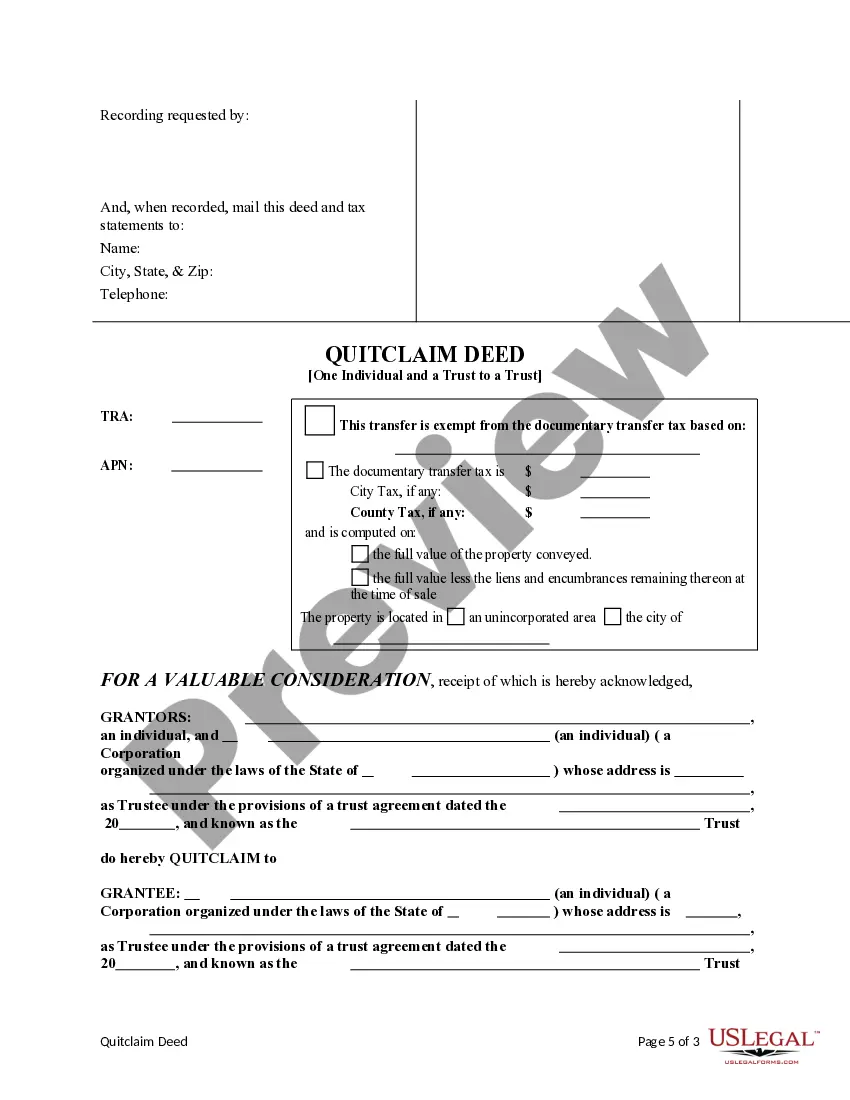

This form is a Quitclaim Deed where the Grantors are an individual and a trust and the Grantee is a trust. Grantors convey and quitclaim the described property to Grantee. This deed complies with all state statutory laws.

Title: Understanding Santa Clara California Quitclaim Deed From an Individual and a Trust to a Trust: Types and Detailed Description Introduction: The Santa Clara California Quitclaim Deed is a legal document used to transfer real estate ownership from an individual and a trust to another trust. This comprehensive guide provides an in-depth description of the process, legal requirements, and different types of quitclaim deeds specific to Santa Clara County, California. Key Terms: Santa Clara California Quitclaim Deed, Individual, Trust, Transfer of Ownership, Real Estate, Legal Document, Types. 1. What is a Santa Clara California Quitclaim Deed from an Individual and a Trust to a Trust? — A Santa Clara California Quitclaim Deed from an Individual and a Trust to a Trust is a legal instrument used to formally transfer ownership of a property from an individual, acting as a granter, and a trust to another trust, acting as a grantee. — This type of quitclaim deed is often utilized in estate planning or asset protection strategies. 2. Legal Requirements for Santa Clara California Quitclaim Deed from an Individual and a Trust to a Trust: — Identifying Information: The deed should contain the names of individuals and trusts involved, as well as the legal description of the property. — Notarization: Thgranteror's signature must be notarized to validate the quitclaim deed. — Recording: The completed quitclaim deed must be filed with the Santa Clara County Recorder's Office to make the transfer of ownership official. — Legal Counsel: It is advisable to consult an attorney experienced in real estate law to ensure compliance with all legal requirements. 3. Types of Santa Clara California Quitclaim Deed from an Individual and a Trust to a Trust: A. Inter Vivos Trust to Revocable Living Trust: — This type of quitclaim deed allows the transfer of a property from an individual's inter vivos trust to a revocable living trust. — It may offer benefits such as avoiding probate and maintaining control over assets during the granter's lifetime. B. Irrevocable Trust to Irrevocable Trust: — Here, the deed facilitates the transfer of ownership from an individual's irrevocable trust to another irrevocable trust. — This type of transfer is commonly used for Medicaid or tax planning, asset protection, or reducing estate taxes. C. Individual to Irrevocable Trust: — This quitclaim deed involves the transfer of property from an individual to an irrevocable trust. — It can be utilized for a variety of purposes, including asset protection or estate planning. Conclusion: Understanding the nuances of a Santa Clara California Quitclaim Deed from an Individual and a Trust to a Trust is crucial when engaging in property transfers involving trusts. Whether it's an inter vivos trust, irrevocable trust, or transferring from an individual to a trust, complying with the legal requirements is essential. Seek professional legal advice for guidance throughout the process to ensure a seamless transfer of ownership.Title: Understanding Santa Clara California Quitclaim Deed From an Individual and a Trust to a Trust: Types and Detailed Description Introduction: The Santa Clara California Quitclaim Deed is a legal document used to transfer real estate ownership from an individual and a trust to another trust. This comprehensive guide provides an in-depth description of the process, legal requirements, and different types of quitclaim deeds specific to Santa Clara County, California. Key Terms: Santa Clara California Quitclaim Deed, Individual, Trust, Transfer of Ownership, Real Estate, Legal Document, Types. 1. What is a Santa Clara California Quitclaim Deed from an Individual and a Trust to a Trust? — A Santa Clara California Quitclaim Deed from an Individual and a Trust to a Trust is a legal instrument used to formally transfer ownership of a property from an individual, acting as a granter, and a trust to another trust, acting as a grantee. — This type of quitclaim deed is often utilized in estate planning or asset protection strategies. 2. Legal Requirements for Santa Clara California Quitclaim Deed from an Individual and a Trust to a Trust: — Identifying Information: The deed should contain the names of individuals and trusts involved, as well as the legal description of the property. — Notarization: Thgranteror's signature must be notarized to validate the quitclaim deed. — Recording: The completed quitclaim deed must be filed with the Santa Clara County Recorder's Office to make the transfer of ownership official. — Legal Counsel: It is advisable to consult an attorney experienced in real estate law to ensure compliance with all legal requirements. 3. Types of Santa Clara California Quitclaim Deed from an Individual and a Trust to a Trust: A. Inter Vivos Trust to Revocable Living Trust: — This type of quitclaim deed allows the transfer of a property from an individual's inter vivos trust to a revocable living trust. — It may offer benefits such as avoiding probate and maintaining control over assets during the granter's lifetime. B. Irrevocable Trust to Irrevocable Trust: — Here, the deed facilitates the transfer of ownership from an individual's irrevocable trust to another irrevocable trust. — This type of transfer is commonly used for Medicaid or tax planning, asset protection, or reducing estate taxes. C. Individual to Irrevocable Trust: — This quitclaim deed involves the transfer of property from an individual to an irrevocable trust. — It can be utilized for a variety of purposes, including asset protection or estate planning. Conclusion: Understanding the nuances of a Santa Clara California Quitclaim Deed from an Individual and a Trust to a Trust is crucial when engaging in property transfers involving trusts. Whether it's an inter vivos trust, irrevocable trust, or transferring from an individual to a trust, complying with the legal requirements is essential. Seek professional legal advice for guidance throughout the process to ensure a seamless transfer of ownership.