This Warranty Deed from two Individuals to LLC form is a Warranty Deed where the Grantors are two individuals and the Grantee is a limited liability company. Grantors convey and warrant the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

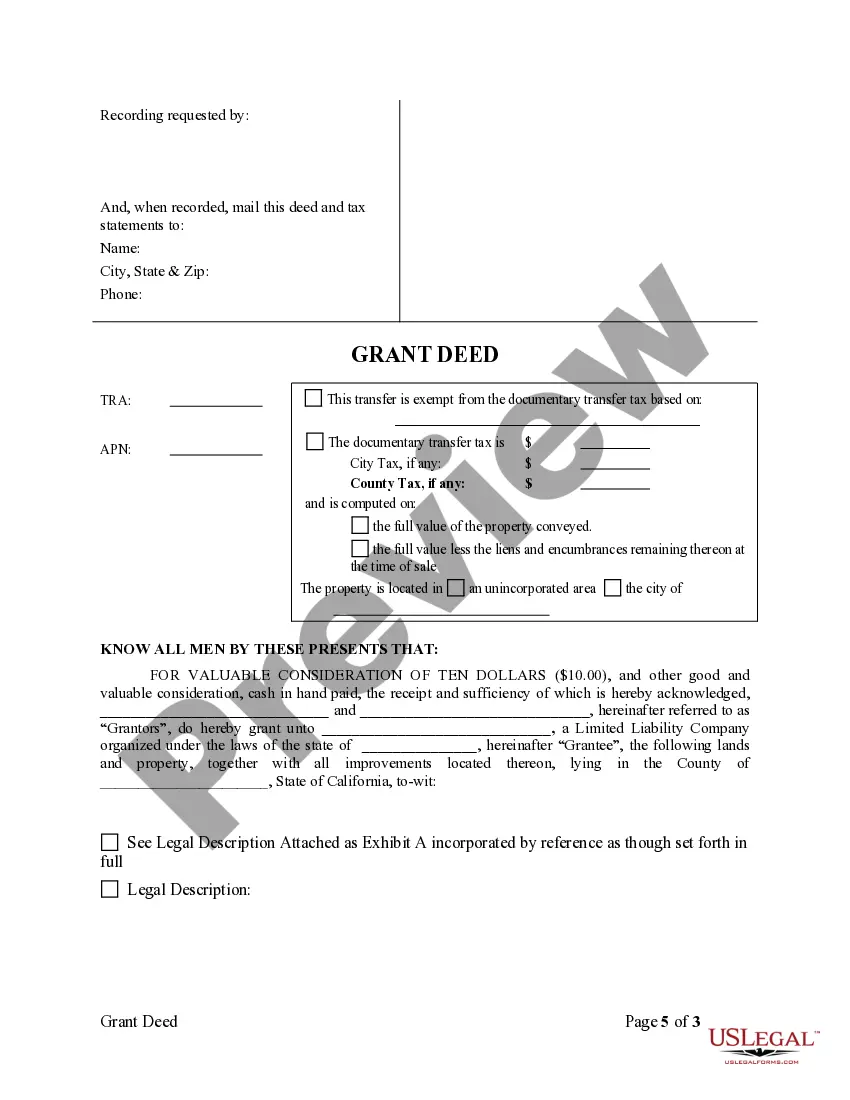

A Murrieta California Grant Deed from Two Individuals to LLC is a legal document that transfers ownership of real property located in Murrieta, California from two individuals to a limited liability company (LLC). This type of deed is commonly used when individuals want to transfer ownership of a property they own jointly or individually to an LLC they have formed. The Murrieta California Grant Deed from Two Individuals to LLC must include specific information to be considered legally valid. This includes the names and legal addresses of the two individuals who are transferring the property, as well as the name and legal address of the LLC receiving the property. The property's legal description, which can be found in the existing deed or property records, must also be included. There are different types of Murrieta California Grant Deed from Two Individuals to LLC that can be employed depending on the specific circumstances: 1. Joint Ownership to LLC: This type of grant deed is used when the two individuals listed as joint owners of the property want to transfer the ownership to their established LLC. This allows them to simplify management and liability structure, as well as potentially protect personal assets. 2. Individual Ownership to LLC: This grant deed is used when a single property owner wishes to transfer ownership of their property to the LLC they have formed or intend to establish. This type of deed allows the individual to separate their personal assets from the property, providing liability protection and potential tax benefits. 3. Married Couple Ownership to LLC: In cases where a property is jointly owned by a married couple, they may choose to transfer it to an LLC they have formed together. This type of grant deed ensures the property ownership is held by the LLC rather than the individuals, offering asset protection and potential tax advantages. It is important to note that the process of preparing and recording a Murrieta California Grant Deed from Two Individuals to LLC involves specific legal requirements and should be executed with the assistance of a qualified attorney or legal professional. Additionally, it is crucial to consult with a tax advisor to understand any potential tax implications associated with the transfer of property ownership to an LLC.A Murrieta California Grant Deed from Two Individuals to LLC is a legal document that transfers ownership of real property located in Murrieta, California from two individuals to a limited liability company (LLC). This type of deed is commonly used when individuals want to transfer ownership of a property they own jointly or individually to an LLC they have formed. The Murrieta California Grant Deed from Two Individuals to LLC must include specific information to be considered legally valid. This includes the names and legal addresses of the two individuals who are transferring the property, as well as the name and legal address of the LLC receiving the property. The property's legal description, which can be found in the existing deed or property records, must also be included. There are different types of Murrieta California Grant Deed from Two Individuals to LLC that can be employed depending on the specific circumstances: 1. Joint Ownership to LLC: This type of grant deed is used when the two individuals listed as joint owners of the property want to transfer the ownership to their established LLC. This allows them to simplify management and liability structure, as well as potentially protect personal assets. 2. Individual Ownership to LLC: This grant deed is used when a single property owner wishes to transfer ownership of their property to the LLC they have formed or intend to establish. This type of deed allows the individual to separate their personal assets from the property, providing liability protection and potential tax benefits. 3. Married Couple Ownership to LLC: In cases where a property is jointly owned by a married couple, they may choose to transfer it to an LLC they have formed together. This type of grant deed ensures the property ownership is held by the LLC rather than the individuals, offering asset protection and potential tax advantages. It is important to note that the process of preparing and recording a Murrieta California Grant Deed from Two Individuals to LLC involves specific legal requirements and should be executed with the assistance of a qualified attorney or legal professional. Additionally, it is crucial to consult with a tax advisor to understand any potential tax implications associated with the transfer of property ownership to an LLC.