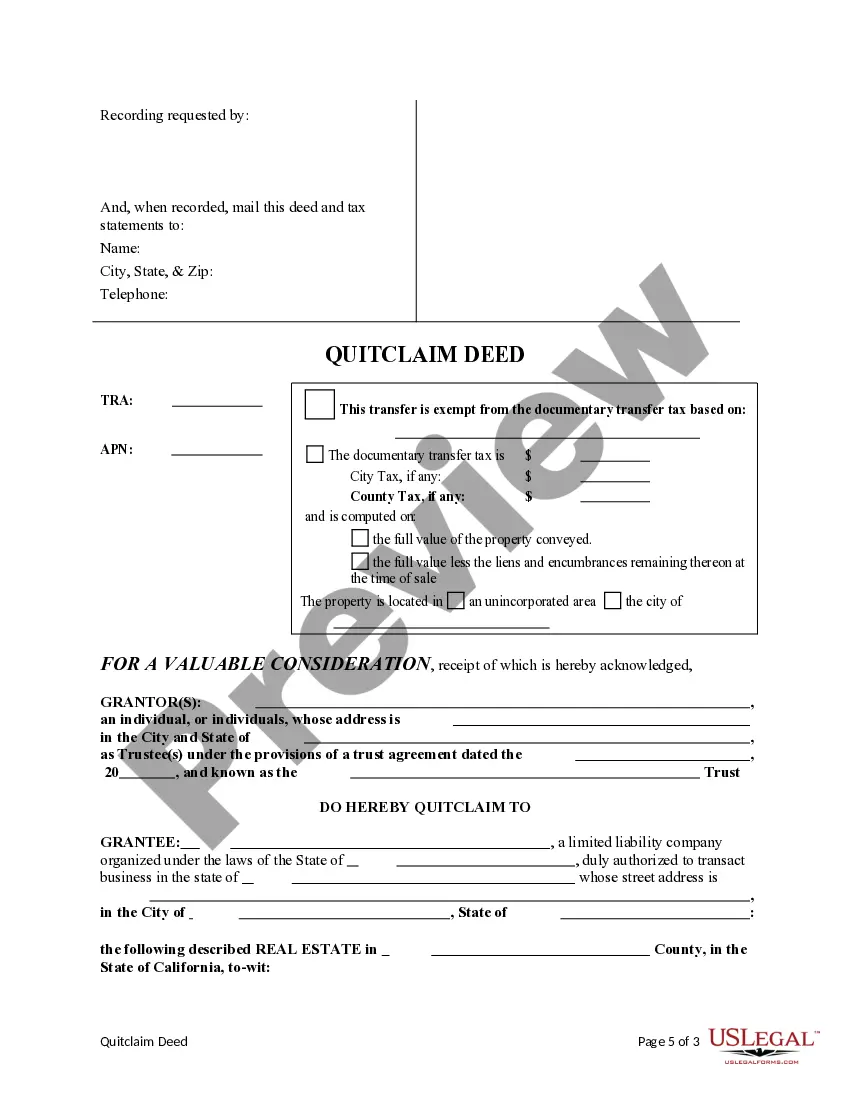

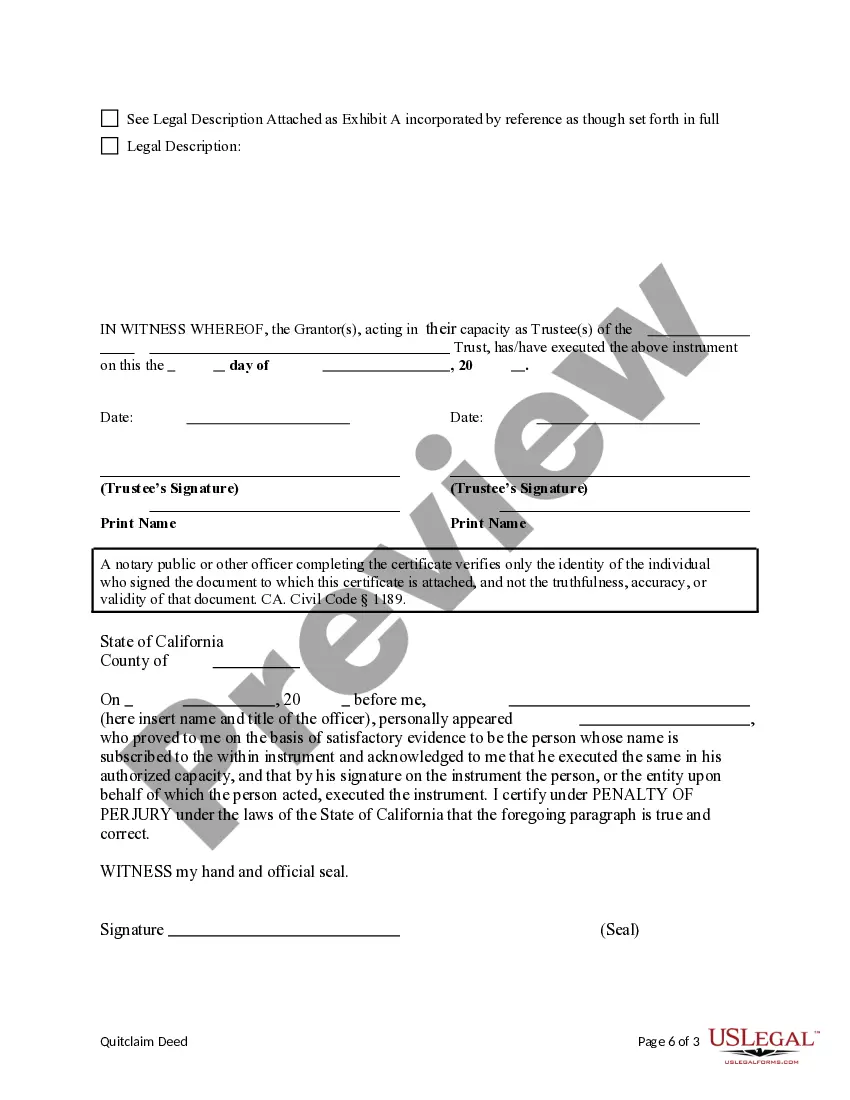

This form is a Quitclaim Deed where the Grantor is a trust and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Irvine California Quitclaim Deed from a Trust to a Limited Liability Company

Description

How to fill out California Quitclaim Deed From A Trust To A Limited Liability Company?

Utilize the US Legal Forms and gain instant access to any form template you need.

Our valuable website featuring thousands of templates streamlines the process of locating and acquiring nearly any document sample you may require.

You can export, fill out, and sign the Irvine California Quitclaim Deed from a Trust to a Limited Liability Company in merely a few minutes instead of spending hours online searching for a suitable template.

Using our directory is an excellent method to enhance the security of your document filing.

If you haven't created an account yet, follow the instructions outlined below.

Feel free to take full advantage of our platform and make your document experience as convenient as possible!

- Our skilled attorneys routinely assess all the documents to ensure that the forms are suitable for a specific area and in accordance with current laws and regulations.

- How can you acquire the Irvine California Quitclaim Deed from a Trust to a Limited Liability Company.

- If you possess an account, simply Log In to your account.

- The Download option will be available on all the documents you view.

- Additionally, you can access all the previously stored documents in the My documents section.

Form popularity

FAQ

Recording a quitclaim deed in California usually takes a few days to a few weeks, depending on the county's workload. Once you submit your Irvine California Quitclaim Deed from a Trust to a Limited Liability Company, the county recorder will process it and send you a stamped copy. This time frame can vary, but you can check with your local recorder's office for specific timelines. Using an organized platform like US Legal Forms can help streamline the entire process.

In California, you file a quitclaim deed with the county recorder’s office in the county where the property is located. Submitting your Irvine California Quitclaim Deed from a Trust to a Limited Liability Company there ensures the public can access the property records. It’s a straightforward process that helps avoid future complications regarding property ownership. Ensure you have all necessary documents ready for a smooth filing experience.

If you do not record a quitclaim deed in California, the transfer of property does not create a legal claim against the property. Without recording, buyers may face challenges when proving ownership. This can lead to disputes about the property's title. Therefore, if you are dealing with an Irvine California Quitclaim Deed from a Trust to a Limited Liability Company, it is crucial to record the deed promptly.

Yes, a quitclaim deed can effectively transfer property out of a trust. However, it is crucial to follow proper legal procedures to ensure the transfer is valid and recognized. Utilizing tools like the USLegalForms platform can simplify this process, guiding you through the necessary steps for an Irvine California Quitclaim Deed from a Trust to a Limited Liability Company. Always consider consulting legal experts to navigate any complexities involved in property transfers.

A quitclaim deed may not be suitable in several cases. For instance, if there are existing liens or judgments against the property, using a quitclaim deed does not resolve these issues. Additionally, if you intend to transfer property ownership without a full transfer of rights, a quitclaim deed from a trust to a Limited Liability Company may not provide adequate protection. It's essential to consult with a legal professional to explore the best options for your specific needs.

You can quitclaim a deed to a Limited Liability Company (LLC), allowing the property to transition from an individual or trust to the LLC. This process is straightforward and utilizes the same quitclaim deed format. It’s beneficial for managing assets under a business structure. Make sure to follow up with your local county recorder's office to complete the filing process correctly.

In California, you file a quitclaim deed with the county recorder's office where the property is located. Once the deed is completed and notarized, take it to the respective office for recording. Filing preserves the public record of the property’s ownership and provides security for future transactions. Keeping documentation organized is vital for property management.

You can indeed transfer property from a trust to an individual using a quitclaim deed. This process allows you to transfer interests without complications. When executing the quitclaim deed, ensure all details are correct, and obtain notarization for validity. This solution is straightforward for individuals looking to simplify property ownership changes.

Yes, a quitclaim deed can successfully transfer property from a trust. This legal instrument effectively conveys any interest the trust holds in the property to another party. It’s essential that the deed accurately reflects the trust's name and is signed by the trustee. This method is efficient and commonly used in real estate transactions in California.

A quitclaim deed from a trust to an individual is a legal document that transfers ownership of property held in a trust directly to an individual. This type of deed offers a quick way to convey property interests without providing warranties about the title. It's particularly useful when the trust is closing out and the property needs to be assigned to beneficiaries or other parties. Using an Irvine California quitclaim deed ensures compliance with local regulations.