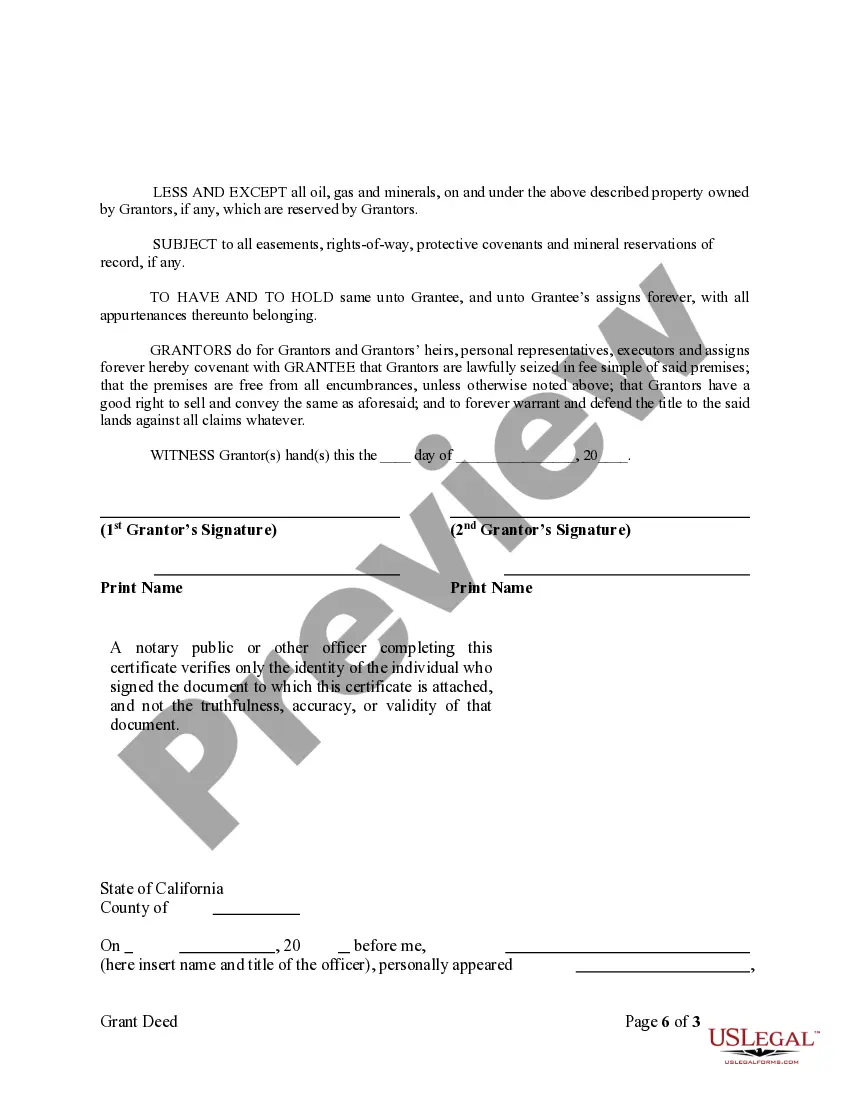

This Warranty Deed from two Individuals to LLC form is a Warranty Deed where the Grantors are two individuals and the Grantee is a limited liability company. Grantors convey and warrant the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

San Bernardino California Grant Deed from Two Individuals to LLC

Description

How to fill out California Grant Deed From Two Individuals To LLC?

If you’ve previously employed our service, Log In to your account and download the San Bernardino California Grant Deed from Two Individuals to LLC onto your device by clicking the Download button. Ensure that your subscription is current. If it's not, renew it according to your payment plan.

If this is your first time using our service, follow these straightforward steps to acquire your document.

You have continuous access to all the documents you have purchased: they are available in your profile under the My documents section whenever you need to retrieve them. Utilize the US Legal Forms service to effortlessly find and save any template for your personal or business requirements!

- Verify you've located a suitable document. Review the description and utilize the Preview feature, if available, to determine if it suits your needs. If it doesn’t fit, use the Search tab above to find the right one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process your payment. Enter your credit card information or choose the PayPal option to finalize the purchase.

- Obtain your San Bernardino California Grant Deed from Two Individuals to LLC. Choose the file format for your document and save it on your device.

- Finalize your document. Print it or utilize professional online editors to complete and electronically sign it.

Form popularity

FAQ

To remove someone from a grant deed in California, you will need to create a new grant deed that excludes that individual as an owner. This process typically requires consent from the person being removed and must meet all state regulations. After completing the deed, record it with the county office. Utilizing our platform can guide you through each necessary step to ensure a smooth transition.

Amending a grant deed in California involves preparing an amended deed that clearly states the changes to be made. You must also provide all required property details and have all parties sign the amendment. After signing, submit the amended deed to the San Bernardino County Recorder's Office. You can find the necessary templates on our platform to assist you with this process.

To change a grant deed in California, draft a new grant deed that reflects the current and new ownership. Be sure to include the legal description of your property and have it signed by the current owner. After that, you will need to file the new deed with the proper county recording office. Our platform offers user-friendly tools to ensure you complete this correctly.

Yes, you can change a deed without a lawyer in California, provided you understand the requirements. You must prepare a new grant deed and comply with local recording rules. However, using our platform can simplify this task with easy-to-follow instructions and ready-made forms, especially for transactions like a San Bernardino California Grant Deed from Two Individuals to LLC.

Changing a deed on your house in California requires you to create a new grant deed that states the new ownership details. Ensure you include the correct legal description of the property. Once completed, file this deed with the appropriate county office, such as the San Bernardino County Recorder's Office. Our platform can help you navigate this procedure effectively.

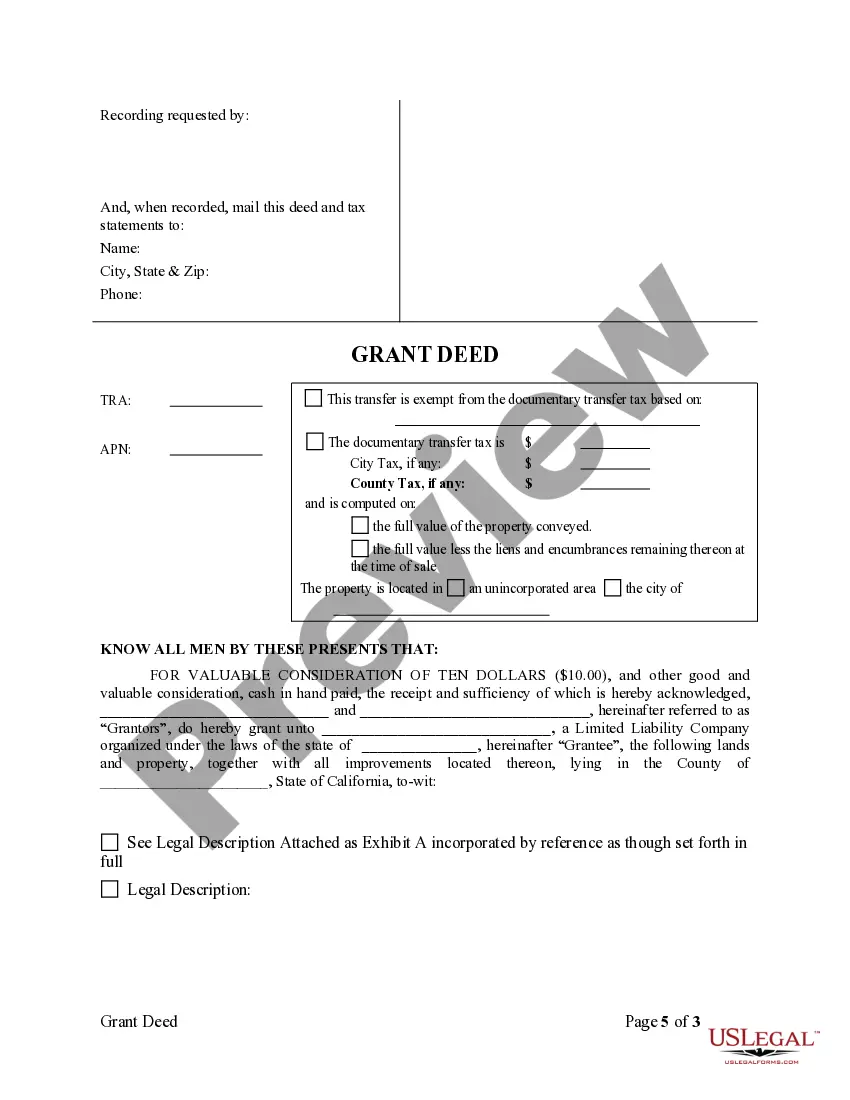

To transfer a deed from individuals to an LLC, you must first prepare a new grant deed that reflects the LLC as the new owner. You will need to include specific details about the property and the LLC. After signing the deed, you should record it with the San Bernardino County Recorder's Office. Using our platform can streamline this process by providing the necessary forms and guidance.

Removing someone from a deed without refinancing is possible in San Bernardino, California, by executing a grant deed that transfers ownership. You can simply prepare a new deed that includes only the remaining owner, thus updating the San Bernardino California Grant Deed from Two Individuals to LLC. After signing, you must record the new deed with the county to make the change official. Consider using US Legal Forms for easy access to the correct documents and instructions.

To remove someone from a grant deed in San Bernardino, California, you must first prepare a new grant deed that reflects the desired ownership change. This deed needs to be signed by the person who remains on the deed. Once completed, the new deed must be filed with the county recorder's office to officially update the San Bernardino California Grant Deed from Two Individuals to LLC. Utilizing a service like US Legal Forms can simplify this process, providing access to the necessary forms and guidance.

To transfer property from one person to another in California, begin by drafting a grant deed that includes the necessary information regarding both parties. You must describe the property being transferred and ensure the document is signed by the current owner. After completing the grant deed, record it with the county for it to take effect. When you involve a San Bernardino California Grant Deed from Two Individuals to LLC, this process can offer added benefits of clear ownership transfer.

Filling out a California grant deed requires attention to detail. First, include the names and addresses of both the granter and the grantee, where the granter is the current owner and the grantee is the LLC. Then, describe the property being transferred clearly, and finally, sign the deed before a notary public. When dealing with a San Bernardino California Grant Deed from Two Individuals to LLC, ensure you accurately complete these sections for a valid transfer.