This form is a Quitclaim Deed where the Grantors are an individual and a trust and the Grantee is a trust. Grantors convey and quitclaim the described property to Grantee. This deed complies with all state statutory laws.

Simi Valley California Quitclaim Deed from an Individual and a Trust to a Trust

Description

How to fill out California Quitclaim Deed From An Individual And A Trust To A Trust?

Regardless of one’s social or occupational standing, completing law-related documents is an unfortunate requirement in the modern era.

Too frequently, it’s virtually unfeasible for an individual lacking any legal training to draft this kind of paperwork from scratch, primarily due to the intricate language and legal subtleties they encompass.

This is where US Legal Forms comes to the aid.

Confirm that the form you have selected is appropriate for your region as the laws of one state or county do not apply to another state or county.

Review the form and examine a brief overview (if available) of situations for which the document can be utilized.

- Our platform offers an extensive compilation of over 85,000 ready-to-use, state-specific documents that are applicable for nearly any legal matter.

- US Legal Forms also acts as a valuable tool for associates or legal advisors wishing to save time utilizing our DIY forms.

- Whether you require the Simi Valley California Quitclaim Deed from an Individual and a Trust to a Trust or any other documentation that will be credible in your state or county, with US Legal Forms, everything is readily available.

- Here are the steps to efficiently obtain the Simi Valley California Quitclaim Deed from an Individual and a Trust to a Trust using our reliable service.

- If you are currently an existing customer, feel free to Log In to your account to download the correct form.

- However, if you are not yet familiar with our library, be sure to adhere to these steps prior to downloading the Simi Valley California Quitclaim Deed from an Individual and a Trust to a Trust.

Form popularity

FAQ

Today, Californians most often transfer title to real property by a simple written instrument, the grant deed. The word ?grant? is expressly designated by statute as a word of conveyance. (Civil Code Section 1092) A second form of deed is the quitclaim deed.

A quit claim deed transfers the legal ownership of the property from one party to another, and doesn't require attorneys or legal help, unless you choose to consult an attorney.

A deed is evidence of a specific event of transferring the title of the property from one person to another. A title is the legal right to use and modify the property how you see fit, or transfer interest or any portion that you own to others via a deed. A deed represents the right of the owner to claim the property.

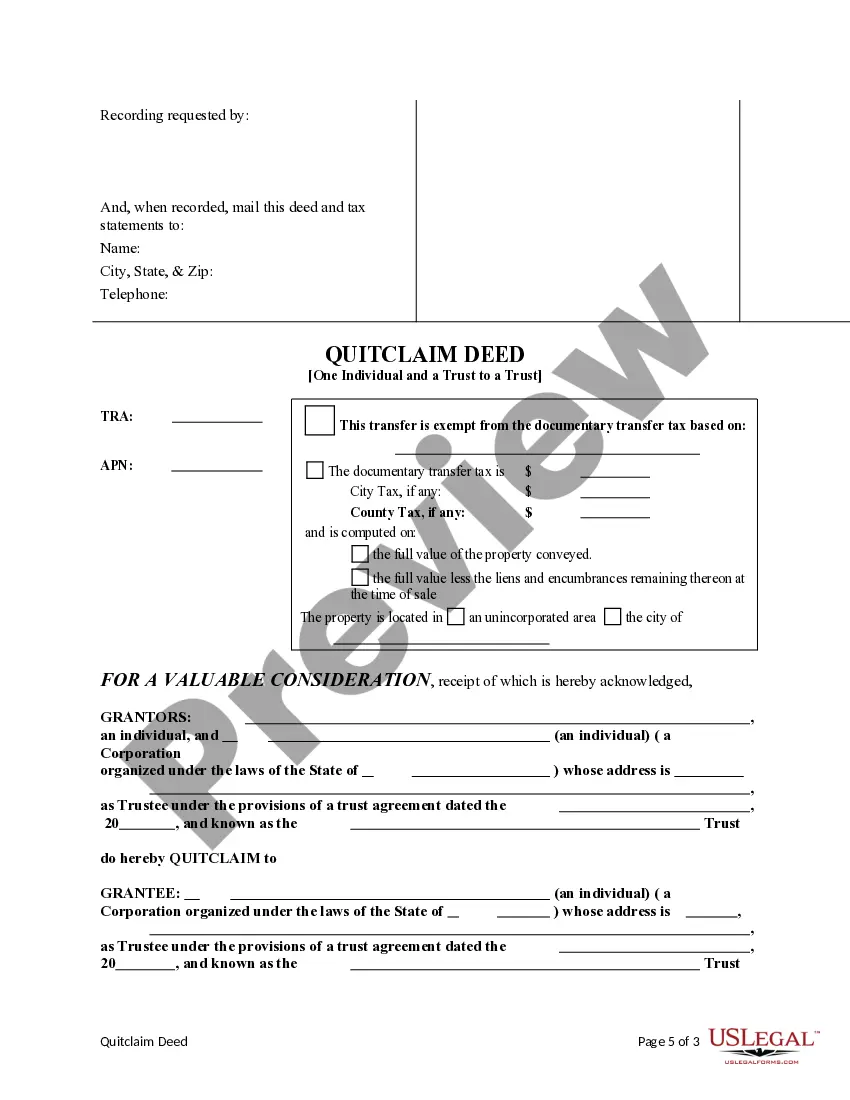

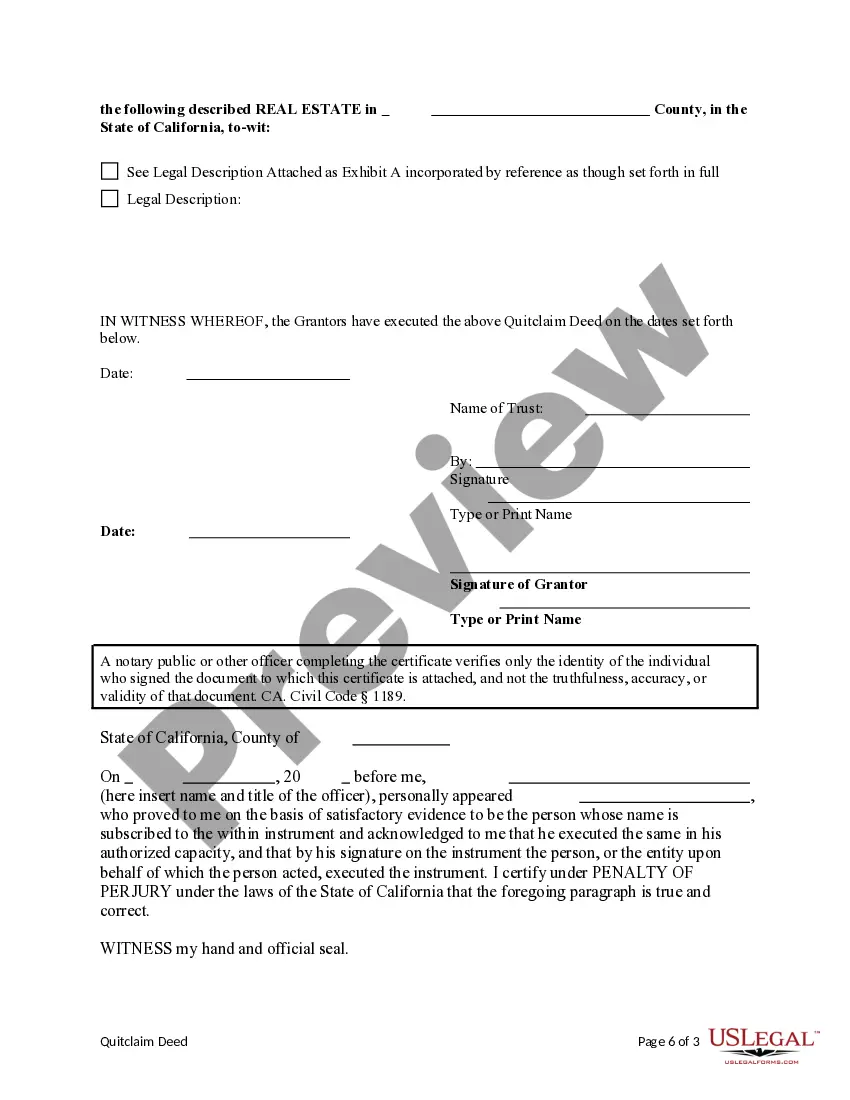

Once you have filled out a California quitclaim deed, you will need to get it notarized. Next, you will need to need to visit your appropriate local government office to file some paperwork. Depending on your county of sale, that may be a Recorder's office, a County Clerk's Office, or an Assessor's office.

File the forms. The recording fee will vary by county, but you can expect as a range to pay between $6 and $21 for the first page and $3 for any additional page. In Sacramento County, for example, the Recorder charges $21 for the first page and $3 for each additional page for recording.

A trust transfer deed is the instrument that effectuates the transfer of ownership of your real-estate from you, as an individual, to your trust. The process of creating and then recording a trust transfer deed is how your property becomes a trust asset (thereby avoiding probate, among other benefits).

Recording Fee for Quitclaim DeedType of FeeFeeBase Fee G.C. § 27361(a) G.C. § 27361.4(a) G.C. § 27361.4(b) G.C. § 27361.4(c) G.C. § 27361(d)(1) G.C. § 27397 (c) Subsection 1$15.004 more rows

The California TOD deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

In California, quitclaim deeds are commonly used between spouses, relatives, or if a property owner is transferring his or her property into his or her trust. A grant deed is commonly used in most arms-length real estate transactions not involving family members or spouses.

California mainly uses two types of deeds: the ?grant deed? and the ?quitclaim deed.? Most other deeds you will see, such as the common ?interspousal transfer deed,? are versions of grant or quitclaim deeds customized for specific circumstances.