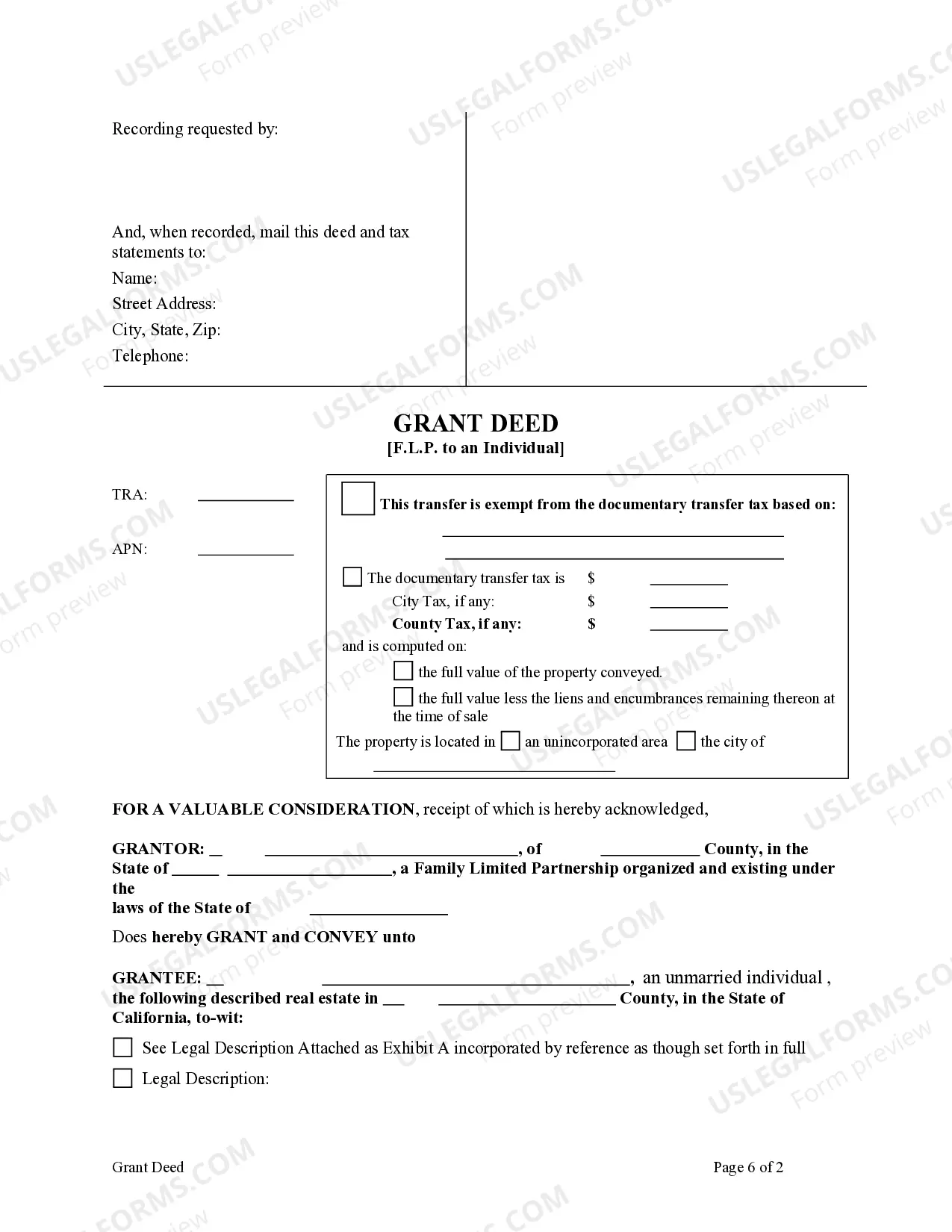

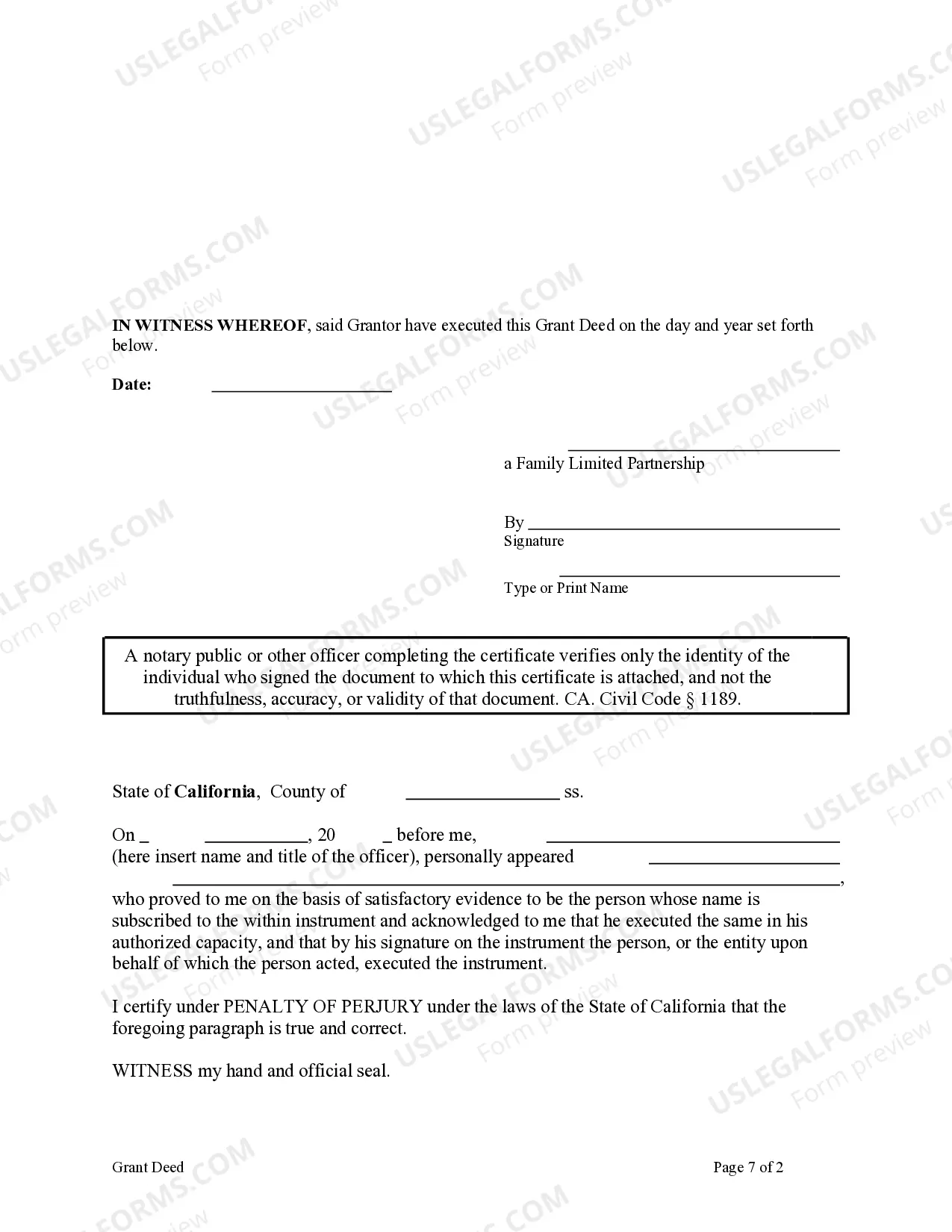

This form is a Grant Deed where the Grantor is a Family Limited Partnership and the Grantee an individual. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

A grant deed is a legal document used to transfer property ownership rights from one party to another. In the case of Riverside, California, a grant deed refers to the specific type of deed used when a Family Limited Partnership (FLP) transfers property to an individual. A Riverside California Grant Deed from a Family Limited Partnership to an Individual serves as proof of the legal transfer of ownership from the FLP to the individual. This document contains essential details about the property being transferred and ensures that the individual receiving the property obtains valid title rights. The Riverside County Clerk's office provides various types of grant deeds that can be used in different circumstances. Some common types include: 1. General Riverside California Grant Deed from Family Limited Partnership to an Individual: This type of grant deed is used when the FLP transfers ownership of the property to an individual without any specific conditions or restrictions. 2. Special Riverside California Grant Deed from Family Limited Partnership to an Individual: This type of grant deed is used when the FLP transfers ownership with certain limitations or conditions defined in the document. These restrictions could include usage limitations, easements, or specific provisions related to the property. 3. Quitclaim Riverside California Grant Deed from Family Limited Partnership to an Individual: This type of grant deed is often used when there is doubt or uncertainty about the ownership status of the property. By signing a quitclaim grant deed, the FLP relinquishes any claim or interest they may have had in the property, allowing the individual to obtain clear ownership. When drafting a Riverside California Grant Deed from a Family Limited Partnership to an Individual, it is crucial to include key information such as: — Full legal names and addresses of both the FLP and the individual. — A legal description of the property being transferred, including its boundaries and any pertinent details. — Consideration being exchanged for the property, usually in the form of money or other valuables. — The signature of an authorized representative from the FLP, attesting to the validity of the transfer. Handling property transfers can be complex, and consulting an attorney or expert in real estate law is advised to ensure compliance with all relevant laws and regulations. The Riverside County Clerk's office can provide additional guidance and resources related to the specific requirements for Riverside, California grant deeds involving a transfer from a Family Limited Partnership to an Individual.A grant deed is a legal document used to transfer property ownership rights from one party to another. In the case of Riverside, California, a grant deed refers to the specific type of deed used when a Family Limited Partnership (FLP) transfers property to an individual. A Riverside California Grant Deed from a Family Limited Partnership to an Individual serves as proof of the legal transfer of ownership from the FLP to the individual. This document contains essential details about the property being transferred and ensures that the individual receiving the property obtains valid title rights. The Riverside County Clerk's office provides various types of grant deeds that can be used in different circumstances. Some common types include: 1. General Riverside California Grant Deed from Family Limited Partnership to an Individual: This type of grant deed is used when the FLP transfers ownership of the property to an individual without any specific conditions or restrictions. 2. Special Riverside California Grant Deed from Family Limited Partnership to an Individual: This type of grant deed is used when the FLP transfers ownership with certain limitations or conditions defined in the document. These restrictions could include usage limitations, easements, or specific provisions related to the property. 3. Quitclaim Riverside California Grant Deed from Family Limited Partnership to an Individual: This type of grant deed is often used when there is doubt or uncertainty about the ownership status of the property. By signing a quitclaim grant deed, the FLP relinquishes any claim or interest they may have had in the property, allowing the individual to obtain clear ownership. When drafting a Riverside California Grant Deed from a Family Limited Partnership to an Individual, it is crucial to include key information such as: — Full legal names and addresses of both the FLP and the individual. — A legal description of the property being transferred, including its boundaries and any pertinent details. — Consideration being exchanged for the property, usually in the form of money or other valuables. — The signature of an authorized representative from the FLP, attesting to the validity of the transfer. Handling property transfers can be complex, and consulting an attorney or expert in real estate law is advised to ensure compliance with all relevant laws and regulations. The Riverside County Clerk's office can provide additional guidance and resources related to the specific requirements for Riverside, California grant deeds involving a transfer from a Family Limited Partnership to an Individual.