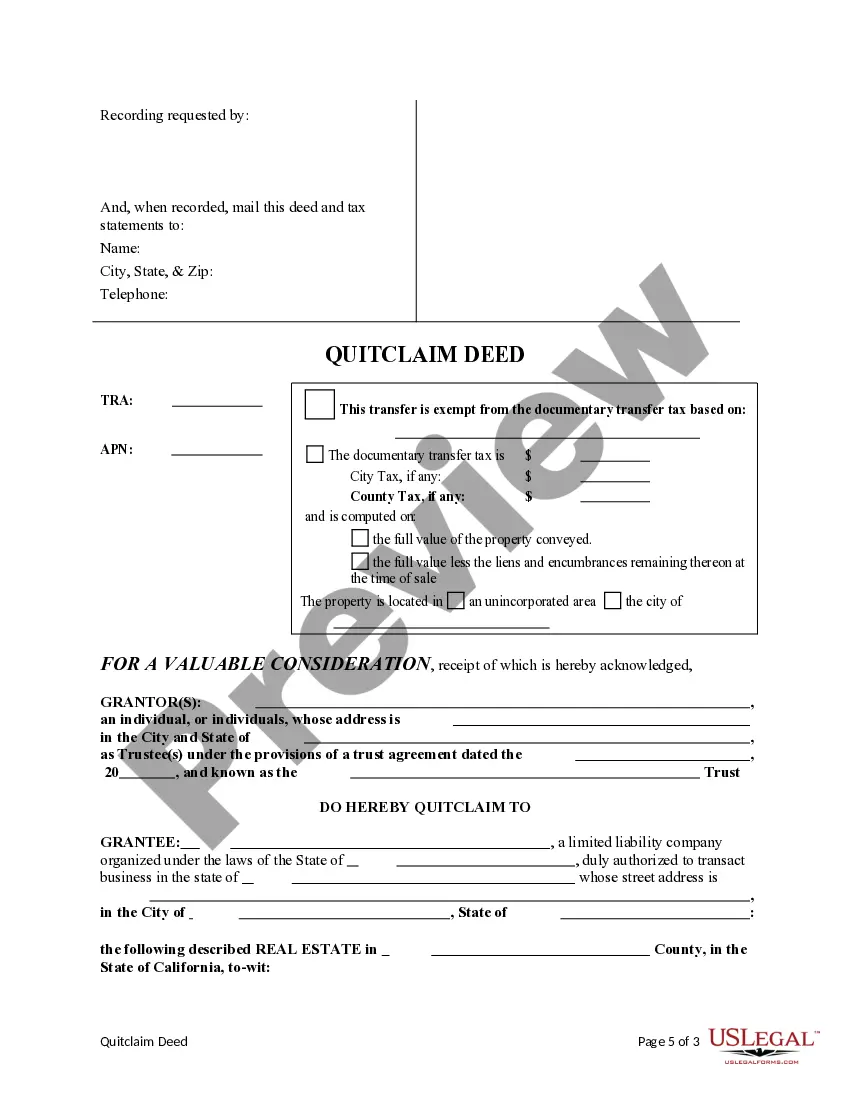

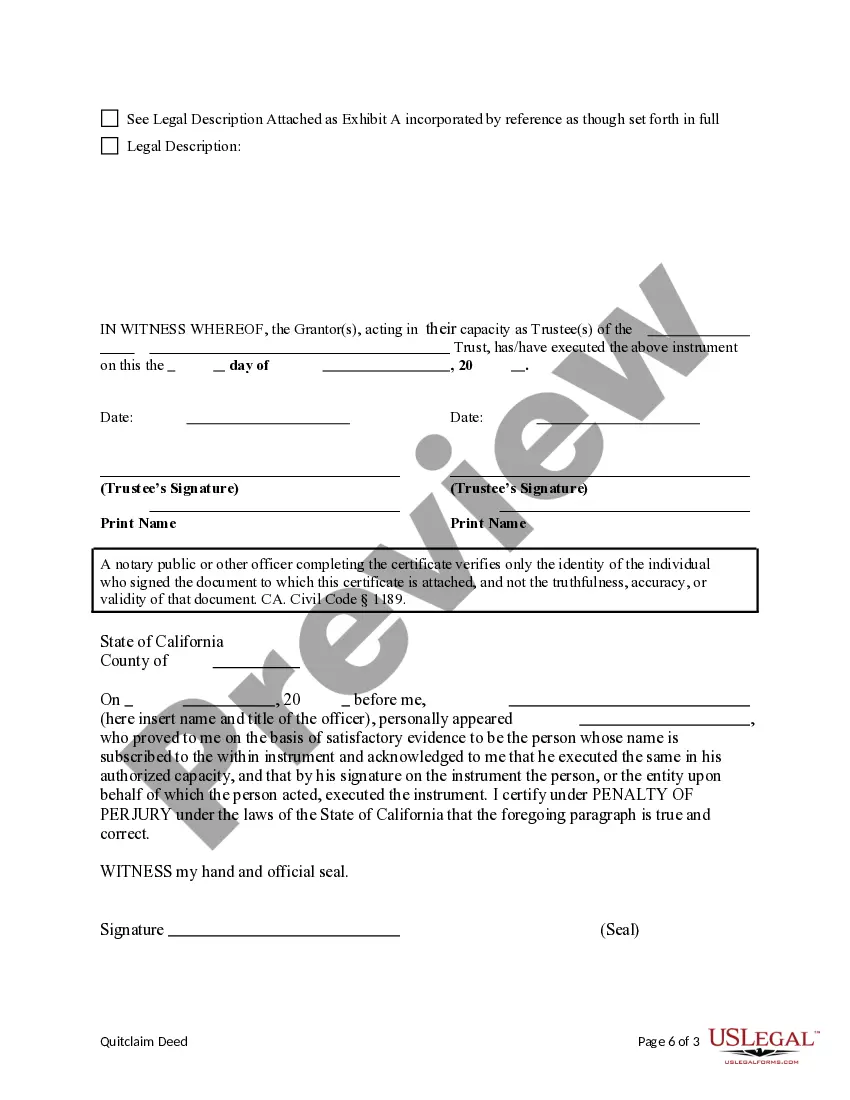

This form is a Quitclaim Deed where the Grantor is a trust and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Palmdale California Quitclaim Deed from a Trust to a Limited Liability Company

Description

How to fill out California Quitclaim Deed From A Trust To A Limited Liability Company?

Regardless of one's social or professional position, completing legal paperwork is an unfortunate essential in today's society.

It is often nearly impossible for individuals lacking legal training to create such documents from scratch due to the complex language and legal nuances involved.

This is where US Legal Forms can be of assistance.

Make sure the form you have selected is suitable for your area since the laws of one state may not apply to another.

Review the form and examine a brief description (if available) outlining the situations for which the document is applicable.

- Our platform offers an extensive collection of over 85,000 state-specific forms tailored to almost any legal circumstance.

- US Legal Forms is also a valuable resource for associates or legal advisors looking to enhance their efficiency through our do-it-yourself forms.

- Whether you require the Palmdale California Quitclaim Deed from a Trust to a Limited Liability Company or any other documentation that is valid in your jurisdiction, with US Legal Forms, everything you need is easily accessible.

- Here’s a quick guide to obtain the Palmdale California Quitclaim Deed from a Trust to a Limited Liability Company using our dependable service.

- If you are already a member, feel free to Log In to your account to download the appropriate form.

- However, if you are new to our site, be sure to complete these steps before obtaining the Palmdale California Quitclaim Deed from a Trust to a Limited Liability Company.

Form popularity

FAQ

To transfer property from a trust to an individual in California, you typically use a quitclaim deed. This legal document allows the trustee to transfer the property to the designated individual, ensuring a smooth transition. If you are in Palmdale, California, consider using a Palmdale California Quitclaim Deed from a Trust to a Limited Liability Company to streamline the process. For added ease, uslegalforms offers various templates and resources to assist you through each step, making the transfer straightforward and efficient.

People often place their property in an LLC to benefit from liability protection and potential tax advantages. This structure can safeguard personal assets against lawsuits related to the property. Additionally, it may simplify the transfer of property through a quitclaim deed, such as the Palmdale California Quitclaim Deed from a Trust to a Limited Liability Company. Utilizing resources like USLegalForms can help you better understand the process and advantages.

To remove property from an LLC, you will need to execute a quitclaim deed that transfers ownership back to yourself or another party. It requires proper documentation to avoid any complications. Ensure that this deed is signed, notarized, and filed with the county where the property is located. USLegalForms provides excellent guidance and templates to help with this process, especially if you are working with a Palmdale California Quitclaim Deed from a Trust to a Limited Liability Company.

Transferring a deed to an LLC requires creating a quitclaim deed that specifies the LLC as the new owner. First, gather all property documentation and ensure you understand the legal ramifications. Sign the deed in front of a notary and record it with your county's recorder’s office. Using a platform like USLegalForms can make this task easier, especially for your Palmdale California Quitclaim Deed from a Trust to a Limited Liability Company.

To quitclaim a deed to an LLC in Palmdale, California, you need to draft a quitclaim deed that names the LLC as the grantee. Make sure to include relevant property details and the previous owner’s information. After completing the deed, you will need to sign it before a notary public and then file it with the appropriate county office. Services like USLegalForms can streamline this process, especially when dealing with a Palmdale California Quitclaim Deed from a Trust to a Limited Liability Company.

Yes, you can certainly do a quitclaim deed yourself in Palmdale, California, provided that you understand the legal requirements involved. It is important to prepare the deed correctly to ensure a smooth transfer of property. However, if you feel unsure, consider using resources like USLegalForms to guide you through the process effectively. They can help you simplify the Palmdale California Quitclaim Deed from a Trust to a Limited Liability Company.

In California, anyone can prepare a quitclaim deed, including the parties involved in the transfer. However, it's advisable to work with a lawyer or a trust professional to ensure accuracy and compliance with local laws. Utilizing services from platforms like U.S. Legal Forms can provide templates and guidance to help you create a valid Palmdale California Quitclaim Deed from a Trust to a Limited Liability Company.

Choosing between a quitclaim deed and a trust depends on your specific needs and intentions. A quitclaim deed is typically simpler and quicker for transferring property, while a trust offers more comprehensive asset protection and management options. Evaluating your personal situation can help you determine the best approach for your real estate transactions. If you are considering a Palmdale California Quitclaim Deed from a Trust to a Limited Liability Company, reflect on your goals carefully.

Absolutely, you can use a quit claim deed to transfer property to a limited liability company. This method streamlines the process of shifting property ownership and can be advantageous for business purposes. However, ensure that you follow the proper legal procedures and consider consulting with a professional. The Palmdale California Quitclaim Deed from a Trust to a Limited Liability Company can be accurately handled through reliable platforms like U.S. Legal Forms.

Yes, a quit claim deed can effectively transfer property out of a trust. When the trustee decides to transfer property to a limited liability company or another individual, this legal instrument makes it possible. Always review the trust document first to confirm that the trustee has the authority to make such a transfer. For guidance on completing a Palmdale California Quitclaim Deed from a Trust to a Limited Liability Company, U.S. Legal Forms can be a valuable resource.