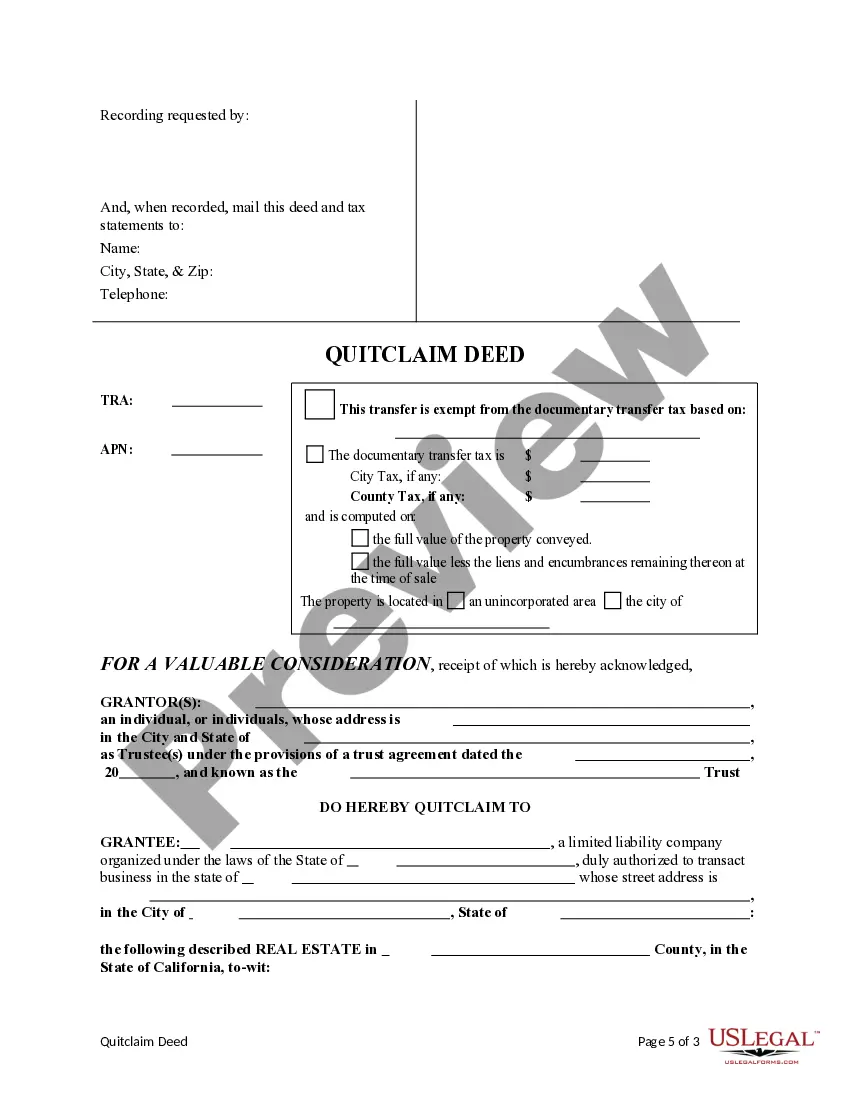

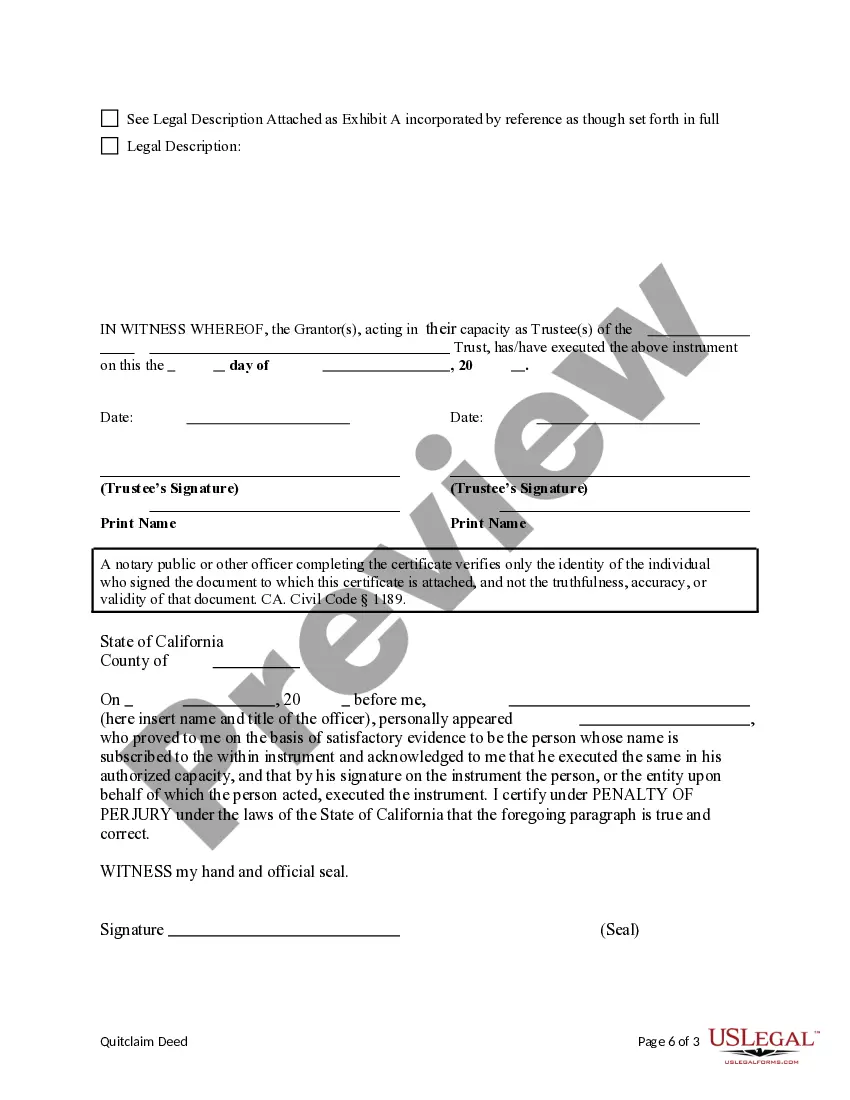

This form is a Quitclaim Deed where the Grantor is a trust and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A Corona California Quitclaim Deed from a Trust to a Limited Liability Company is a legal document used to transfer ownership of real property from a trust to a limited liability company (LLC) in the city of Corona, California. This deed is commonly utilized when individuals or entities wish to protect their personal assets by holding the property under an LLC, providing limited liability protection. In this type of transfer, the trust, acting as the granter, relinquishes all its interest and rights to the property, known as the granter's interest, to the LLC, known as the grantee. This legal process ensures a smooth transition of property ownership, without the need for an elaborate sale agreement and associated fees. By employing a Quitclaim Deed, the transfer of ownership is relatively simple and straightforward, satisfying all legal requirements. This type of deed is often used when the trust holding the property wishes to establish a separate legal entity, such as an LLC, to manage and control the property's affairs while reducing personal liability. There can be various types of Quitclaim Deeds from a Trust to an LLC in Corona, California, depending on different scenarios and circumstances. These may include: 1. Trust to Single-Member LLC: This type of transfer occurs when the trust conveys the property to an LLC with a single member or owner. It is commonly used for estate planning purposes or when maintaining privacy becomes essential. 2. Trust to Multi-Member LLC: In this scenario, the trust transfers the property ownership to an LLC with multiple members. Generally, this type of transfer occurs when multiple beneficiaries of the trust wish to hold the property collectively under the LLC. 3. Trust to Series LLC: A series LLC is a unique form of Limited Liability Company that allows for the creation of separate series, each with independent assets and liabilities. This type of transfer may be beneficial when the trust holds multiple properties or wants to segregate different assets within the LLC. The above-described Quitclaim Deeds allow the trust to smoothly transfer property ownership to an LLC, preserving limited liability protection, streamlining management, and potentially providing tax advantages. It is crucial to consult a qualified attorney or legal professional well-versed in California real estate law to ensure a valid and enforceable transfer.