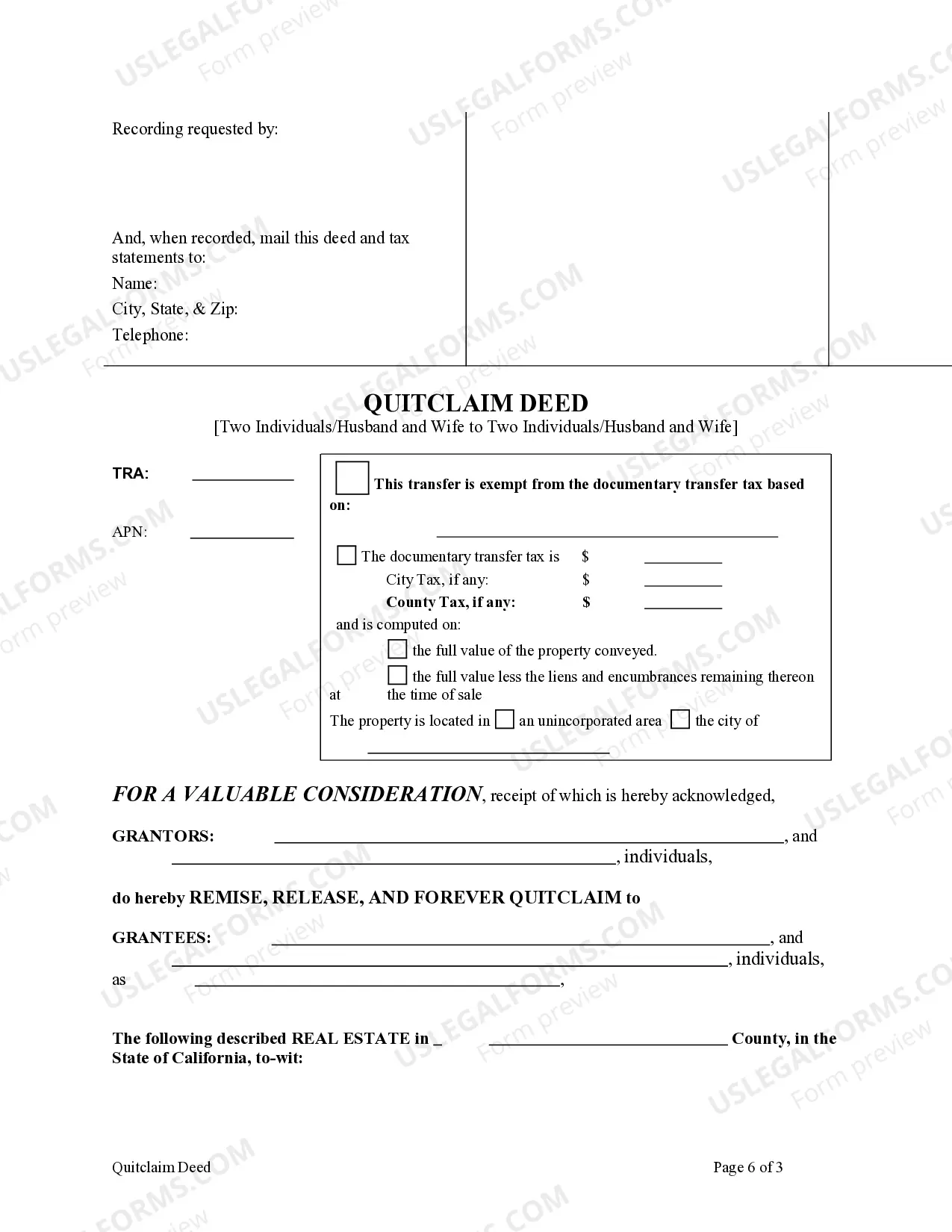

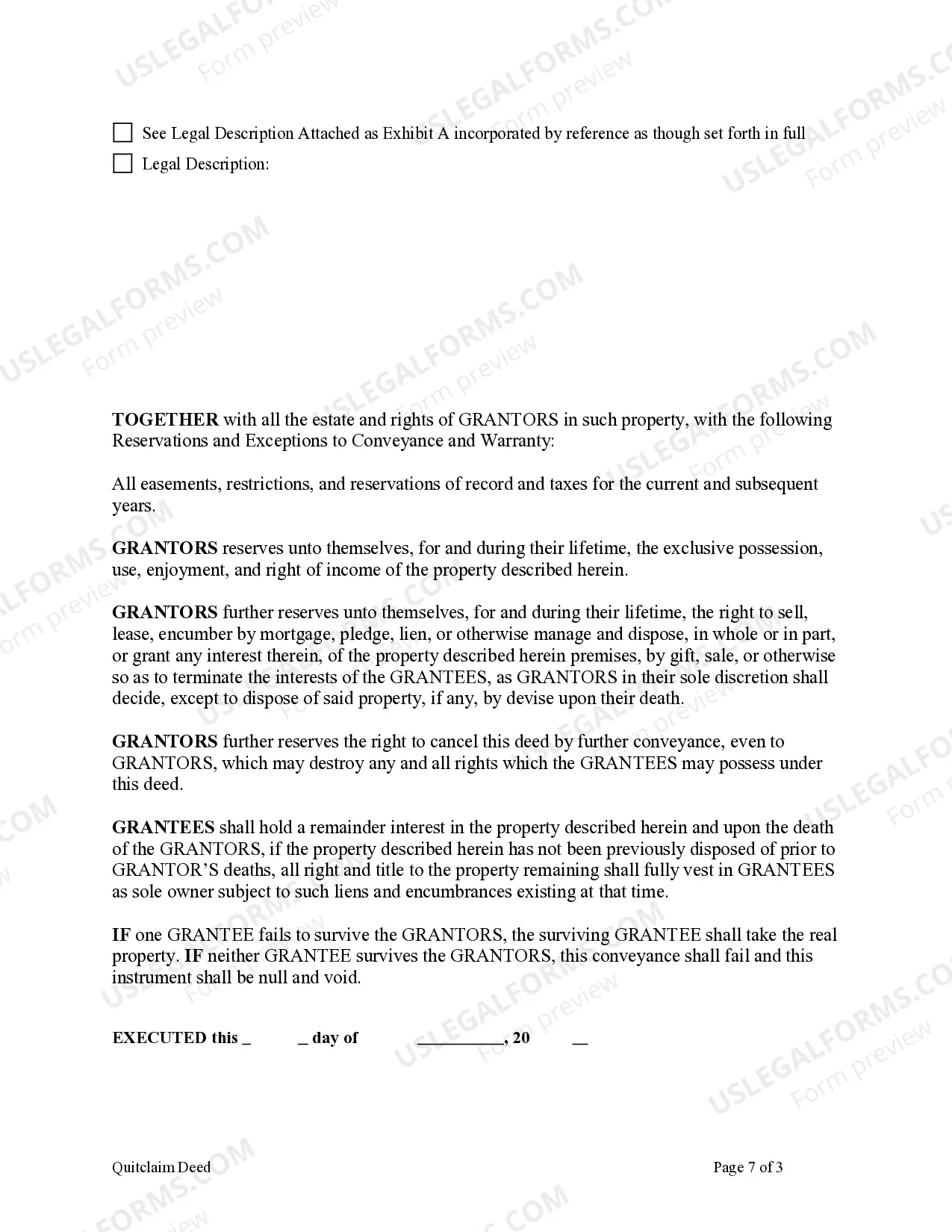

This form is a Quitclaim Deed with retained Enhanced Life Estates where the Grantors are two individuals or husband and wife and the Grantees are two individuals or husband and wife. Grantors convey the property to Grantees subject to an enhanced retained life estate. The Grantors retains the right to sell, encumber, mortgage or otherwise impair the interest Grantees might receive in the future, without joinder or notice to Grantees, with the exception of the right to transfer the property by will. Grantees are required to survive the Grantors in order to receive the real property. This deed complies with all state statutory laws.

Norwalk California Enhanced Life Estate or Lady Bird Quitclaim Deed from Two Individuals, or Husband and Wife, is a legal instrument used for property transfers in the state of California. This type of deed provides specific benefits and protections to the granter (original property owners) and grantees (new property owners). By using relevant keywords, let's explore the various aspects and types of Norwalk California Enhanced Life Estate or Lady Bird Quitclaim Deeds in detail. Norwalk California Enhanced Life Estate Deed: The Norwalk California Enhanced Life Estate Deed, also known as the Lady Bird Deed, is a specialized form of a life estate deed. It allows property owners (husband and wife or two individuals) to retain control and ownership of their property during their lifetimes while still ensuring seamless transfer to their chosen beneficiaries upon their demise. This type of deed offers flexibility and probate-avoiding benefits to the granters, making it an attractive option for estate planning. Features and Benefits: 1. Retained Control: The granters maintain complete control over the property during their lifetimes, including the ability to sell, mortgage, or make changes. 2. Avoiding Probate: Unlike traditional wills or other deeds, the Norwalk California Enhanced Life Estate Deed bypasses probate, providing a quicker and simpler transfer of the property to the beneficiaries. 3. Medicaid Planning: This deed can be a useful tool for individuals seeking to protect their assets from Medicaid recovery. If the granters require long-term care, the property may be excluded from Medicaid estate recovery, potentially preserving it as an inheritance for their loved ones. 4. Tax Benefits: The Norwalk California Enhanced Life Estate Deed allows for stepped-up tax basis on the property, potentially reducing capital gains taxes upon its sale in the future. Additional Types: While the Norwalk California Enhanced Life Estate or Lady Bird Quitclaim Deed typically refers to the aforementioned characteristics, it is crucial to mention some additional variations of this deed that can exist: 1. Joint Tenancy with Right of Survivorship: This type of Norwalk California Enhanced Life Estate Deed involves two individuals, usually married couples, jointly owning the property during their lifetimes. Upon the death of one spouse, the surviving spouse automatically becomes the sole owner of the property by right of survivorship, without the need for probate. 2. Tenancy by the Entirety: Similar to Joint Tenancy with Right of Survivorship, this variation specifically applies to married couples. It carries the additional benefit of protecting the property from any potential claims by individual creditors of one spouse. In conclusion, the Norwalk California Enhanced Life Estate or Lady Bird Quitclaim Deed from Two Individuals, or Husband and Wife, serves as a highly advantageous instrument for property transfer and estate planning. Its features, benefits, and variations provide individuals and couples with tailored solutions to protect and streamline the transfer of their real estate assets, ensuring a smooth transition to their chosen beneficiaries.