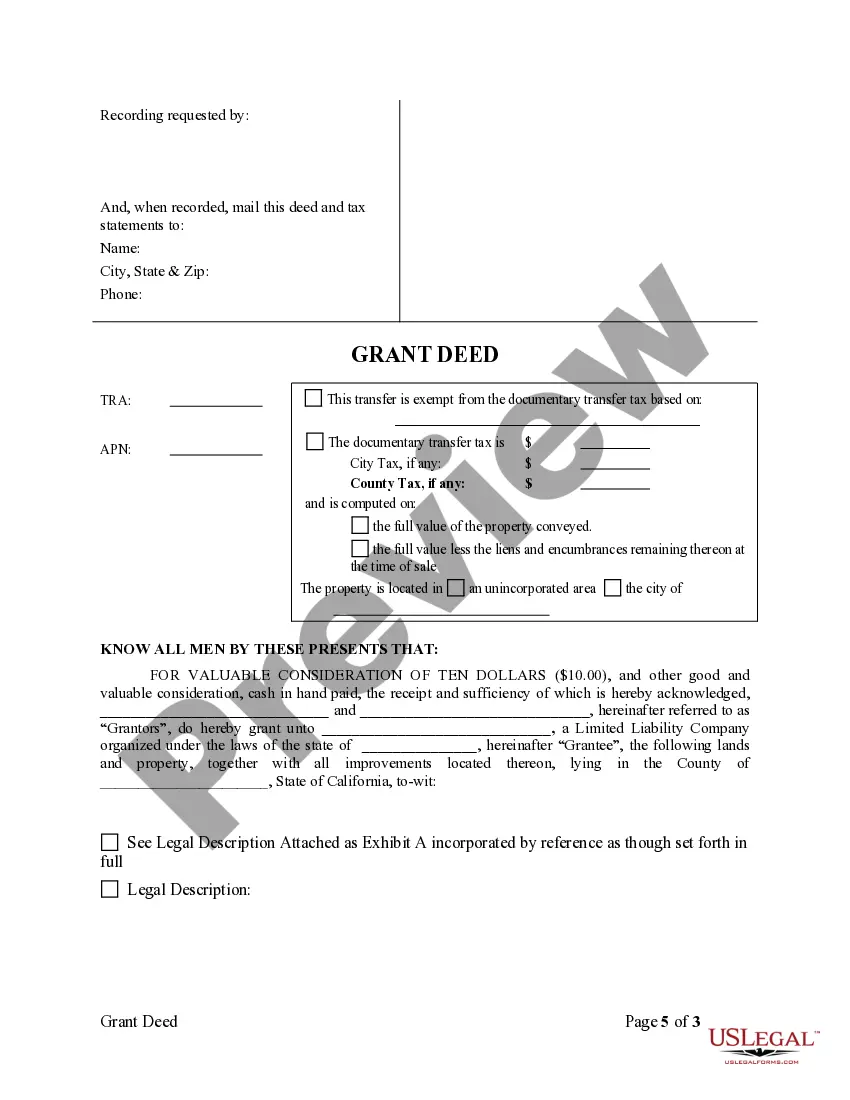

This Warranty Deed from two Individuals to LLC form is a Warranty Deed where the Grantors are two individuals and the Grantee is a limited liability company. Grantors convey and warrant the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Salinas California Grant Deed from Two Individuals to LLC is a legal document that transfers ownership of property from two individuals to a limited liability company (LLC) in the city of Salinas, California. The granters, who are the current property owners, grant their rights, title, and interest in the property to the LLC, which becomes the new owner. This type of transfer is often chosen when the individuals want to operate their business activities or manage their property assets under the protection of an LLC. The LLC structure offers limited liability protection for the owners, meaning their personal assets are safeguarded in the event of any legal issues or debts incurred by the LLC. The Salinas California Grant Deed from Two Individuals to LLC is an essential document that helps establish a proper legal framework for the ownership of real estate assets within the city and ensures that all rights and responsibilities associated with the property are accurately transferred to the new LLC owner. Some variations or types of Salinas California Grant Deeds from Two Individuals to LLC may include: 1. Traditional Salinas California Grant Deed from Two Individuals to LLC: This is the standard and most common type of grant deed, where the two individuals are identified as the granters, and the LLC is specified as the grantee. 2. Joint Tenancy Grant Deed from Two Individuals to LLC: In this type of grant deed, the individuals may hold joint tenancy over the property, which means they have an equal undivided interest in the property. The transfer to the LLC would still require both individuals to execute the grant deed. 3. Tenancy in Common Grant Deed from Two Individuals to LLC: Unlike joint tenancy, tenancy in common allows individuals to have separate and distinct percentages of ownership. If the individuals are tenants in common, they can transfer their respective ownership shares to the LLC in this type of grant deed. 4. Community Property Grant Deed from Two Individuals to LLC: If the individuals are married and the property is considered community property, this type of grant deed is used to transfer ownership to the LLC. Community property is jointly owned by the spouses, and both spouses' consent is required to transfer the property. It is essential to consult with a real estate attorney or title company to ensure the correct type of grant deed is used and that all legal requirements and regulations specific to Salinas, California, are adhered to during the transfer process.A Salinas California Grant Deed from Two Individuals to LLC is a legal document that transfers ownership of property from two individuals to a limited liability company (LLC) in the city of Salinas, California. The granters, who are the current property owners, grant their rights, title, and interest in the property to the LLC, which becomes the new owner. This type of transfer is often chosen when the individuals want to operate their business activities or manage their property assets under the protection of an LLC. The LLC structure offers limited liability protection for the owners, meaning their personal assets are safeguarded in the event of any legal issues or debts incurred by the LLC. The Salinas California Grant Deed from Two Individuals to LLC is an essential document that helps establish a proper legal framework for the ownership of real estate assets within the city and ensures that all rights and responsibilities associated with the property are accurately transferred to the new LLC owner. Some variations or types of Salinas California Grant Deeds from Two Individuals to LLC may include: 1. Traditional Salinas California Grant Deed from Two Individuals to LLC: This is the standard and most common type of grant deed, where the two individuals are identified as the granters, and the LLC is specified as the grantee. 2. Joint Tenancy Grant Deed from Two Individuals to LLC: In this type of grant deed, the individuals may hold joint tenancy over the property, which means they have an equal undivided interest in the property. The transfer to the LLC would still require both individuals to execute the grant deed. 3. Tenancy in Common Grant Deed from Two Individuals to LLC: Unlike joint tenancy, tenancy in common allows individuals to have separate and distinct percentages of ownership. If the individuals are tenants in common, they can transfer their respective ownership shares to the LLC in this type of grant deed. 4. Community Property Grant Deed from Two Individuals to LLC: If the individuals are married and the property is considered community property, this type of grant deed is used to transfer ownership to the LLC. Community property is jointly owned by the spouses, and both spouses' consent is required to transfer the property. It is essential to consult with a real estate attorney or title company to ensure the correct type of grant deed is used and that all legal requirements and regulations specific to Salinas, California, are adhered to during the transfer process.