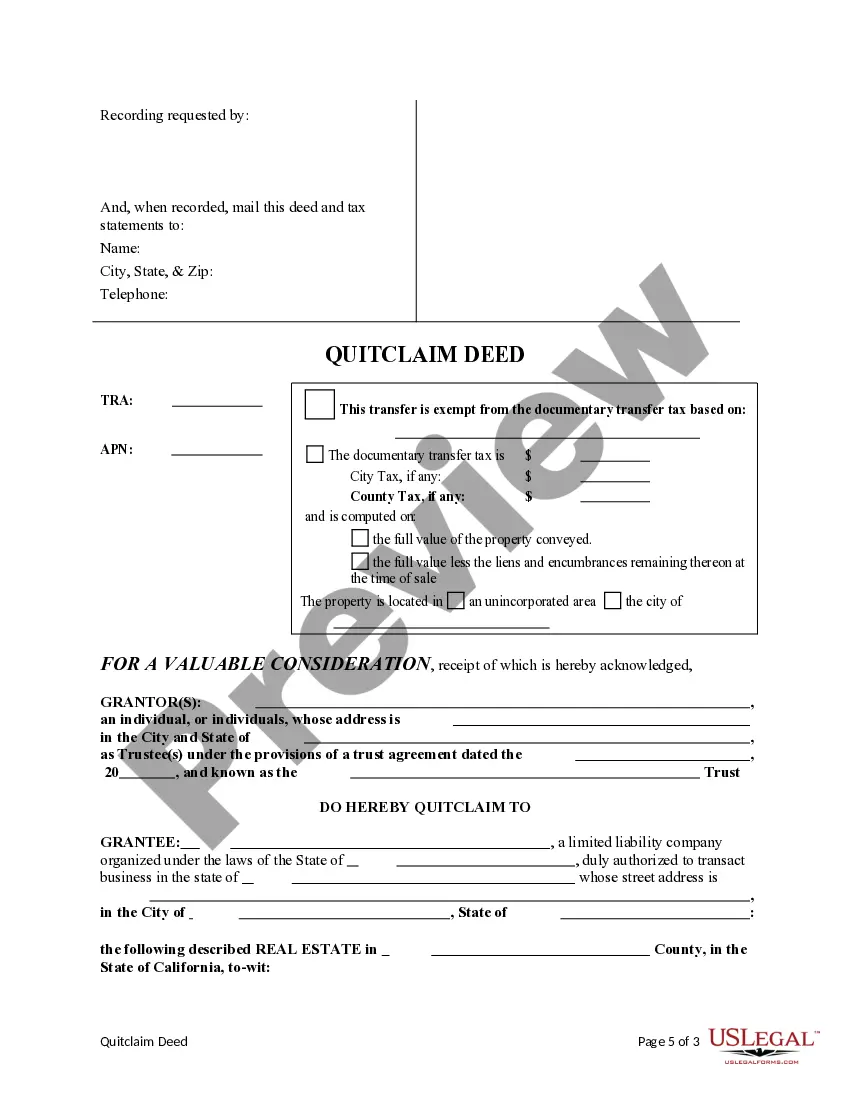

This form is a Quitclaim Deed where the Grantor is a trust and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

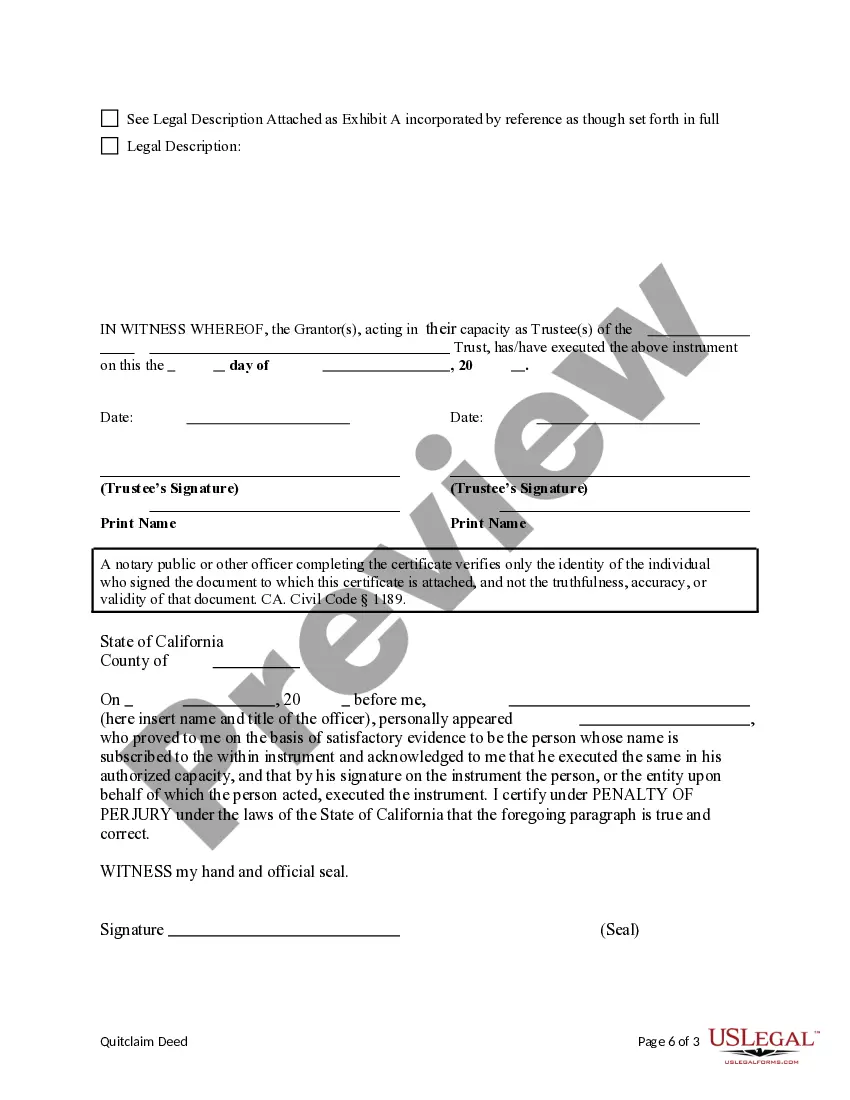

A Costa Mesa California Quitclaim Deed from a Trust to a Limited Liability Company is a legal document that facilitates the transfer of property ownership from a trust to a limited liability company (LLC) in the region of Costa Mesa, California. This type of deed is commonly used when a property held in a trust needs to be transferred to an LLC for various reasons, such as asset protection or business purposes. The quitclaim deed is a legal instrument that enables the trust, acting as the granter, to relinquish all legal rights and interests it may have in the property in favor of the LLC, the grantee. Unlike a warranty deed, a quitclaim deed does not guarantee that the granter has clear ownership rights and only transfers whatever interest the granter possesses. Key terms in a Costa Mesa California Quitclaim Deed from a Trust to a Limited Liability Company may include: 1. Property Description: The deed should include a detailed and accurate description of the property being transferred, encompassing its boundaries, address, and legal description as found in official records. 2. Granter and Grantee Details: The deed should identify the trust, acting as the granter, along with its full legal name, address, and any relevant trust details. Likewise, the LLC, acting as the grantee, should have its complete legal name, address, and relevant company information specified. 3. Trust Certification: To ensure the validity of the transfer, the deed might require a certification from the trustee, verifying that the trust exists, the granter has the authority to transfer the property, and that the transfer aligns with the trust's best interests. 4. Consideration: The deed should mention the consideration, typically indicated as "for valuable consideration" or "in exchange for." While quitclaim deeds often involve nominal or no consideration, it is necessary to specify an amount (even a nominal one) to satisfy legal requirements. 5. Execution and Notary: To be legally binding, the deed must be duly executed by the granter and notarized. It is crucial to comply with California's specific requirements for notarization, including affixing an official seal and obtaining a proper acknowledgement. Different types of Costa Mesa California Quitclaim Deeds from a Trust to an LLC may be distinguished by the unique circumstances of the transfer. Some possible variations include: 1. Trust-to-LLC Asset Protection Transfer: Often used when transferring property from a trust to an LLC to safeguard assets from potential legal liabilities. 2. Trust-to-LLC Business Purposes Transfer: This type of transfer may occur when the property held by the trust is being utilized for business activities, and it becomes advantageous to operate it under the auspices of an LLC. 3. Trust-to-LLC Estate Planning Transfer: In estate planning, property is sometimes transferred from a trust to an LLC to facilitate management and distribution among beneficiaries while maintaining tax efficiencies. In all cases, it is crucial to consult with legal professionals well-versed in California real estate and business law to ensure the relevant requirements are met and to gain a thorough understanding of the specific requirements for executing a Costa Mesa California Quitclaim Deed from a Trust to a Limited Liability Company.A Costa Mesa California Quitclaim Deed from a Trust to a Limited Liability Company is a legal document that facilitates the transfer of property ownership from a trust to a limited liability company (LLC) in the region of Costa Mesa, California. This type of deed is commonly used when a property held in a trust needs to be transferred to an LLC for various reasons, such as asset protection or business purposes. The quitclaim deed is a legal instrument that enables the trust, acting as the granter, to relinquish all legal rights and interests it may have in the property in favor of the LLC, the grantee. Unlike a warranty deed, a quitclaim deed does not guarantee that the granter has clear ownership rights and only transfers whatever interest the granter possesses. Key terms in a Costa Mesa California Quitclaim Deed from a Trust to a Limited Liability Company may include: 1. Property Description: The deed should include a detailed and accurate description of the property being transferred, encompassing its boundaries, address, and legal description as found in official records. 2. Granter and Grantee Details: The deed should identify the trust, acting as the granter, along with its full legal name, address, and any relevant trust details. Likewise, the LLC, acting as the grantee, should have its complete legal name, address, and relevant company information specified. 3. Trust Certification: To ensure the validity of the transfer, the deed might require a certification from the trustee, verifying that the trust exists, the granter has the authority to transfer the property, and that the transfer aligns with the trust's best interests. 4. Consideration: The deed should mention the consideration, typically indicated as "for valuable consideration" or "in exchange for." While quitclaim deeds often involve nominal or no consideration, it is necessary to specify an amount (even a nominal one) to satisfy legal requirements. 5. Execution and Notary: To be legally binding, the deed must be duly executed by the granter and notarized. It is crucial to comply with California's specific requirements for notarization, including affixing an official seal and obtaining a proper acknowledgement. Different types of Costa Mesa California Quitclaim Deeds from a Trust to an LLC may be distinguished by the unique circumstances of the transfer. Some possible variations include: 1. Trust-to-LLC Asset Protection Transfer: Often used when transferring property from a trust to an LLC to safeguard assets from potential legal liabilities. 2. Trust-to-LLC Business Purposes Transfer: This type of transfer may occur when the property held by the trust is being utilized for business activities, and it becomes advantageous to operate it under the auspices of an LLC. 3. Trust-to-LLC Estate Planning Transfer: In estate planning, property is sometimes transferred from a trust to an LLC to facilitate management and distribution among beneficiaries while maintaining tax efficiencies. In all cases, it is crucial to consult with legal professionals well-versed in California real estate and business law to ensure the relevant requirements are met and to gain a thorough understanding of the specific requirements for executing a Costa Mesa California Quitclaim Deed from a Trust to a Limited Liability Company.