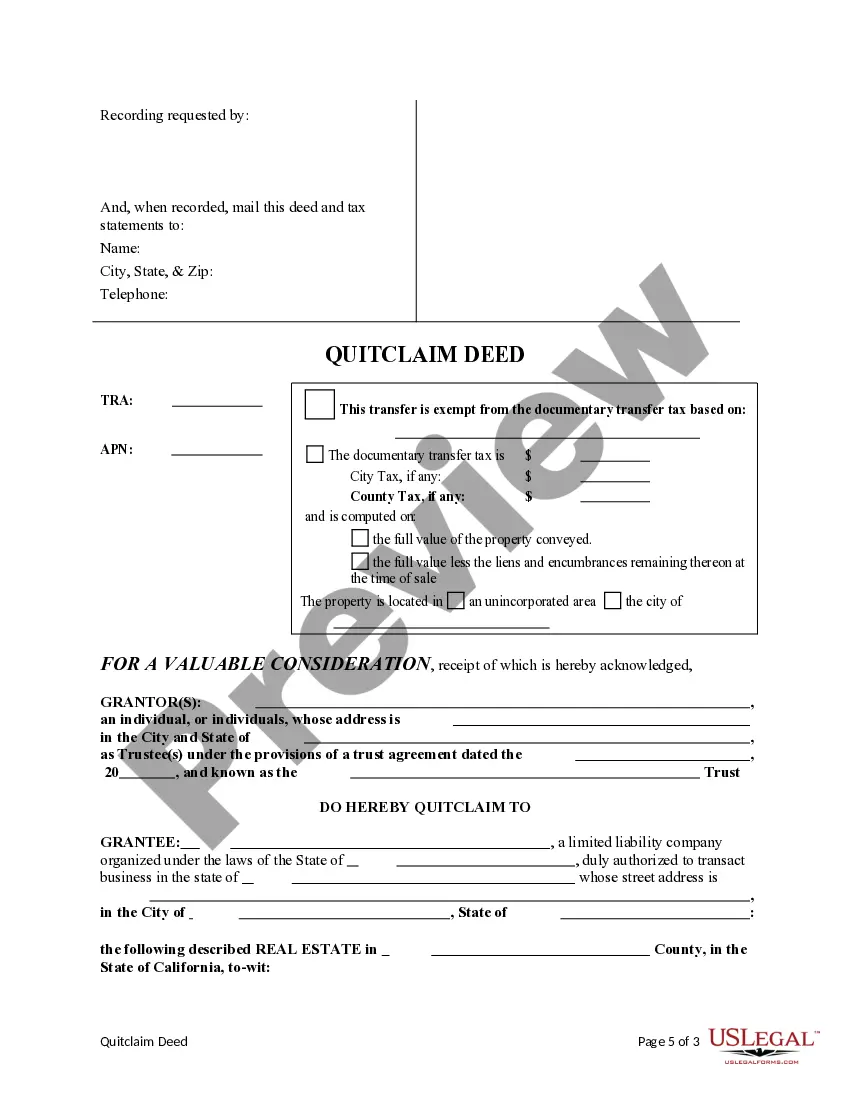

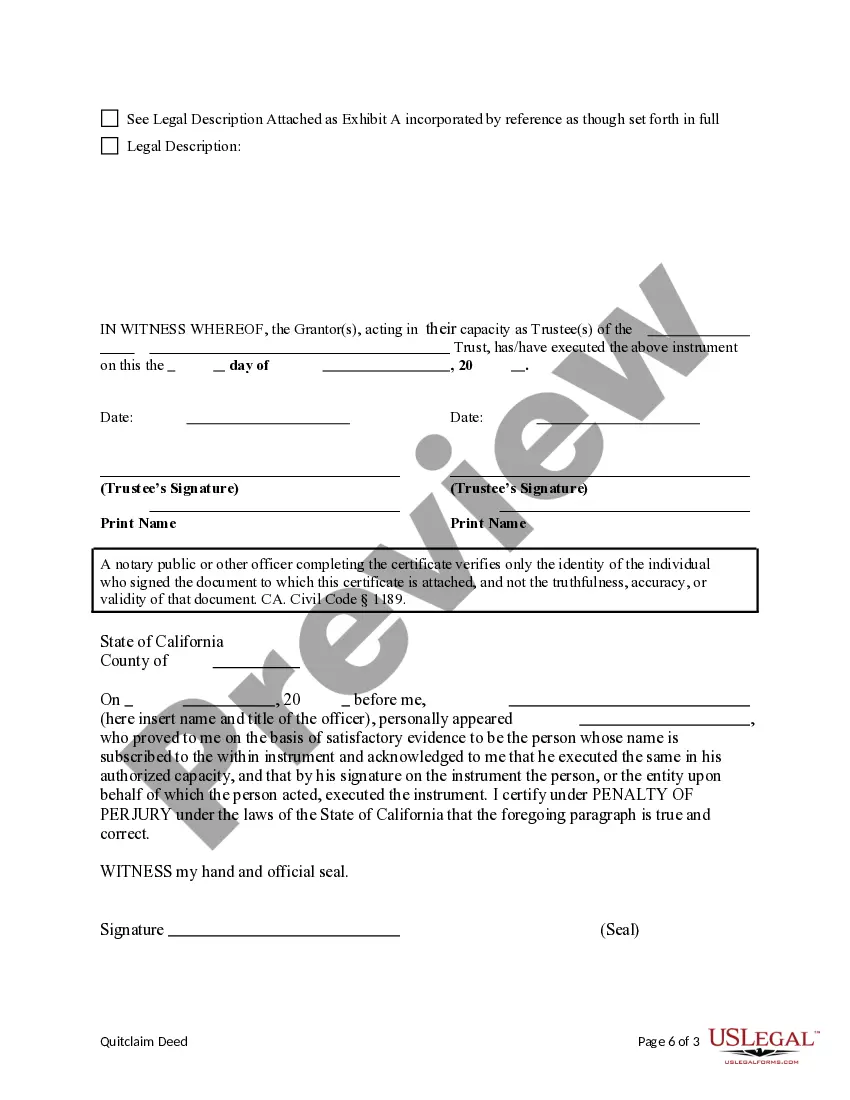

This form is a Quitclaim Deed where the Grantor is a trust and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A Pomona California Quitclaim Deed from a Trust to a Limited Liability Company involves the transfer of property ownership from a trust to an LLC through the use of a quitclaim deed. This legal document allows the trust, acting as the granter, to transfer its interest or ownership rights in a property to the LLC, the grantee. The quitclaim deed is widely used for transferring property when there is a preexisting relationship between the parties involved or when the granter wants to relinquish any claim on the property without making any warranties or guarantees regarding the property's title. In Pomona, California, there are various types of Quitclaim Deeds from a Trust to a Limited Liability Company that can be employed based on specific circumstances: 1. Interspousal Quitclaim Deed: This type of quitclaim deed is used when one spouse transfers their interest or ownership rights in a property to their partner's LLC. It may be employed during divorce settlements or when the couple wishes to reorganize their assets. The trust acting as the granter relinquishes the ownership rights, while the LLC becomes the new owner. 2. Beneficiary Quitclaim Deed: In cases where a trust is set up with multiple beneficiaries or co-owners, a beneficiary quitclaim deed might be used to transfer one beneficiary's interest in the trust-owned property to an LLC. This allows for division of ownership or rearrangement of assets among the beneficiaries. 3. Successor Trustee Quitclaim Deed: When a successor trustee is appointed to take over the trust's administration, a quitclaim deed can be utilized to transfer the trust's interest in the property to the LLC. This ensures a smooth transition of property ownership and management within the trust. 4. Trustee to LLC Quitclaim Deed: In situations where a trust intends to facilitate the creation of an LLC to hold property assets, this type of quitclaim deed is employed. The trust, acting as the granter, transfers ownership rights of the property directly to the LLC. This enables the LLC to have legal ownership of the property, providing asset protection benefits and flexibility in managing and expanding the property portfolio. The use of a Quitclaim Deed from a Trust to a Limited Liability Company in Pomona, California, allows for the seamless transfer of property ownership from a trust to an LLC. It is important for the parties involved to consult with legal professionals specializing in real estate and estate planning to ensure all legal requirements are met and to understand the implications and benefits of such a transaction.