This form is a Grant Deed where the Grantors are Husband and Wife and the Grantees are two married couples. This deed complies with all state statutory laws.

San Diego California Grant Deed from Three Individuals to an Individual

Description

How to fill out California Grant Deed From Three Individuals To An Individual?

Acquiring authenticated templates tailored to your local laws can be difficult unless you access the US Legal Forms library.

It’s an online repository of over 85,000 legal forms catering to both personal and professional requirements as well as various real-life situations.

All the documents are systematically categorized by usage area and jurisdiction, making the search for the San Diego California Grant Deed from Three Individuals to an Individual as swift and simple as pie.

Maintaining organized paperwork that complies with legal standards is crucial. Take advantage of the US Legal Forms library to always have vital document templates for any requirement readily available!

- Examine the Preview mode and form details.

- Ensure you’ve selected the correct form that aligns with your needs and fully adheres to your local jurisdiction standards.

- Look for another template, if necessary.

- If you discover any discrepancies, employ the Search tab above to locate the appropriate one.

- If it meets your criteria, proceed to the subsequent step.

Form popularity

FAQ

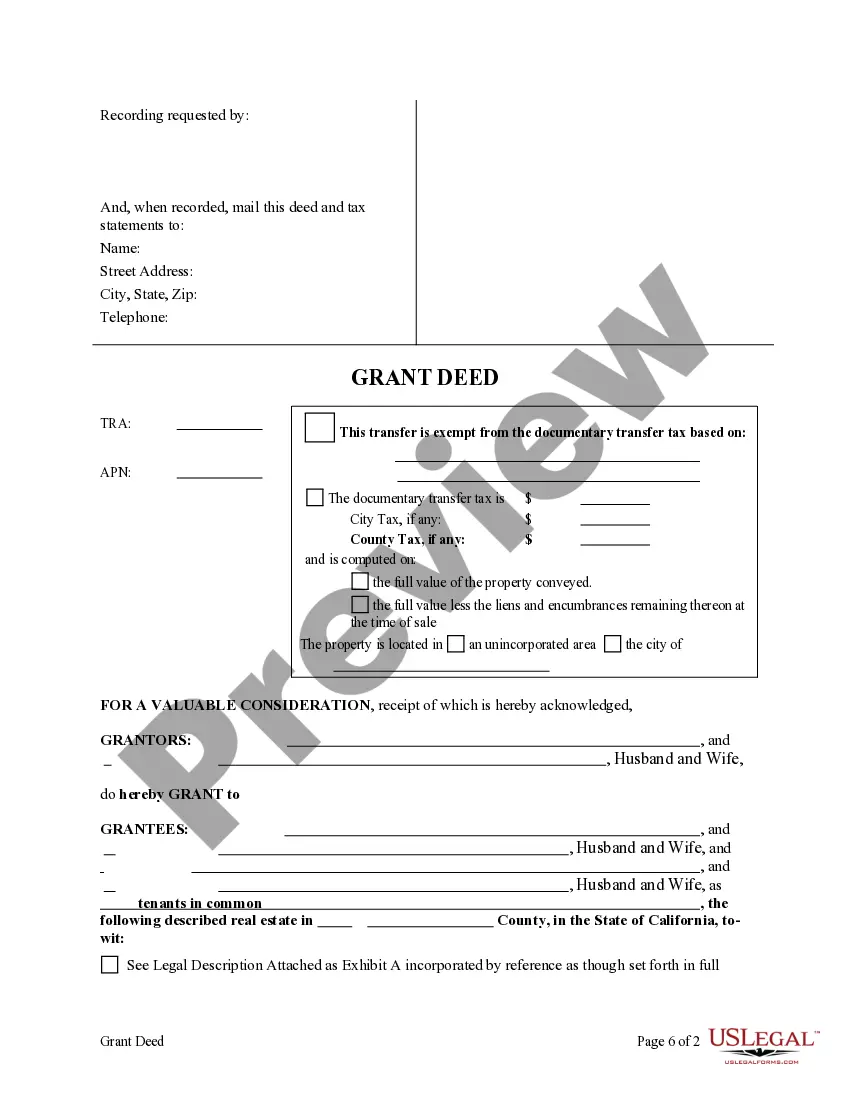

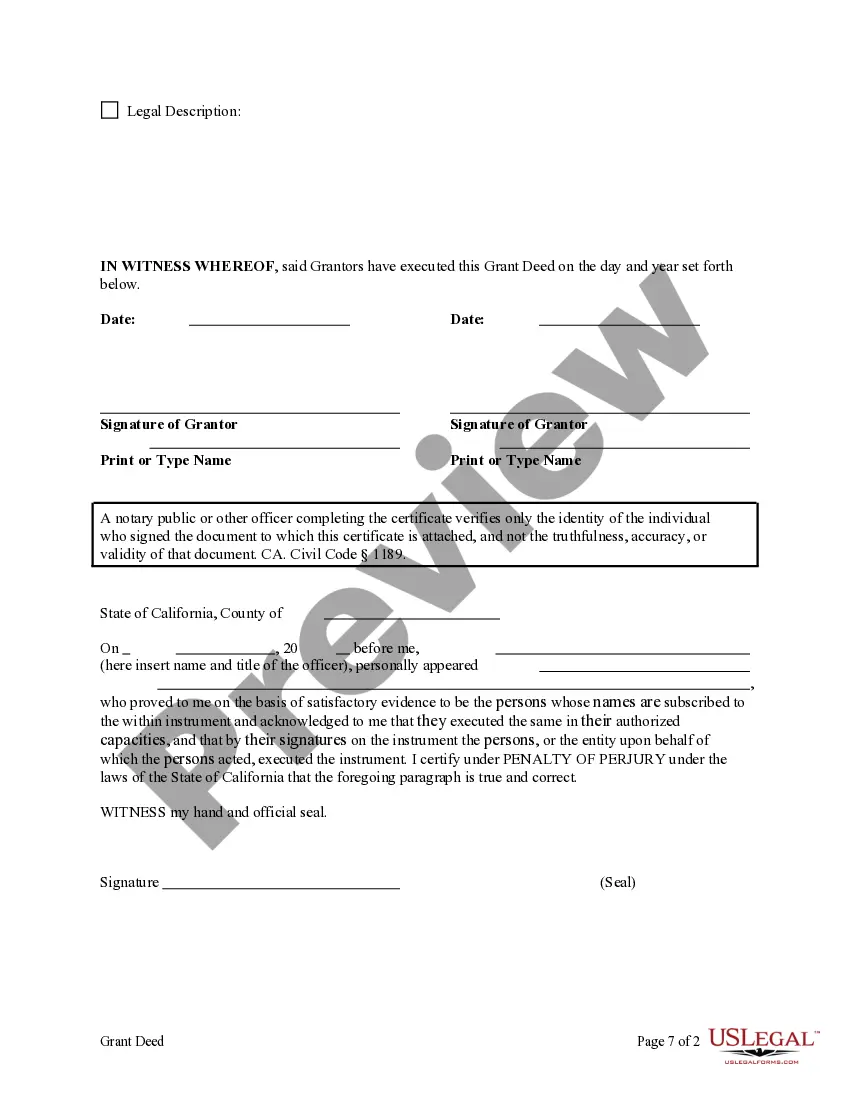

Filling out a California grant deed requires careful attention to detail. First, you must include the names of all parties involved, ensuring that they align with the San Diego California Grant Deed from Three Individuals to an Individual. Next, clearly describe the property in question, along with its legal description, to avoid any confusion. Finally, sign the deed in front of a notary public to validate the transfer and make it official.

Adding someone to a deed in California can have tax implications, such as potential changes in property taxes. It is essential to consider the implications for gift tax if the addition can be seen as a transfer of property. When dealing with a San Diego California Grant Deed from Three Individuals to an Individual, it's wise to consult a tax professional to better understand any financial responsibilities that may arise.

Yes, you can add someone to a deed without hiring a lawyer by using online resources or platforms like uslegalforms. You will need to draft a new grant deed and follow local requirements for execution. However, be cautious, as thorough knowledge of the laws is important, especially when dealing with a San Diego California Grant Deed from Three Individuals to an Individual.

To remove someone from a grant deed in California, you will need to complete a new grant deed that excludes the individual being removed. This process usually requires consent from all party members involved, as it's vital to have all signatures for legal and practical purposes. In cases like the San Diego California Grant Deed from Three Individuals to an Individual, proper documentation can help prevent any future disputes.

Adding someone to a grand deed in California involves creating a new grant deed that names the existing and new owners. You must ensure the deed is executed properly, meaning all parties need to sign and have it notarized. Following the steps carefully guarantees that the changes reflect accurately in the property records, especially in scenarios resembling a San Diego California Grant Deed from Three Individuals to an Individual.

To add someone to a deed, you should prepare a new grant deed that includes both the current owner and the new individual. It is essential to have the new deed signed and notarized to ensure its validity. For instances like a San Diego California Grant Deed from Three Individuals to an Individual, having everyone in agreement is crucial to avoid potential disputes.

Transferring property in California involves executing a grant deed. This document must be signed by the current owner and clearly describe the property. If you are dealing with a case similar to a San Diego California Grant Deed from Three Individuals to an Individual, ensure that all individuals agree and sign the deed to complete the transfer effectively.

Adding someone to your deed can create potential complications. For instance, a San Diego California Grant Deed from Three Individuals to an Individual may lead to shared ownership issues, particularly if disagreements arise about property use or decisions. Additionally, adding someone could affect your property taxes or expose your asset to your co-owner's liabilities. It is essential to weigh these considerations before proceeding.

You do not necessarily need a lawyer to add someone to your deed, but it can be beneficial to consult one. The process of executing a San Diego California Grant Deed from Three Individuals to an Individual can involve legal nuances that might be complex. A lawyer can help ensure that your deed complies with California laws and that your intentions are clearly stated. If you want to avoid potential disputes in the future, getting legal advice is a wise choice.