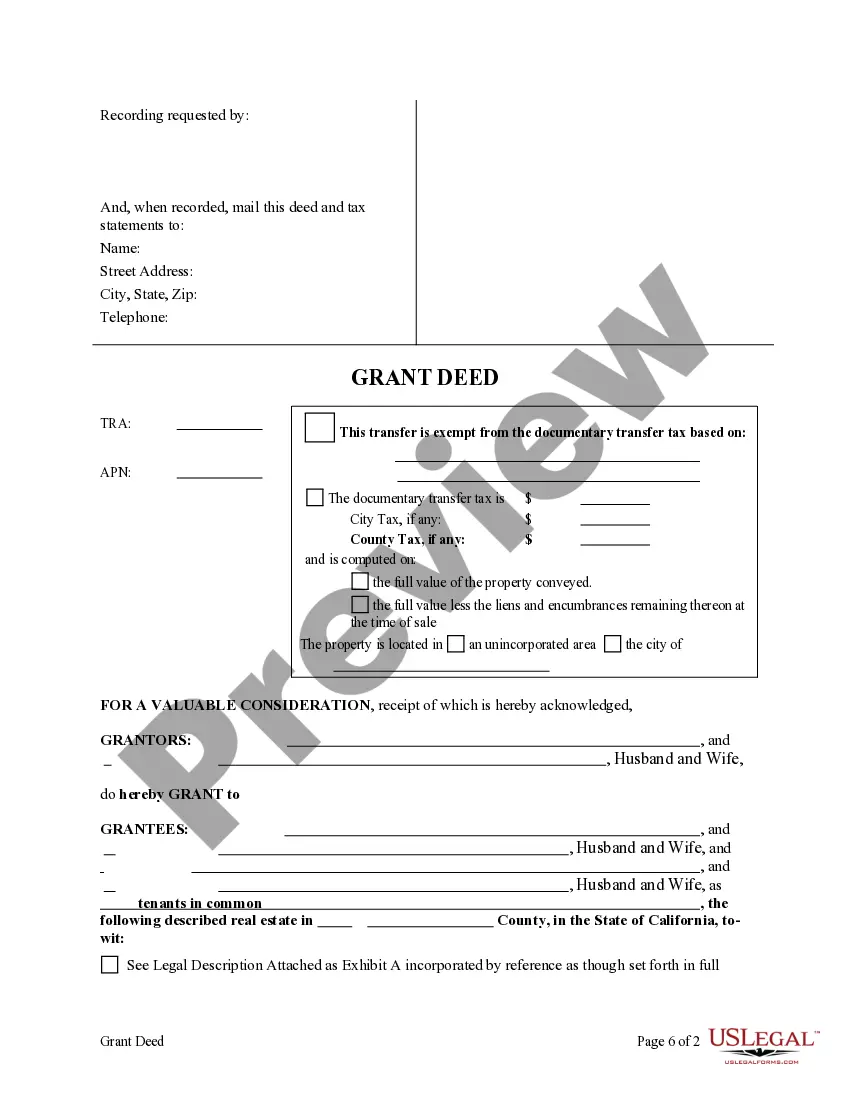

This form is a Grant Deed where the Grantors are Husband and Wife and the Grantees are two married couples. This deed complies with all state statutory laws.

A Santa Clara California Grant Deed from Three Individuals to an Individual is a legally binding document that transfers ownership of real property located in Santa Clara, California from three individuals (granters) to a single individual (grantee). This type of deed is commonly executed for various reasons such as gifting, sale, or inheritance. In this specific context, there are no different types of Santa Clara California Grant Deeds from Three Individuals to an Individual as the concept remains the same across various scenarios. Nonetheless, it is important to note that these deeds can have specific variations depending on the circumstances of the transfer of property. The Santa Clara California Grant Deed is a legal instrument used to convey the title of a property from the granters to the grantee. It assures that the granters have the legal right to sell, transfer, or convey the property and that the property is free from any encumbrances or undisclosed claims. The key elements included in a Santa Clara California Grant Deed from Three Individuals to an Individual are the names and addresses of all the granters and the grantee, a complete and accurate legal description of the property being transferred, the consideration or payment involved, and the signatures of all parties involved, including witnesses and a notary public. It is essential to mention that before executing a Santa Clara California Grant Deed, the granters should perform a thorough title search to ensure there are no unanticipated issues, such as outstanding liens, easements, or other encumbrances that could affect the grantee's ownership rights. The Santa Clara California Grant Deed from Three Individuals to an Individual is an important legal document in real estate transactions, as it formally transfers ownership rights and establishes a clear chain of title. It provides the grantee with legal protection and establishes their rightful ownership of the property in Santa Clara, California. Overall, a Santa Clara California Grant Deed from Three Individuals to an Individual is a vital instrument when it comes to transferring property ownership in Santa Clara, California. Its purpose is to legally document the transfer and ensure a smooth and transparent transaction for all parties involved.