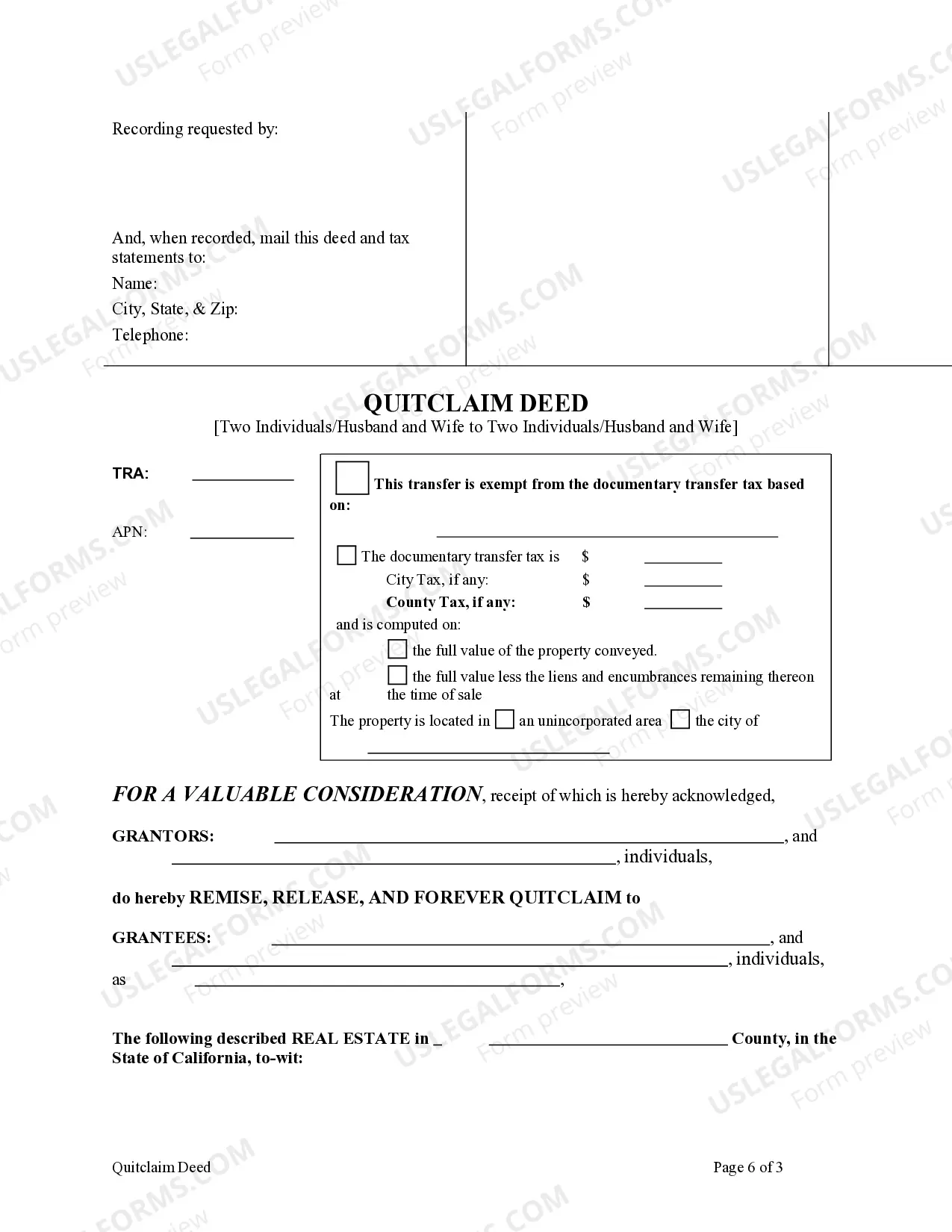

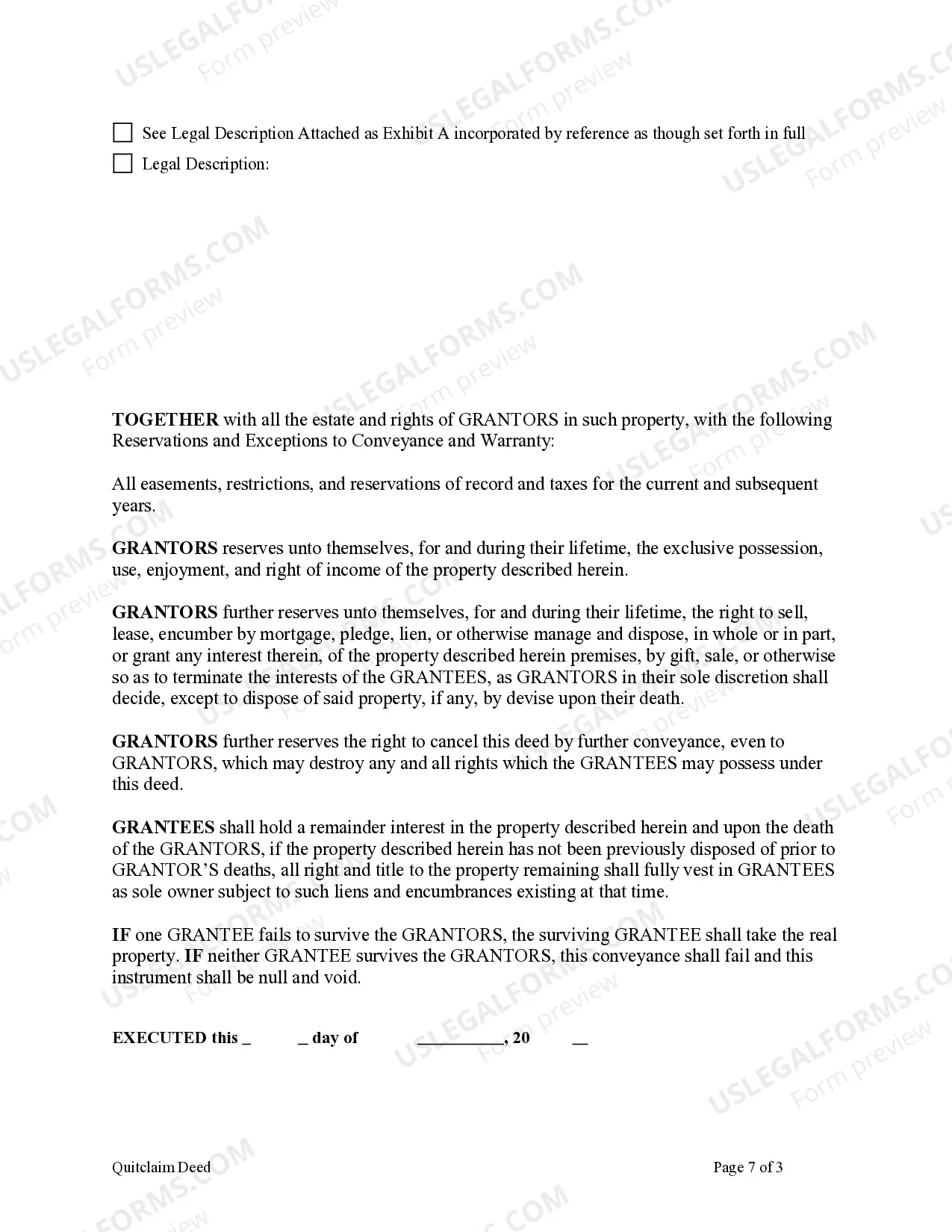

This form is a Quitclaim Deed with retained Enhanced Life Estates where the Grantors are two individuals or husband and wife and the Grantees are two individuals or husband and wife. Grantors convey the property to Grantees subject to an enhanced retained life estate. The Grantors retains the right to sell, encumber, mortgage or otherwise impair the interest Grantees might receive in the future, without joinder or notice to Grantees, with the exception of the right to transfer the property by will. Grantees are required to survive the Grantors in order to receive the real property. This deed complies with all state statutory laws.

The Murrieta California Enhanced Life Estate or Lady Bird Quitclaim Deed is a legal instrument used in real estate transactions that allows for the transfer of property from two individuals, whether they are a married couple or not, to two individuals, either another married couple or individuals of their choosing. This type of deed provides significant benefits and protections for the current owners and the designated beneficiaries. One key advantage of the Murrieta California Enhanced Life Estate or Lady Bird Quitclaim Deed is the retention of control and ownership by the original owners, even after the transfer of the property. This means that the individuals executing the deed, referred to as the "granters," continue to enjoy full control and use of the property during their lifetime, including the ability to sell, mortgage, or lease the property without the involvement or consent of the beneficiaries, known as the "grantees." In addition to preserving control, the Lady Bird Quitclaim Deed provides several additional benefits. Most notably, it enables the granters to bypass the probate process when the property is transferred to the grantees upon the death of the granters. This efficient transfer avoids the need for costly and time-consuming probate procedures, enabling the grantees to assume immediate ownership and avoid potential disputes or delays. Another significant advantage of the Murrieta California Enhanced Life Estate or Lady Bird Quitclaim Deed is the ability to obtain a step-up in tax basis. When the property is transferred to the grantees as a result of the granters' death, the tax basis of the property is adjusted to its current fair market value. This step-up in basis can result in substantial tax savings for the grantees if they choose to sell the property. It is essential to note that while the Murrieta California Enhanced Life Estate or Lady Bird Quitclaim Deed is a commonly used instrument, there are no specific subtypes associated with these deeds. However, various individuals may have different needs or preferences when executing such a deed. Seeking legal counsel is crucial to ensure that the specific provisions meet the requirements and objectives of the involved parties. In summary, the Murrieta California Enhanced Life Estate or Lady Bird Quitclaim Deed is a powerful tool for transferring property while maintaining control and providing protections for the original owners. By establishing an enhanced life estate and enabling the bypass of probate, this deed offers significant benefits, including tax advantages, to both the current owners and the designated grantees.The Murrieta California Enhanced Life Estate or Lady Bird Quitclaim Deed is a legal instrument used in real estate transactions that allows for the transfer of property from two individuals, whether they are a married couple or not, to two individuals, either another married couple or individuals of their choosing. This type of deed provides significant benefits and protections for the current owners and the designated beneficiaries. One key advantage of the Murrieta California Enhanced Life Estate or Lady Bird Quitclaim Deed is the retention of control and ownership by the original owners, even after the transfer of the property. This means that the individuals executing the deed, referred to as the "granters," continue to enjoy full control and use of the property during their lifetime, including the ability to sell, mortgage, or lease the property without the involvement or consent of the beneficiaries, known as the "grantees." In addition to preserving control, the Lady Bird Quitclaim Deed provides several additional benefits. Most notably, it enables the granters to bypass the probate process when the property is transferred to the grantees upon the death of the granters. This efficient transfer avoids the need for costly and time-consuming probate procedures, enabling the grantees to assume immediate ownership and avoid potential disputes or delays. Another significant advantage of the Murrieta California Enhanced Life Estate or Lady Bird Quitclaim Deed is the ability to obtain a step-up in tax basis. When the property is transferred to the grantees as a result of the granters' death, the tax basis of the property is adjusted to its current fair market value. This step-up in basis can result in substantial tax savings for the grantees if they choose to sell the property. It is essential to note that while the Murrieta California Enhanced Life Estate or Lady Bird Quitclaim Deed is a commonly used instrument, there are no specific subtypes associated with these deeds. However, various individuals may have different needs or preferences when executing such a deed. Seeking legal counsel is crucial to ensure that the specific provisions meet the requirements and objectives of the involved parties. In summary, the Murrieta California Enhanced Life Estate or Lady Bird Quitclaim Deed is a powerful tool for transferring property while maintaining control and providing protections for the original owners. By establishing an enhanced life estate and enabling the bypass of probate, this deed offers significant benefits, including tax advantages, to both the current owners and the designated grantees.