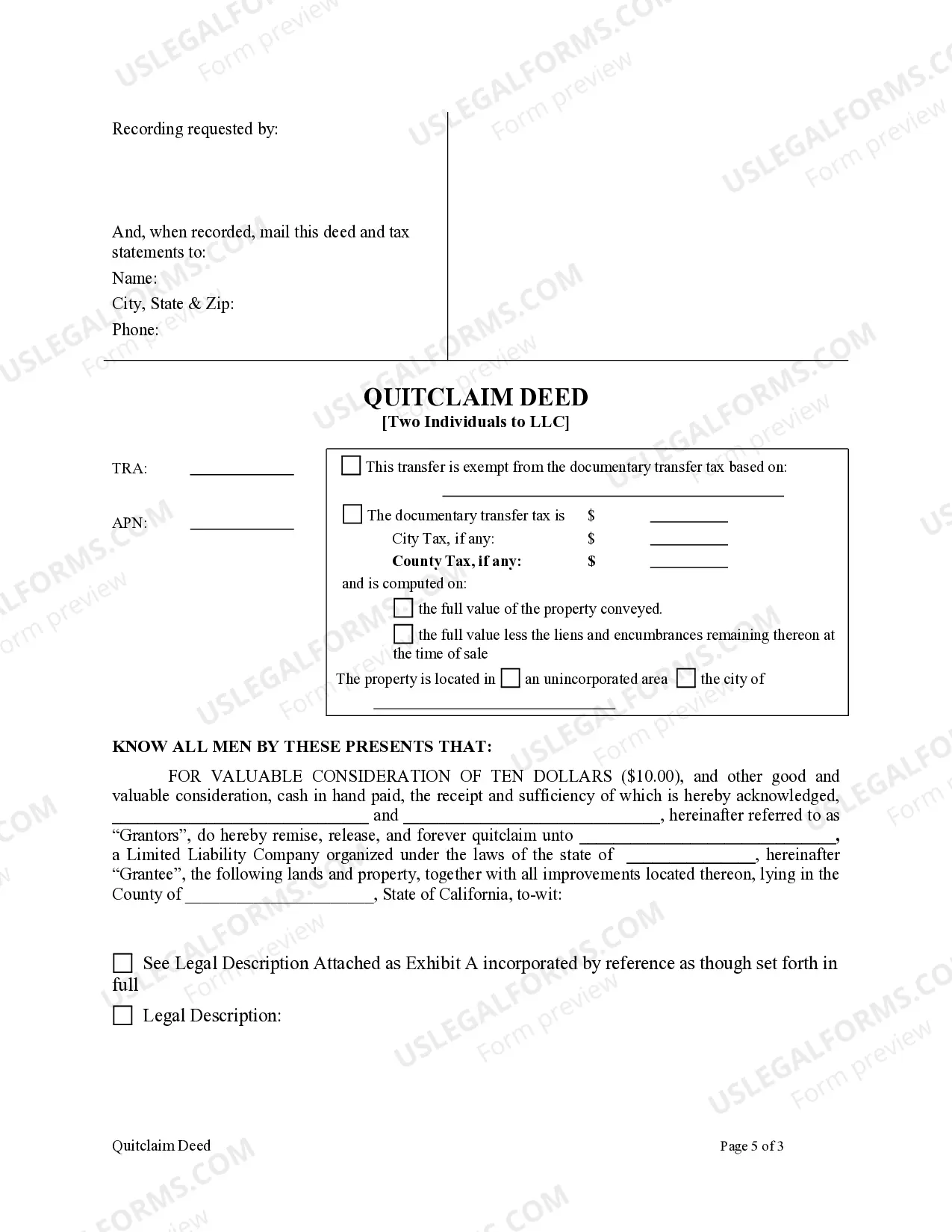

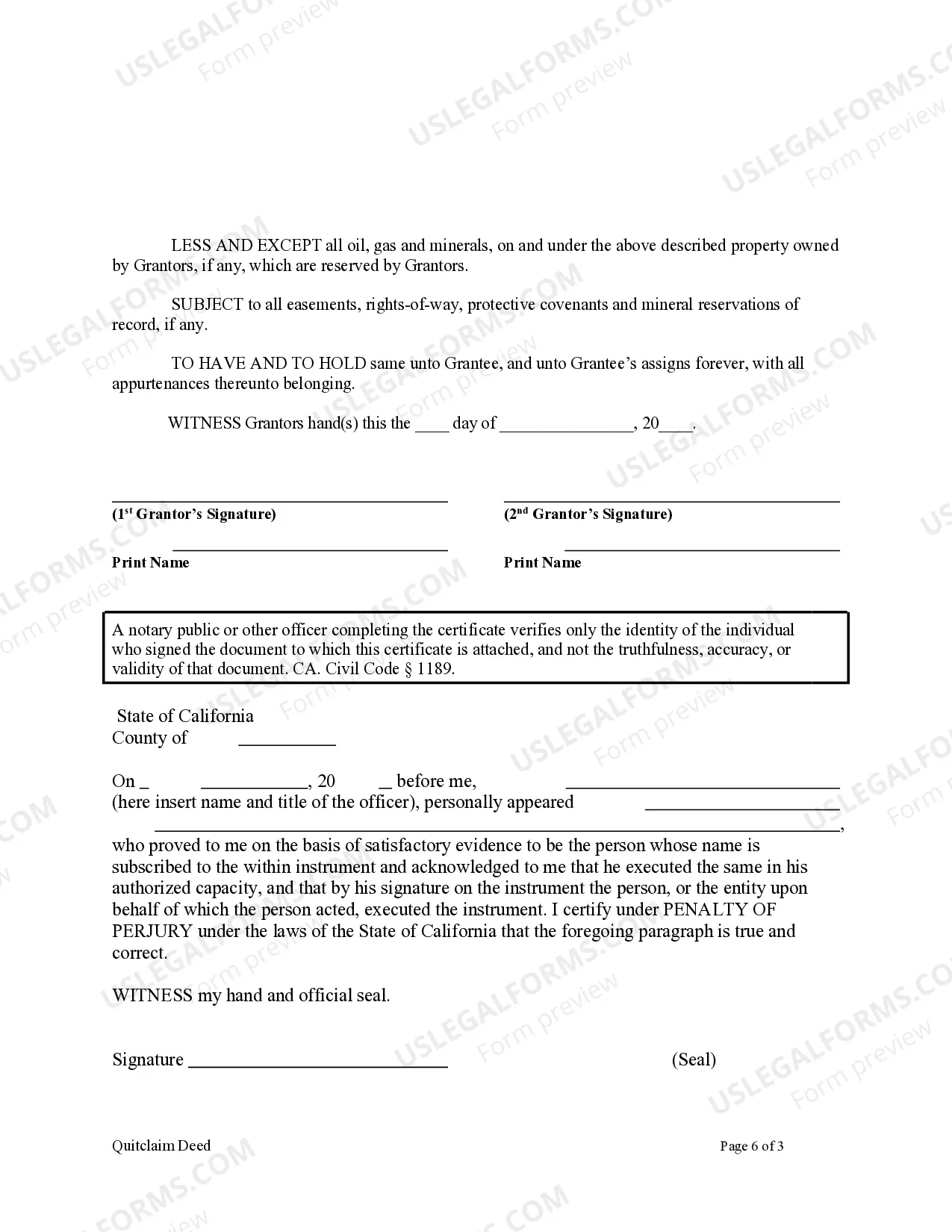

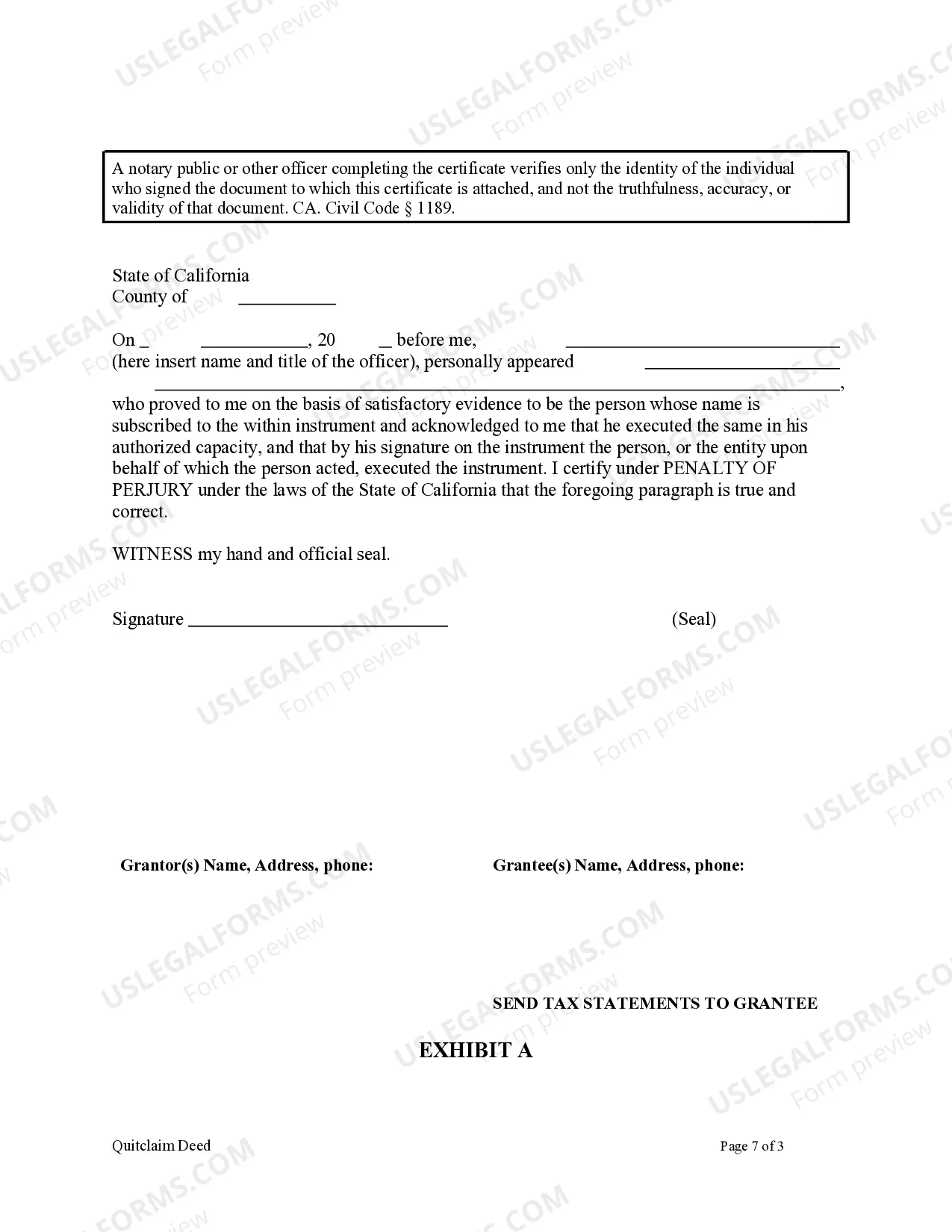

This Quitclaim Deed is used where the Grantors are two individuals and the Grantee is a limited liability company. Grantors convey and quitclaim the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This form complies with all state statutory laws.

A Vista California Quitclaim Deed by Two Individuals to LLC is a legal document used to transfer ownership of real estate property from two individuals to a Limited Liability Company (LLC) in the city of Vista, California. This type of deed is commonly used to convey property between family members, business partners, or in situations where the property is being transferred to a newly formed LLC. The Quitclaim Deed is a legally binding document that signifies the individuals' intention to relinquish their ownership rights to the property and transfer it to the LLC, effectively making the LLC the new owner. It is important to note that a Quitclaim Deed only transfers whatever interest the granter has in the property, and does not provide any warranties or guarantees about the property's title. There may be different variations of Vista California Quitclaim Deed by Two Individuals to LLC, based on specific circumstances or conditions. Some examples include: 1. Vista California Quitclaim Deed by Married Couple to LLC: This type of deed is used when a married couple jointly owns a property and wants to transfer their ownership to an LLC. 2. Vista California Quitclaim Deed by Siblings to LLC: This type of deed is utilized when siblings own a property together and wish to transfer their ownership to an LLC. 3. Vista California Quitclaim Deed by Business Partners to LLC: This type of deed is employed when business partners who jointly own a property decide to transfer their ownership to an LLC for liability protection or business purposes. It is essential to consult with a qualified real estate attorney or a title company to ensure the proper completion and recording of the Quitclaim Deed. Additionally, it is crucial to thoroughly understand the legal implications and potential responsibilities associated with transferring the property to an LLC, as each situation may vary.A Vista California Quitclaim Deed by Two Individuals to LLC is a legal document used to transfer ownership of real estate property from two individuals to a Limited Liability Company (LLC) in the city of Vista, California. This type of deed is commonly used to convey property between family members, business partners, or in situations where the property is being transferred to a newly formed LLC. The Quitclaim Deed is a legally binding document that signifies the individuals' intention to relinquish their ownership rights to the property and transfer it to the LLC, effectively making the LLC the new owner. It is important to note that a Quitclaim Deed only transfers whatever interest the granter has in the property, and does not provide any warranties or guarantees about the property's title. There may be different variations of Vista California Quitclaim Deed by Two Individuals to LLC, based on specific circumstances or conditions. Some examples include: 1. Vista California Quitclaim Deed by Married Couple to LLC: This type of deed is used when a married couple jointly owns a property and wants to transfer their ownership to an LLC. 2. Vista California Quitclaim Deed by Siblings to LLC: This type of deed is utilized when siblings own a property together and wish to transfer their ownership to an LLC. 3. Vista California Quitclaim Deed by Business Partners to LLC: This type of deed is employed when business partners who jointly own a property decide to transfer their ownership to an LLC for liability protection or business purposes. It is essential to consult with a qualified real estate attorney or a title company to ensure the proper completion and recording of the Quitclaim Deed. Additionally, it is crucial to thoroughly understand the legal implications and potential responsibilities associated with transferring the property to an LLC, as each situation may vary.