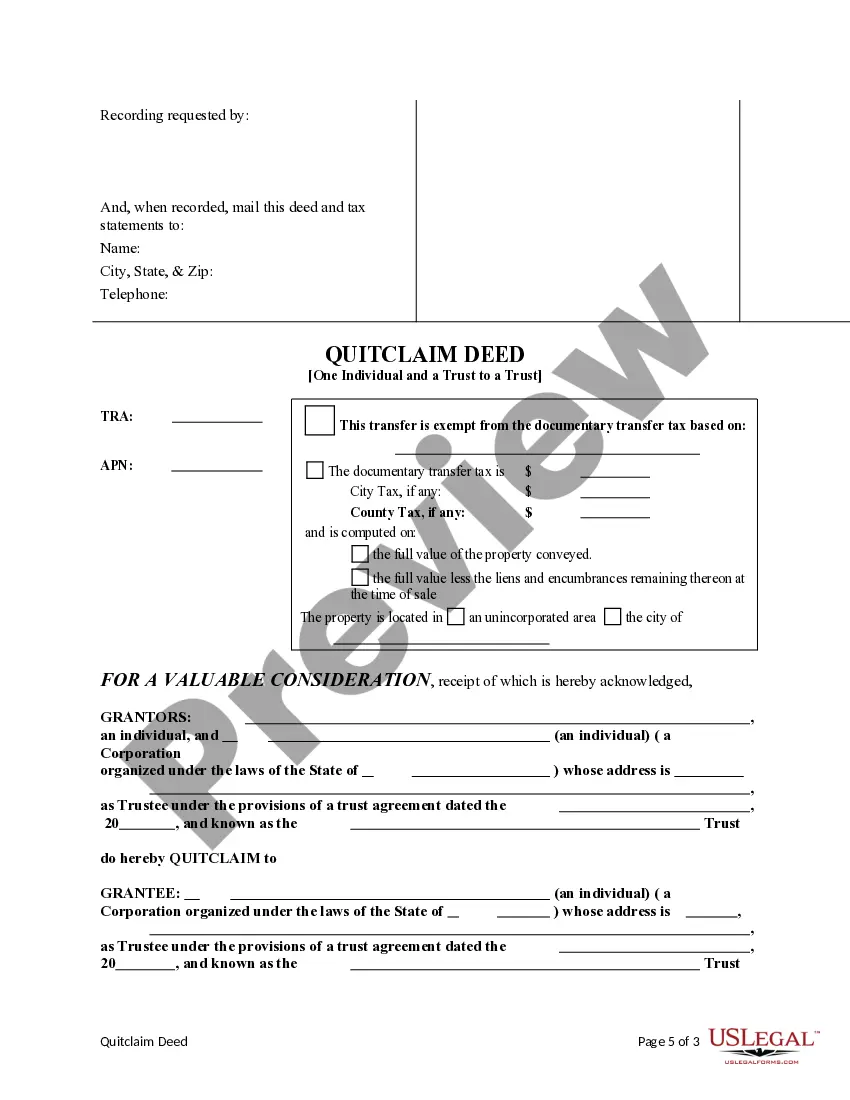

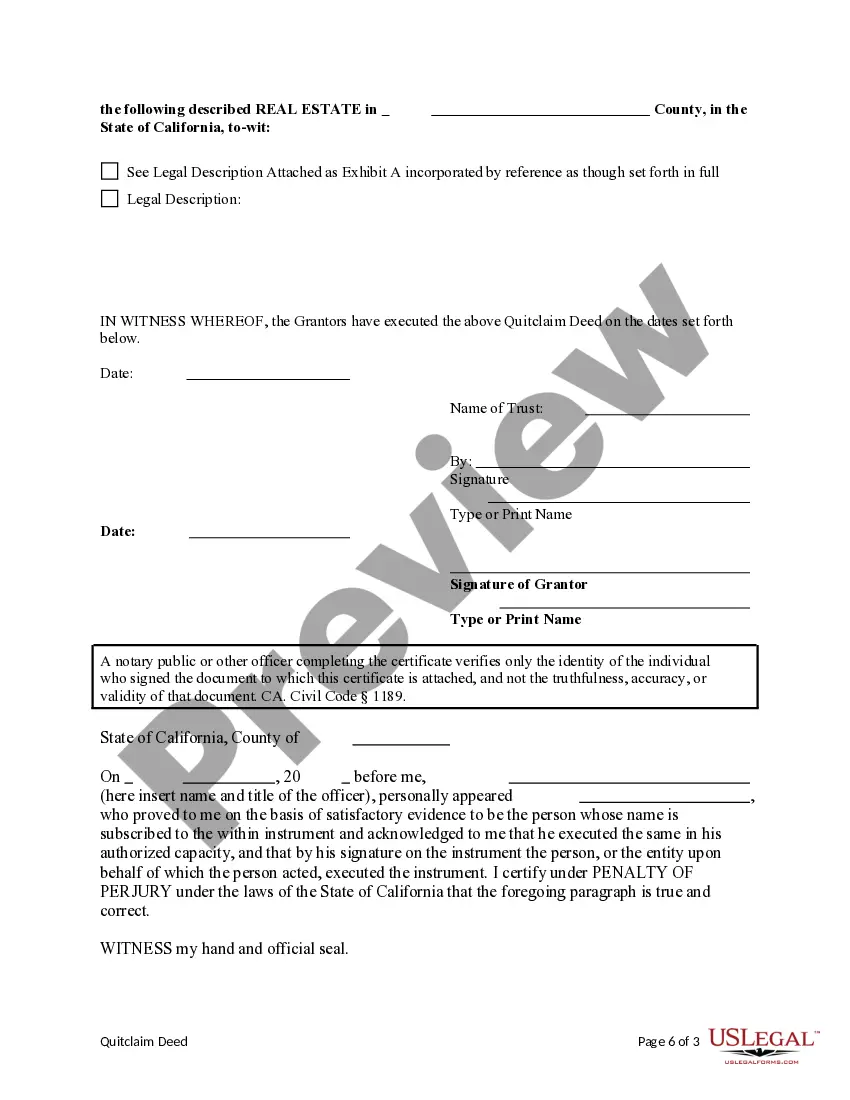

This form is a Quitclaim Deed where the Grantors are an individual and a trust and the Grantee is a trust. Grantors convey and quitclaim the described property to Grantee. This deed complies with all state statutory laws.

If you are looking for information about the Inglewood California Quitclaim Deed from an Individual and a Trust to a Trust, you've come to the right place. In this article, we will provide you with a detailed description of this specific type of deed, including its purpose, process, and any variations that exist. Inglewood, California Quitclaim Deed from an Individual and a Trust to a Trust: A Quitclaim Deed is a legal document used to transfer ownership of real estate property from one party to another. In this case, we will focus on the scenario where an individual and a trust transfer the property to another trust. The purpose of this type of deed is to facilitate the transfer of ownership rights and interests in real estate. By using a Quitclaim Deed, the current owner, the individual, and the trust can convey their entire legal interest in the property to the receiving trust without making any warranties or guarantees about the property's title status. The process of creating an Inglewood California Quitclaim Deed from an Individual and a Trust to a Trust typically involves the following steps: 1. Drafting the deed: The individual and the trustee(s) of the trust must prepare a quitclaim deed that clearly states the intent to transfer the property from the individual and the trust to the receiving trust. It is crucial to include accurate legal descriptions of the property, the names of the parties involved, and any specific terms or conditions of the transfer. 2. Signing the deed: The individual and the trustee(s) of the existing trust must sign the Quitclaim Deed in the presence of a notary public. It is essential to ensure that all parties involved sign the deed voluntarily and with a clear understanding of the consequences. 3. Recording the deed: After the deed is signed, it should be recorded with the Los Angeles County Recorder's Office or the appropriate county office where the property is located. Recording the deed ensures that the transfer is publicly documented and establishes legal proof of the change in ownership. Different types of Inglewood California Quitclaim Deeds from an Individual and a Trust to a Trust may exist depending on specific circumstances. These may include: 1. Interviews Trust to Testamentary Trust Quitclaim Deed: In this variation, the property is transferred from a trust created during the individual's lifetime (interviews trust) to a trust established through their will or testament (testamentary trust). 2. Joint Tenancy to Trust Quitclaim Deed: This type of deed involves the transfer of property from an individual and another person who jointly owned the property with rights of survivorship to a trust. 3. Living Trust to Revocable Trust Quitclaim Deed: Here, the property is transferred from a trust that the individual created during their lifetime (living trust) to a revocable trust, allowing the owner to modify or dissolve the trust as needed. In conclusion, the Inglewood California Quitclaim Deed from an Individual and a Trust to a Trust is a legal instrument used for transferring real estate ownership from an individual and a trust to another trust. The process involves drafting, signing, and recording the deed, ensuring that the transfer is lawfully executed and documented. Variations of this deed may include transfers between different types of trusts or from joint tenancy to a trust.