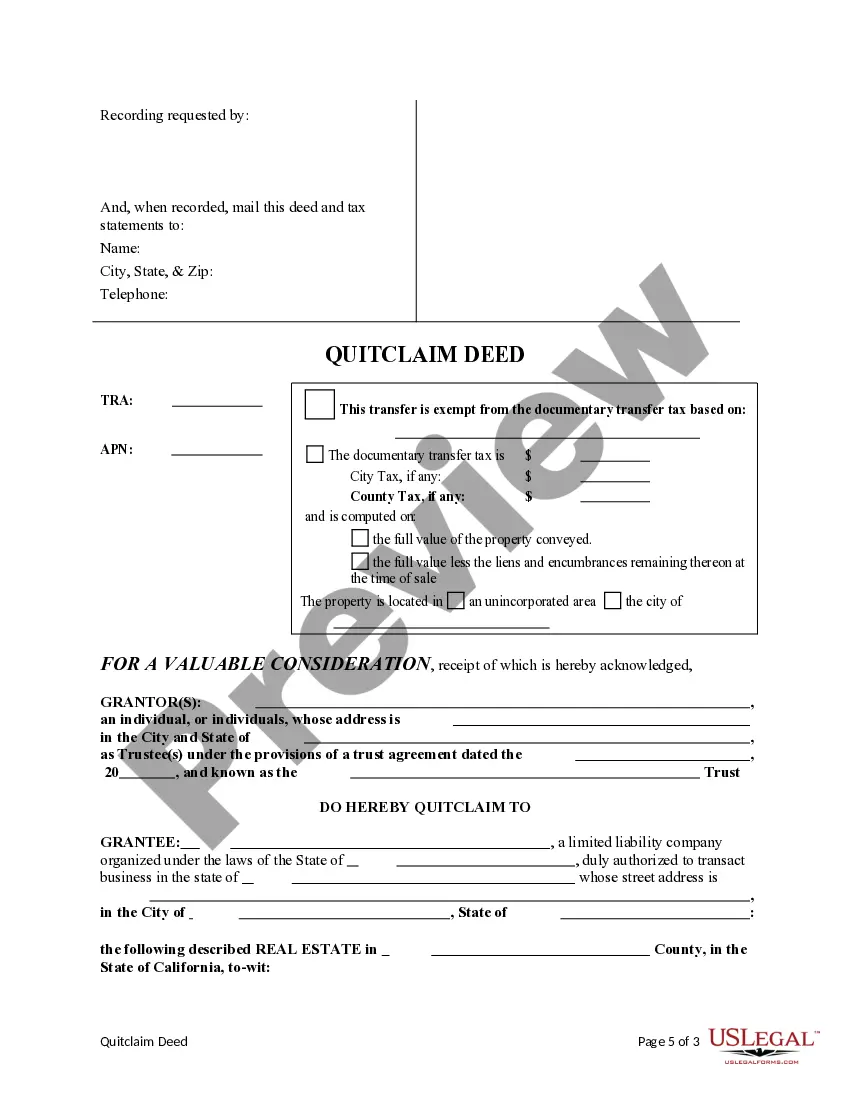

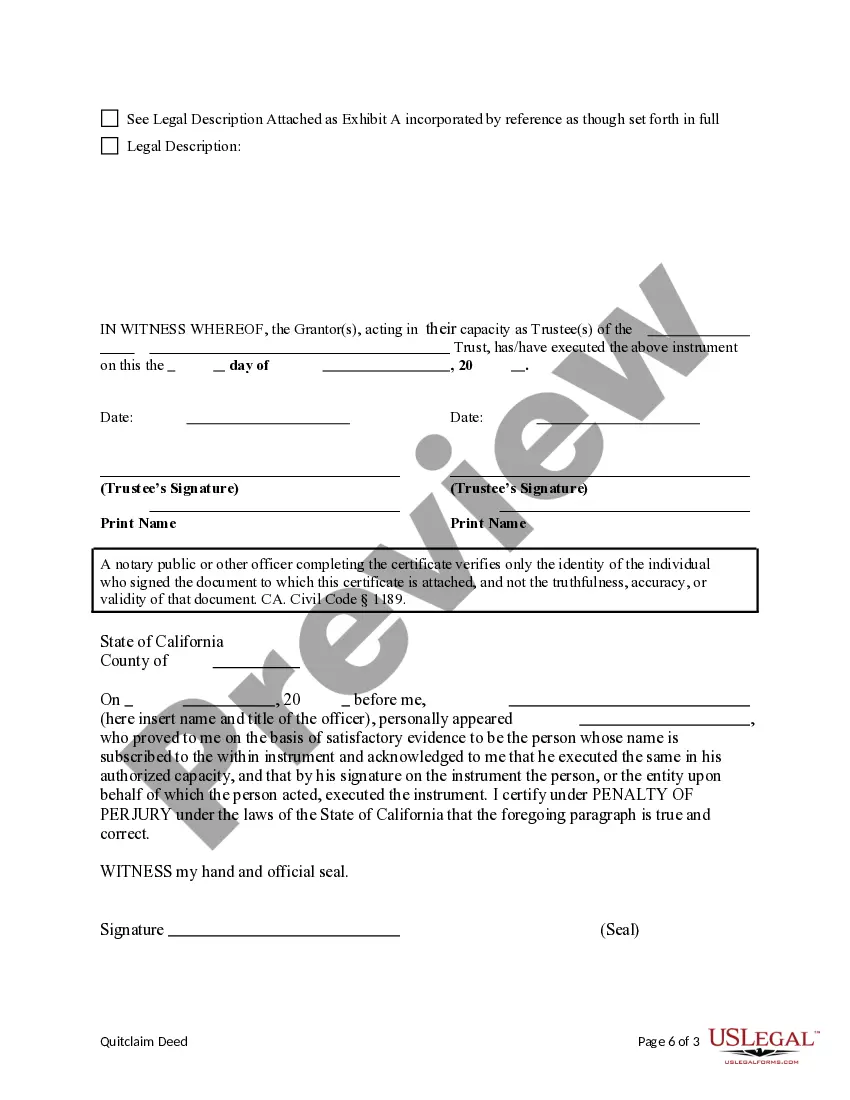

This form is a Quitclaim Deed where the Grantor is a trust and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Elk Grove California Quitclaim Deed from a Trust to a Limited Liability Company allows for the transfer of property ownership from a trust to a limited liability company (LLC) in Elk Grove, California. This type of deed is commonly used when the trust property needs to be transferred to an entity rather than an individual. Here is a detailed description of this process and its different types: 1. Elk Grove California Quitclaim Deed from a Trust to a Limited Liability Company: This type of quitclaim deed involves the transfer of real property ownership from a trust to an LLC operating in Elk Grove, California. This means that the property held in the trust will be conveyed to the LLC, thereby changing the legal ownership of the property. 2. Elk Grove California Irrevocable Trust Quitclaim Deed to Single-Member LLC: In this specific type of quitclaim deed, the property is transferred from an irrevocable trust (which typically cannot be changed or revoked) to a single-member LLC. This type of arrangement allows for asset protection and may have tax benefits. 3. Elk Grove California Revocable Living Trust Quitclaim Deed to Multi-Member LLC: This variation of the quitclaim deed involves transferring property from a revocable living trust to a multi-member LLC. Revocable living trusts are commonly used for estate planning purposes, and transferring the property to an LLC provides flexibility and protection while allowing multiple members to be involved in the ownership. 4. Elk Grove California Testamentary Trust Quitclaim Deed to Special Purpose LLC: A testamentary trust quitclaim deed refers to transferring property from a trust created through a will to a special purpose LLC. This could be used when the trust or's will dictates the transfer of specific assets to a designated LLC that serves a unique purpose, such as managing rental properties or operating a business. It is important to note that while the quitclaim deed transfers the legal ownership of the property, it is recommended to consult with legal professionals, such as real estate attorneys or estate planners, when considering or executing such transactions. They can guide individuals in understanding the legal requirements, tax implications, and potential benefits associated with these types of transfers accurately.Elk Grove California Quitclaim Deed from a Trust to a Limited Liability Company allows for the transfer of property ownership from a trust to a limited liability company (LLC) in Elk Grove, California. This type of deed is commonly used when the trust property needs to be transferred to an entity rather than an individual. Here is a detailed description of this process and its different types: 1. Elk Grove California Quitclaim Deed from a Trust to a Limited Liability Company: This type of quitclaim deed involves the transfer of real property ownership from a trust to an LLC operating in Elk Grove, California. This means that the property held in the trust will be conveyed to the LLC, thereby changing the legal ownership of the property. 2. Elk Grove California Irrevocable Trust Quitclaim Deed to Single-Member LLC: In this specific type of quitclaim deed, the property is transferred from an irrevocable trust (which typically cannot be changed or revoked) to a single-member LLC. This type of arrangement allows for asset protection and may have tax benefits. 3. Elk Grove California Revocable Living Trust Quitclaim Deed to Multi-Member LLC: This variation of the quitclaim deed involves transferring property from a revocable living trust to a multi-member LLC. Revocable living trusts are commonly used for estate planning purposes, and transferring the property to an LLC provides flexibility and protection while allowing multiple members to be involved in the ownership. 4. Elk Grove California Testamentary Trust Quitclaim Deed to Special Purpose LLC: A testamentary trust quitclaim deed refers to transferring property from a trust created through a will to a special purpose LLC. This could be used when the trust or's will dictates the transfer of specific assets to a designated LLC that serves a unique purpose, such as managing rental properties or operating a business. It is important to note that while the quitclaim deed transfers the legal ownership of the property, it is recommended to consult with legal professionals, such as real estate attorneys or estate planners, when considering or executing such transactions. They can guide individuals in understanding the legal requirements, tax implications, and potential benefits associated with these types of transfers accurately.