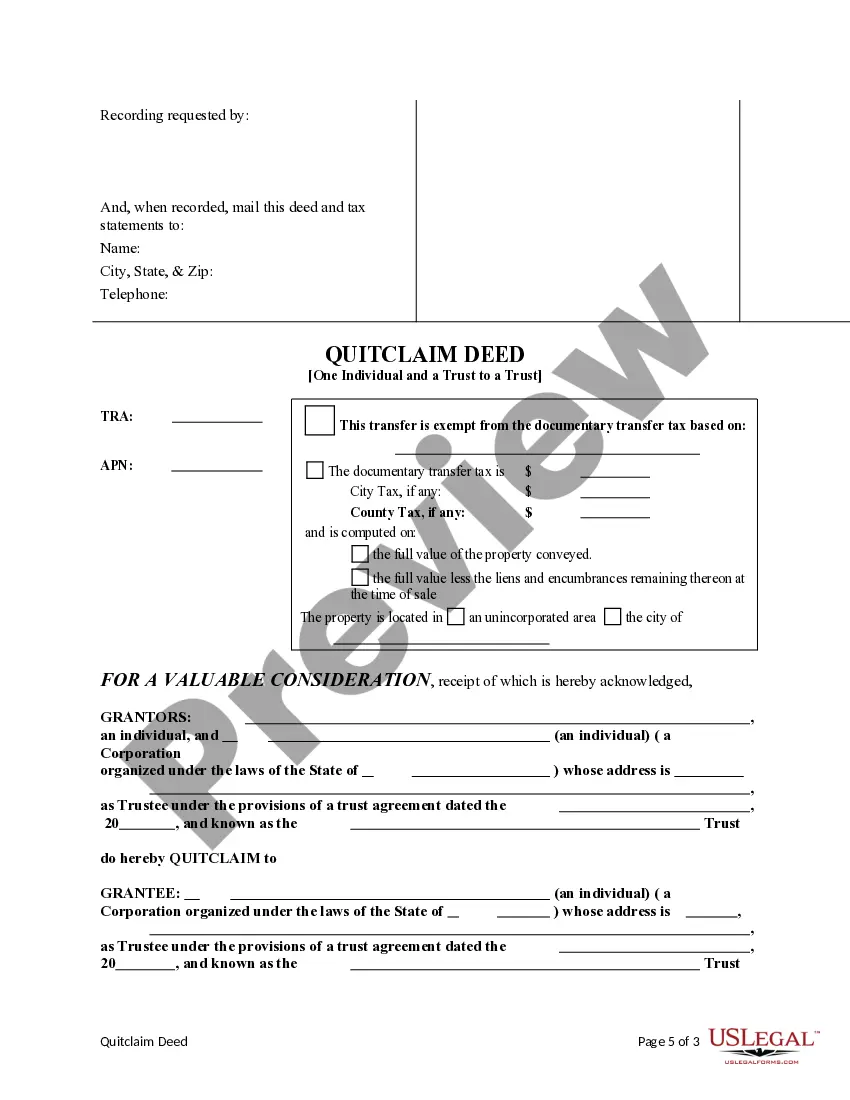

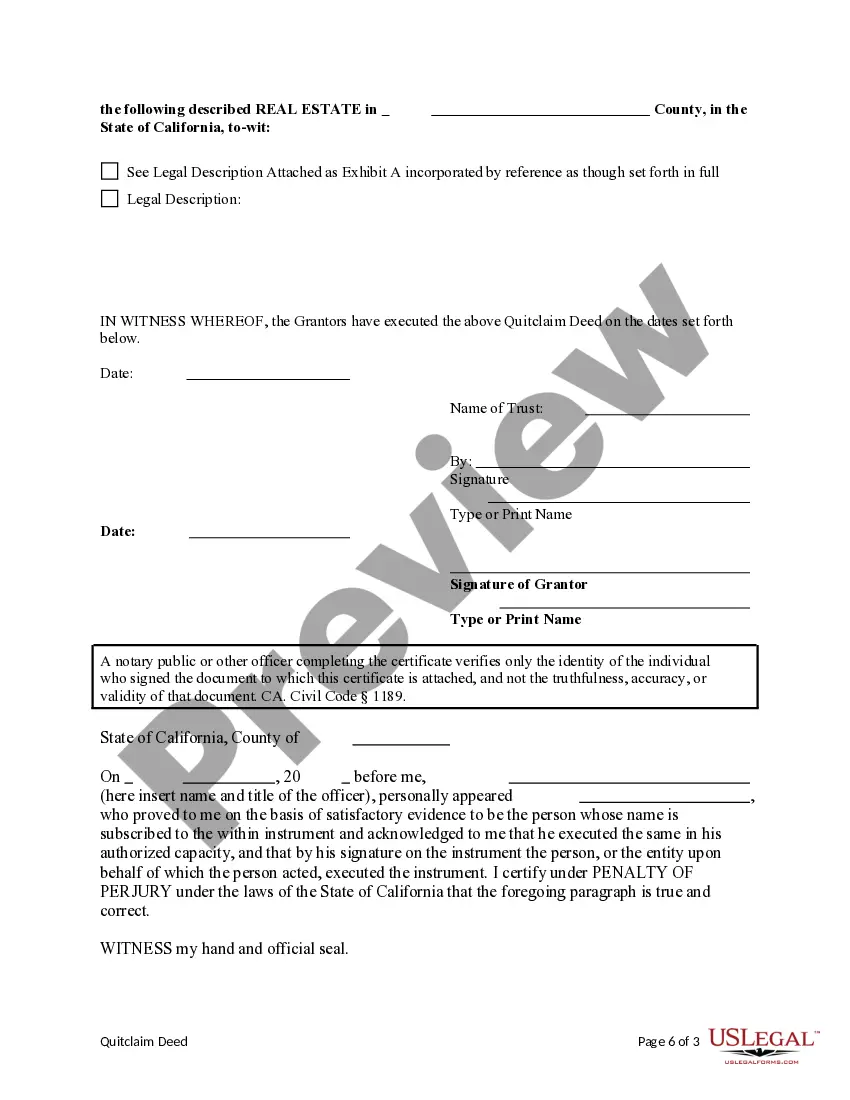

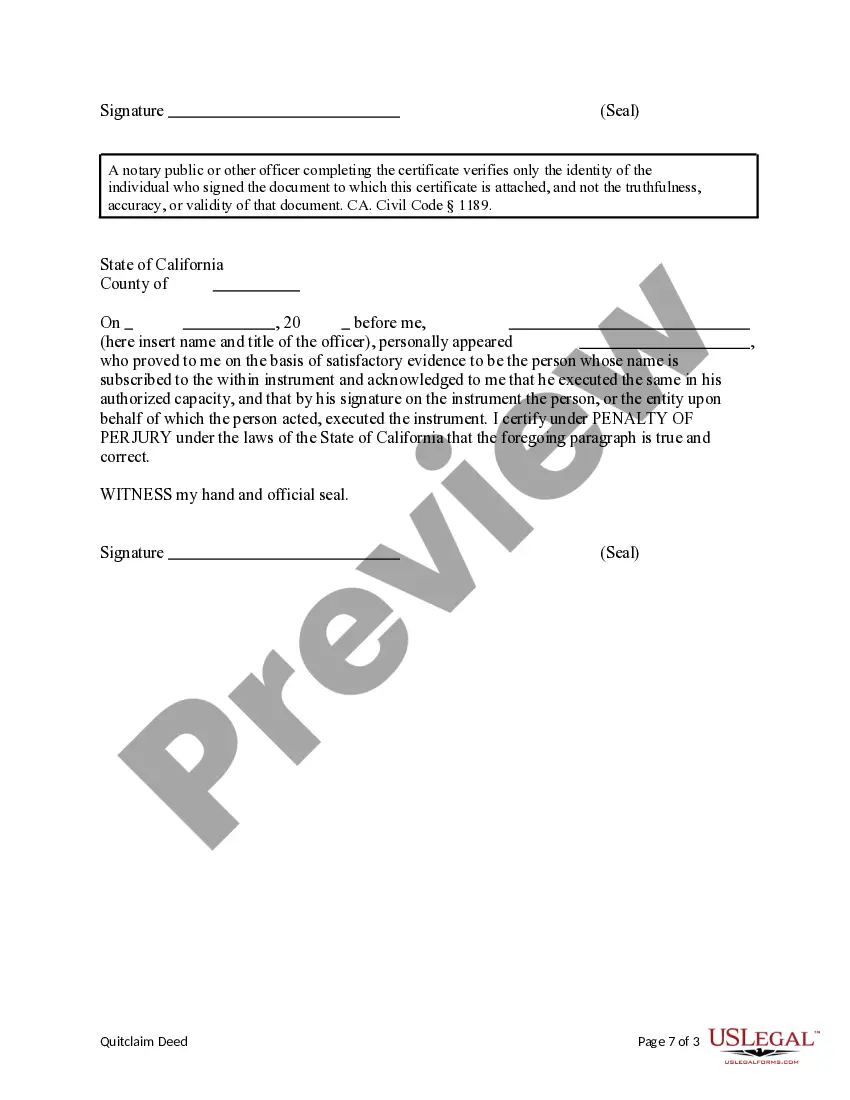

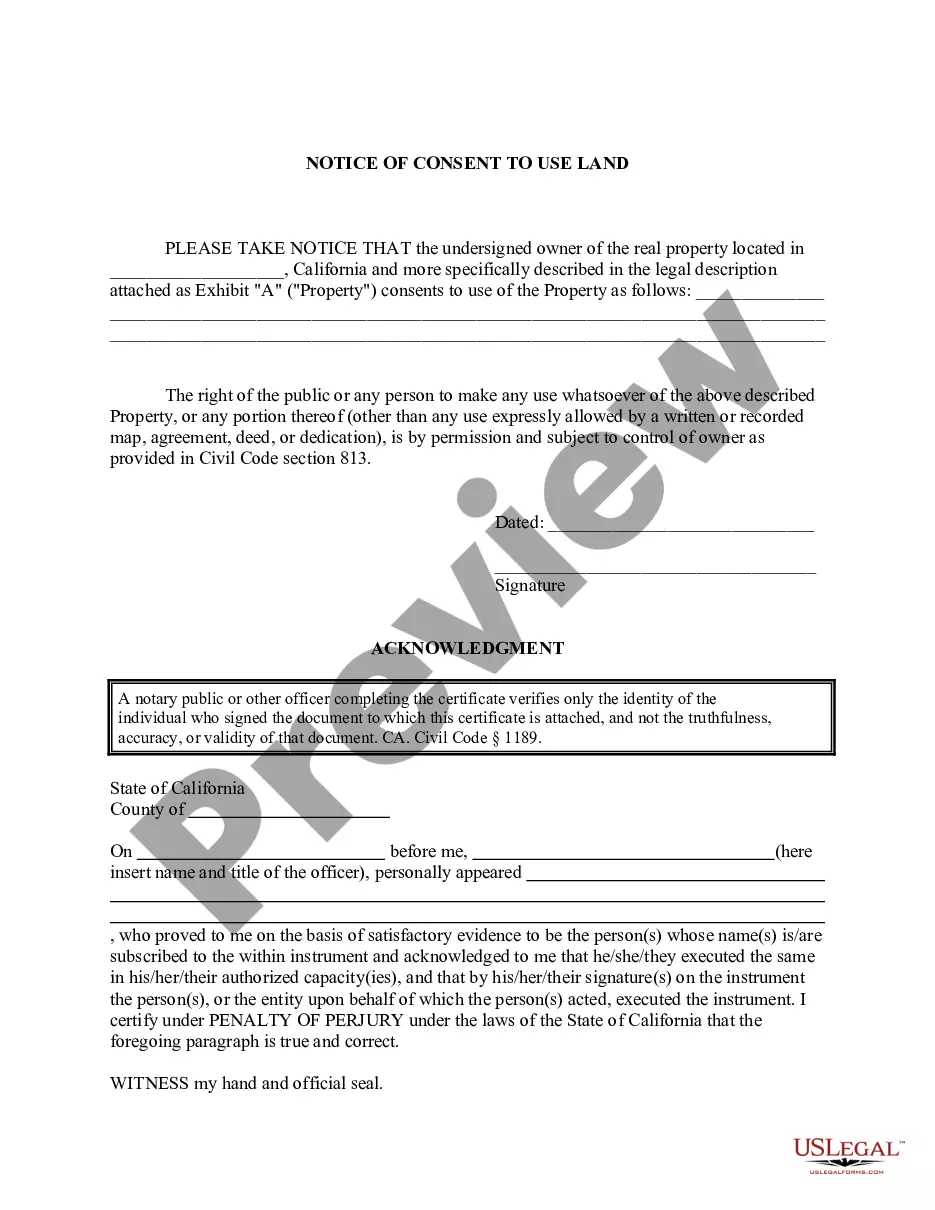

This form is a Quitclaim Deed where the Grantors are an individual and a trust and the Grantee is a trust. Grantors convey and quitclaim the described property to Grantee. This deed complies with all state statutory laws.

Santa Ana California Quitclaim Deed from an Individual and a Trust to a Trust

Description

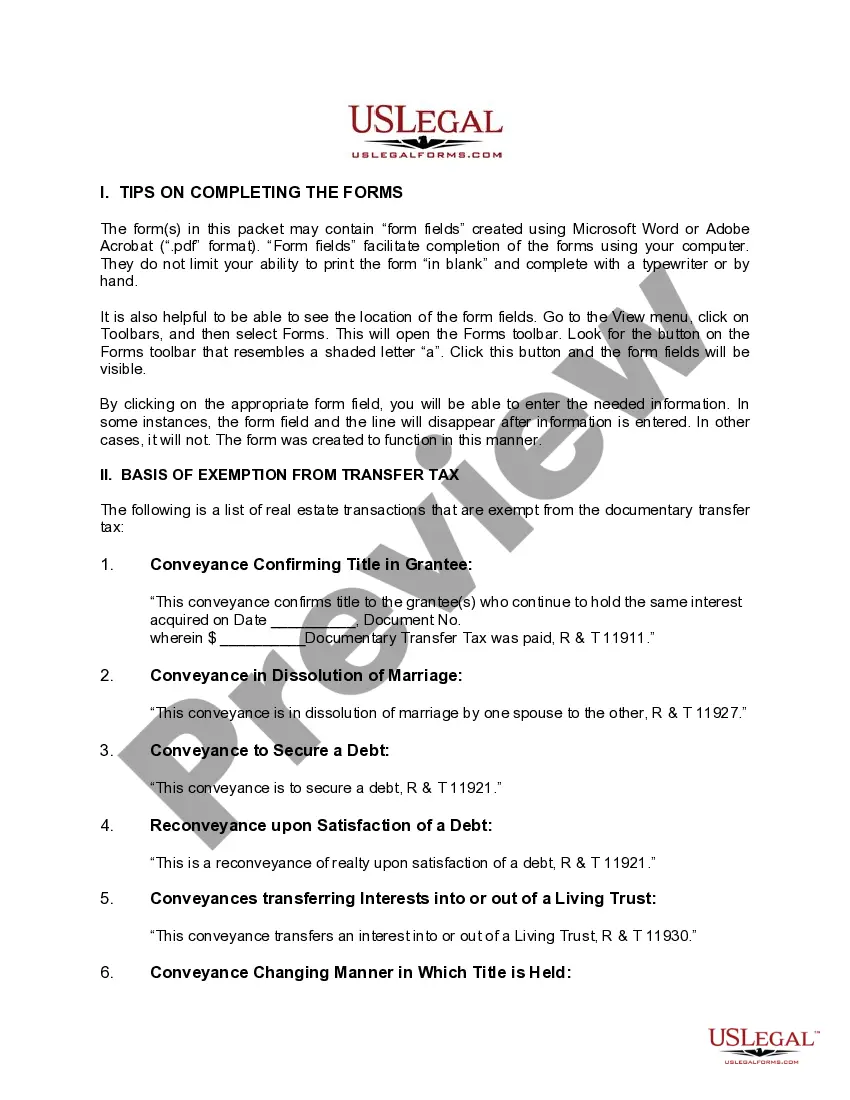

How to fill out Santa Ana California Quitclaim Deed From An Individual And A Trust To A Trust?

If you are in search of a legitimate document, it’s unfeasible to find a superior source than the US Legal Forms platform – one of the most extensive repositories online.

With this repository, you can discover numerous sample documents for business and personal needs categorized by type and location or search terms.

Utilizing our enhanced search feature, locating the latest Santa Ana California Quitclaim Deed from an Individual and a Trust to a Trust is incredibly straightforward.

Execute the payment transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the document. Specify the format and save it to your device.

- Moreover, the accuracy of each document is confirmed by a group of professional lawyers who routinely assess the templates on our site and refresh them according to the latest state and county regulations.

- If you are already familiar with our platform and possess a registered account, all you need to obtain the Santa Ana California Quitclaim Deed from an Individual and a Trust to a Trust is to Log Into your user account and select the Download option.

- If you are using US Legal Forms for the first time, simply adhere to the steps outlined below.

- Ensure that you have selected the sample you require. Review its details and utilize the Preview option to examine its contents. If it does not satisfy your needs, employ the Search bar at the top of the page to locate the desired document.

- Confirm your selection. Click the Buy now button. Then, select your desired pricing plan and submit your information to create an account.

Form popularity

FAQ

A quitclaim deed is not suitable in situations where a warranty of title is required, such as in the sale of real estate where a buyer needs assurance of clear title. This deed does not provide protection against claims from other parties. Additionally, it cannot be used to transfer property owned individually to a joint ownership status. For complicated situations, trust USLegalForms for tailored advice and assistance in managing your Santa Ana California Quitclaim Deed from an Individual and a Trust to a Trust.

Certainly, you can transfer property from a trust to an individual. This transfer typically requires a properly executed deed, such as a quitclaim deed. When using a Santa Ana California Quitclaim Deed from an Individual and a Trust to a Trust, ensure that all details are accurate to avoid complications. Consider utilizing platforms like USLegalForms to assist you in navigating this process efficiently.

Yes, a quitclaim deed can transfer property out of a trust. This type of deed conveys the interest of the property holder without guaranteeing that the title is clear. Therefore, if you decide to transfer property from a trust, a Santa Ana California Quitclaim Deed from an Individual and a Trust to a Trust can effectively meet your needs. Always consult with a legal professional to ensure compliance with state laws.

Transferring property from a trust to an individual in California typically involves drafting and executing a formal deed. In this case, you would use a quitclaim deed for the transaction. It is essential to ensure that the deed clearly specifies the property being transferred. Utilizing resources like USLegalForms can guide you through the proper documentation process, ensuring your Santa Ana California Quitclaim Deed from an Individual and a Trust to a Trust is executed smoothly.

To transfer a deed to a trust in California, you will need to prepare a Santa Ana California Quitclaim Deed from an Individual and a Trust to a Trust. This deed must be completed accurately and signed, transferring ownership from yourself to the trust. After executing the deed, file it with the county recorder's office to ensure the transfer is officially recognized. Using resources from uslegalforms can help you navigate this process smoothly and efficiently.

To place your property in a trust in California, start by selecting a suitable trust type, such as a revocable living trust. Next, prepare a Santa Ana California Quitclaim Deed from an Individual and a Trust to a Trust, which transfers the title of your property into the trust’s name. It's essential to ensure that all documents comply with California state laws. For assistance and templates, consider visiting uslegalforms to simplify the process and ensure accuracy.

Determining if a quitclaim deed is better than a trust depends on your individual needs. A Santa Ana California Quitclaim Deed from an Individual and a Trust to a Trust offers a straightforward approach for property transfer, while a trust provides greater security and long-term asset management. If your goal is immediate transfer, a quitclaim deed may work best. However, if you're seeking to safeguard your assets, a trust is often a more reliable option.

People looking for a simple transfer of property often benefit the most from a quitclaim deed. A Santa Ana California Quitclaim Deed from an Individual and a Trust to a Trust ideal serves family members or friends who want to transfer real estate easily without going through lengthy probate processes. Moreover, this method can help those needing to quickly resolve property issues.

While a trust can provide benefits, there are also downsides to consider. A Santa Ana California Quitclaim Deed from an Individual and a Trust to a Trust may lead to reduced access to the property for certain individuals since it becomes an asset of the trust. Additionally, setting up and maintaining a trust can involve costs, and it may also require ongoing management that can be complex.

Choosing between a quitclaim deed and a trust depends on your specific situation. A Santa Ana California Quitclaim Deed from an Individual and a Trust to a Trust offers quick property transfers, while a trust provides asset protection and estate planning benefits. If you are looking for immediate transfer without restrictions, a quitclaim deed might be suitable. However, for long-term protection and management, a trust is often the best choice.