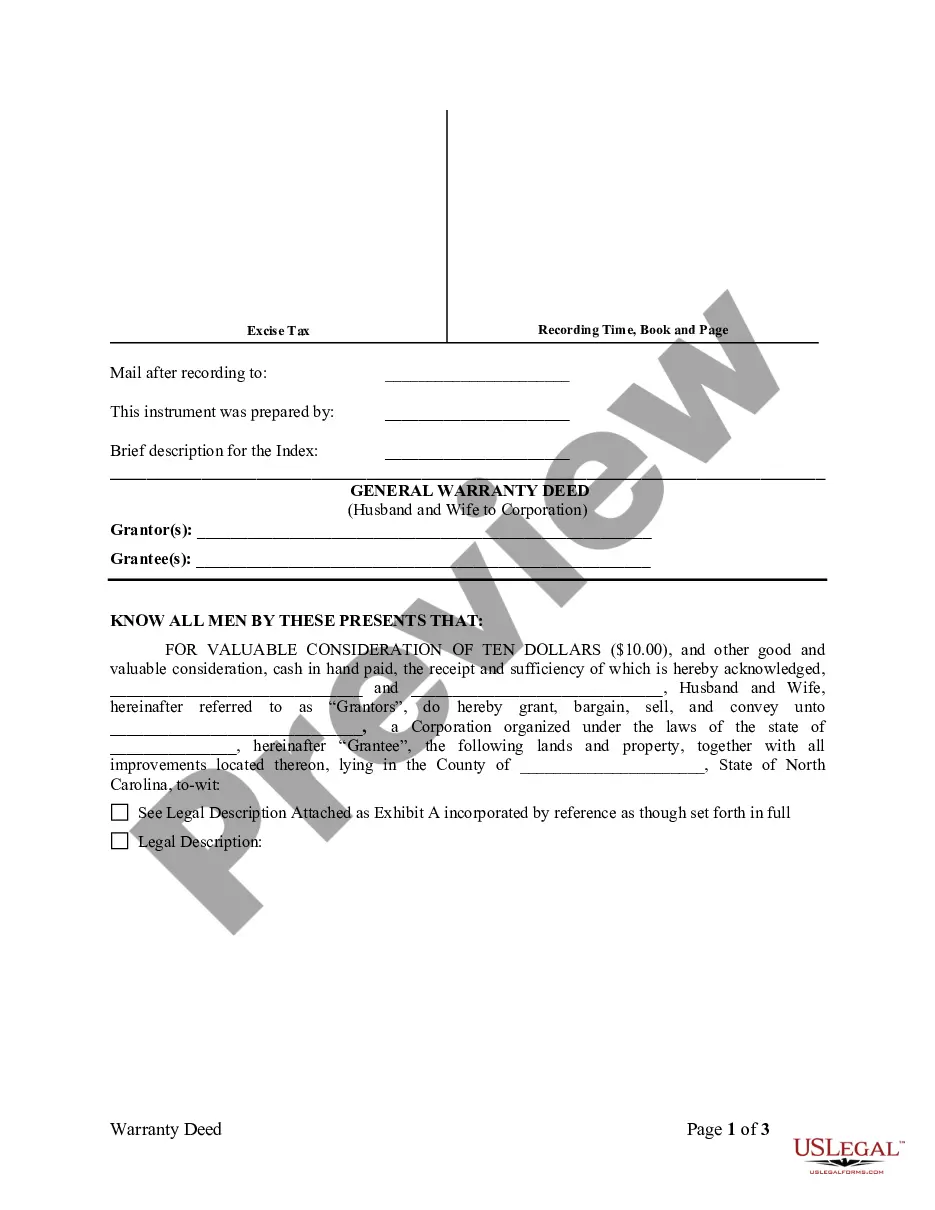

This form is a Quitclaim Deed with retained Enhanced Life Estates where the Grantors are two individuals or husband and wife and the Grantees are two individuals or husband and wife. Grantors convey the property to Grantees subject to an enhanced retained life estate. The Grantors retains the right to sell, encumber, mortgage or otherwise impair the interest Grantees might receive in the future, without joinder or notice to Grantees, with the exception of the right to transfer the property by will. Grantees are required to survive the Grantors in order to receive the real property. This deed complies with all state statutory laws.

When it comes to estate planning in San Diego, California, one option that individuals, or even married couples, may consider is the Enhanced Life Estate, also known as the Lady Bird Quitclaim Deed. This legal instrument grants certain rights and benefits to the granter while simplifying the transfer of property to the grantees upon the granter's passing. The San Diego California Enhanced Life Estate or Lady Bird Quitclaim Deed from Two Individuals, or Husband and Wife, serves as a valuable tool in estate planning. It allows the granter (or granters) to retain control over the property during their lifetime while providing a seamless transfer process to the grantees upon their demise. This type of deed offers several advantages. Firstly, it allows the granter to maintain full control over the property, including the ability to sell, mortgage, or gift it during their lifetime. By putting their property in an Enhanced Life Estate, individuals or couples can ensure they have a secure place to reside and enjoy the property's benefits until their passing. Upon the granter's death, the property automatically passes to the grantees without going through the tedious and time-consuming probate process. This streamlined transfer enhances the beneficiaries' ability to access and manage the property promptly. The San Diego California Enhanced Life Estate or Lady Bird Quitclaim Deed from Two Individuals, or Husband and Wife, has a few different variations worth mentioning. One of them is the Joint Tenancy with Right of Survivorship, where the property passes to the surviving spouse or co-owner upon one spouse's death. Another variation is the Tenancy in Common, where each spouse or co-owner retains an individual and distinct portion of the property, which they can transfer through inheritance or sale. It's essential to consult with a knowledgeable estate planning attorney to determine the best type of Enhanced Life Estate or Lady Bird Quitclaim Deed for your specific needs. They can assess your circumstances, explain your options, and help you draft a legally sound and personalized deed that protects your interests and ensures a smooth transfer of property to your chosen grantees. In conclusion, the San Diego California Enhanced Life Estate or Lady Bird Quitclaim Deed from Two Individuals, or Husband and Wife, allows individuals and married couples to maintain control over their property while simplifying the transfer process to their chosen beneficiaries. By utilizing this estate planning tool, individuals can enjoy peace of mind knowing that their property will be seamlessly passed on to their loved ones, bypassing the complexities of probate. Contact a reputable estate planning attorney to explore the different types and benefits of Enhanced Life Estates or Lady Bird Quitclaim Deeds available in San Diego, California.