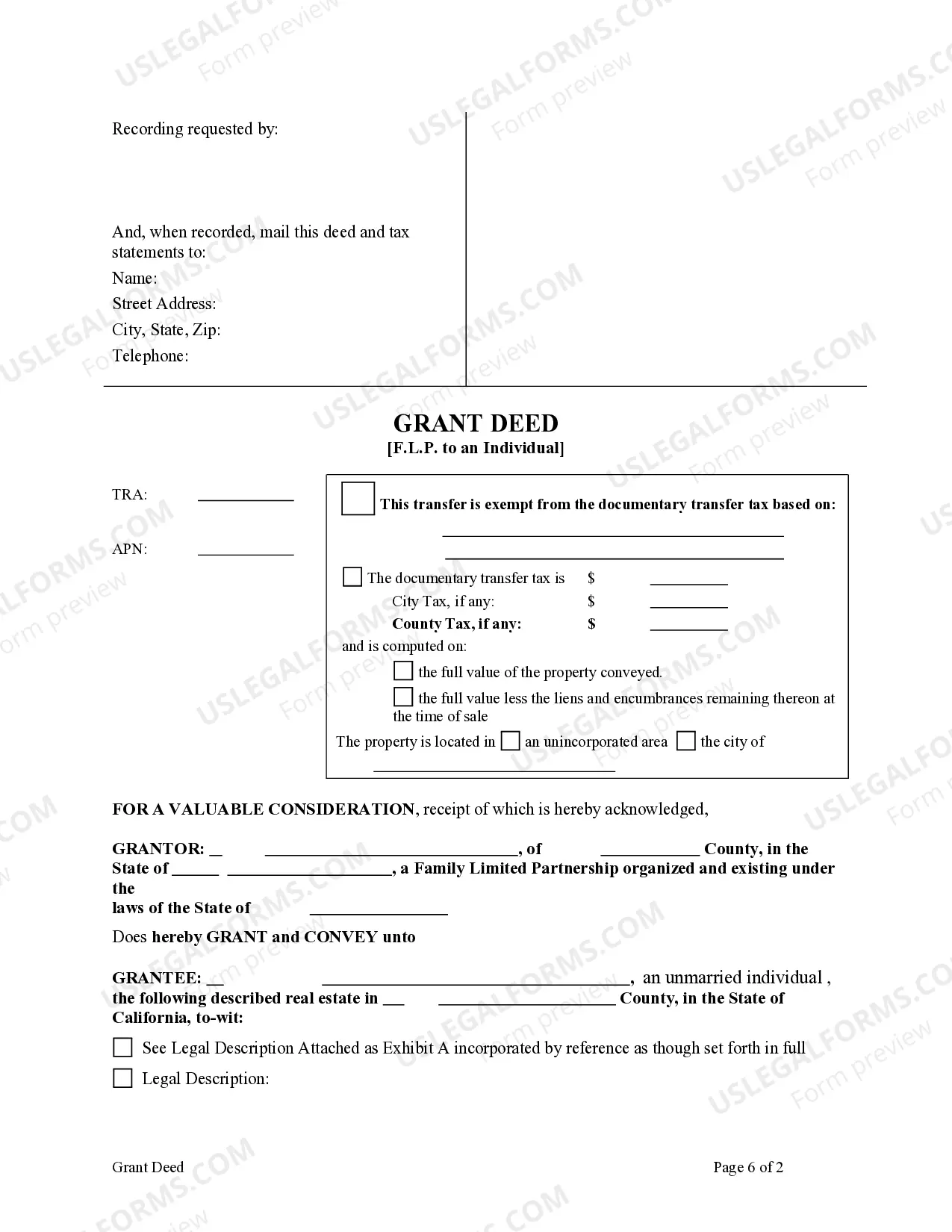

This form is a Grant Deed where the Grantor is a Family Limited Partnership and the Grantee an individual. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

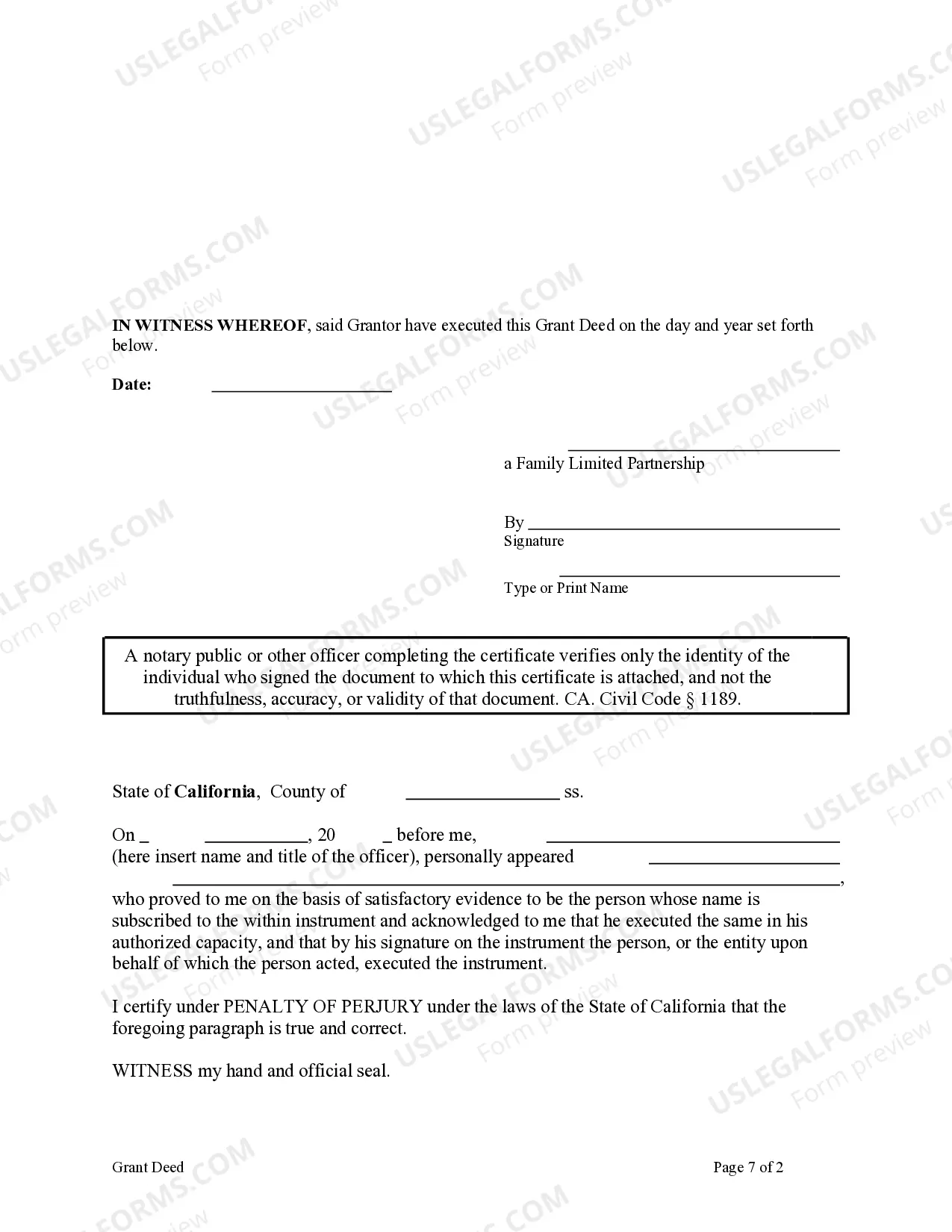

A Rialto California Grant Deed from Family Limited Partnership to an Individual is a legal document used to transfer ownership of a property from a Family Limited Partnership to an individual. This type of deed contains important details about the property, the parties involved, and the terms of the transfer. Here is a detailed description of this type of deed: 1. What is a Grant Deed? A grant deed is a legal instrument used in real estate transactions to convey ownership rights from one party, called the granter, to another party, known as the grantee. It guarantees that the property title is free of any liens or encumbrances, and the granter has the legal authority to sell or transfer the property. 2. Family Limited Partnership (FLP) A Family Limited Partnership is a partnership agreement established by family members to hold and manage assets, usually real estate or investments, together. This business entity offers various benefits, such as asset protection, estate planning, tax advantages, and centralized management. 3. Purpose of the Grant Deed The purpose of transferring property through a grant deed from a Family Limited Partnership to an individual is to dissolve the partnership or allocate the property's ownership to a specific family member. This may occur due to various reasons, including estate planning, division of assets, retiring or exiting the partnership, or transferring ownership to the next generation. 4. Types of Rialto California Grant Deeds from Family Limited Partnership to an Individual a. Traditional Grant Deed: This is the most common type of grant deed where the granter transfers the property's ownership to the individual without any additional conditions or restrictions. b. Special Warranty Deed: This type of grant deed guarantees that the granter has not taken any actions during their ownership that would impact the title, except those mentioned in the deed. c. Quitclaim Deed: A quitclaim deed transfers the granter's rights or interests in the property to the grantee without guaranteeing the title's validity. It is often used for transfers between family members or in situations where the granter does not wish to provide any warranties or guarantees. 5. Key Elements of the Grant Deed a. Legal Description: The deed must include a detailed legal description of the property being transferred, including its boundaries, lot number, and any relevant survey information. b. Granter and Grantee Information: The names, addresses, and contact details of both the granter, representing the Family Limited Partnership, and the individual receiving the property (the grantee), must be clearly mentioned. c. Consideration: The deed should state the amount paid or the consideration exchanged for the property, even if it is a nominal amount or if the transfer is made as a gift. d. Signature and Notarization: The granter's signature is required for the deed to be valid, while some states also require notarization or witnessing by impartial third parties. In conclusion, a Rialto California Grant Deed from Family Limited Partnership to an Individual is a legal document used to transfer property ownership from a partnership entity to an individual. It is crucial to consult with legal professionals to ensure compliance with local laws, fully understand the ramifications of the transfer, and complete the necessary paperwork accurately.A Rialto California Grant Deed from Family Limited Partnership to an Individual is a legal document used to transfer ownership of a property from a Family Limited Partnership to an individual. This type of deed contains important details about the property, the parties involved, and the terms of the transfer. Here is a detailed description of this type of deed: 1. What is a Grant Deed? A grant deed is a legal instrument used in real estate transactions to convey ownership rights from one party, called the granter, to another party, known as the grantee. It guarantees that the property title is free of any liens or encumbrances, and the granter has the legal authority to sell or transfer the property. 2. Family Limited Partnership (FLP) A Family Limited Partnership is a partnership agreement established by family members to hold and manage assets, usually real estate or investments, together. This business entity offers various benefits, such as asset protection, estate planning, tax advantages, and centralized management. 3. Purpose of the Grant Deed The purpose of transferring property through a grant deed from a Family Limited Partnership to an individual is to dissolve the partnership or allocate the property's ownership to a specific family member. This may occur due to various reasons, including estate planning, division of assets, retiring or exiting the partnership, or transferring ownership to the next generation. 4. Types of Rialto California Grant Deeds from Family Limited Partnership to an Individual a. Traditional Grant Deed: This is the most common type of grant deed where the granter transfers the property's ownership to the individual without any additional conditions or restrictions. b. Special Warranty Deed: This type of grant deed guarantees that the granter has not taken any actions during their ownership that would impact the title, except those mentioned in the deed. c. Quitclaim Deed: A quitclaim deed transfers the granter's rights or interests in the property to the grantee without guaranteeing the title's validity. It is often used for transfers between family members or in situations where the granter does not wish to provide any warranties or guarantees. 5. Key Elements of the Grant Deed a. Legal Description: The deed must include a detailed legal description of the property being transferred, including its boundaries, lot number, and any relevant survey information. b. Granter and Grantee Information: The names, addresses, and contact details of both the granter, representing the Family Limited Partnership, and the individual receiving the property (the grantee), must be clearly mentioned. c. Consideration: The deed should state the amount paid or the consideration exchanged for the property, even if it is a nominal amount or if the transfer is made as a gift. d. Signature and Notarization: The granter's signature is required for the deed to be valid, while some states also require notarization or witnessing by impartial third parties. In conclusion, a Rialto California Grant Deed from Family Limited Partnership to an Individual is a legal document used to transfer property ownership from a partnership entity to an individual. It is crucial to consult with legal professionals to ensure compliance with local laws, fully understand the ramifications of the transfer, and complete the necessary paperwork accurately.