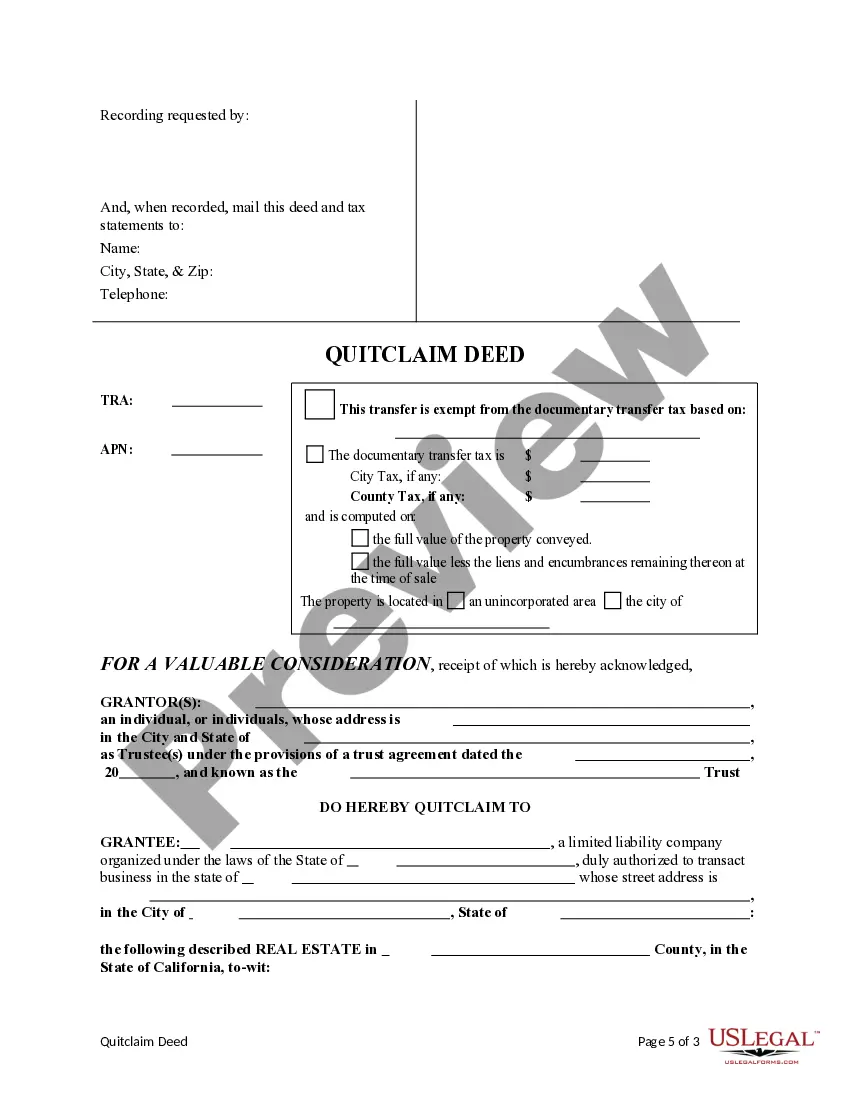

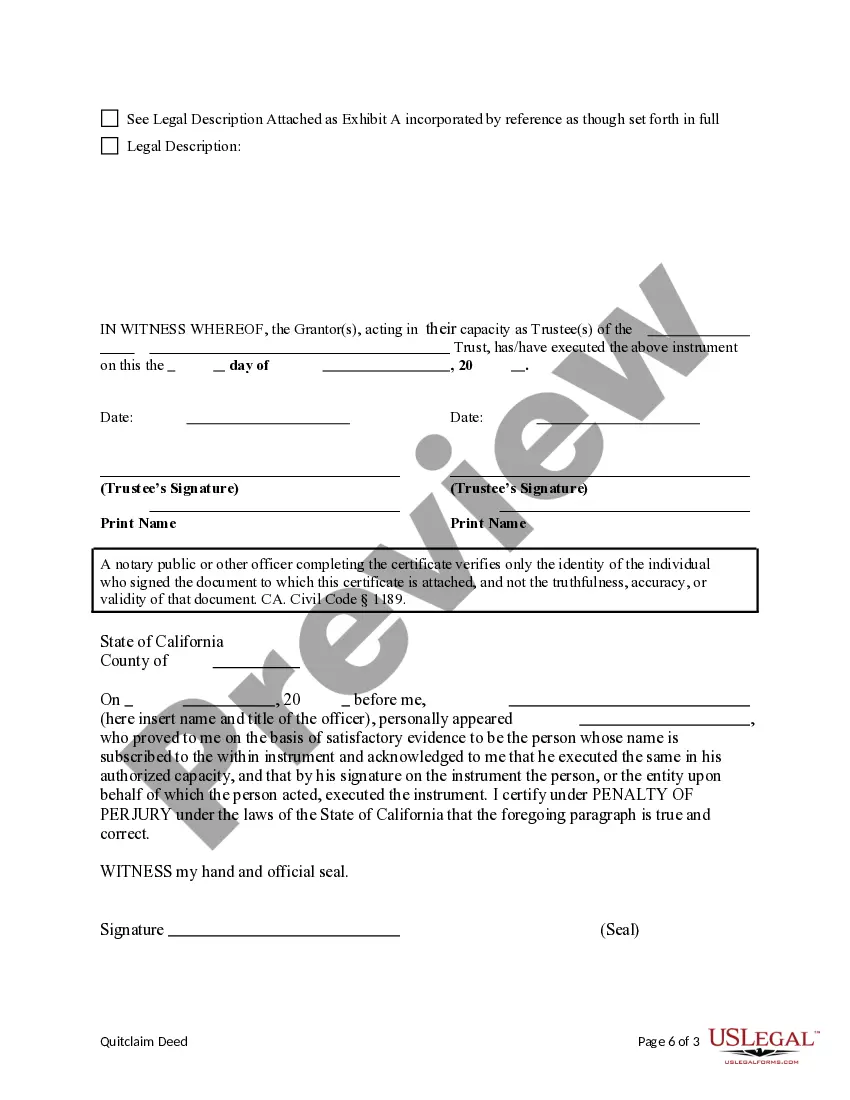

This form is a Quitclaim Deed where the Grantor is a trust and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Title: Inglewood, California Quitclaim Deed from a Trust to a Limited Liability Company: Understanding the Process and Types Description: If you are looking to transfer property located in Inglewood, California, from a trust to a limited liability company (LLC), the process typically involves executing a quitclaim deed. In this detailed description, we will explore the essence of Inglewood California Quitclaim Deeds, highlight their importance, and mention any additional types that may exist. Keywords: Inglewood California quitclaim deed, trust, limited liability company (LLC), property transfer, real estate, legal document, title transfer. What is an Inglewood California Quitclaim Deed from a Trust to a Limited Liability Company? An Inglewood California Quitclaim Deed from a Trust to a Limited Liability Company is a legal document used to transfer property ownership from a trust to an LLC entity. A quitclaim deed is commonly utilized when the property transfer occurs between related parties or when the transferor wants to convey their interest in the property without providing any warranties and guarantees. The Importance of Inglewood California Quitclaim Deeds from a Trust to an LLC: 1. Property Transfer Clarification: Executing a quitclaim deed ensures that the transfer of property ownership is correctly recorded, establishing a clear chain of title. 2. Legal Protection: A properly executed quitclaim deed offers some level of legal protection to the grantee (LLC) by clarifying the transferor's intent and preventing any future claims or disputes. 3. Tax Implications: Transferring property from a trust to an LLC may have tax consequences. Consulting with legal and tax professionals is crucial to understanding the potential impact on tax liabilities and benefits. Types of Inglewood California Quitclaim Deeds from a Trust to an LLC: 1. Inglewood California Trust-to-LLC Beneficiary Deed: — This type of quitclaim deed is typically used when the trust is transferring property ownership to an LLC where the beneficiary has a controlling interest. — It ensures a smooth transfer of property ownership while maintaining the integrity of the trust and its beneficiaries. 2. Inglewood California Trust-to-LLC Sole Granter Deed: — This type of quitclaim deed is employed when a trust's sole granter intends to transfer property ownership directly to an LLC. — It simplifies the transfer process, allowing the granter to establish ownership rights within the LLC structure. 3. Inglewood California Trust-to-LLC Multiple Granters with Reserving Rights: — Occasionally, a trust may have multiple granters who wish to transfer property ownership collectively to an LLC while reserving specific rights or interests. — This type of quitclaim deed provides clarity regarding the interests retained by the granters and those vested in the LLC. Remember, while quitclaim deeds are commonly used, it is essential to consult with legal professionals to ensure compliance with Inglewood, California's specific requirements for transferring property from a trust to an LLC. Additionally, seeking guidance from a tax advisor will help navigate any potential tax implications resulting from the property transfer. In summary, an Inglewood California Quitclaim Deed from a Trust to a Limited Liability Company is a critical legal document that facilitates the smooth transfer of property ownership. Understanding the various types available can help navigate the specific requirements and tailor the transfer to suit individual circumstances effectively.