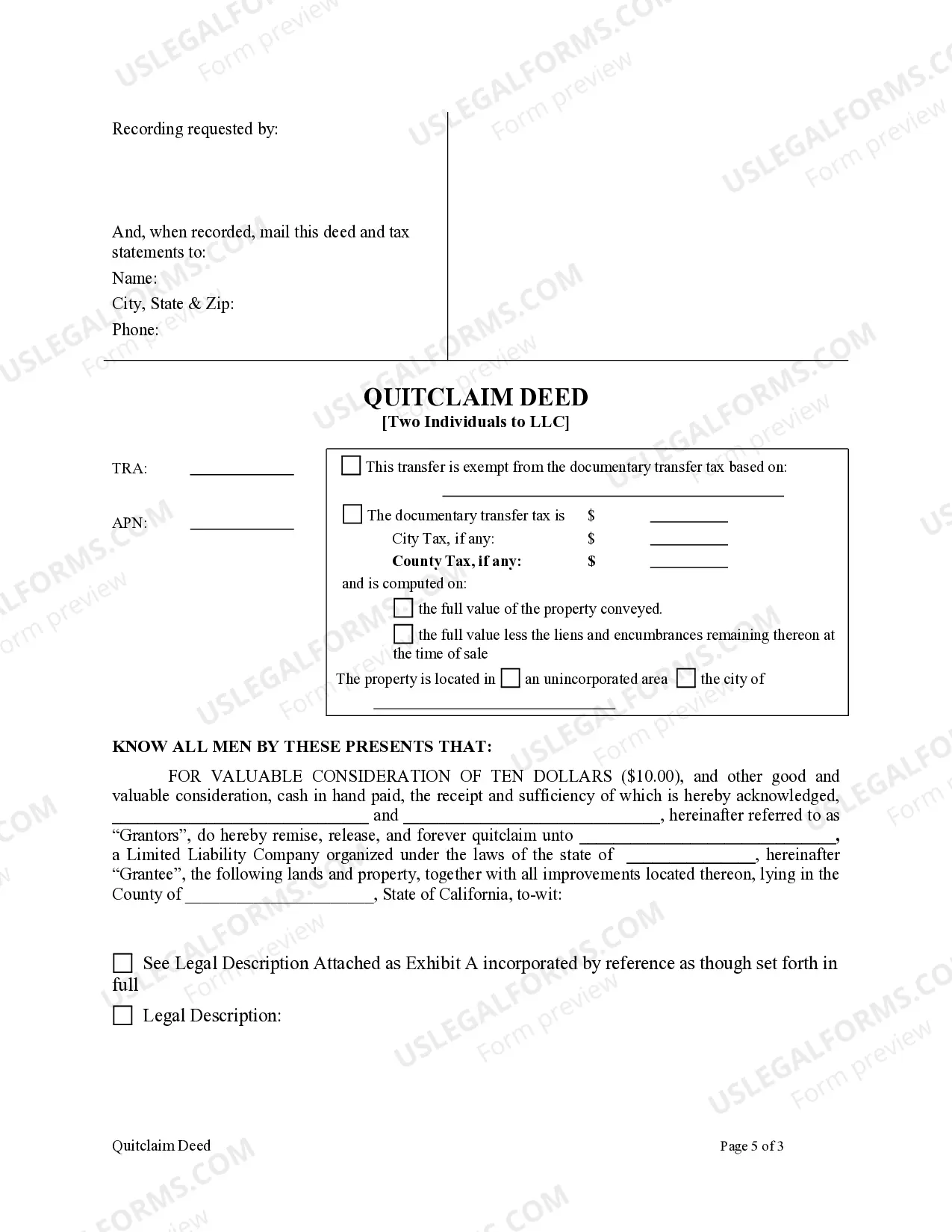

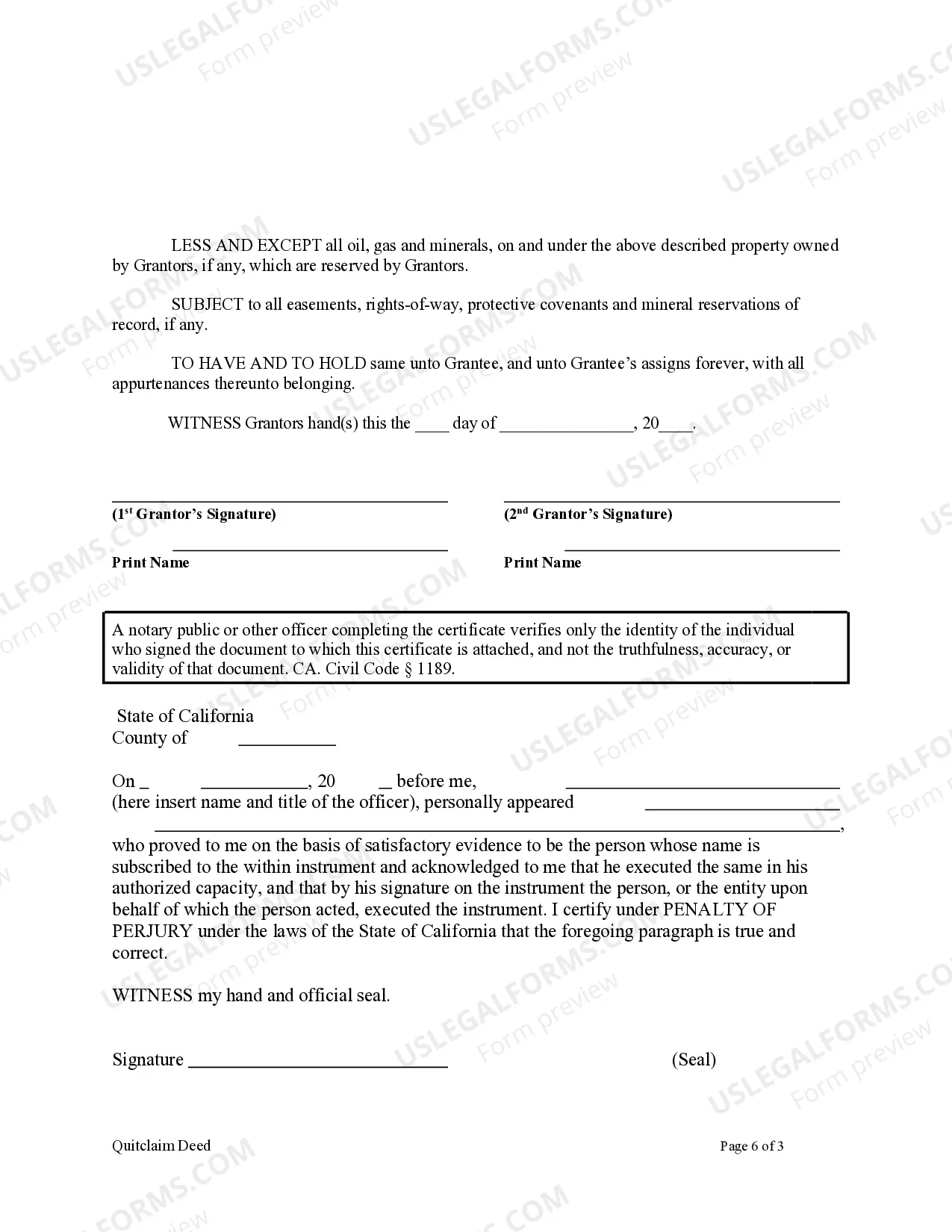

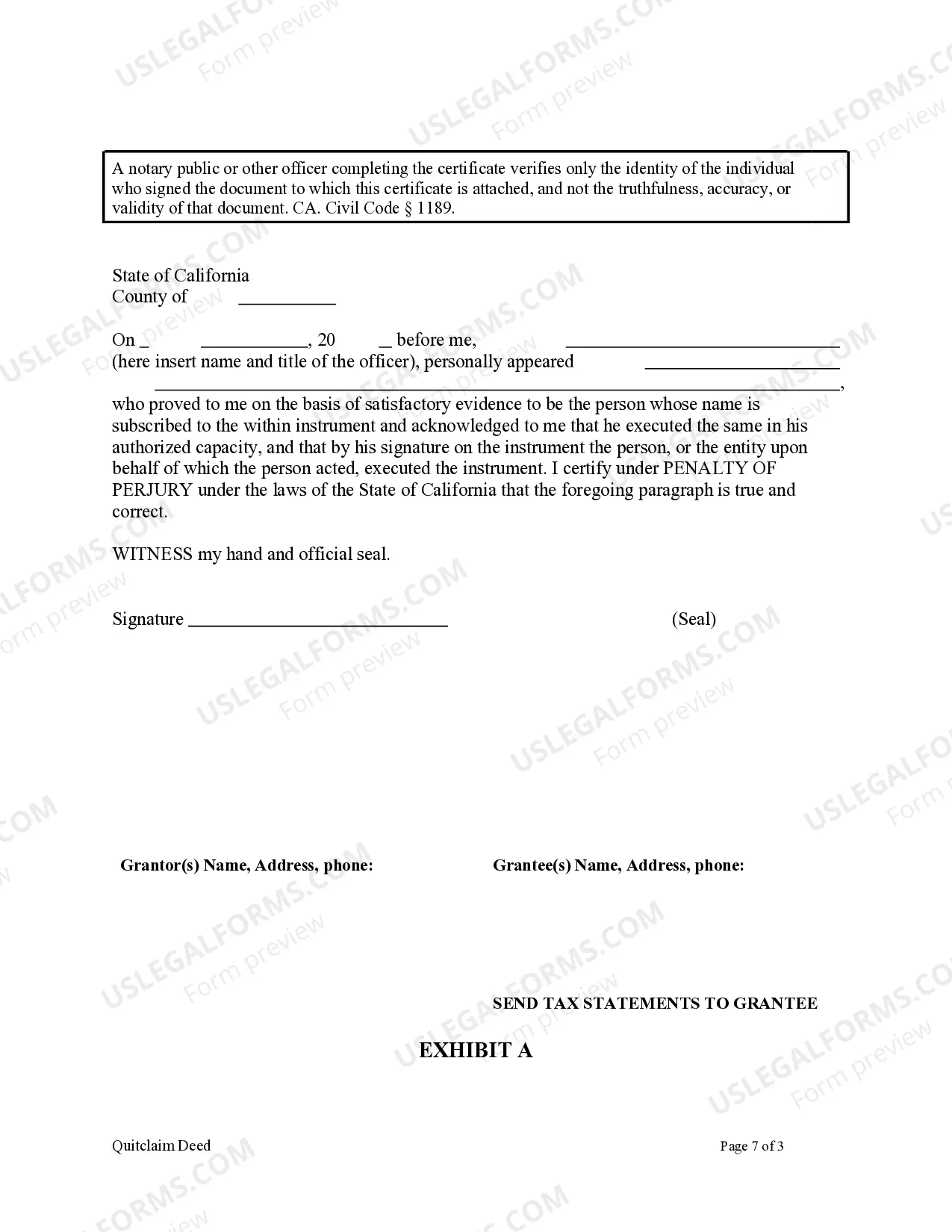

This Quitclaim Deed is used where the Grantors are two individuals and the Grantee is a limited liability company. Grantors convey and quitclaim the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This form complies with all state statutory laws.

Bakersfield California Quitclaim Deed by Two Individuals to LLC

Description

How to fill out California Quitclaim Deed By Two Individuals To LLC?

If you’ve previously utilized our service, Log In to your account and download the Bakersfield California Quitclaim Deed by Two Individuals to LLC onto your device by selecting the Download button. Ensure that your subscription is current. If it is not, renew it as per your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have ongoing access to all the documents you have purchased: you can find them in your profile within the My documents section whenever you need to refer to them again. Leverage the US Legal Forms service to effortlessly discover and save any template for your personal or business requirements!

- Ensure you’ve located an appropriate document. Review the description and utilize the Preview feature, if available, to verify if it aligns with your needs. If it’s not suitable, employ the Search tab above to find the right one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Bakersfield California Quitclaim Deed by Two Individuals to LLC. Select the file format for your document and store it on your device.

- Finalize your document. Print it out or utilize professional online editors to complete and sign it digitally.

Form popularity

FAQ

Adding a name to the deeds Equity transfer is not just about removing a name from the deeds. It also includes adding a name. For example, parents may want to add their children to the deeds of the family home. When someone marries their partner, they may want to add them to the deeds of the property they already owned.

You'll need to transfer an interest by writing up another deed with the person's name on it. In California, you can use either a grant deed, a quitclaim deed or an interspousal deed, depending on your circumstances. Each one has its own requirements and works best in different circumstances.

Recording Fee for Quitclaim DeedType of FeeFeeBase Fee G.C. § 27361(a) G.C. § 27361.4(a) G.C. § 27361.4(b) G.C. § 27361.4(c) G.C. § 27361(d)(1) G.C. § 27397 (c) Subsection 1$15.004 more rows

Today, Californians most often transfer title to real property by a simple written instrument, the grant deed. The word ?grant? is expressly designated by statute as a word of conveyance. (Civil Code Section 1092) A second form of deed is the quitclaim deed.

The California TOD deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

In California, quitclaim deeds are commonly used between spouses, relatives, or if a property owner is transferring his or her property into his or her trust. A grant deed is commonly used in most arms-length real estate transactions not involving family members or spouses.

California mainly uses two types of deeds: the ?grant deed? and the ?quitclaim deed.? Most other deeds you will see, such as the common ?interspousal transfer deed,? are versions of grant or quitclaim deeds customized for specific circumstances.

The California quitclaim deed form gives the new owner whatever interest the current owner has in the property when the deed is signed and delivered. It makes no promises about whether the current owner has clear title to the property.

?Adding someone to a deed? means transferring ownership to that person. The transfer of ownership can occur during life (with a regular quitclaim deed, for example) or at death (using a lady bird deed, transfer-on-death-deed, or life estate deed).

The easiest way to grant your spouse title to your home is via a quitclaim deed (Californians generally use an interspousal grant deed). With a quitclaim deed, you can name your spouse as the property's joint owner. The quitclaim deed must include the property's description, including its boundary lines.