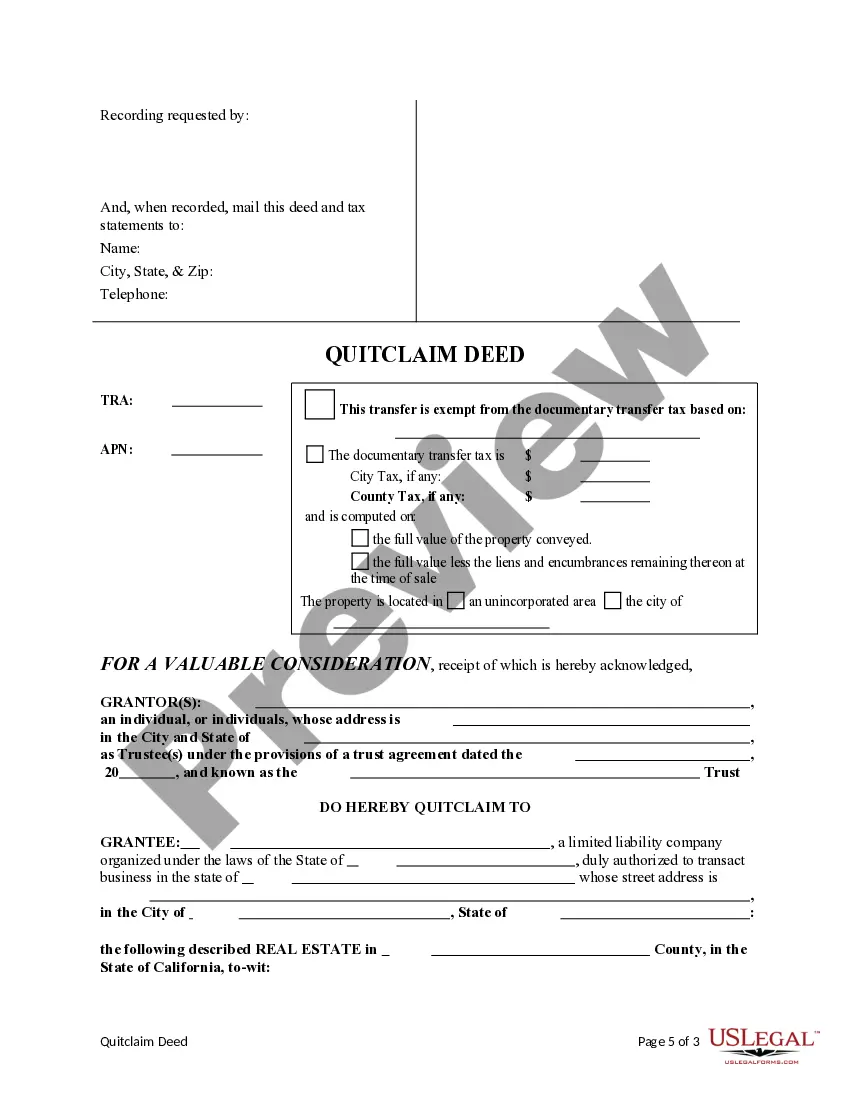

This form is a Quitclaim Deed where the Grantor is a trust and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A Jurupa Valley California Quitclaim Deed from a Trust to a Limited Liability Company is a legal document that facilitates the transfer of ownership of a property from a trust to a limited liability company (LLC) in Jurupa Valley, California. This type of deed is commonly used when a trust wishes to transfer ownership of a property to an LLC, either for asset protection or for business purposes. The Quitclaim Deed is a legal instrument that transfers the ownership interest or claim the granter (in this case, the trust) has in the property to the grantee (the LLC) without offering any guarantees or warranties concerning the property's title. It is essential to note that a quitclaim deed does not necessarily indicate the existence of a sale or exchange of money—it can be used purely for transferring ownership. There are two primary types of Jurupa Valley California quitclaim deeds from a trust to an LLC that can be distinguished based on the circumstances: 1. Trust to LLC Transfer for Asset Protection: This type of transfer is commonly employed as a strategy for protecting assets from liabilities. By transferring the property ownership from a trust to an LLC, the trust beneficiaries or owners can potentially limit personal liability claims against their personal assets. It offers a layer of protection where the LLC acts as a safeguard between the property and potential creditors or litigation risks. 2. Trust to LLC Transfer for Business Purposes: In some cases, trusts holding real estate assets opt to transfer ownership to an LLC for business purposes. This allows for a more manageable and structured management of the property, especially when dealing with multiple owners or potential investors. The LLC structure provides flexibility in terms of managing decision-making, liability, and potential tax benefits. When executing a Jurupa Valley California Quitclaim Deed from a Trust to an LLC, it is crucial to involve legal professionals specializing in real estate law to ensure compliance with the applicable state laws and regulations. Additionally, it is advisable to seek the assistance of a certified public accountant (CPA) or tax attorney to evaluate the potential tax consequences of such a transfer. Overall, a Jurupa Valley California Quitclaim Deed from a Trust to a Limited Liability Company serves as a vital legal tool for transferring property ownership from a trust to an LLC, providing asset protection or facilitating business purposes. It is a strategic option that should be thoroughly evaluated and executed with professional guidance to ensure the best outcomes for all parties involved.A Jurupa Valley California Quitclaim Deed from a Trust to a Limited Liability Company is a legal document that facilitates the transfer of ownership of a property from a trust to a limited liability company (LLC) in Jurupa Valley, California. This type of deed is commonly used when a trust wishes to transfer ownership of a property to an LLC, either for asset protection or for business purposes. The Quitclaim Deed is a legal instrument that transfers the ownership interest or claim the granter (in this case, the trust) has in the property to the grantee (the LLC) without offering any guarantees or warranties concerning the property's title. It is essential to note that a quitclaim deed does not necessarily indicate the existence of a sale or exchange of money—it can be used purely for transferring ownership. There are two primary types of Jurupa Valley California quitclaim deeds from a trust to an LLC that can be distinguished based on the circumstances: 1. Trust to LLC Transfer for Asset Protection: This type of transfer is commonly employed as a strategy for protecting assets from liabilities. By transferring the property ownership from a trust to an LLC, the trust beneficiaries or owners can potentially limit personal liability claims against their personal assets. It offers a layer of protection where the LLC acts as a safeguard between the property and potential creditors or litigation risks. 2. Trust to LLC Transfer for Business Purposes: In some cases, trusts holding real estate assets opt to transfer ownership to an LLC for business purposes. This allows for a more manageable and structured management of the property, especially when dealing with multiple owners or potential investors. The LLC structure provides flexibility in terms of managing decision-making, liability, and potential tax benefits. When executing a Jurupa Valley California Quitclaim Deed from a Trust to an LLC, it is crucial to involve legal professionals specializing in real estate law to ensure compliance with the applicable state laws and regulations. Additionally, it is advisable to seek the assistance of a certified public accountant (CPA) or tax attorney to evaluate the potential tax consequences of such a transfer. Overall, a Jurupa Valley California Quitclaim Deed from a Trust to a Limited Liability Company serves as a vital legal tool for transferring property ownership from a trust to an LLC, providing asset protection or facilitating business purposes. It is a strategic option that should be thoroughly evaluated and executed with professional guidance to ensure the best outcomes for all parties involved.