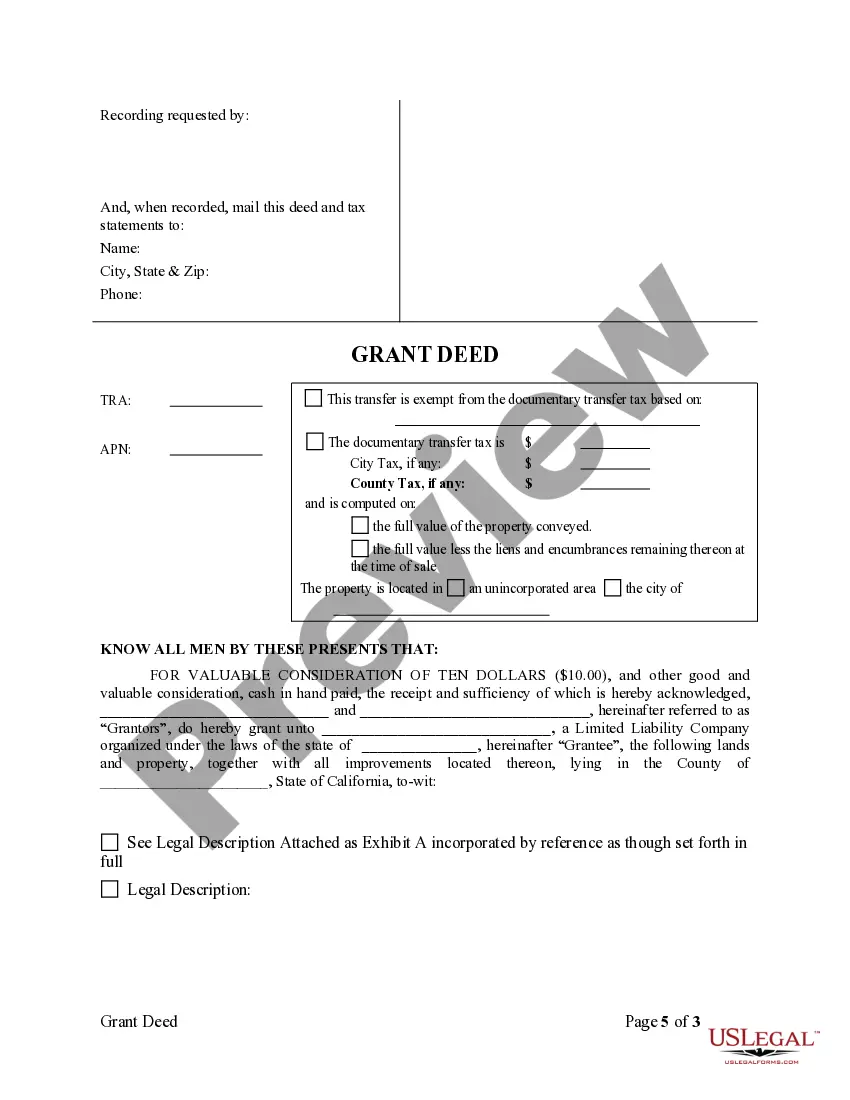

This Warranty Deed from two Individuals to LLC form is a Warranty Deed where the Grantors are two individuals and the Grantee is a limited liability company. Grantors convey and warrant the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

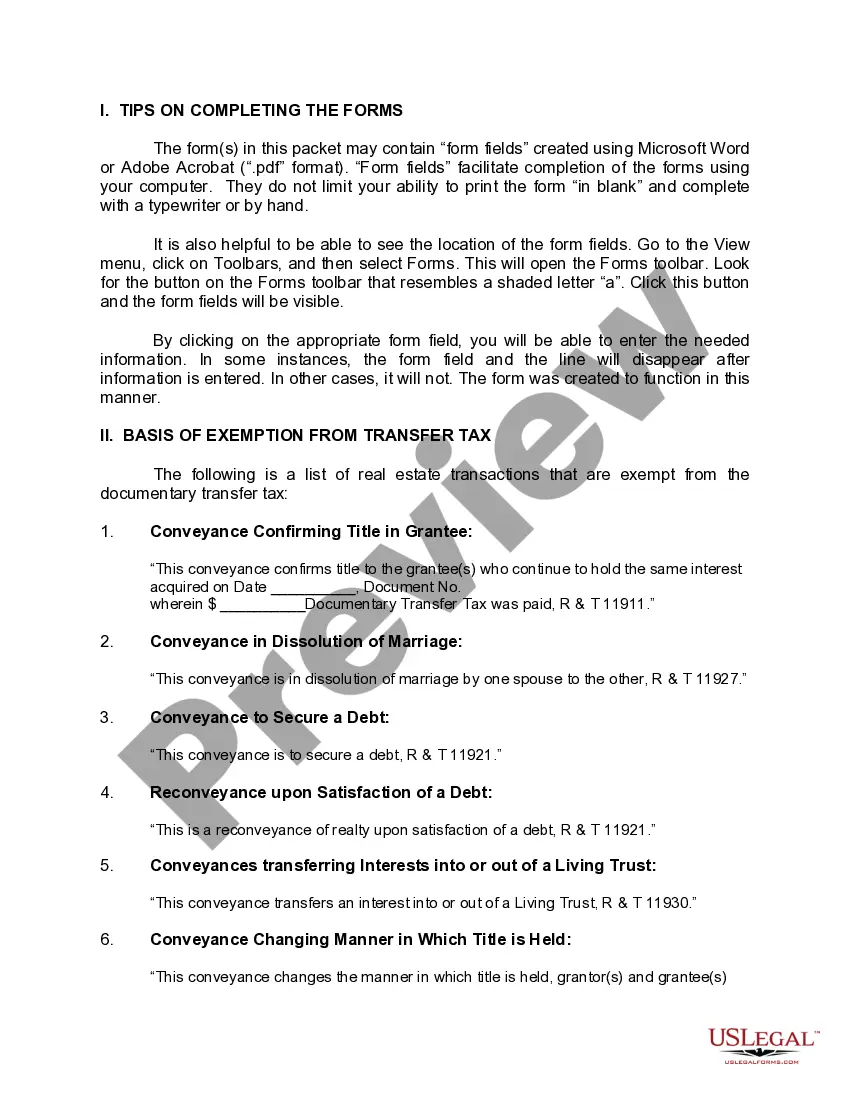

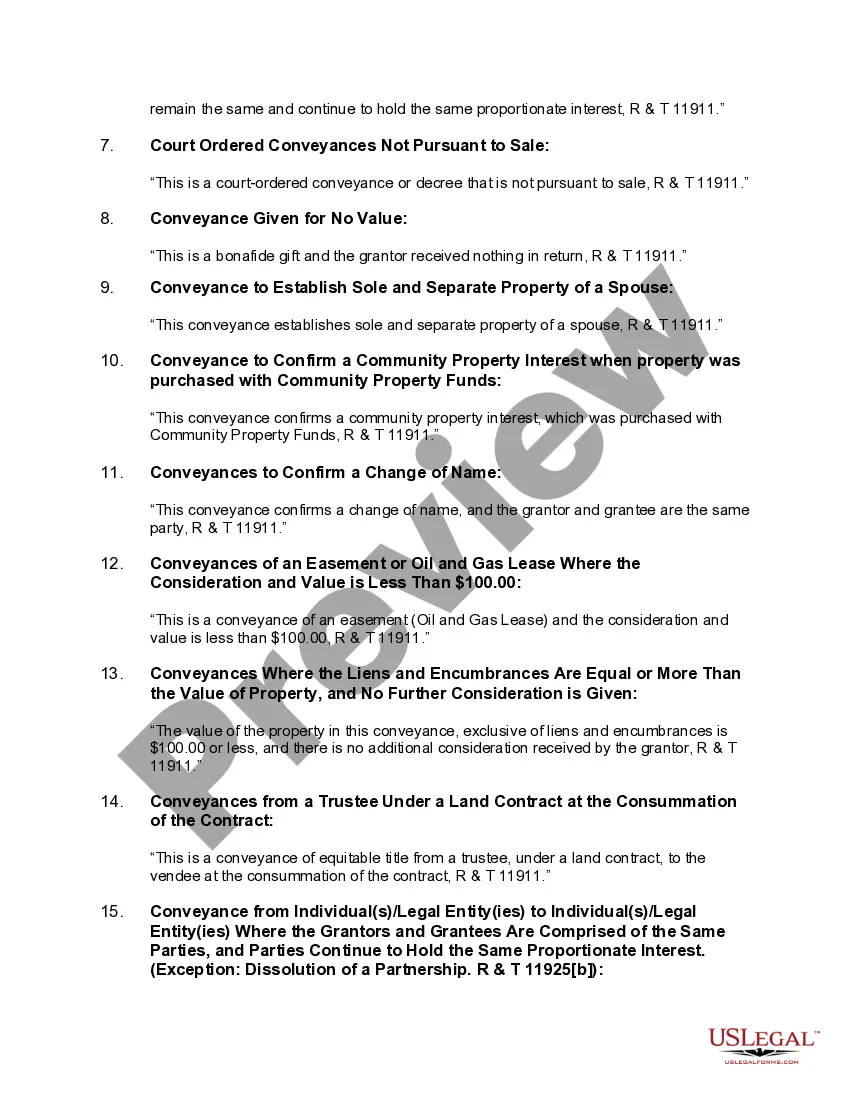

Antioch California Grant Deed: A Comprehensive Overview of the Different Types and Process When it comes to transferring property ownership from two individuals to an LLC in Antioch, California, a Grant Deed is a commonly utilized legal instrument. This document enables individuals to convey their ownership interest to a limited liability company (LLC) in a straightforward and legally binding manner. Here, we will explore the various types of Antioch California Grant Deeds used in such transactions, along with important keywords associated with the process. 1. Inter-Spousal Grant Deed: This type of Grant Deed is used when a married couple jointly owns a property and intends to transfer ownership to their LLC. 2. Joint Grant Deed: When two individuals, who are not married, co-own a property and decide to transfer their ownership to an LLC, they can use a Joint Grant Deed. 3. Interspousal Transfer Grant Deed: Similar to the Inter-Spousal Grant Deed, this type of deed is specifically designed for transferring property ownership between spouses and can be used for conveying the property to an LLC. 4. General Grant Deed: This type of Grant Deed is commonly used for transferring property ownership between two individuals, regardless of their relationship or marital status, to an LLC. It provides a comprehensive conveyance of the ownership rights. The process of executing an Antioch California Grant Deed from Two Individuals to an LLC involves the following steps: 1. Prepare the Grant Deed: A qualified attorney or legal professional should draft the Grant Deed ensuring that it includes accurate information, such as the names of the granters (current owners), the LLC's name and address, a clear property description, and the legal names and signatures of the granters. 2. Obtain Notarization: All granters must sign the Grant Deed in the presence of a notary public, who will verify their identities, witness the signatures, and affix an official seal. 3. File the Grant Deed: The completed Grant Deed should be recorded at the Contra Costa County Recorder's Office, along with the appropriate fees. This step is crucial to provide public notice of the property transfer. 4. Pay Transfer Taxes: Depending on the property's value, there may be transfer taxes that need to be paid during the recording process. It is essential to research and understand any applicable taxes beforehand. 5. Obtain Title Insurance: The LLC acquiring the property should consider obtaining title insurance to protect against any potential ownership disputes or title defects that may arise after the transfer is complete. 6. Update Ownership Documents: Once the Grant Deed is recorded, it is imperative to update relevant documents such as property tax records and insurance policies to reflect the LLC as the new owner. In summary, when transferring property ownership from two individuals to an LLC in Antioch, California, different types of Grant Deeds, such as Inter-Spousal Grant Deed, Joint Grant Deed, Interspousal Transfer Grant Deed, and General Grant Deed are utilized. Executing this process involves thorough preparation, notarization, filing, payment of taxes, and updating relevant ownership documents. It is crucial to consult with a qualified legal professional to ensure a smooth and legally sound property transfer.Antioch California Grant Deed: A Comprehensive Overview of the Different Types and Process When it comes to transferring property ownership from two individuals to an LLC in Antioch, California, a Grant Deed is a commonly utilized legal instrument. This document enables individuals to convey their ownership interest to a limited liability company (LLC) in a straightforward and legally binding manner. Here, we will explore the various types of Antioch California Grant Deeds used in such transactions, along with important keywords associated with the process. 1. Inter-Spousal Grant Deed: This type of Grant Deed is used when a married couple jointly owns a property and intends to transfer ownership to their LLC. 2. Joint Grant Deed: When two individuals, who are not married, co-own a property and decide to transfer their ownership to an LLC, they can use a Joint Grant Deed. 3. Interspousal Transfer Grant Deed: Similar to the Inter-Spousal Grant Deed, this type of deed is specifically designed for transferring property ownership between spouses and can be used for conveying the property to an LLC. 4. General Grant Deed: This type of Grant Deed is commonly used for transferring property ownership between two individuals, regardless of their relationship or marital status, to an LLC. It provides a comprehensive conveyance of the ownership rights. The process of executing an Antioch California Grant Deed from Two Individuals to an LLC involves the following steps: 1. Prepare the Grant Deed: A qualified attorney or legal professional should draft the Grant Deed ensuring that it includes accurate information, such as the names of the granters (current owners), the LLC's name and address, a clear property description, and the legal names and signatures of the granters. 2. Obtain Notarization: All granters must sign the Grant Deed in the presence of a notary public, who will verify their identities, witness the signatures, and affix an official seal. 3. File the Grant Deed: The completed Grant Deed should be recorded at the Contra Costa County Recorder's Office, along with the appropriate fees. This step is crucial to provide public notice of the property transfer. 4. Pay Transfer Taxes: Depending on the property's value, there may be transfer taxes that need to be paid during the recording process. It is essential to research and understand any applicable taxes beforehand. 5. Obtain Title Insurance: The LLC acquiring the property should consider obtaining title insurance to protect against any potential ownership disputes or title defects that may arise after the transfer is complete. 6. Update Ownership Documents: Once the Grant Deed is recorded, it is imperative to update relevant documents such as property tax records and insurance policies to reflect the LLC as the new owner. In summary, when transferring property ownership from two individuals to an LLC in Antioch, California, different types of Grant Deeds, such as Inter-Spousal Grant Deed, Joint Grant Deed, Interspousal Transfer Grant Deed, and General Grant Deed are utilized. Executing this process involves thorough preparation, notarization, filing, payment of taxes, and updating relevant ownership documents. It is crucial to consult with a qualified legal professional to ensure a smooth and legally sound property transfer.