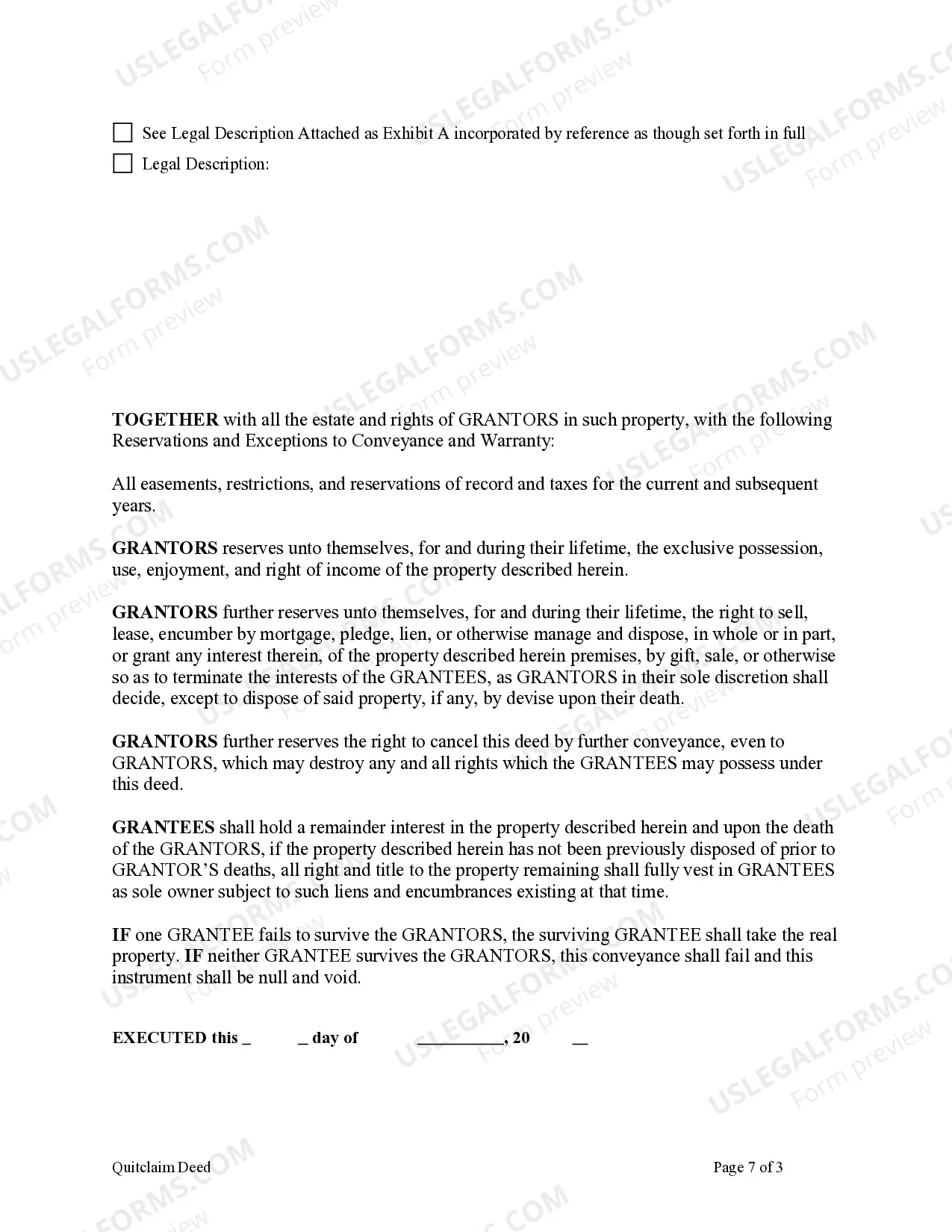

This form is a Quitclaim Deed with retained Enhanced Life Estates where the Grantors are two individuals or husband and wife and the Grantees are two individuals or husband and wife. Grantors convey the property to Grantees subject to an enhanced retained life estate. The Grantors retains the right to sell, encumber, mortgage or otherwise impair the interest Grantees might receive in the future, without joinder or notice to Grantees, with the exception of the right to transfer the property by will. Grantees are required to survive the Grantors in order to receive the real property. This deed complies with all state statutory laws.

Santa Clara California Enhanced Life Estate or Lady Bird Quitclaim Deed can be a useful tool for estate planning and asset protection. This type of deed allows two individuals, typically a husband and wife, to transfer real property to another two individuals or a couple while retaining certain rights and benefits during their lifetime. The Enhanced Life Estate Deed, commonly known as the "Lady Bird Deed," is designed to bypass probate and provides the granters with enhanced control and flexibility over their property. With this deed, the granters retain a life estate, meaning they have the right to live in and use the property for the remainder of their lives. They can also sell, mortgage, or gift the property without the consent of the remainder beneficiaries. Additionally, they have the power to revoke or change the beneficiaries at any time. Such deeds are often used to ensure that the granters' beneficiaries or chosen individuals receive the property after their passing without the need for probate. By avoiding probate, the process becomes less time-consuming, costly, and public. Different types of Santa Clara California Enhanced Life Estate or Lady Bird Quitclaim Deeds may include variations in the rights and benefits retained by the granters. Some specific types include: 1. Standard Enhanced Life Estate Deed: In this type, the granters retain the right to live in the property for their lifetime, while still maintaining the ability to sell, mortgage, or make changes to beneficiaries. They have complete control over the property during their lifetime. 2. Limited Enhanced Life Estate Deed: Here, the granters retain the right to live in the property, but with certain limitations. They may not have the authority to sell or mortgage the property without the consent of the remainder beneficiaries. 3. Enhanced Life Estate Deed with Special Powers: This type grants the granters additional powers that allow them to lease the property, collect and retain rents, or use the property for commercial purposes during their lifetime. 4. Joint Enhanced Life Estate Deed: This deed is executed by two individuals, commonly a husband and wife, who transfer their property to another couple or individuals. Both granters retain the right to live in the property for their lifetimes, with the same control and benefits as any other Enhanced Life Estate Deed. It is important to consult with a qualified attorney before proceeding with Santa Clara California Enhanced Life Estate or Lady Bird Quitclaim Deed. The attorney can provide guidance on the specific deed type that best suits your needs and ensure its compliance with state laws and regulations. Retaining legal assistance during the process can offer peace of mind and ensure a smooth transfer of property rights.