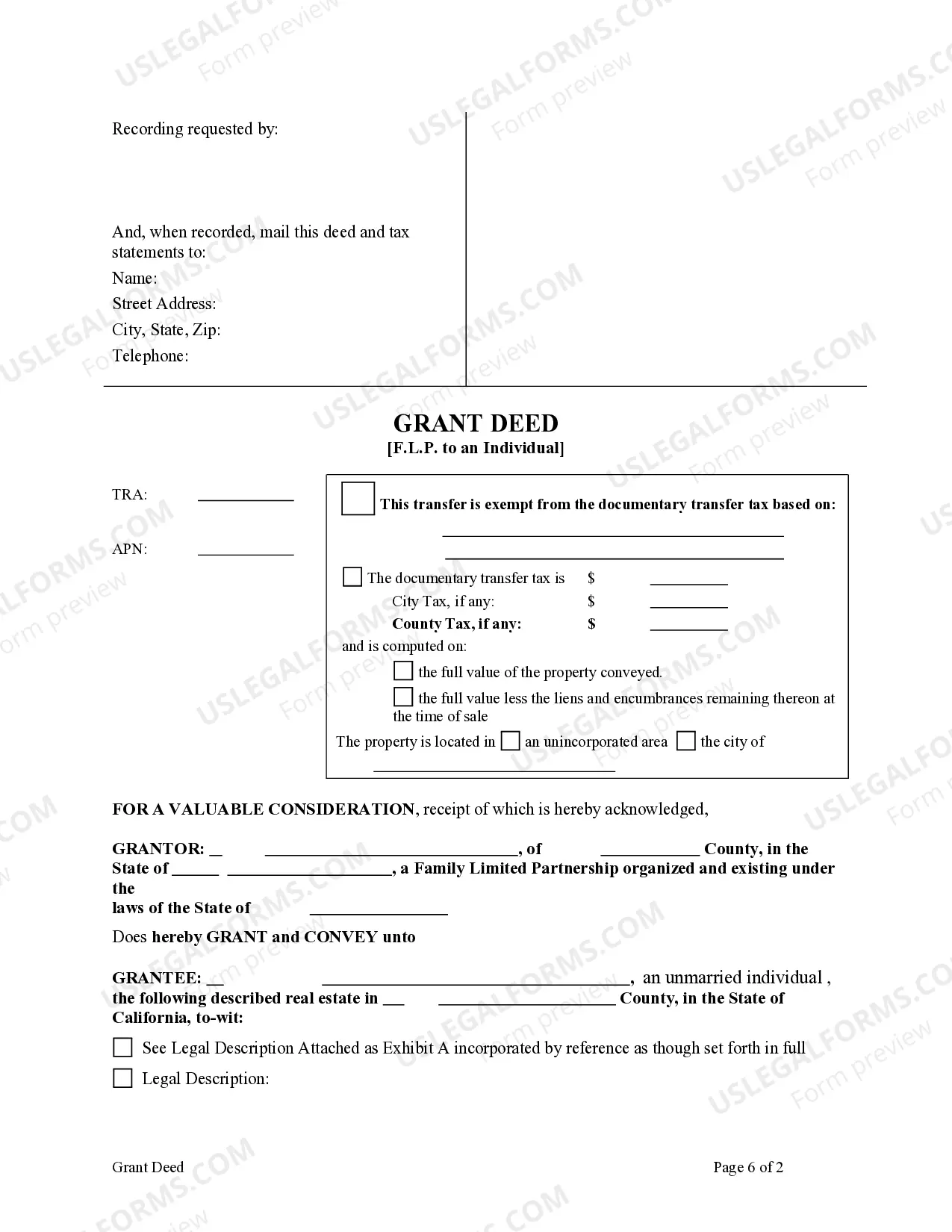

This form is a Grant Deed where the Grantor is a Family Limited Partnership and the

Grantee an individual. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Santa Clara California Grant Deed from Family Limited Partnership to an Individual.

Description

How to fill out California Grant Deed From Family Limited Partnership To An Individual.?

Regardless of one’s social or career standing, finalizing legal documents has become a regrettable requirement in the contemporary professional landscape.

Too frequently, it is nearly unfeasible for individuals lacking legal training to draft such documents from scratch, primarily because of the intricate terminology and legal nuances they encompass.

This is where US Legal Forms can come to the rescue.

Verify that the template you have located is appropriate for your area, as the laws of one location may not apply to another.

Preview the document and review a brief summary (if available) of situations the document is applicable for.

- Our service boasts an extensive collection of more than 85,000 ready-to-use state-specific templates applicable for nearly any legal circumstance.

- US Legal Forms also serves as a valuable resource for associates or legal advisors aiming to save time through our DIY paperwork.

- Whether you need the Santa Clara California Grant Deed from Family Limited Partnership to an Individual or any other forms suitable for your state or locality, US Legal Forms provides everything you require.

- Here's how you can acquire the Santa Clara California Grant Deed from Family Limited Partnership to an Individual in minutes using our reliable service.

- If you're an existing member, you may proceed to Log In to your account to retrieve the relevant form.

- However, if you are new to our platform, make sure to follow these steps before securing the Santa Clara California Grant Deed from Family Limited Partnership to an Individual.

Form popularity

FAQ

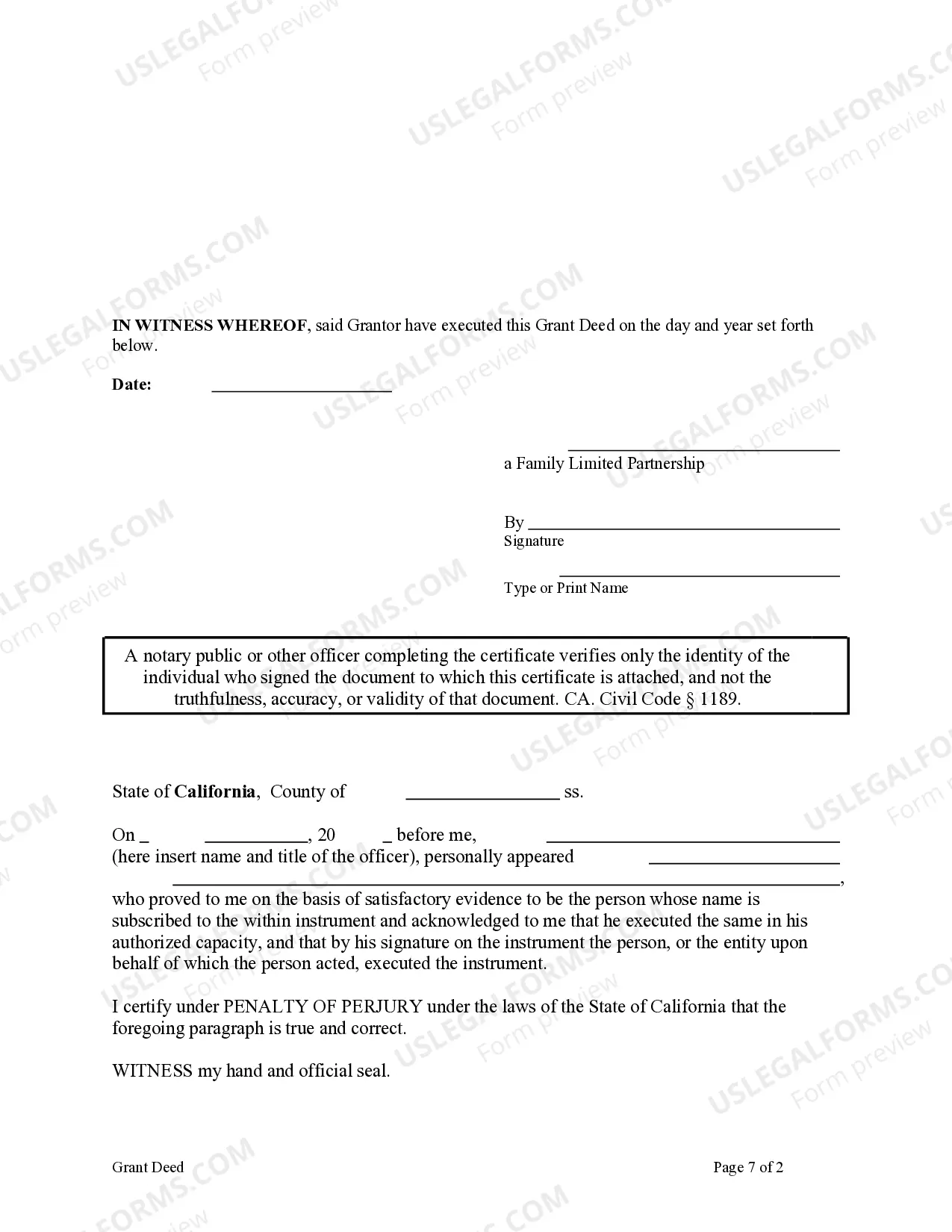

Changing a grant deed in California typically involves drafting a new grant deed that reflects the desired modifications. Make sure all current owners sign the new deed before a notary, ensuring legal acknowledgment. After notarization, you must record the new deed with the county recorder’s office. If you are managing a Santa Clara California Grant Deed from Family Limited Partnership to an Individual, follow these steps carefully to ensure compliance and proper documentation.

To remove someone from a deed without refinancing, you can execute a quitclaim deed, which allows the individual to relinquish their interest in the property. This process generally does not involve the lender and can be executed directly through a notarized document. Once the quitclaim deed is signed, file it with the county recorder to update the ownership records. This option can be particularly beneficial for a Santa Clara California Grant Deed from Family Limited Partnership to an Individual.

Filling out a California grant deed requires entering specific information regarding the property and the parties involved. Start by writing the names of the grantors and grantees, then provide a description of the property being transferred. Ensure you include the appropriate legal description of the property, which can often be obtained from previous deeds or tax records. Utilizing resources such as uslegalforms can assist you in accurately completing a Santa Clara California Grant Deed from Family Limited Partnership to an Individual.

In California, to remove someone from a grant deed, you should prepare a revised grant deed that clearly outlines the change in ownership. All current owners must sign the document, and it needs to be notarized before submission. After notarization, file the amended deed with your county recorder’s office to finalize the process. This is particularly relevant when handling a Santa Clara California Grant Deed from Family Limited Partnership to an Individual.

Removing someone from a grant deed involves creating a new grant deed that transfers the property rights from the individual you wish to remove. This new deed must be signed by all remaining owners and notarized. Afterwards, file this new deed with the appropriate county recorder to update the ownership records effectively. It’s crucial to accurately reflect these changes if you are dealing with a Santa Clara California Grant Deed from Family Limited Partnership to an Individual.

To amend a grant deed in California, you need to draft a new grant deed that includes the changes you want to make. Ensure that the new deed accurately reflects the current owners and their interests in the property. After preparing the new document, you must sign it in front of a notary public and then record it with the county recorder’s office. This process is especially important when dealing with a Santa Clara California Grant Deed from Family Limited Partnership to an Individual.

To dissolve a family limited partnership, you typically need to follow specific steps outlined in your partnership agreement. First, ensure that all partners agree to the dissolution and document this decision. Then, settle any outstanding debts or obligations, and distribute the remaining assets according to the terms of your agreement. If you're transferring property, such as in a Santa Clara California Grant Deed from Family Limited Partnership to an Individual, you may want to consult legal resources to ensure proper handling and documentation.

Transferring ownership in a partnership can be straightforward if all partners agree and the partnership agreement permits it. However, clarity and proper documentation are crucial to avoid disputes. Using tools like a Santa Clara California Grant Deed from Family Limited Partnership to an Individual can aid in making the process smoother and more transparent.

Yes, in California, a Grant Deed must be recorded to ensure its legal effect. Recording the deed protects the new owner's interest and provides public notice of the ownership transfer. Utilizing a Santa Clara California Grant Deed from Family Limited Partnership to an Individual helps create a formal record of the transfer, solidifying your ownership rights.

Transferring ownership of a limited partnership usually involves drafting a formal transfer agreement and securing approval from all partners. This process may include creating a Santa Clara California Grant Deed from Family Limited Partnership to an Individual to clearly record the new ownership structure. Completing this transfer properly ensures compliance and keeps records accurate.