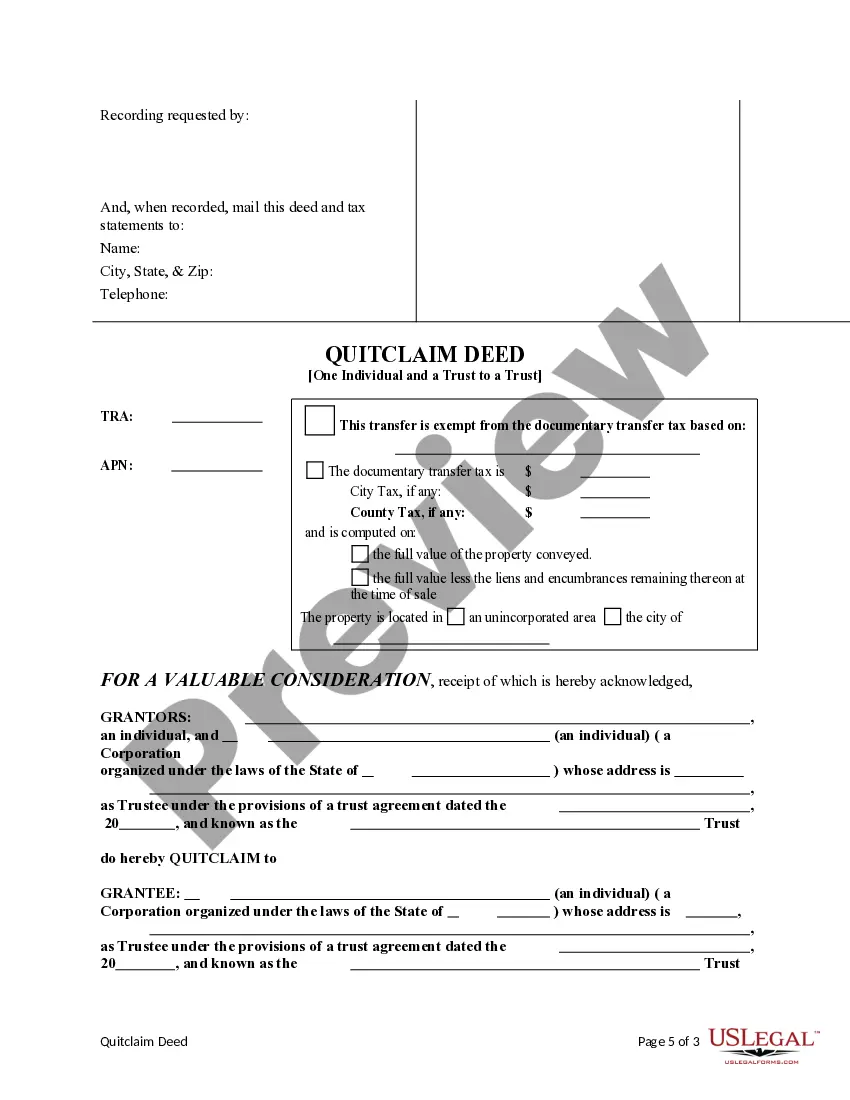

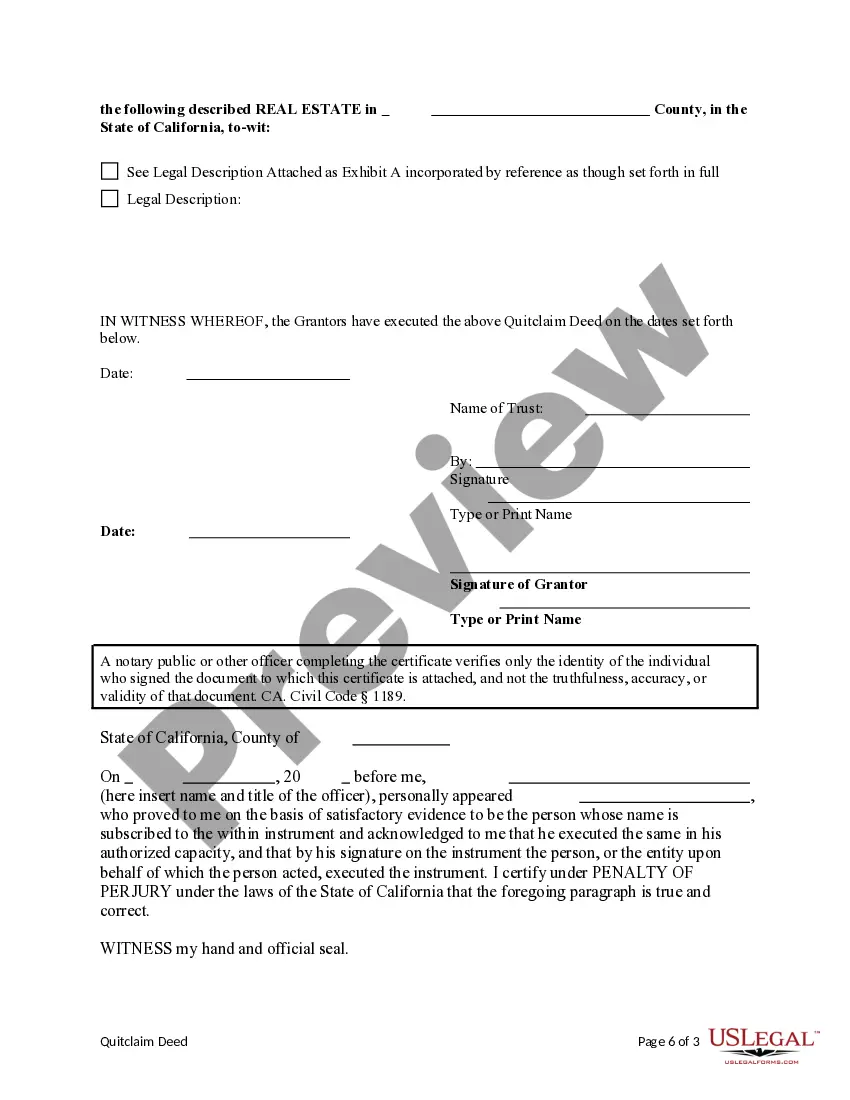

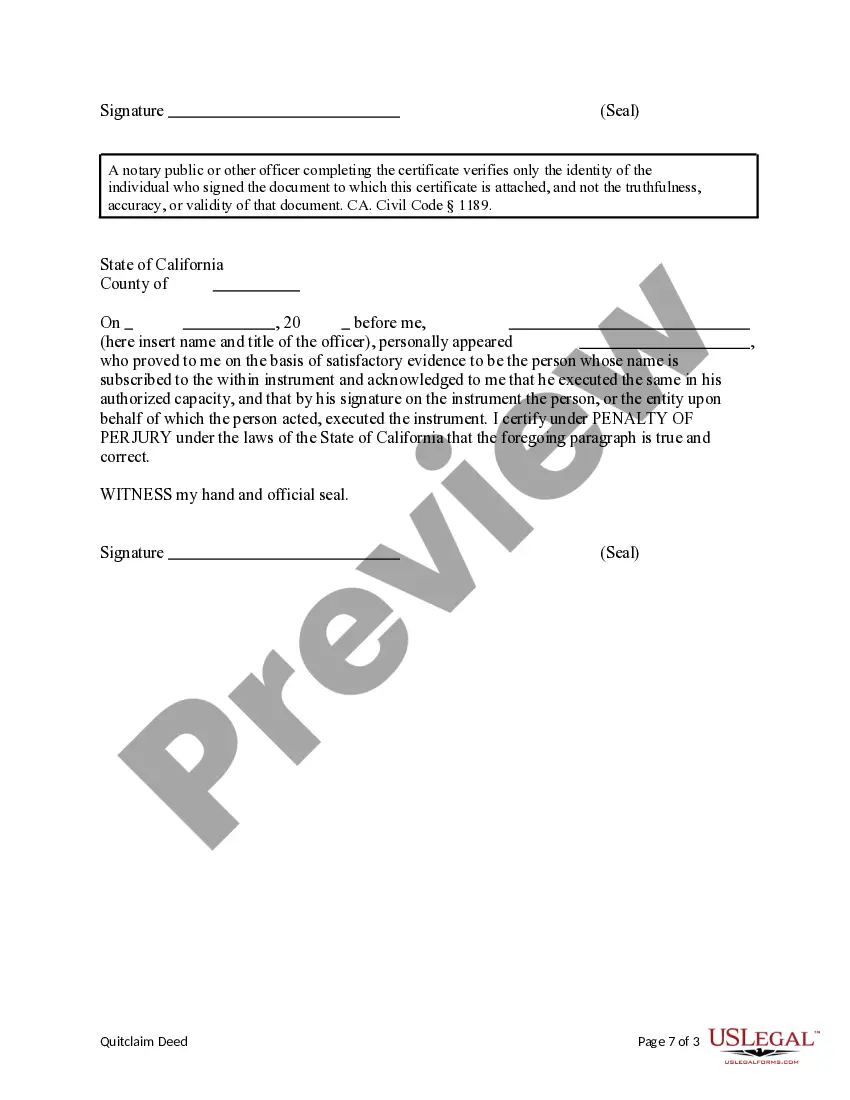

This form is a Quitclaim Deed where the Grantors are an individual and a trust and the Grantee is a trust. Grantors convey and quitclaim the described property to Grantee. This deed complies with all state statutory laws.

In Alameda, California, a Quitclaim Deed from an Individual and a Trust to a Trust is a legal document used to transfer ownership of real estate property from a person and a trust to another trust. This type of deed is commonly employed when a property held by an individual and a trust needs to be transferred and placed solely under the ownership and control of a different trust. The Alameda County Quitclaim Deed from an Individual and a Trust to a Trust is a legal process that involves the conveyance of real property rights. It is vital for all parties involved in the transaction to have a clear understanding of the process and legal implications associated with this type of deed. This particular type of quitclaim deed ensures that both an individual and a trust transfer their respective interests in the property to another trust entity. By using a quitclaim deed, the individual and trust relinquish any claims or rights they may have on the property, allowing the new trust to assume complete ownership and control. It is important to note that there are different variations of the Alameda California Quitclaim Deed from an Individual and a Trust to a Trust. These include: 1. Trust-to-Trust Transfer: This is the most common type of quitclaim deed involving a transfer between trusts. It enables the individual and the existing trust to transfer their ownership interest to a new trust entity. 2. Individual-to-Trust Transfer: In some cases, an individual who jointly owns a property with a trust wishes to transfer their interest solely to the trust. This type of quitclaim deed allows the individual to transfer their ownership rights to the trust entity. 3. Trust-to-Individual Transfer: In rare instances, a trust may choose to transfer the property solely to an individual. This type of quitclaim deed enables the trust to convey its interest in the property to the individual. It is crucial to consult with a qualified attorney or real estate professional experienced in Alameda County real estate laws to ensure the appropriate type of quitclaim deed is used and all legal requirements are met. Additionally, engaging the services of a trusted title company can help facilitate a smooth transfer of ownership and ensure accurate documentation.