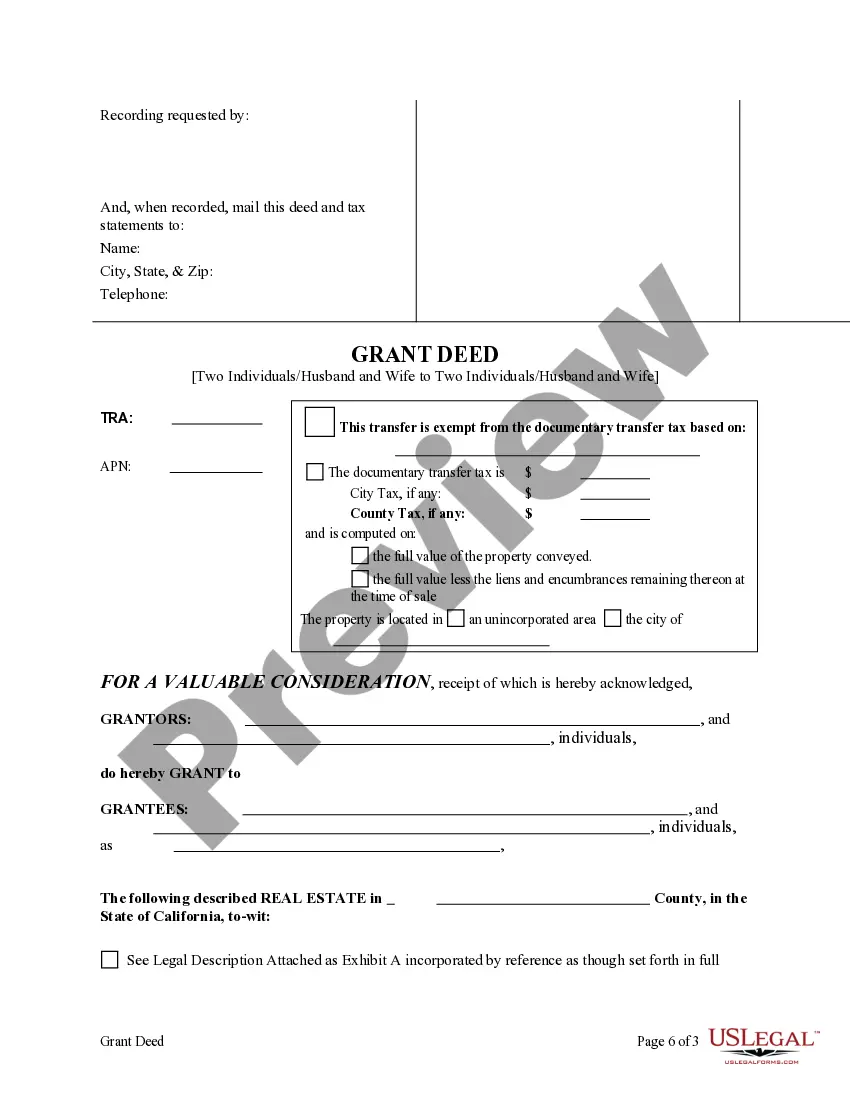

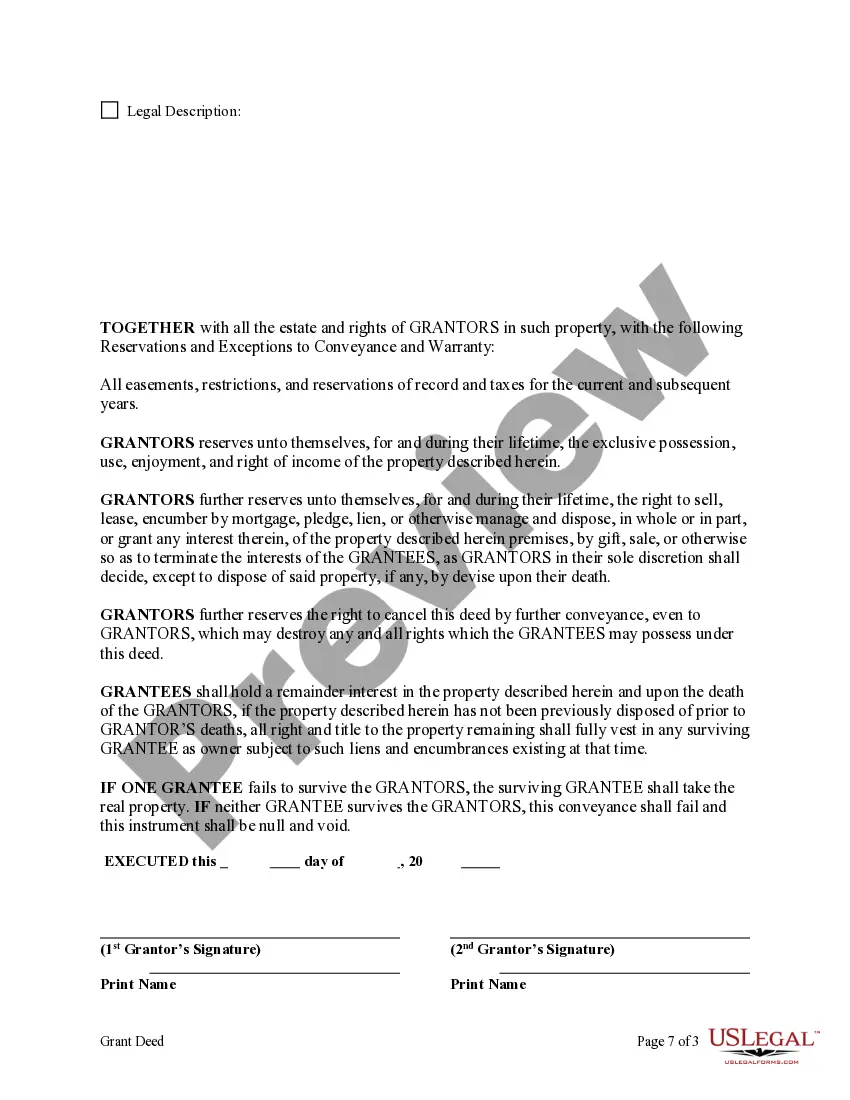

This form is a Grant Deed with retained Enhanced Life Estates where the Grantors are two individuals or husband and wife and the Grantees are two individuals or husband and wife. Grantors convey the property to Grantees subject to an enhanced retained life estate. The Grantors retains the right to sell, encumber, mortgage or otherwise impair the interest Grantees might receive in the future, without joinder or notice to Grantees, with the exception of the right to transfer the property by will. Grantees are required to survive the Grantors in order to receive the real property. This deed complies with all state statutory laws.

Santa Clara California Enhanced Life Estate Deed or Lady Bird Grant Deed is a legal document used by two individuals, or a husband and wife, to transfer property ownership while retaining certain rights and control during their lifetime. This type of deed provides several advantages and protections to the granters (property owners) and the grantees (recipients of the property). One variation of the Santa Clara California Enhanced Life Estate Deed is the "Enhanced Life Estate Deed with Joint Tenancy." In this arrangement, the property owners grant the property to the grantees, typically a husband and wife, while reserving a life estate for themselves. This ensures that the granters can continue to live in and use the property during their lifetime. The grantees, on the other hand, receive the property with rights of survivorship, meaning that the surviving spouse will automatically inherit the property upon the death of the other spouse without the need for probate. Another variation is the "Enhanced Life Estate Deed with Right of Reversion." With this type of deed, the granters transfer the property to the grantees while reserving a life estate for themselves. However, in addition to the life estate, the granters also retain the right to reclaim full ownership of the property if certain conditions are met, such as the grantee’s death before thgrantersrs or the grantee’s failure to maintain the property. The Santa Clara California Enhanced Life Estate Deed and Lady Bird Grant Deed offer unique benefits compared to traditional forms of property transfer. By using such deeds, individuals can bypass probate, eliminate the need for court supervision, and ensure a smooth transition of ownership upon the granters' death. Additionally, these deeds may allow the granters to qualify for certain government benefits, such as Medicaid, since the property is effectively transferred outside their estate. It is important to note that the Santa Clara California Enhanced Life Estate Deed or Lady Bird Grant Deed should be prepared and executed with the assistance of a qualified attorney to ensure its legal validity and compliance with state laws. Each individual's situation may vary, and it is crucial to consider specific circumstances and objectives when choosing the appropriate type of deed.