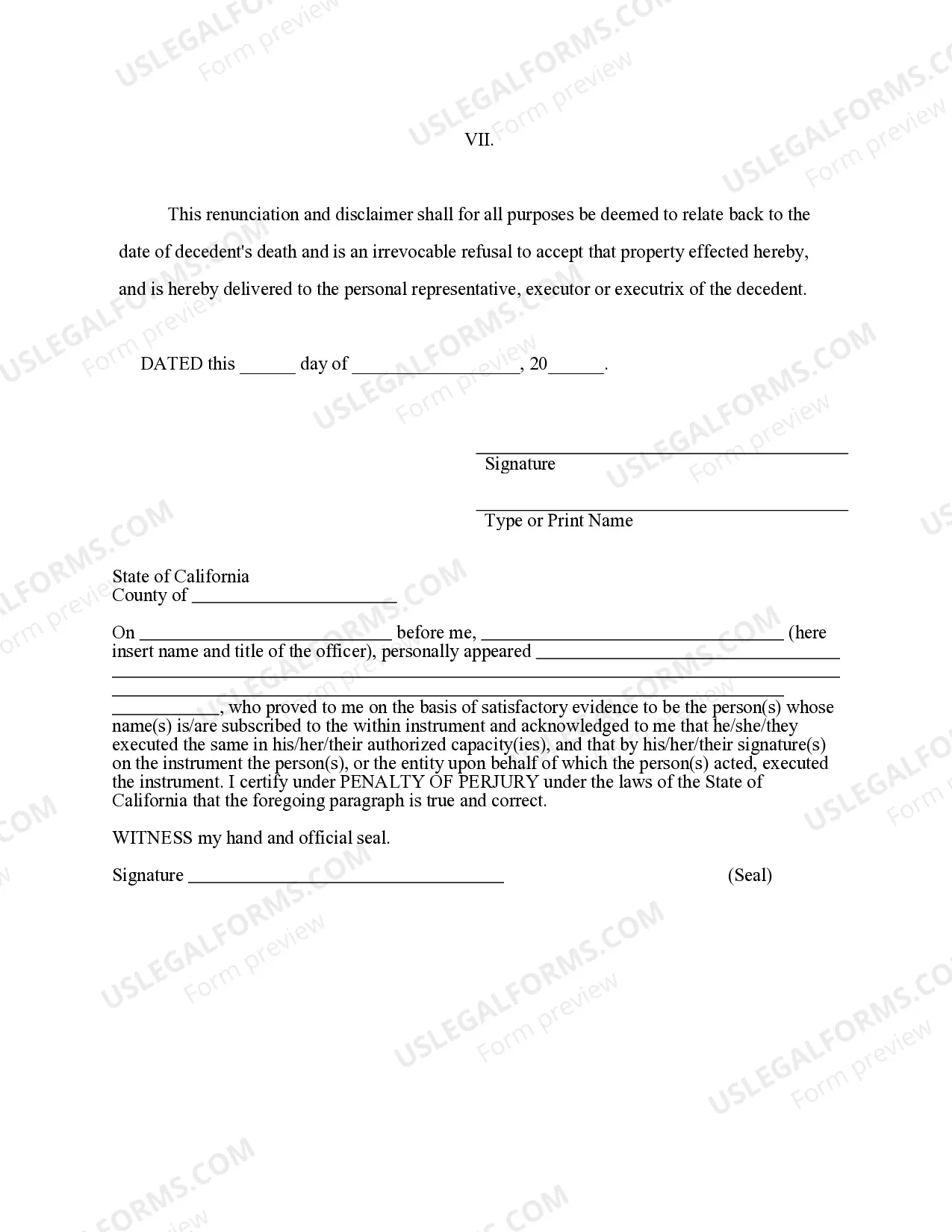

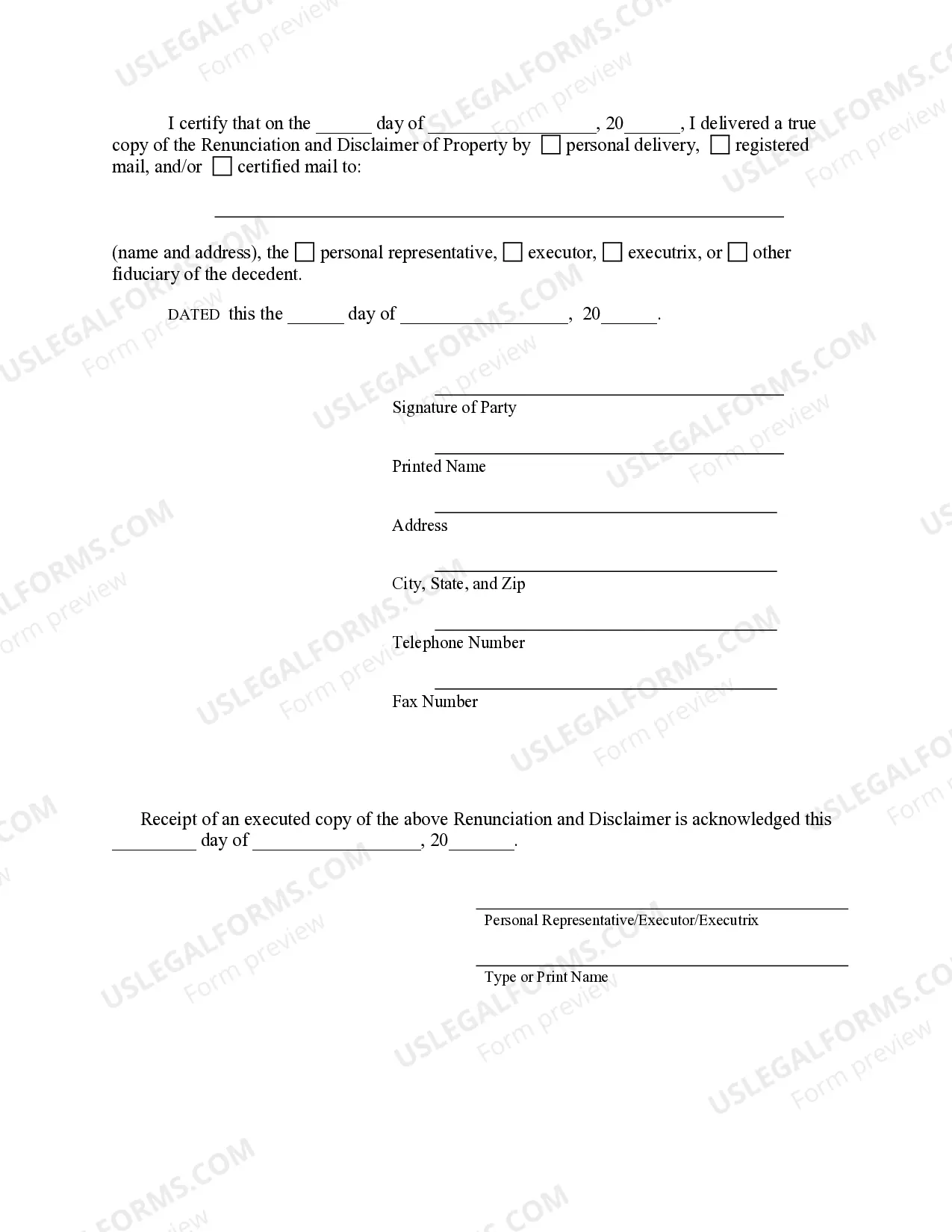

This form is a Renunciation and Disclaimer of Life Insurance and/or Annuity Contract proceeds. The beneficiary has an interest in life insurance and/or annuity contract proceeds due to the death of the decedent. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has chosen to disclaim his/her interest in the proceeds. Under California law, the beneficiary is also required to list in the disclaimer the individual(s) who will take the interest or the right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Title: Understanding the Vista California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract Introduction: The Vista California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is a legal process by which an individual voluntarily gives up their right to receive property, specifically related to life insurance or annuity contracts. This detailed description will provide an overview of this process while highlighting different types of renunciation and disclaimer options available in Vista, California. 1. Basic Concept: The renunciation and disclaimer process allows an individual, called to disclaim ant, to refuse property rights specifically arising from life insurance or annuity contracts. By renouncing their interest, to disclaim ant declines any claim to the property, allowing it to pass to an alternative beneficiary or follow the contract's default provisions. 2. Types of Renunciation or Disclaimer: a. Partial Renunciation or Disclaimer: In certain situations, an individual may choose to renounce or disclaim only a portion of the property from a life insurance or annuity contract. This option can be beneficial when to disclaim ant wants to retain some benefits while renouncing others. b. Complete Renunciation or Disclaimer: This type involves the complete refusal of all property rights associated with a life insurance or annuity contract. To disclaim ant effectively forfeits their claim to the property, allowing it to pass to another designated beneficiary or follow the contract's stipulations. c. Conditional Renunciation or Disclaimer: In some cases, an individual may choose to disclaim property rights from a life insurance or annuity contract under specified circumstances. This type of renunciation becomes effective only if certain conditions are met, ensuring flexibility for the disclaim ant. 3. Legal Considerations: a. Time Limitations: To be valid, the renunciation or disclaimer must be completed within a certain timeframe. Vista, California follows the federal rules, which generally require the process to be completed within nine months of the property acquisition or to disclaim ant turning 21 years old, whichever is later. b. No Financial Consideration: Renunciation or disclaimer of property rights should be made without any prior agreement or consideration. It must be a voluntary act by the disclaim ant, underlining their intent not to accept the property. c. Written Documentation: The renunciation or disclaimer of property from a life insurance or annuity contract in Vista, California must be in writing and include specific details regarding the disclaim ant, the property being renounced, and the process undertaken. d. Legal Assistance: Given the complexity of renouncing or disclaiming property rights, seeking legal advice from a qualified attorney is highly recommended. An attorney can guide individuals through the process, ensuring compliance with state laws and offering protection against potential legal ramifications. Conclusion: The Vista California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract provides individuals with the option to voluntarily relinquish their right to receive property. Whether through partial, complete, or conditional renunciation or disclaimer, it is essential to understand the legal considerations and seek professional guidance to ensure a valid and effective renunciation or disclaimer process. By lawfully navigating this procedure, individuals can pass property rights to alternative beneficiaries or adhere to the contractual terms according to their specific circumstances.Title: Understanding the Vista California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract Introduction: The Vista California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is a legal process by which an individual voluntarily gives up their right to receive property, specifically related to life insurance or annuity contracts. This detailed description will provide an overview of this process while highlighting different types of renunciation and disclaimer options available in Vista, California. 1. Basic Concept: The renunciation and disclaimer process allows an individual, called to disclaim ant, to refuse property rights specifically arising from life insurance or annuity contracts. By renouncing their interest, to disclaim ant declines any claim to the property, allowing it to pass to an alternative beneficiary or follow the contract's default provisions. 2. Types of Renunciation or Disclaimer: a. Partial Renunciation or Disclaimer: In certain situations, an individual may choose to renounce or disclaim only a portion of the property from a life insurance or annuity contract. This option can be beneficial when to disclaim ant wants to retain some benefits while renouncing others. b. Complete Renunciation or Disclaimer: This type involves the complete refusal of all property rights associated with a life insurance or annuity contract. To disclaim ant effectively forfeits their claim to the property, allowing it to pass to another designated beneficiary or follow the contract's stipulations. c. Conditional Renunciation or Disclaimer: In some cases, an individual may choose to disclaim property rights from a life insurance or annuity contract under specified circumstances. This type of renunciation becomes effective only if certain conditions are met, ensuring flexibility for the disclaim ant. 3. Legal Considerations: a. Time Limitations: To be valid, the renunciation or disclaimer must be completed within a certain timeframe. Vista, California follows the federal rules, which generally require the process to be completed within nine months of the property acquisition or to disclaim ant turning 21 years old, whichever is later. b. No Financial Consideration: Renunciation or disclaimer of property rights should be made without any prior agreement or consideration. It must be a voluntary act by the disclaim ant, underlining their intent not to accept the property. c. Written Documentation: The renunciation or disclaimer of property from a life insurance or annuity contract in Vista, California must be in writing and include specific details regarding the disclaim ant, the property being renounced, and the process undertaken. d. Legal Assistance: Given the complexity of renouncing or disclaiming property rights, seeking legal advice from a qualified attorney is highly recommended. An attorney can guide individuals through the process, ensuring compliance with state laws and offering protection against potential legal ramifications. Conclusion: The Vista California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract provides individuals with the option to voluntarily relinquish their right to receive property. Whether through partial, complete, or conditional renunciation or disclaimer, it is essential to understand the legal considerations and seek professional guidance to ensure a valid and effective renunciation or disclaimer process. By lawfully navigating this procedure, individuals can pass property rights to alternative beneficiaries or adhere to the contractual terms according to their specific circumstances.