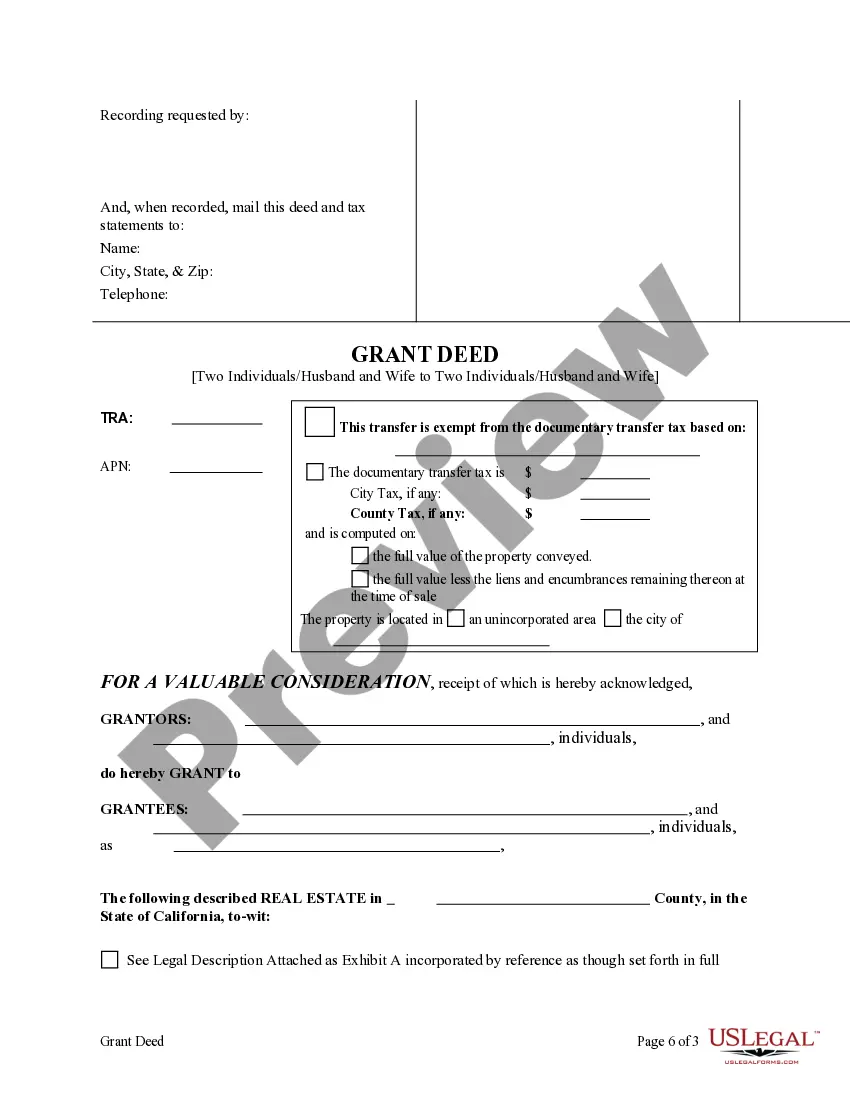

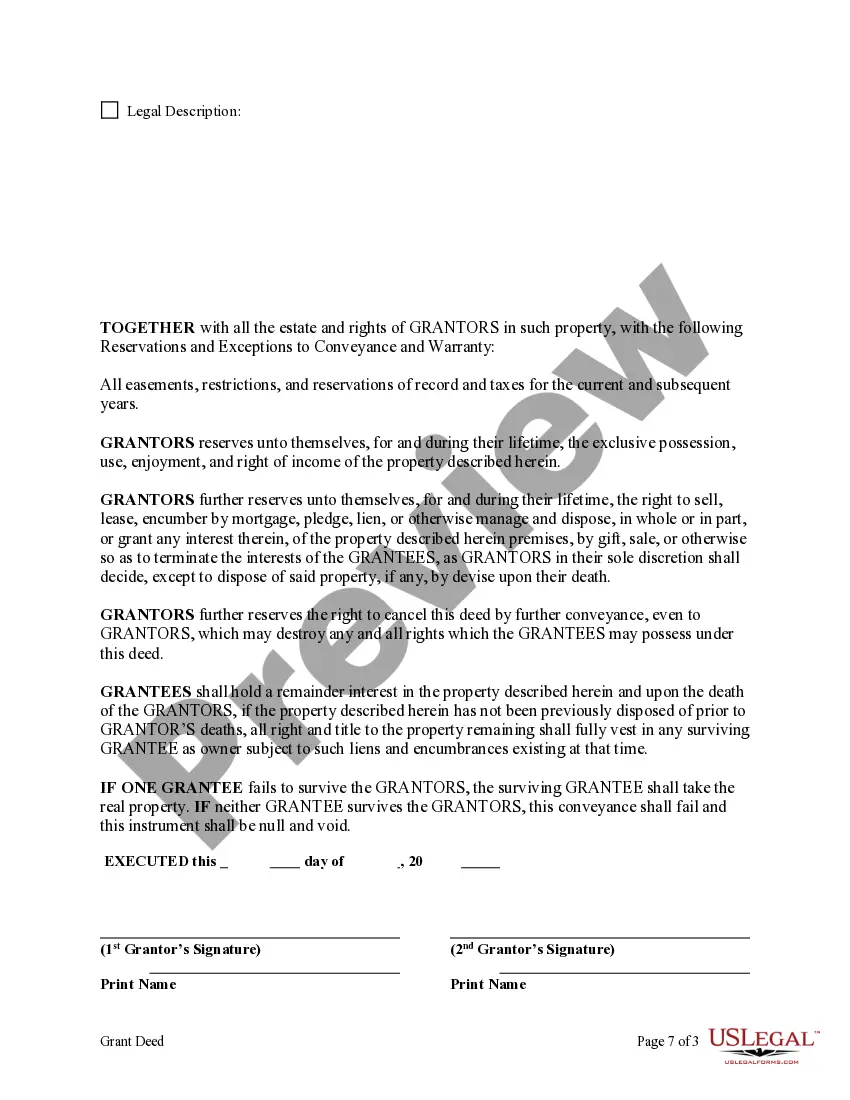

This form is a Grant Deed with retained Enhanced Life Estates where the Grantors are two individuals or husband and wife and the Grantees are two individuals or husband and wife. Grantors convey the property to Grantees subject to an enhanced retained life estate. The Grantors retains the right to sell, encumber, mortgage or otherwise impair the interest Grantees might receive in the future, without joinder or notice to Grantees, with the exception of the right to transfer the property by will. Grantees are required to survive the Grantors in order to receive the real property. This deed complies with all state statutory laws.

A Salinas California Enhanced Life Estate or Lady Bird Grant Deed is a specific type of real estate transfer document that allows two individuals, including a husband and wife, to transfer property ownership to two other individuals, including another set of spouses. This type of deed provides certain benefits and protections to the granters (the individuals transferring the property) and the grantees (the individuals receiving the property). The key feature of the Salinas California Enhanced Life Estate or Lady Bird Grant Deed is the retention of a life estate by the granters. A life estate ensures that the granters maintain the right to use and enjoy the property during their lifetimes. However, unlike a traditional life estate, the granters also retain the power to sell, gift, or even mortgage the property without the consent of the grantees. The enhanced aspect of this type of deed refers to the granters' ability to transfer the property to the grantees, while bypassing the probate process. This means that upon the death of the granters, the property will automatically pass to the grantees, avoiding the need for a court-supervised probate proceeding. This feature can save time, money, and simplify the transfer of property ownership. There are various types of Salinas California Enhanced Life Estate or Lady Bird Grant Deeds, including: 1. Enhanced Life Estate Deed: This version of the grant deed allows the granters to retain a life estate and the power to sell, gift, or mortgage the property without the grantees' consent. Additionally, it provides for the automatic transfer of the property to the grantees upon the granters' death, bypassing probate. 2. Enhanced Life Estate with Reserved Power Deed: This type of deed includes specific reserved powers for the granters, such as the ability to change the grantees or revoke the deed entirely. This offers extra flexibility to the granters. 3. Enhanced Life Estate with Medicaid Planning Deed: This variation of the deed is designed specifically for individuals looking to protect their property from potential Medicaid liens or estate recovery claims. It incorporates certain provisions to comply with Medicaid rules and regulations, allowing the granters to benefit from Medicaid assistance while preserving their property for the grantees. In conclusion, Salinas California Enhanced Life Estate or Lady Bird Grant Deeds provide an effective means for two individuals, including a married couple, to transfer property ownership to another pair of individuals, including another married couple. The granters retain a life estate and certain powers, while facilitating the automatic transfer of the property to the grantees upon the granters' death. Different variations of the deed offer additional flexibility or performance under specific circumstances, such as the need for Medicaid planning.A Salinas California Enhanced Life Estate or Lady Bird Grant Deed is a specific type of real estate transfer document that allows two individuals, including a husband and wife, to transfer property ownership to two other individuals, including another set of spouses. This type of deed provides certain benefits and protections to the granters (the individuals transferring the property) and the grantees (the individuals receiving the property). The key feature of the Salinas California Enhanced Life Estate or Lady Bird Grant Deed is the retention of a life estate by the granters. A life estate ensures that the granters maintain the right to use and enjoy the property during their lifetimes. However, unlike a traditional life estate, the granters also retain the power to sell, gift, or even mortgage the property without the consent of the grantees. The enhanced aspect of this type of deed refers to the granters' ability to transfer the property to the grantees, while bypassing the probate process. This means that upon the death of the granters, the property will automatically pass to the grantees, avoiding the need for a court-supervised probate proceeding. This feature can save time, money, and simplify the transfer of property ownership. There are various types of Salinas California Enhanced Life Estate or Lady Bird Grant Deeds, including: 1. Enhanced Life Estate Deed: This version of the grant deed allows the granters to retain a life estate and the power to sell, gift, or mortgage the property without the grantees' consent. Additionally, it provides for the automatic transfer of the property to the grantees upon the granters' death, bypassing probate. 2. Enhanced Life Estate with Reserved Power Deed: This type of deed includes specific reserved powers for the granters, such as the ability to change the grantees or revoke the deed entirely. This offers extra flexibility to the granters. 3. Enhanced Life Estate with Medicaid Planning Deed: This variation of the deed is designed specifically for individuals looking to protect their property from potential Medicaid liens or estate recovery claims. It incorporates certain provisions to comply with Medicaid rules and regulations, allowing the granters to benefit from Medicaid assistance while preserving their property for the grantees. In conclusion, Salinas California Enhanced Life Estate or Lady Bird Grant Deeds provide an effective means for two individuals, including a married couple, to transfer property ownership to another pair of individuals, including another married couple. The granters retain a life estate and certain powers, while facilitating the automatic transfer of the property to the grantees upon the granters' death. Different variations of the deed offer additional flexibility or performance under specific circumstances, such as the need for Medicaid planning.