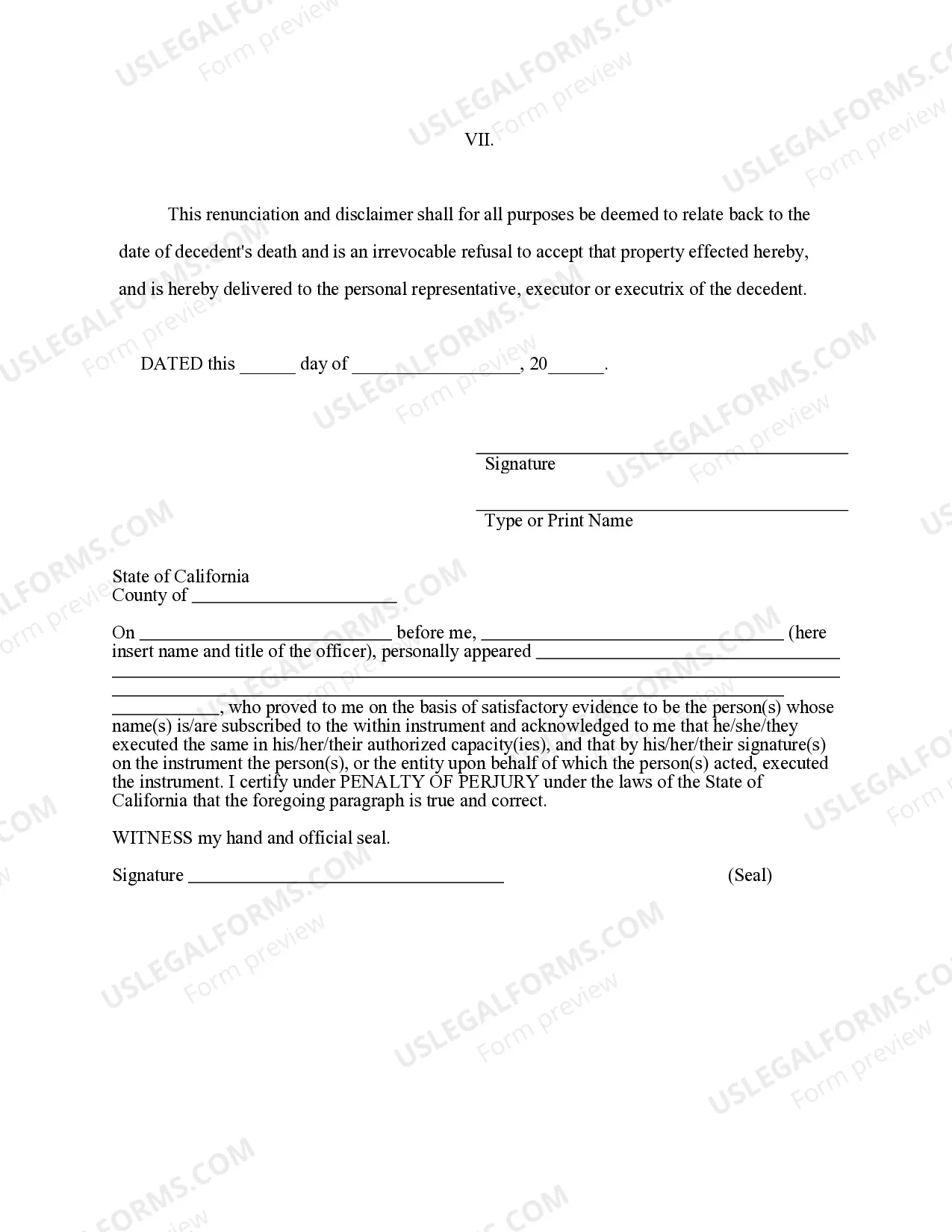

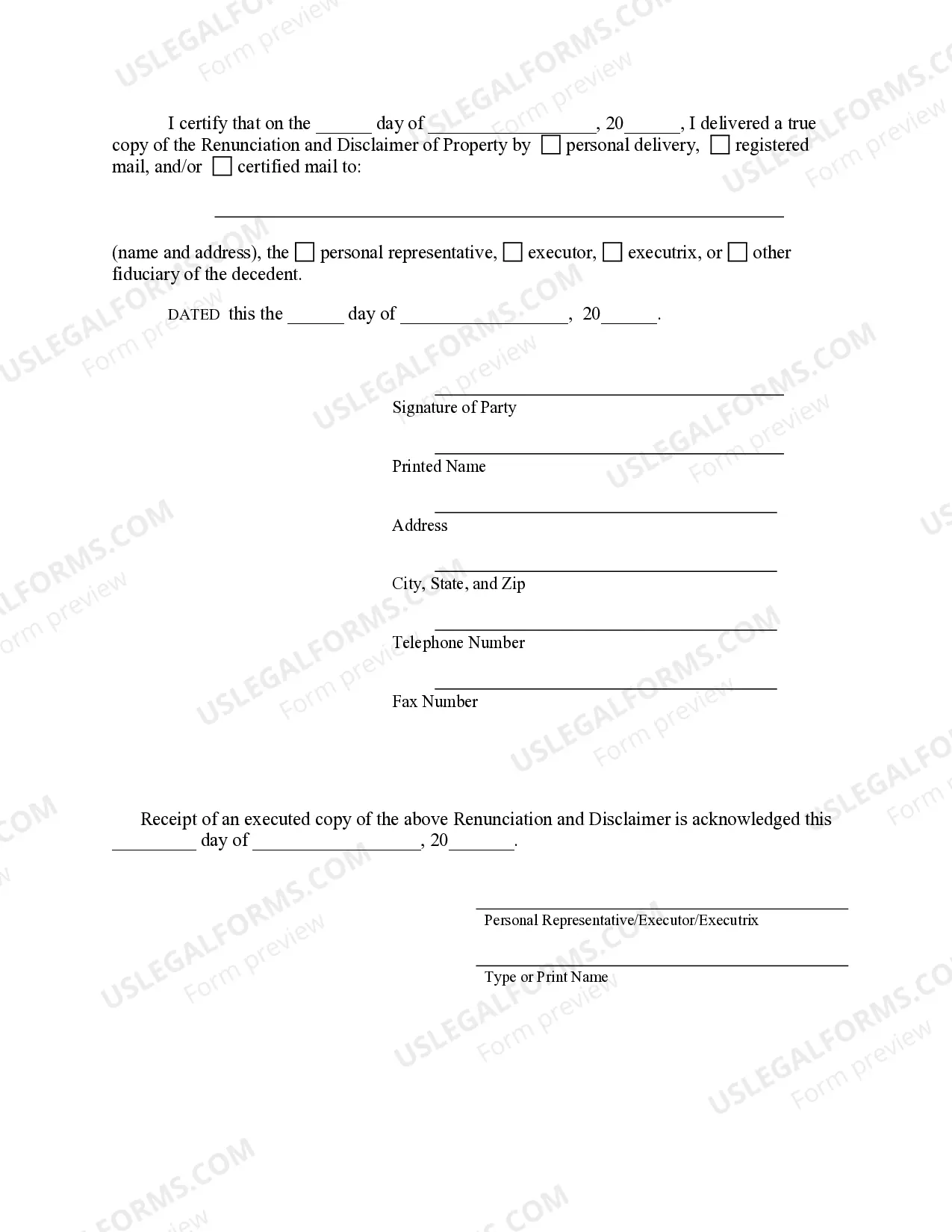

This form is a Renunciation and Disclaimer of Life Insurance and/or Annuity Contract proceeds. The beneficiary has an interest in life insurance and/or annuity contract proceeds due to the death of the decedent. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has chosen to disclaim his/her interest in the proceeds. Under California law, the beneficiary is also required to list in the disclaimer the individual(s) who will take the interest or the right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

West Covina California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract In West Covina, California, individuals may encounter situations where they need to renounce or disclaim their property from a life insurance or annuity contract. This legal process allows individuals to refuse their interest or benefits from such contracts, safeguarding their assets and ensuring a smooth transfer of property ownership. It is crucial to understand the specifics of this process and its different types to make informed decisions. One type of renunciation and disclaimer in West Covina involves disclaiming property from a life insurance contract. When an individual disclaims their property, they essentially decline to accept any benefits or proceeds from the life insurance policy. This can occur if the policyholder deems the coverage unnecessary, wants to disinherit a particular beneficiary, or wishes to minimize their taxable estate. Another type of renunciation and disclaimer pertains to annuity contracts. Similar to life insurance policies, individuals may choose to renounce their interest in the annuity, forfeiting their rights to future payments or any associated benefits. This decision can be made for various reasons, such as recognizing alternative investment opportunities, adjusting financial strategies, or disassociating from a particular annuity provider. To initiate the renunciation and disclaimer process, individuals must follow specific legal requirements in West Covina, California. Firstly, it is crucial to draft a clear and unambiguous written document stating the renunciation or disclaimer of property from the life insurance or annuity contract. The document should include essential details, such as the policyholder's name, contract number, and a statement clearly expressing the intent to renounce or disclaim the property. Furthermore, the renunciation and disclaimer document must be properly signed and acknowledged before a notary public. This ensures the document's validity and authenticity, preventing any future disputes or challenges regarding the renunciation's effectiveness. Once the document is executed, it is essential to deliver a copy to all relevant parties involved, such as the insurance company or annuity provider. By doing so, the renunciation and disclaimer become legally binding and enforceable, protecting the individual's interests and ensuring the smooth transition of property ownership. Renunciation and disclaimer of property from life insurance or annuity contracts in West Covina, California, require careful consideration and compliance with legal procedures. Individuals seeking to exercise their rights to renounce or disclaim should consult with experienced legal professionals knowledgeable in this area of law. By doing so, individuals can navigate the process successfully, protecting their assets, and securing their financial future.West Covina California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract In West Covina, California, individuals may encounter situations where they need to renounce or disclaim their property from a life insurance or annuity contract. This legal process allows individuals to refuse their interest or benefits from such contracts, safeguarding their assets and ensuring a smooth transfer of property ownership. It is crucial to understand the specifics of this process and its different types to make informed decisions. One type of renunciation and disclaimer in West Covina involves disclaiming property from a life insurance contract. When an individual disclaims their property, they essentially decline to accept any benefits or proceeds from the life insurance policy. This can occur if the policyholder deems the coverage unnecessary, wants to disinherit a particular beneficiary, or wishes to minimize their taxable estate. Another type of renunciation and disclaimer pertains to annuity contracts. Similar to life insurance policies, individuals may choose to renounce their interest in the annuity, forfeiting their rights to future payments or any associated benefits. This decision can be made for various reasons, such as recognizing alternative investment opportunities, adjusting financial strategies, or disassociating from a particular annuity provider. To initiate the renunciation and disclaimer process, individuals must follow specific legal requirements in West Covina, California. Firstly, it is crucial to draft a clear and unambiguous written document stating the renunciation or disclaimer of property from the life insurance or annuity contract. The document should include essential details, such as the policyholder's name, contract number, and a statement clearly expressing the intent to renounce or disclaim the property. Furthermore, the renunciation and disclaimer document must be properly signed and acknowledged before a notary public. This ensures the document's validity and authenticity, preventing any future disputes or challenges regarding the renunciation's effectiveness. Once the document is executed, it is essential to deliver a copy to all relevant parties involved, such as the insurance company or annuity provider. By doing so, the renunciation and disclaimer become legally binding and enforceable, protecting the individual's interests and ensuring the smooth transition of property ownership. Renunciation and disclaimer of property from life insurance or annuity contracts in West Covina, California, require careful consideration and compliance with legal procedures. Individuals seeking to exercise their rights to renounce or disclaim should consult with experienced legal professionals knowledgeable in this area of law. By doing so, individuals can navigate the process successfully, protecting their assets, and securing their financial future.