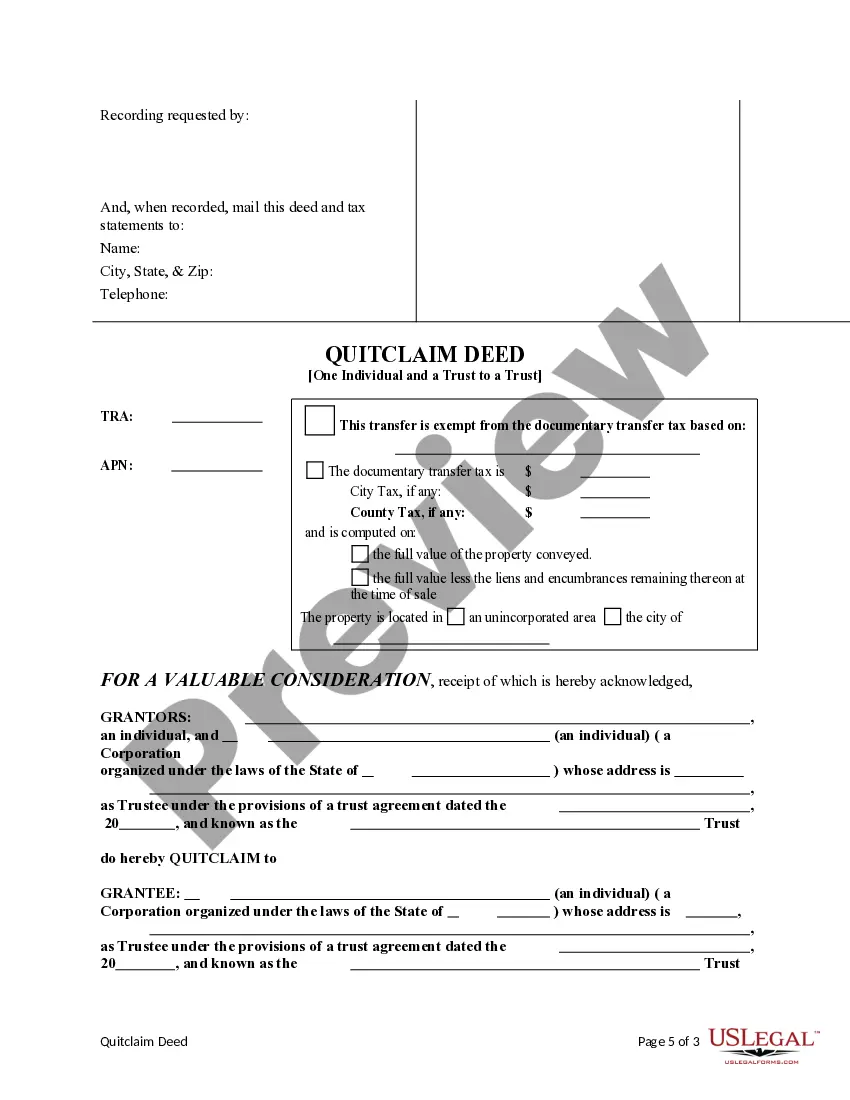

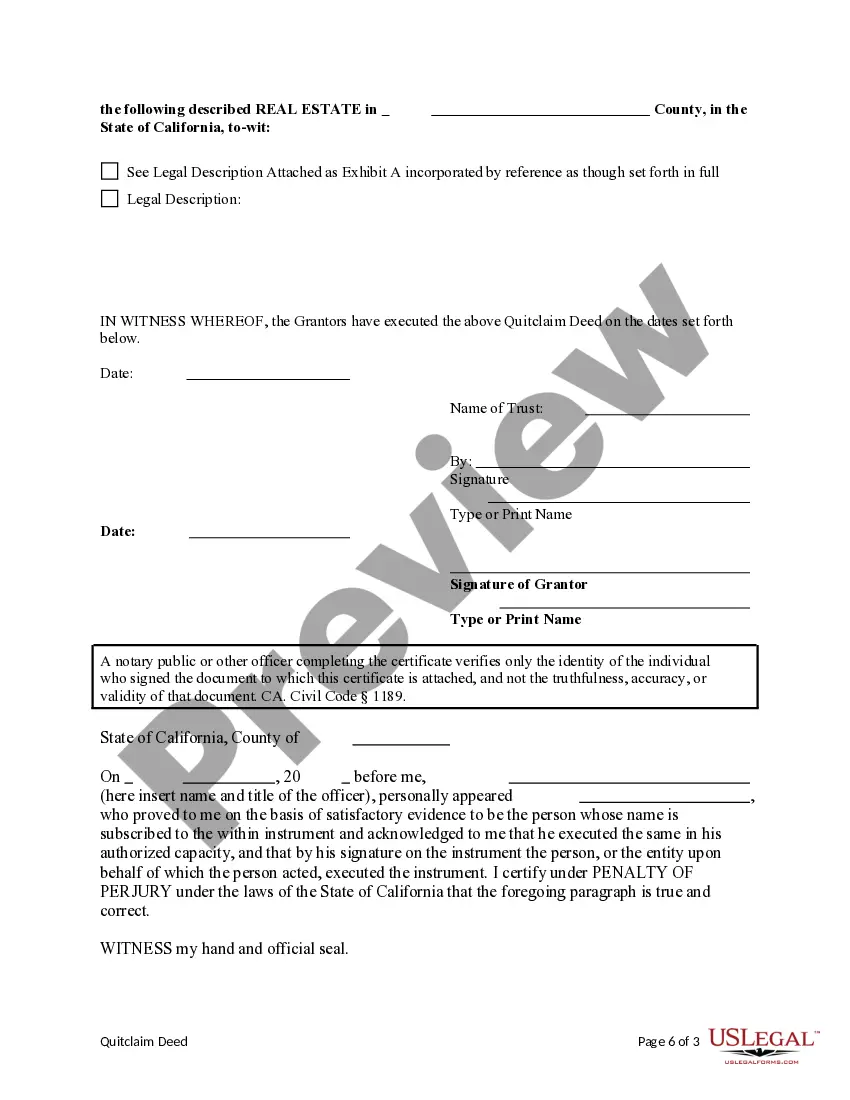

This form is a Quitclaim Deed where the Grantors are an individual and a trust and the Grantee is a trust. Grantors convey and quitclaim the described property to Grantee. This deed complies with all state statutory laws.

A San Diego California Quitclaim Deed from an Individual and a Trust to a Trust is a legal document that facilitates the transfer of property ownership from an individual and a trust to another trust without any warranty or guarantee of title. This type of deed is often used in estate planning or when there is a need to transfer real estate assets between different trusts. There are different variations of San Diego California Quitclaim Deeds from an Individual and a Trust to a Trust, each serving a specific purpose. These may include: 1. Revocable Living Trust to Irrevocable Trust: This type of quitclaim deed is commonly used when the granter (individual or trustee of a revocable living trust) wishes to transfer property ownership to an irrevocable trust. By doing so, they effectively remove the property from their taxable estate and potentially gain certain tax advantages. 2. Trust to Special Needs Trust: Special Needs Trusts are set up to protect the assets and provide for the care of individuals with disabilities. In some cases, a trust may transfer property ownership to a separate Special Needs Trust to ensure the continued support and well-being of the beneficiary with special needs. 3. Individual and Trust to Joint Trust: When an individual and a trust (such as a revocable living trust) jointly own a property, they may decide to consolidate ownership into a single joint trust. This is typically done to simplify estate planning and ensure that the property seamlessly passes to the intended beneficiaries upon the death of the granter(s). 4. Testamentary Trust to Living Trust: A testamentary trust is established through a will and only takes effect upon the granter's death. In some cases, individuals may wish to transfer the property held in a testamentary trust to a living trust while they are still alive. This transfer avoids potential probate issues and allows for greater control over the assets during the granter's lifetime. It is important to note that the use of a San Diego California Quitclaim Deed from an Individual and a Trust to a Trust should only be undertaken with legal advice and guidance. The specific requirements, tax implications, and potential risks associated with such a transfer can vary based on individual circumstances. Consulting with an experienced real estate attorney or estate planning professional is advisable to ensure compliance with applicable laws and to protect the interests of all parties involved in the transfer.