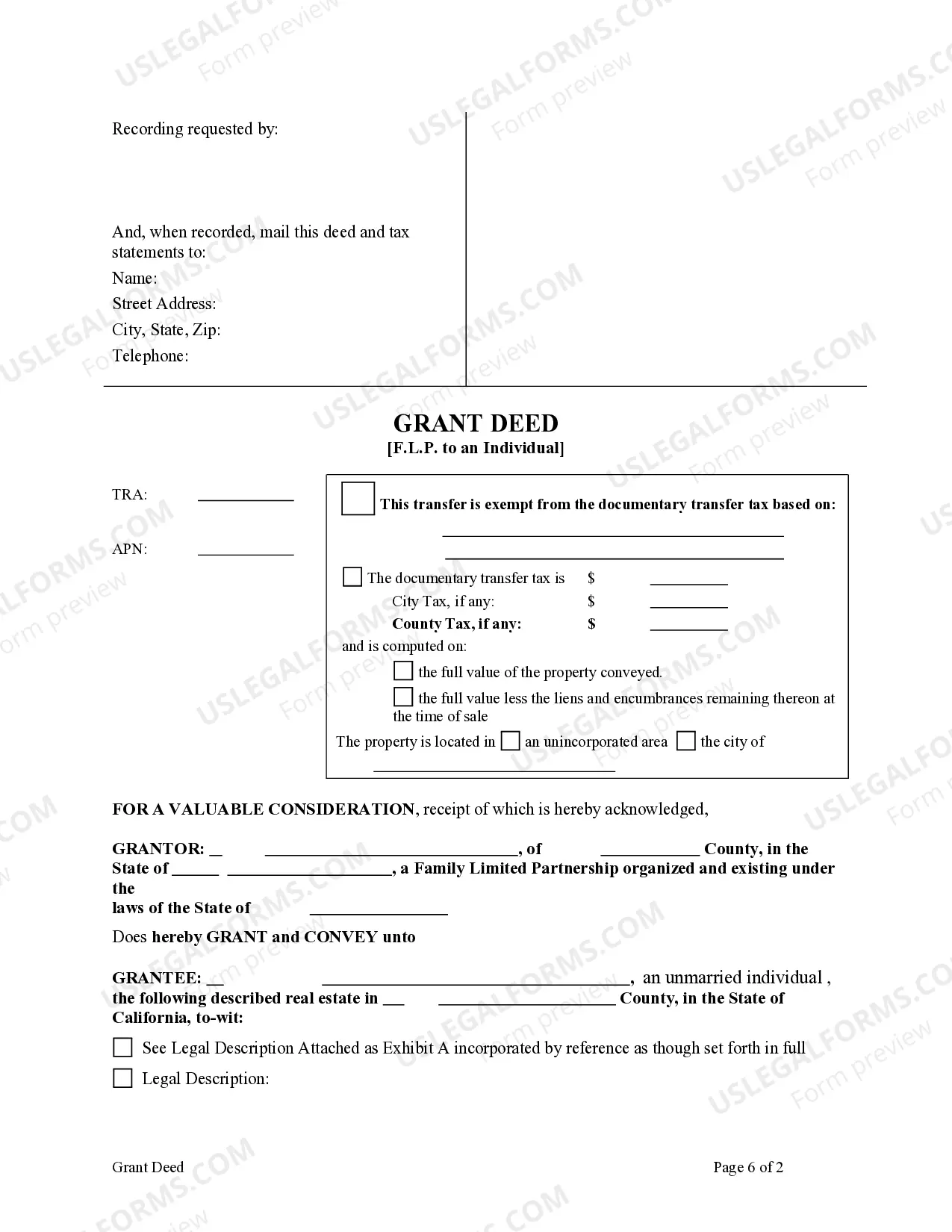

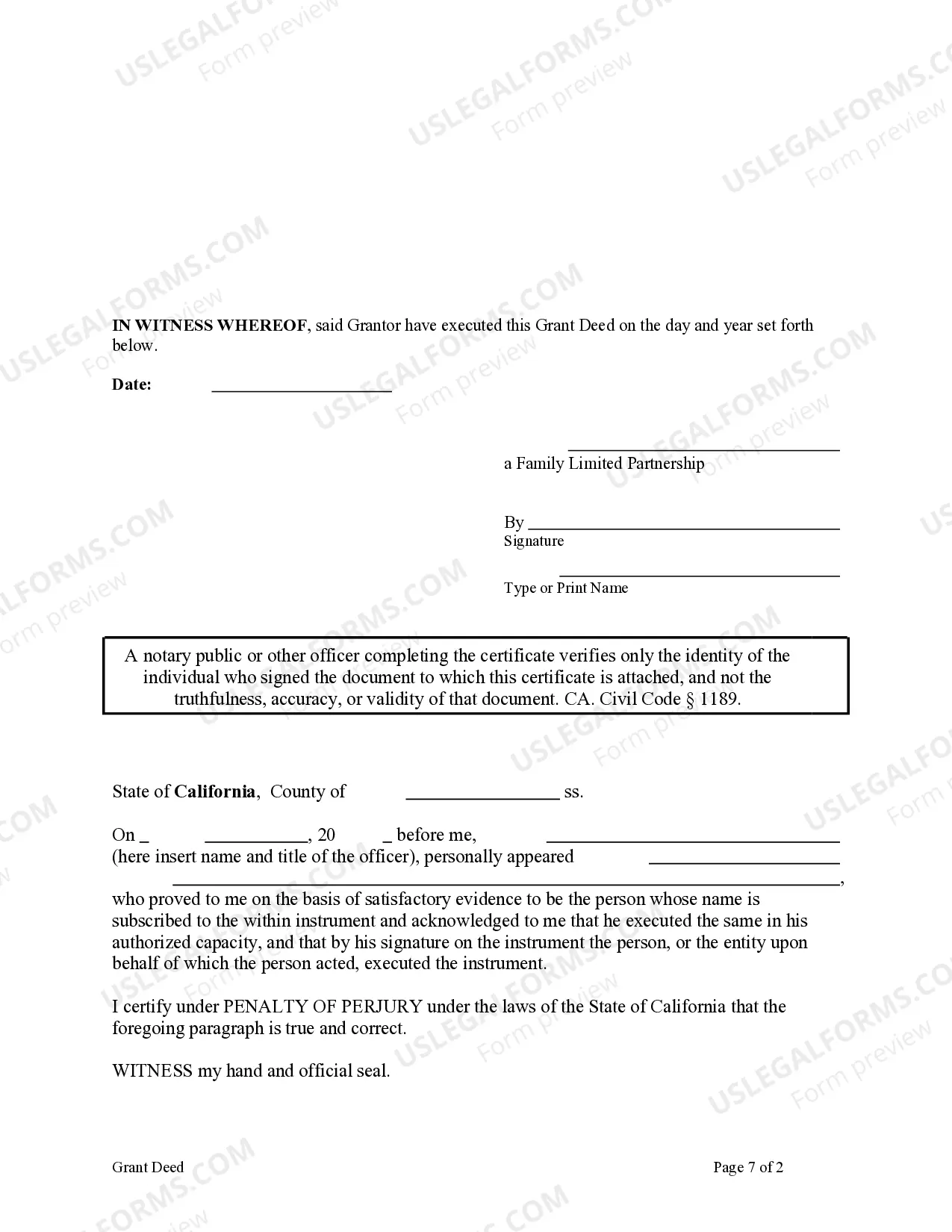

This form is a Grant Deed where the Grantor is a Family Limited Partnership and the

Grantee an individual. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Concord California Grant Deed from Family Limited Partnership to an Individual.

Description

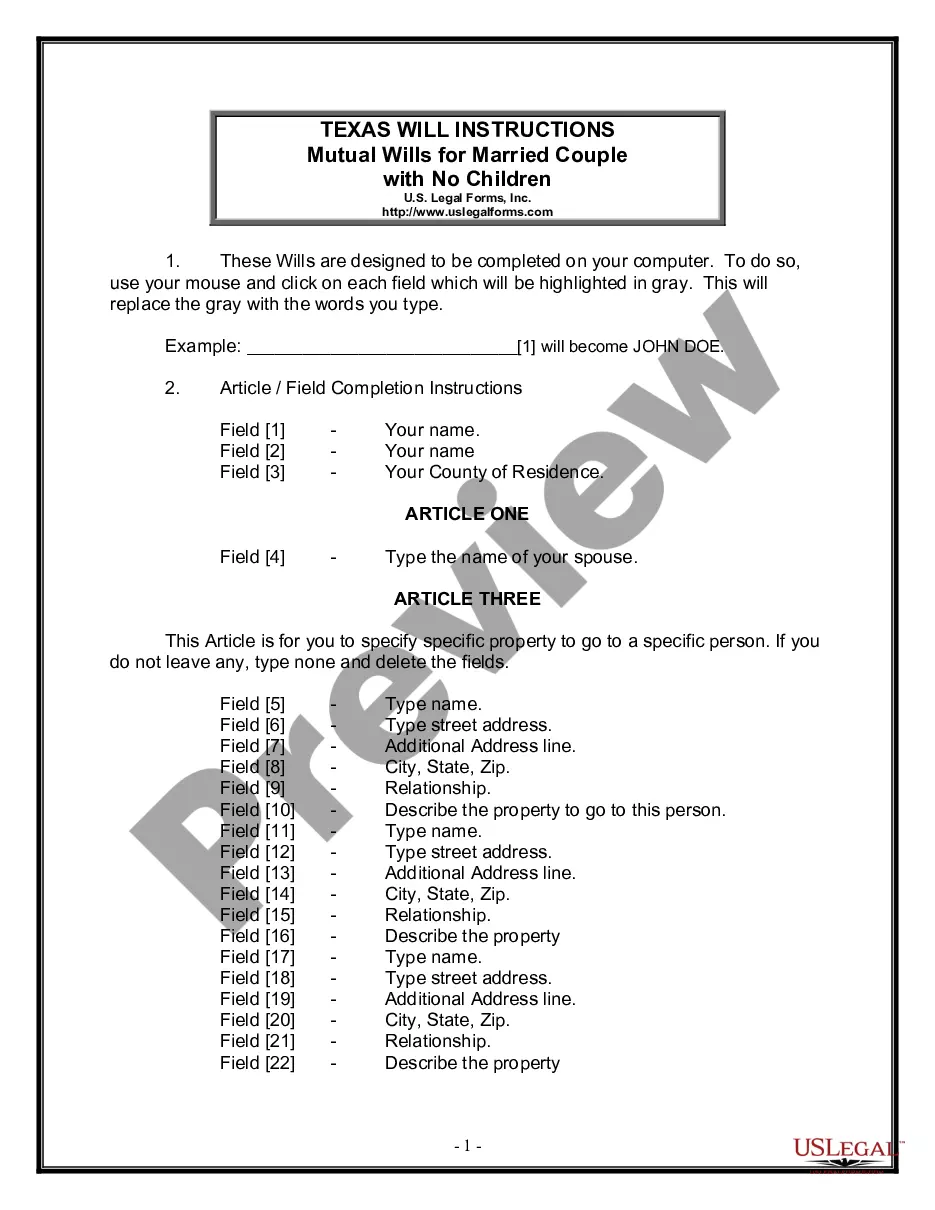

How to fill out California Grant Deed From Family Limited Partnership To An Individual.?

Are you searching for a trustworthy and budget-friendly supplier of legal forms to acquire the Concord California Grant Deed from Family Limited Partnership to an Individual.

US Legal Forms is your perfect answer.

Whether you require a straightforward agreement to establish rules for living together with your partner or a collection of documents to initiate your divorce through the court, we have you covered.

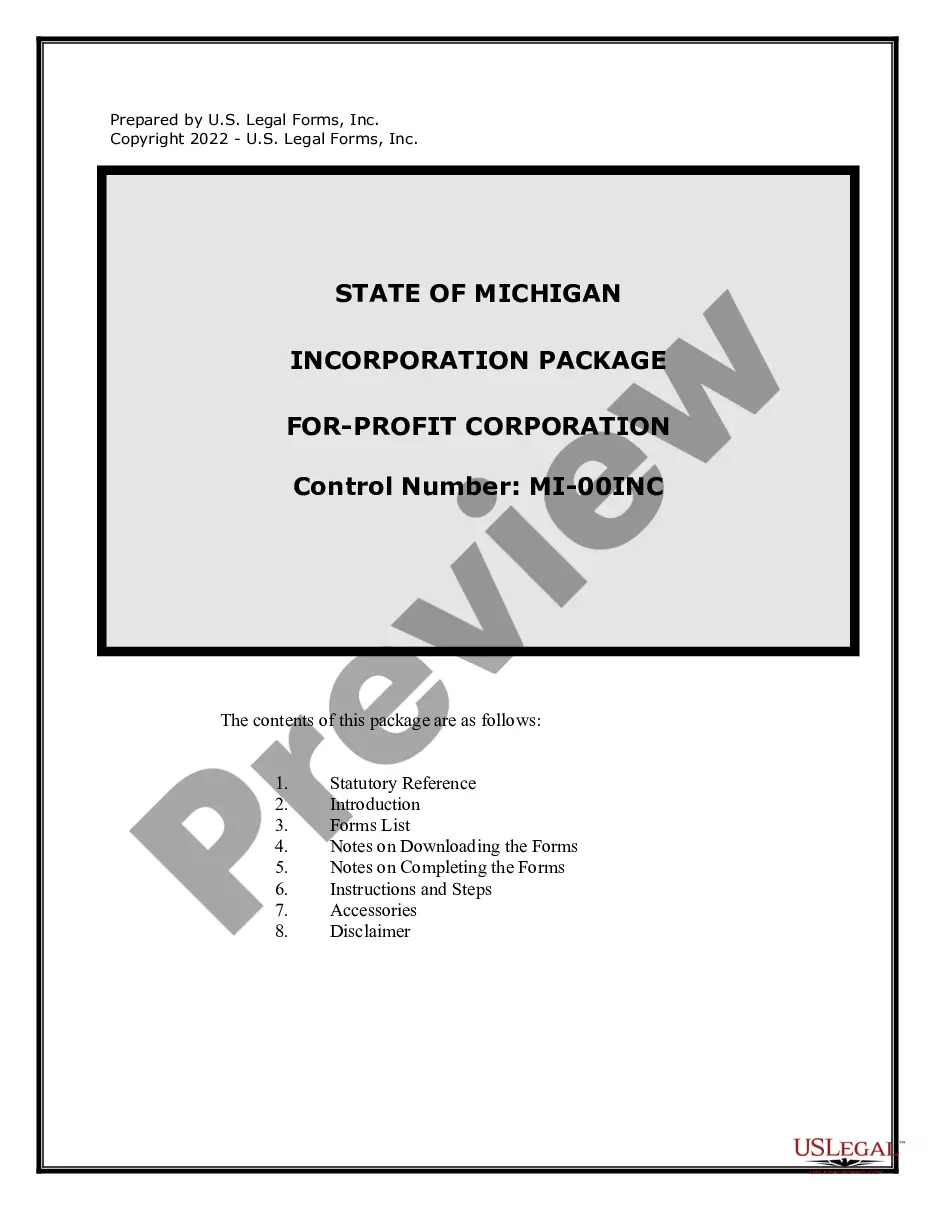

Our website contains over 85,000 current legal document templates for personal and business purposes.

Verify if the Concord California Grant Deed from Family Limited Partnership to an Individual conforms to your state's and local area's laws.

Review the form's details (if available) to determine who and what the document is appropriate for.

- All the templates we provide are not generic and are based on the specific requirements of individual states and counties.

- To download the document, you must Log In to your account, locate the desired form, and click the Download button beside it.

- Please remember that you can re-download any previously acquired document templates at any time in the My documents section.

- Are you a newcomer to our platform? No need to worry.

- You can easily set up an account, but before you do, ensure to check the following.

Form popularity

FAQ

In Pennsylvania, it is not mandatory to hire a lawyer to transfer property, but it is often advisable, especially for complex transactions. A conveyancer can help ensure that your Concord California Grant Deed from Family Limited Partnership to an Individual meets legal requirements. However, many people choose to use online resources like US Legal Forms for document preparation, making the process more accessible without legal representation.

The most efficient way to transfer property to a family member is to use a grant deed or a quitclaim deed, which allows you to transfer your ownership without complications. Especially for a Concord California Grant Deed from Family Limited Partnership to an Individual, ensure that the deed is accurately drafted and recorded with the county. Utilizing platforms like US Legal Forms can simplify this process by providing the necessary forms and guidance tailored to your needs.

Adding someone to your deed does not typically require refinancing the property. You can execute a Concord California Grant Deed from Family Limited Partnership to an Individual, which should be done carefully to prevent any future complications. Ensure you check with your lender, as some may have specific guidelines for such transactions that you will want to adhere to.

To add someone to a grant deed in California, start by obtaining the appropriate form, like a grant deed, from a reliable source. Fill out the form with both the current owner’s and the new owner’s details, making sure to sign it in front of a notary. Once completed, record the new deed with your county recorder's office to legally finalize the addition, ensuring it accurately reflects the change from the Family Limited Partnership.

Yes, you can transfer a deed without an attorney, especially if you have a clear understanding of the process. Using resources like US Legal Forms can streamline your efforts by providing templates and guidelines for creating a Concord California Grant Deed from Family Limited Partnership to an Individual. However, ensure that you comply with all local regulations to avoid future complications.

Adding someone to a deed in California can have tax implications, particularly regarding property taxes and potential capital gains tax. When you transfer a property, the new owner may inherit the original property's taxable value, which can affect future tax assessments. It's beneficial to consider consulting a tax professional to understand how a Concord California Grant Deed from Family Limited Partnership to an Individual might impact your specific tax situation.

To add a name to a grant deed in California, you must complete a new deed form, such as a grant deed, and include the name of the individual you wish to add. After filling out the form, you need to sign it before a notary public. Finally, submit the deed to your local county recorder's office for it to take effect, ensuring it reflects the transfer of ownership from the Family Limited Partnership to the individual.

You do not necessarily need a lawyer to add someone to a deed in California. However, consulting a legal professional can provide clarity and ensure that the process aligns with state laws. A properly executed Concord California Grant Deed from Family Limited Partnership to an Individual may require specific legal language, which an attorney can help you draft correctly.

To transfer property out of a trust in California, start by reviewing the trust documentation for any specific instructions regarding property distribution. Creating a Grant Deed is essential in this process—it officially records the change in ownership. Using a Concord California Grant Deed from Family Limited Partnership to an Individual simplifies this process and ensures that all legal requirements are met. Finally, remember to file the deed with the local recorder's office to finalize the transfer.

In California, property held in a trust is owned by the trust itself, not by the individual trustee or the beneficiaries. The trustee manages the property according to the terms of the trust document, while beneficiaries have equitable interests. Understanding this distinction is crucial, especially when considering using a Concord California Grant Deed from Family Limited Partnership to an Individual for future transfers.