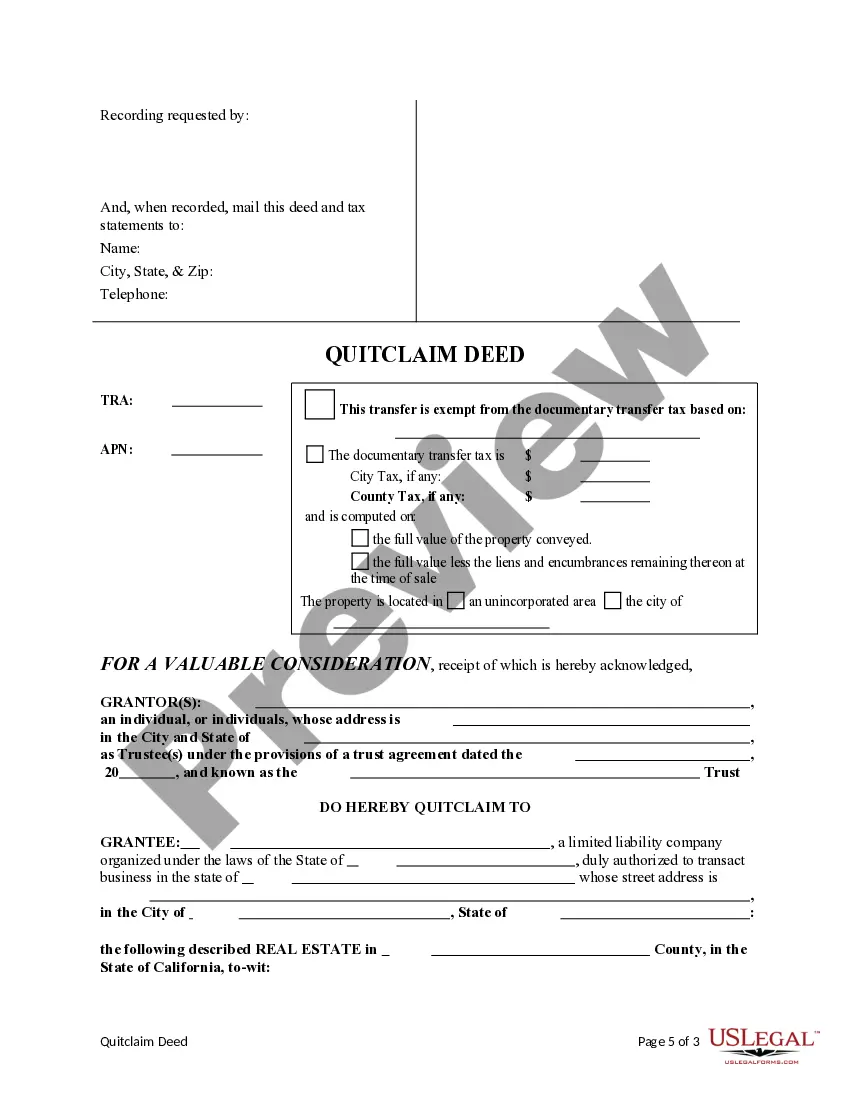

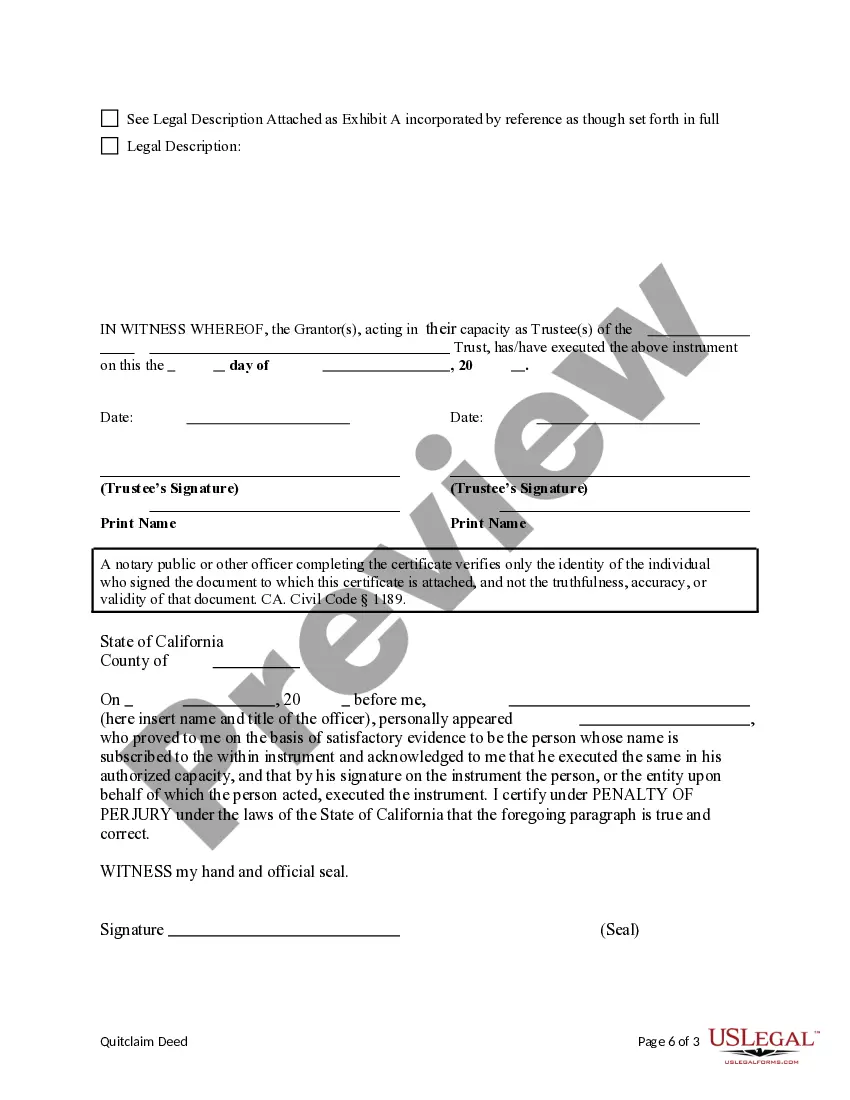

This form is a Quitclaim Deed where the Grantor is a trust and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A Norwalk California Quitclaim Deed from a Trust to a Limited Liability Company is a legal document that transfers the ownership of a property held within a trust to a newly formed or existing limited liability company (LLC) in Norwalk, California. This type of transfer is often used for estate planning purposes, asset protection, or to facilitate changes in property ownership for investment or business purposes. Keywords: Norwalk California, Quitclaim Deed, Trust, Limited Liability Company, property ownership, estate planning, asset protection, investment, business purposes. There are several variations of Norwalk California Quitclaim Deeds from a Trust to a Limited Liability Company depending on specific circumstances: 1. Revocable Trust to LLC Quitclaim Deed: This type of quitclaim deed is used when a property is owned by a revocable trust and the trust or (the person who established the trust) wants to transfer the property ownership to an LLC in Norwalk, California. By doing so, the trust or retains control over the LLC, allowing for flexibility in managing the property. 2. Irrevocable Trust to LLC Quitclaim Deed: In cases where a property is held by an irrevocable trust, this type of quitclaim deed is utilized to transfer the property to an LLC. Irrevocable trusts are often created for asset protection or tax planning purposes, and transferring the property ownership to an LLC offers additional protection while maintaining some level of control. 3. Testamentary Trust to LLC Quitclaim Deed: When property is held within a testamentary trust, which is established upon the trust or's death according to their will, a quitclaim deed can be used to transfer the property ownership to an LLC. This type of transfer allows the LLC to manage and distribute the property without the need for probate. 4. Living Trust Conversion to LLC Quitclaim Deed: For individuals who have their properties held in a living trust but decide to convert it into an LLC, a quitclaim deed is necessary. This process involves transferring the property from the living trust to the newly formed LLC, providing the trust or with additional liability protection and potential tax benefits. Regardless of the specific type of Norwalk California Quitclaim Deed from a Trust to a Limited Liability Company, it is crucial to consult with an experienced attorney or legal professional to ensure the legality and proper execution of the transfer.A Norwalk California Quitclaim Deed from a Trust to a Limited Liability Company is a legal document that transfers the ownership of a property held within a trust to a newly formed or existing limited liability company (LLC) in Norwalk, California. This type of transfer is often used for estate planning purposes, asset protection, or to facilitate changes in property ownership for investment or business purposes. Keywords: Norwalk California, Quitclaim Deed, Trust, Limited Liability Company, property ownership, estate planning, asset protection, investment, business purposes. There are several variations of Norwalk California Quitclaim Deeds from a Trust to a Limited Liability Company depending on specific circumstances: 1. Revocable Trust to LLC Quitclaim Deed: This type of quitclaim deed is used when a property is owned by a revocable trust and the trust or (the person who established the trust) wants to transfer the property ownership to an LLC in Norwalk, California. By doing so, the trust or retains control over the LLC, allowing for flexibility in managing the property. 2. Irrevocable Trust to LLC Quitclaim Deed: In cases where a property is held by an irrevocable trust, this type of quitclaim deed is utilized to transfer the property to an LLC. Irrevocable trusts are often created for asset protection or tax planning purposes, and transferring the property ownership to an LLC offers additional protection while maintaining some level of control. 3. Testamentary Trust to LLC Quitclaim Deed: When property is held within a testamentary trust, which is established upon the trust or's death according to their will, a quitclaim deed can be used to transfer the property ownership to an LLC. This type of transfer allows the LLC to manage and distribute the property without the need for probate. 4. Living Trust Conversion to LLC Quitclaim Deed: For individuals who have their properties held in a living trust but decide to convert it into an LLC, a quitclaim deed is necessary. This process involves transferring the property from the living trust to the newly formed LLC, providing the trust or with additional liability protection and potential tax benefits. Regardless of the specific type of Norwalk California Quitclaim Deed from a Trust to a Limited Liability Company, it is crucial to consult with an experienced attorney or legal professional to ensure the legality and proper execution of the transfer.