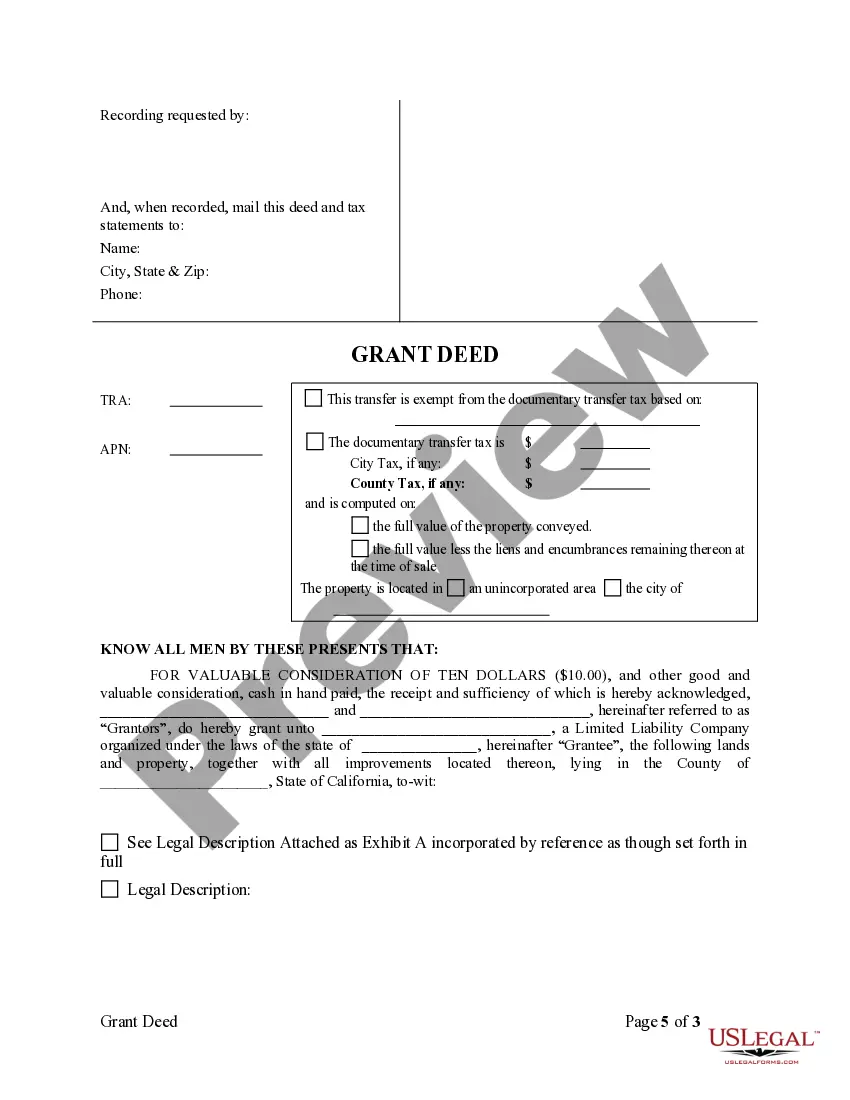

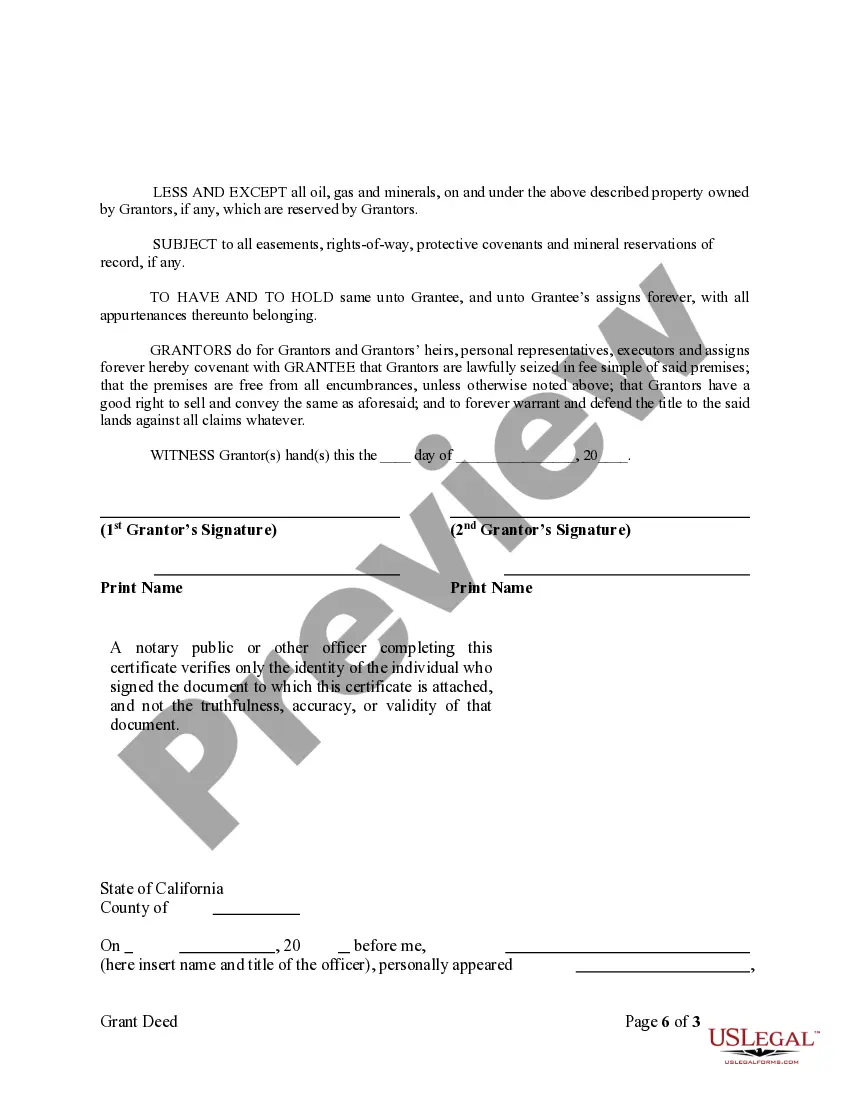

This Warranty Deed from two Individuals to LLC form is a Warranty Deed where the Grantors are two individuals and the Grantee is a limited liability company. Grantors convey and warrant the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

Riverside California Grant Deed from Two Individuals to LLC

Description

How to fill out California Grant Deed From Two Individuals To LLC?

In spite of social or occupational standing, finishing legal paperwork is a regrettable requirement in today’s workplace.

Frequently, it’s nearly impossible for an individual without any legal expertise to create such documents from the ground up, primarily due to the intricate language and legal nuances they involve.

This is where US Legal Forms comes in to help.

Ensure that the template you have selected is relevant for your region since the laws of one state do not apply to another.

Review the document and check a brief summary (if available) of the situations where the document can be utilized.

- Our platform offers an extensive collection of over 85,000 state-specific templates that are suitable for nearly every legal circumstance.

- US Legal Forms also acts as a valuable tool for associates or legal advisors aiming to be more productive with our DYI forms.

- Whether you need the Riverside California Grant Deed from Two Individuals to LLC or any other document that is valid in your region, everything is available through US Legal Forms.

- Here’s how you can quickly obtain the Riverside California Grant Deed from Two Individuals to LLC using our dependable platform.

- If you are already a registered user, you can go ahead to Log In to your account to access the correct form.

- However, if you are not familiar with our platform, make sure you follow these steps before acquiring the Riverside California Grant Deed from Two Individuals to LLC.

Form popularity

FAQ

Yes, you can change a deed without a lawyer in California, provided you understand the process. You must create and properly complete a grant deed, obtain notarizations, and file it with the Riverside County Recorder's Office. However, platforms like uslegalforms can offer guidance and templates to ensure that you follow all necessary legal steps confidently.

Changing the deed on your house in California starts with drafting a new grant deed that reflects the intended change in ownership. This new deed requires notarization for all signatures involved. Finally, take the updated grant deed to the Riverside County Recorder's Office to ensure the changes are officially recorded and recognized.

To change a grant deed in California, you will need to create a new grant deed that outlines the amendments or changes to ownership. Ensure that all involved parties sign and have their signatures notarized. Once completed, submit the new grant deed to the Riverside County Recorder's Office for official recording and recognition.

Amending a grant deed in California involves drafting a new deed with the desired changes clearly indicated. Both the original grantors and the new parties must sign and notarize this deed. Afterward, you should file the amended grant deed at the appropriate Recorder's Office in Riverside County to update the title records accordingly.

You can file a grant deed at the Riverside County Recorder's Office. It is advisable to visit the office in person or check their website for specific filing instructions and requirements. Properly filing the Riverside California Grant Deed from Two Individuals to LLC ensures that the deed is legally recognized and maintains the integrity of ownership records.

To transfer a deed from individuals to an LLC, you need to execute a grant deed that clearly states both the current owners and the LLC as the new owner. This document must be signed, dated, and notarized. Additionally, you should file the grant deed with the Riverside County Recorder's Office to update public records, ensuring a smooth transition in ownership.

The best way to add someone to a deed is by using a grant deed, which provides a clear record of ownership changes. You should complete the deed form, ensuring it includes accurate details about all parties involved and the property. Notarizing the deed and filing it with your local county recorder will finalize the change. If you're handling a Riverside California Grant Deed from Two Individuals to LLC, consider using platforms like uslegalforms to streamline the documentation process with easy-to-use templates.

To add someone to a grant deed in California, begin by getting the appropriate grant deed form, which you can easily find online. Fill in the new owner's name along with the existing owner's information, and ensure all parties sign the document in front of a notary public. After that, submit the completed grant deed to the county recorder's office for filing. This process ensures the addition is legally recognized and protects everyone’s interests.

Adding someone to a deed in California potentially has tax implications, including reassessment of property taxes based on the new ownership. If the transfer relates to a Riverside California Grant Deed from Two Individuals to LLC, it's essential to consider how this might impact your tax liability. Consult with a tax professional to understand potential changes in property tax rates or responsibilities. Tax implications vary by situation, and expert advice can clarify your specific circumstances.

Yes, you can add someone to a deed without a lawyer, although it is often advisable to seek legal help. Start by obtaining a new grant deed form and clearly indicate the addition of the new owner. Make sure all parties involved sign the deed, and then file it with your local county recorder. This process is especially important when dealing with a Riverside California Grant Deed from Two Individuals to LLC to ensure the transaction is legally binding.