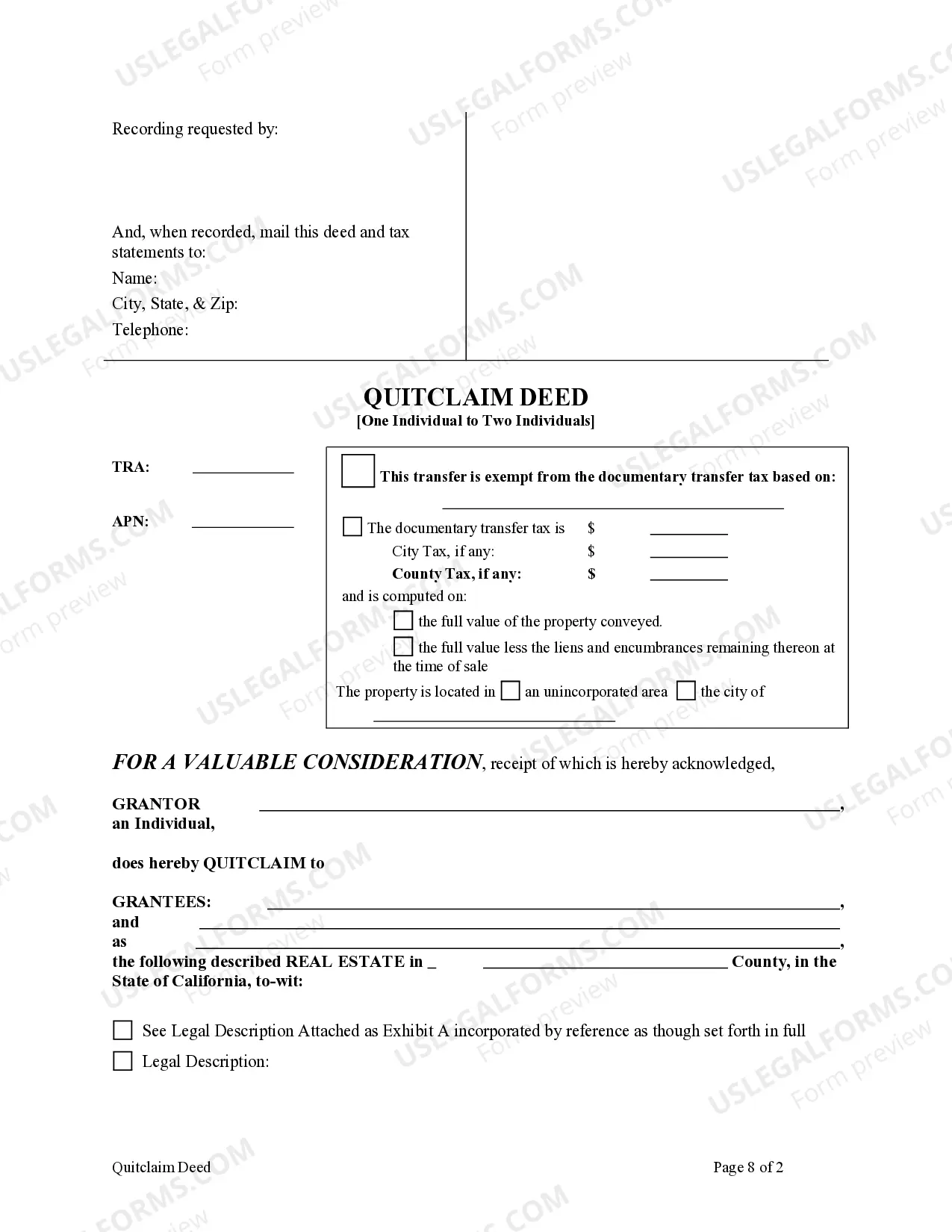

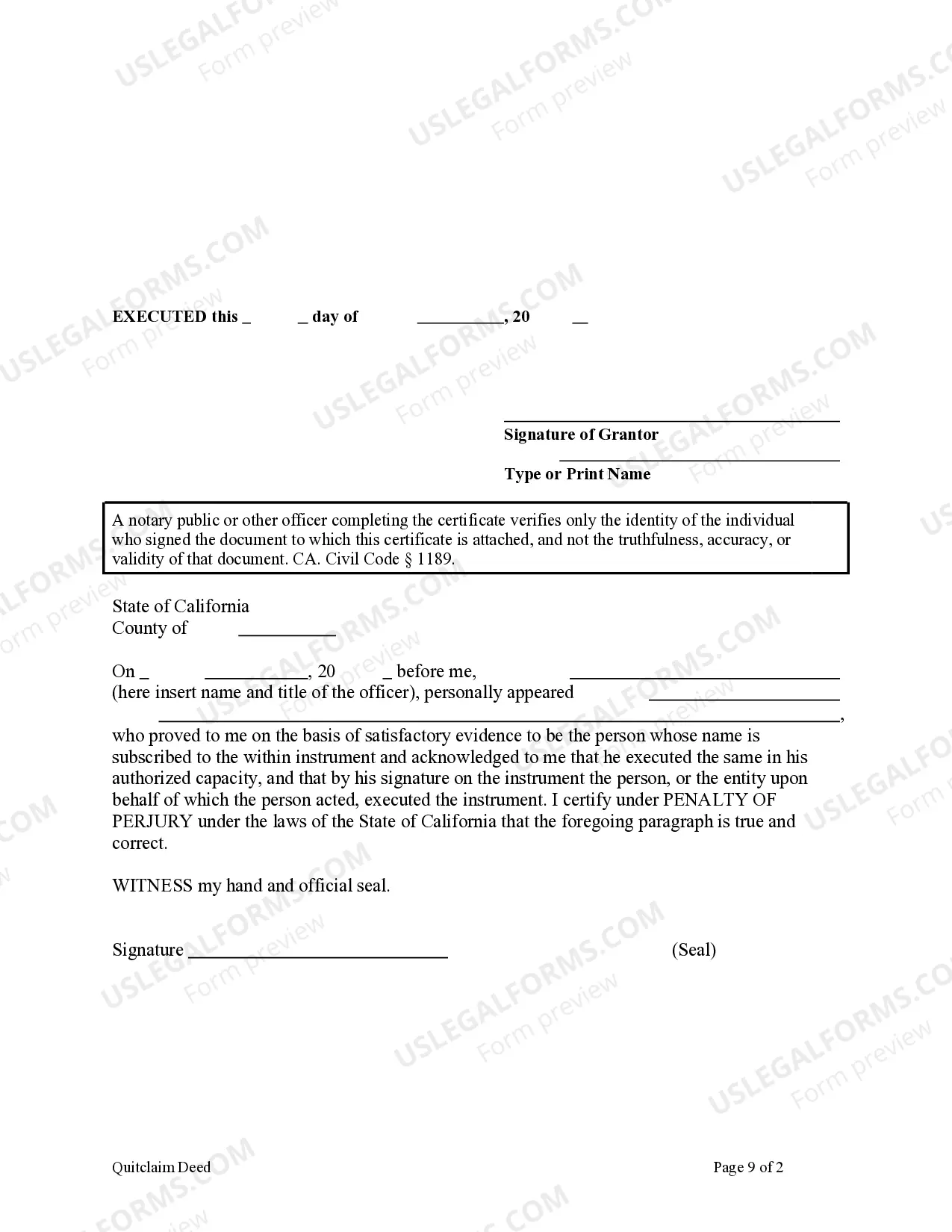

This form is a Quitclaim Deed where the Grantor is an individual and the Grantees are two Individuals. Grantor conveys and quitclaims the described property to Grantees. The Grantees take the property as tenants in common or joint tenants with the right of survivorship. This deed complies with all state statutory laws.

El Cajon California Quitclaim Deed — IndividuaGranteror to Two Individual Grantees is a legal document used for transferring property ownership between an individual granter and two individual grantees. This type of quitclaim deed is specific to El Cajon, California, and follows the legal requirements set forth by the state. A quitclaim deed is a common method of transferring property ownership, especially in situations where the parties involved have an existing relationship or trust. It is important to note that a quitclaim deed does not guarantee ownership or clear title to the property. Instead, it transfers whatever interest or claim the granter may have to the grantees. In the case of El Cajon California Quitclaim Deed — IndividuaGranteror to Two Individual Grantees, this particular deed is suited for situations where the granter wishes to transfer property ownership to two separate individuals as grantees. This can be ideal for spouses, family members, or business partners seeking joint ownership of a property. The process of creating and executing a quitclaim deed in El Cajon, California typically involves several steps. Firstly, the document must contain a clear legal description of the property being transferred, including the parcel number and address. It should also include the names and contact information of the granter(s) and grantees. To ensure legal validity, the quitclaim deed must be drafted according to the specific formatting requirements outlined by the county recorder's office in El Cajon. It should be notarized and signed by all parties involved, including any necessary witnesses. Once executed, the deed must be filed with the county recorder's office to officially record the transfer of ownership. While El Cajon California Quitclaim Deed — IndividuaGranteror to Two Individual Grantees is the standard type of quitclaim deed for transferring property to two individual grantees, there may be variations depending on specific circumstances. Some potential variations include: 1. El Cajon California Quitclaim Deed — IndividuaGranteror to Individual Grantee and Spouse: This type of quitclaim deed is suitable for situations where the granter wishes to transfer property ownership to one individual grantee and their spouse. 2. El Cajon California Quitclaim Deed — IndividuaGranteror to Two Individual Grantees with Specific Shares: This type of quitclaim deed allows for the granter to specify the percentage or share of ownership each grantee will hold. It can be used when joint ownership is desired, but each party has a different level of investment or interest. In conclusion, El Cajon California Quitclaim Deed — IndividuaGranteror to Two Individual Grantees is a legally binding document used for transferring property ownership between an individual granter and two individual grantees. It is important to consult with a legal professional to ensure compliance with all applicable laws and regulations when using this type of deed.El Cajon California Quitclaim Deed — IndividuaGranteror to Two Individual Grantees is a legal document used for transferring property ownership between an individual granter and two individual grantees. This type of quitclaim deed is specific to El Cajon, California, and follows the legal requirements set forth by the state. A quitclaim deed is a common method of transferring property ownership, especially in situations where the parties involved have an existing relationship or trust. It is important to note that a quitclaim deed does not guarantee ownership or clear title to the property. Instead, it transfers whatever interest or claim the granter may have to the grantees. In the case of El Cajon California Quitclaim Deed — IndividuaGranteror to Two Individual Grantees, this particular deed is suited for situations where the granter wishes to transfer property ownership to two separate individuals as grantees. This can be ideal for spouses, family members, or business partners seeking joint ownership of a property. The process of creating and executing a quitclaim deed in El Cajon, California typically involves several steps. Firstly, the document must contain a clear legal description of the property being transferred, including the parcel number and address. It should also include the names and contact information of the granter(s) and grantees. To ensure legal validity, the quitclaim deed must be drafted according to the specific formatting requirements outlined by the county recorder's office in El Cajon. It should be notarized and signed by all parties involved, including any necessary witnesses. Once executed, the deed must be filed with the county recorder's office to officially record the transfer of ownership. While El Cajon California Quitclaim Deed — IndividuaGranteror to Two Individual Grantees is the standard type of quitclaim deed for transferring property to two individual grantees, there may be variations depending on specific circumstances. Some potential variations include: 1. El Cajon California Quitclaim Deed — IndividuaGranteror to Individual Grantee and Spouse: This type of quitclaim deed is suitable for situations where the granter wishes to transfer property ownership to one individual grantee and their spouse. 2. El Cajon California Quitclaim Deed — IndividuaGranteror to Two Individual Grantees with Specific Shares: This type of quitclaim deed allows for the granter to specify the percentage or share of ownership each grantee will hold. It can be used when joint ownership is desired, but each party has a different level of investment or interest. In conclusion, El Cajon California Quitclaim Deed — IndividuaGranteror to Two Individual Grantees is a legally binding document used for transferring property ownership between an individual granter and two individual grantees. It is important to consult with a legal professional to ensure compliance with all applicable laws and regulations when using this type of deed.