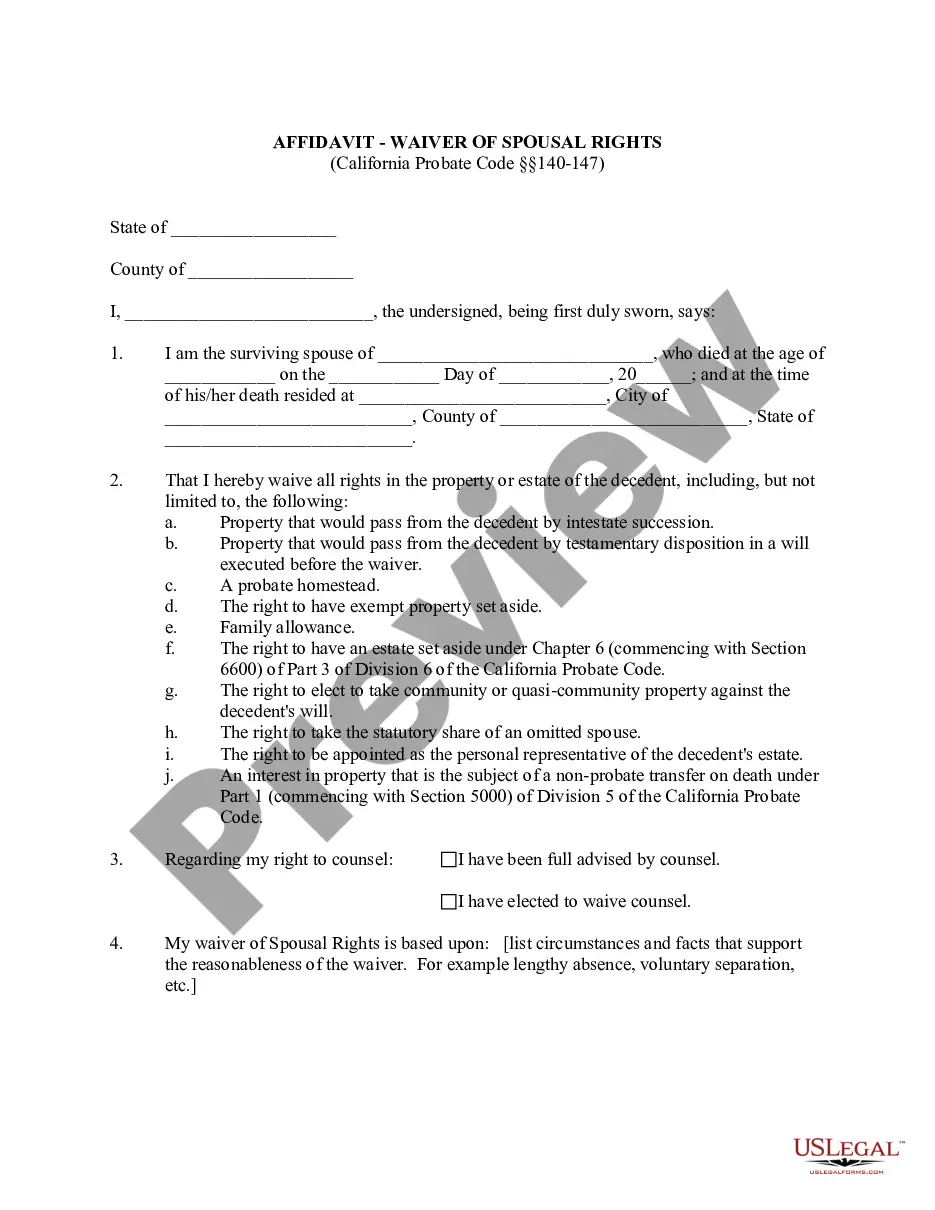

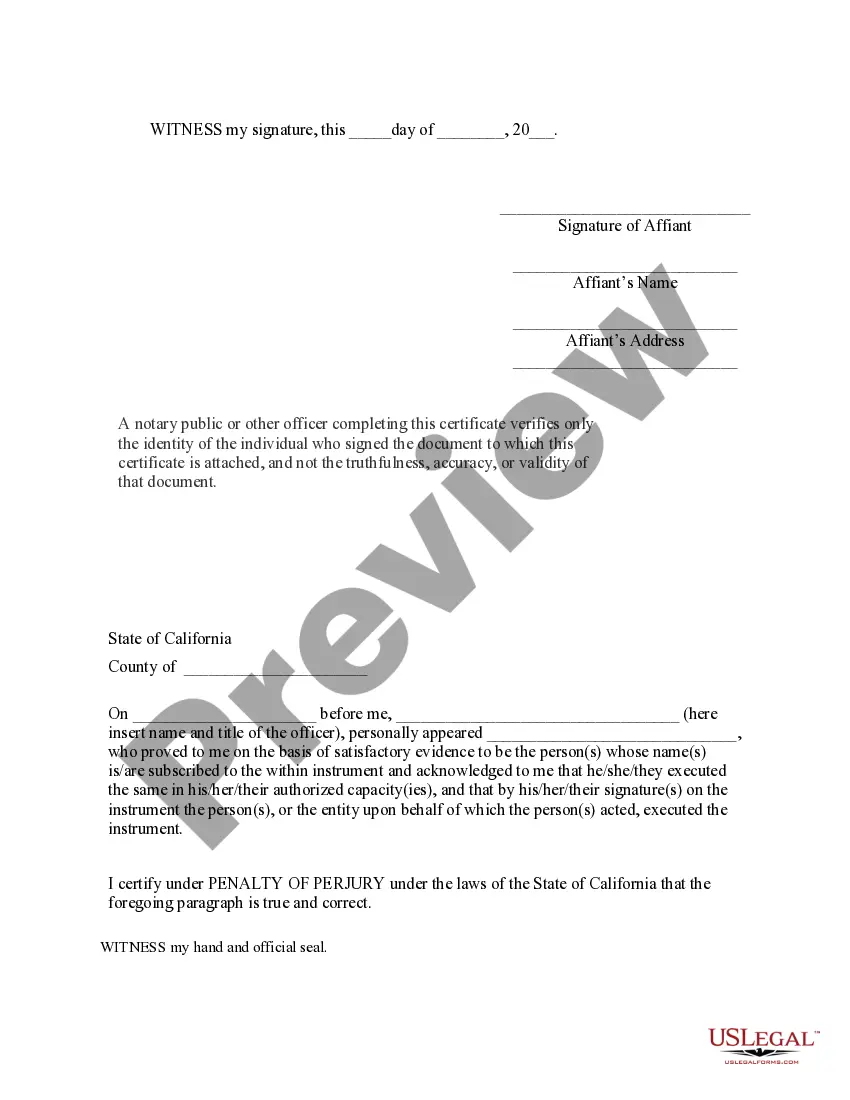

An Affidavit is a sworn, written statement of facts, signed by the 'affiant' (the person making the statement) before a notary public or other official witness. The affiant swears to the truth and accuracy of the statement contained in the affidavit. This document, an Affidavit - Waiver of Spousal Rights (California Probate Code 140-147) , is a model affidavit for recording the type of information stated. It must be signed before a notary, who must sign and stamp the document. Adapt the text to fit your facts. Available for download now in standard format(s). USLF control no. CA-04001

A Downey Affidavit regarding Waiver of Spousal Rights is a legal document governed by the California Probate Code Sections 140-147. This type of affidavit allows a surviving spouse to waive their rights to inherit certain property or assets from the deceased spouse's estate. In California, when a person passes away, their estate generally goes through the probate process, which involves the distribution of their assets to heirs and beneficiaries. However, the law recognizes that some individuals may wish to bypass this process and transfer their assets to their chosen beneficiaries outside of probate. With a Downey Affidavit regarding Waiver of Spousal Rights, the surviving spouse agrees to forego their right to inherit a portion of the estate and allows for a simplified transfer of assets. There are different types of Downey Affidavits that can be used depending on the circumstances: 1. Downey Affidavit of Disposition Without Administration: Under Section 140 of the California Probate Code, this affidavit can be used by a surviving spouse if the value of the deceased spouse's assets, excluding joint tenancy and community property, does not exceed $166,250. This affidavit allows the transfer of these assets without the need for formal probate administration. 2. Downey Affidavit for Small Estates: If the value of the deceased spouse's assets, excluding joint tenancy and community property, does not exceed $166,250 and there is no real property involved, the surviving spouse can use this affidavit to transfer the assets without probate, according to Section 13100-13115 of the California Probate Code. 3. Downey Affidavit for Affiliated Assets: Section 146(b) of the California Probate Code allows for the use of this affidavit when the surviving spouse is entitled to insurance proceeds, pension plan benefits, or retirement plan benefits payable upon the deceased spouse's death. The affidavit serves as a waiver of the spouse's rights to these assets and enables their immediate transfer. 4. Downey Affidavit for Joint Tenancy Property: In cases where the deceased spouse held assets in joint tenancy with rights of survivorship, this affidavit can be used to transfer the property to the surviving joint tenant without the need for probate proceedings, as stated under Section 141 of the California Probate Code. It is important to note that Downey Affidavits require strict adherence to the guidelines and requirements set forth by the California Probate Code. Consulting with an experienced attorney or legal professional is highly recommended ensuring that the affidavit is prepared accurately and effectively, taking into account any specific circumstances or complexities of the estate.A Downey Affidavit regarding Waiver of Spousal Rights is a legal document governed by the California Probate Code Sections 140-147. This type of affidavit allows a surviving spouse to waive their rights to inherit certain property or assets from the deceased spouse's estate. In California, when a person passes away, their estate generally goes through the probate process, which involves the distribution of their assets to heirs and beneficiaries. However, the law recognizes that some individuals may wish to bypass this process and transfer their assets to their chosen beneficiaries outside of probate. With a Downey Affidavit regarding Waiver of Spousal Rights, the surviving spouse agrees to forego their right to inherit a portion of the estate and allows for a simplified transfer of assets. There are different types of Downey Affidavits that can be used depending on the circumstances: 1. Downey Affidavit of Disposition Without Administration: Under Section 140 of the California Probate Code, this affidavit can be used by a surviving spouse if the value of the deceased spouse's assets, excluding joint tenancy and community property, does not exceed $166,250. This affidavit allows the transfer of these assets without the need for formal probate administration. 2. Downey Affidavit for Small Estates: If the value of the deceased spouse's assets, excluding joint tenancy and community property, does not exceed $166,250 and there is no real property involved, the surviving spouse can use this affidavit to transfer the assets without probate, according to Section 13100-13115 of the California Probate Code. 3. Downey Affidavit for Affiliated Assets: Section 146(b) of the California Probate Code allows for the use of this affidavit when the surviving spouse is entitled to insurance proceeds, pension plan benefits, or retirement plan benefits payable upon the deceased spouse's death. The affidavit serves as a waiver of the spouse's rights to these assets and enables their immediate transfer. 4. Downey Affidavit for Joint Tenancy Property: In cases where the deceased spouse held assets in joint tenancy with rights of survivorship, this affidavit can be used to transfer the property to the surviving joint tenant without the need for probate proceedings, as stated under Section 141 of the California Probate Code. It is important to note that Downey Affidavits require strict adherence to the guidelines and requirements set forth by the California Probate Code. Consulting with an experienced attorney or legal professional is highly recommended ensuring that the affidavit is prepared accurately and effectively, taking into account any specific circumstances or complexities of the estate.