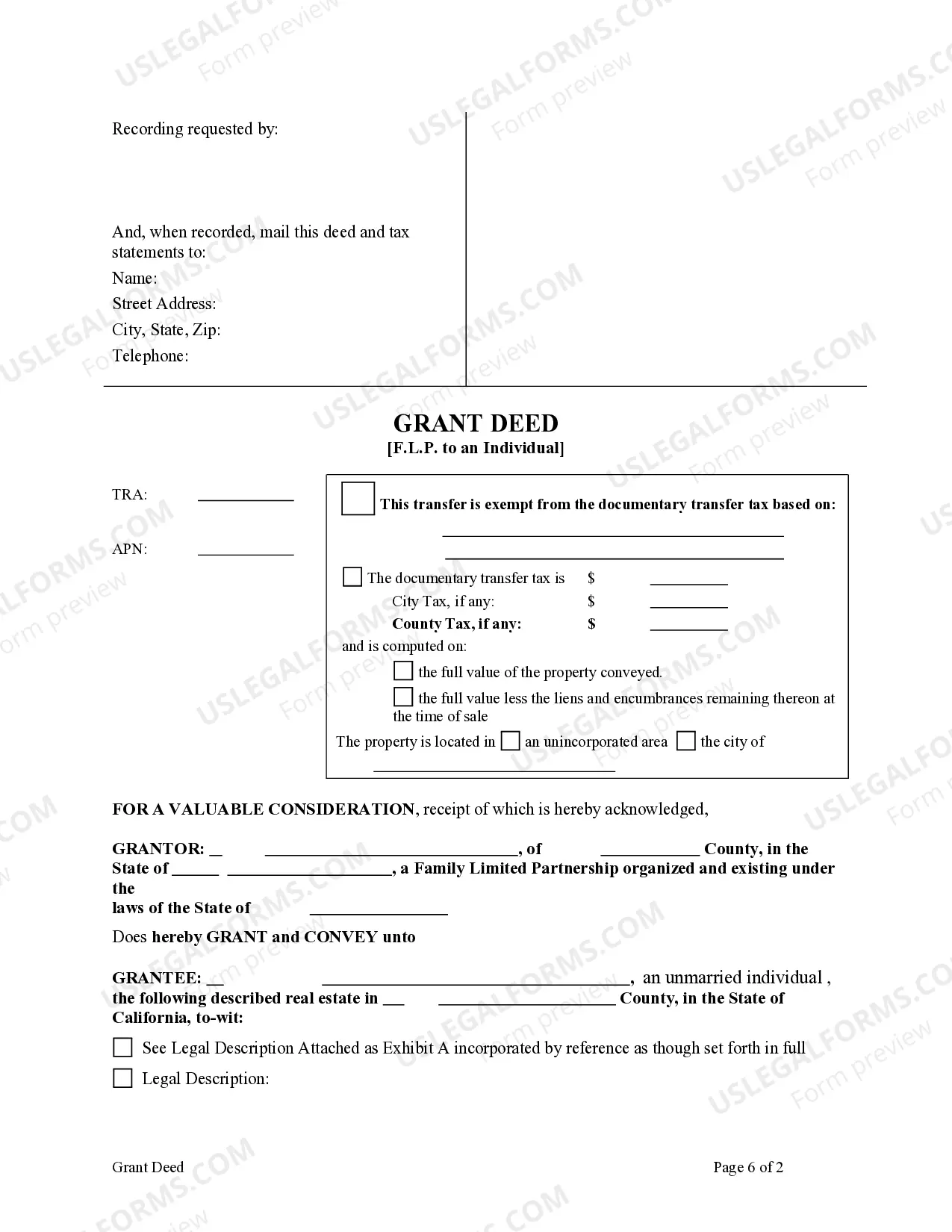

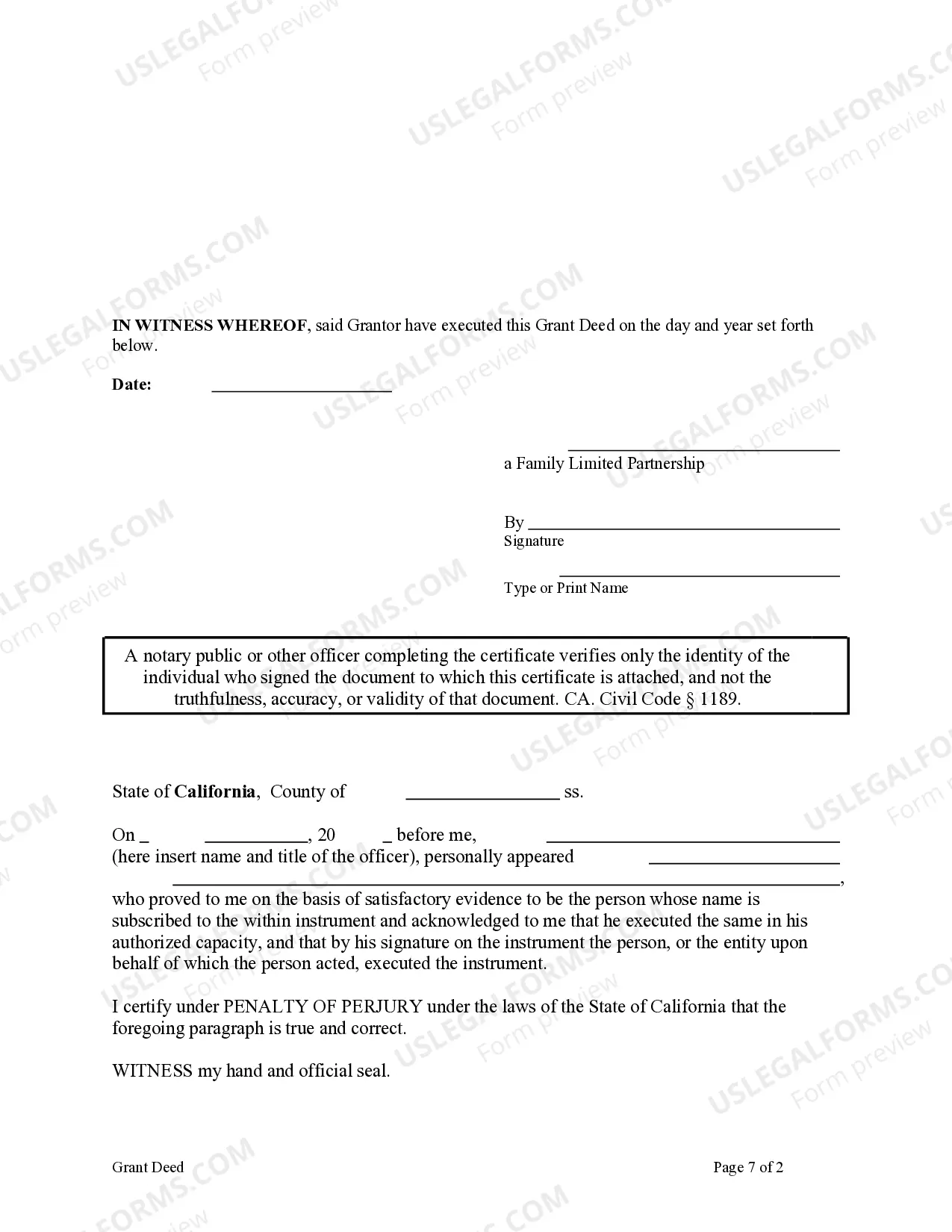

This form is a Grant Deed where the Grantor is a Family Limited Partnership and the Grantee an individual. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

A Garden Grove California Grant Deed from a Family Limited Partnership to an Individual is a legal document that transfers ownership of real property from a partnership entity, known as a Family Limited Partnership, to an individual. This type of transfer is commonly used for estate planning purposes, asset protection, or to restructure ownership within a family business. The Garden Grove California Grant Deed ensures a seamless transfer of ownership by outlining specific details about the property and the parties involved. It includes the names and addresses of the granter (the Family Limited Partnership) and the grantee (the individual receiving the property), as well as a legal description of the property being transferred. There are different types of Garden Grove California Grant Deeds from Family Limited Partnership to an Individual, including: 1. General Grant Deed: This type of deed creates a simple transfer of property ownership. It guarantees that the granter has the legal authority to transfer the property and guarantees the grantee's right to possess and enjoy it. 2. Special Warranty Deed: This deed provides limited protection to the grantee against any potential defects in the title caused by the granter or its predecessors. The granter warrants that no title defects occurred during their ownership but does not guarantee against any prior defects. 3. Quitclaim Deed: This type of deed conveys any interest the granter may have in the property without providing any warranty or guarantee of title. It is often used between family members or in situations where the granter's interest is uncertain. It is important to consult with an experienced real estate attorney or legal professional when dealing with Garden Grove California Grant Deeds from Family Limited Partnership to an Individual. They can guide you through the process, ensure all necessary documents are prepared correctly, and advise on any taxation or legal implications related to the transfer.A Garden Grove California Grant Deed from a Family Limited Partnership to an Individual is a legal document that transfers ownership of real property from a partnership entity, known as a Family Limited Partnership, to an individual. This type of transfer is commonly used for estate planning purposes, asset protection, or to restructure ownership within a family business. The Garden Grove California Grant Deed ensures a seamless transfer of ownership by outlining specific details about the property and the parties involved. It includes the names and addresses of the granter (the Family Limited Partnership) and the grantee (the individual receiving the property), as well as a legal description of the property being transferred. There are different types of Garden Grove California Grant Deeds from Family Limited Partnership to an Individual, including: 1. General Grant Deed: This type of deed creates a simple transfer of property ownership. It guarantees that the granter has the legal authority to transfer the property and guarantees the grantee's right to possess and enjoy it. 2. Special Warranty Deed: This deed provides limited protection to the grantee against any potential defects in the title caused by the granter or its predecessors. The granter warrants that no title defects occurred during their ownership but does not guarantee against any prior defects. 3. Quitclaim Deed: This type of deed conveys any interest the granter may have in the property without providing any warranty or guarantee of title. It is often used between family members or in situations where the granter's interest is uncertain. It is important to consult with an experienced real estate attorney or legal professional when dealing with Garden Grove California Grant Deeds from Family Limited Partnership to an Individual. They can guide you through the process, ensure all necessary documents are prepared correctly, and advise on any taxation or legal implications related to the transfer.