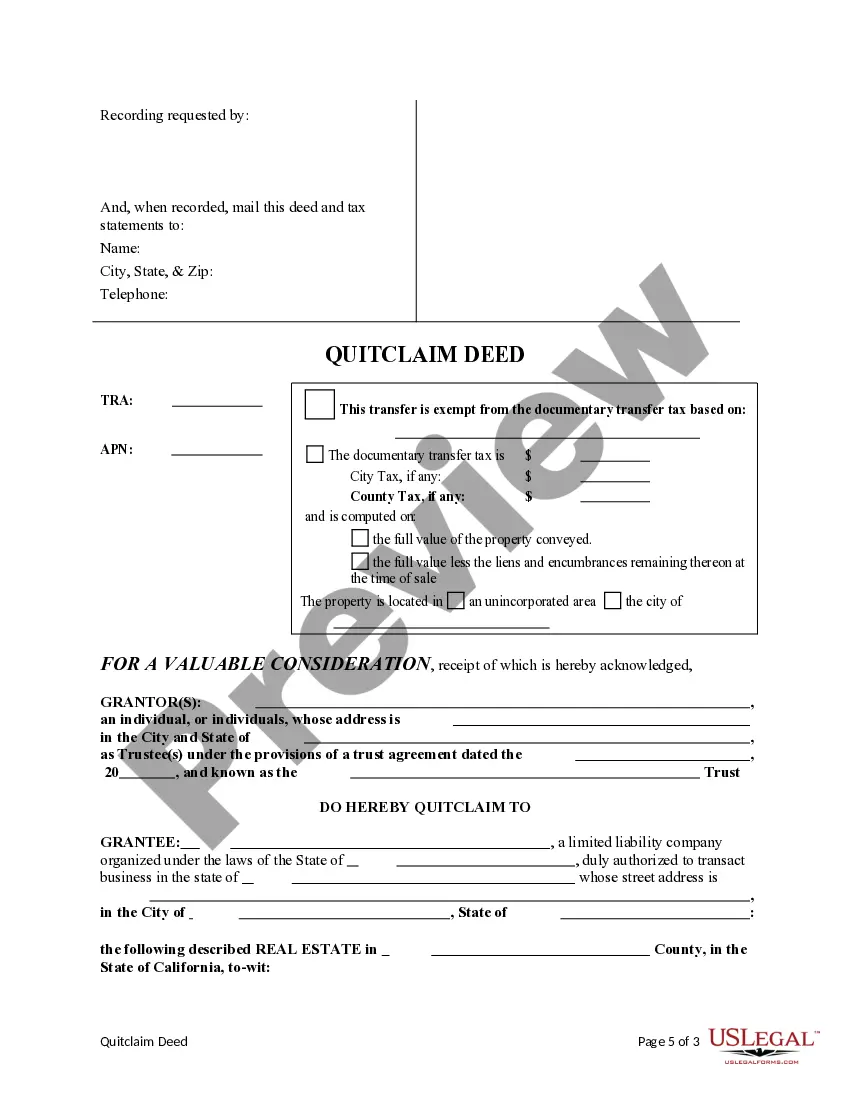

This form is a Quitclaim Deed where the Grantor is a trust and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

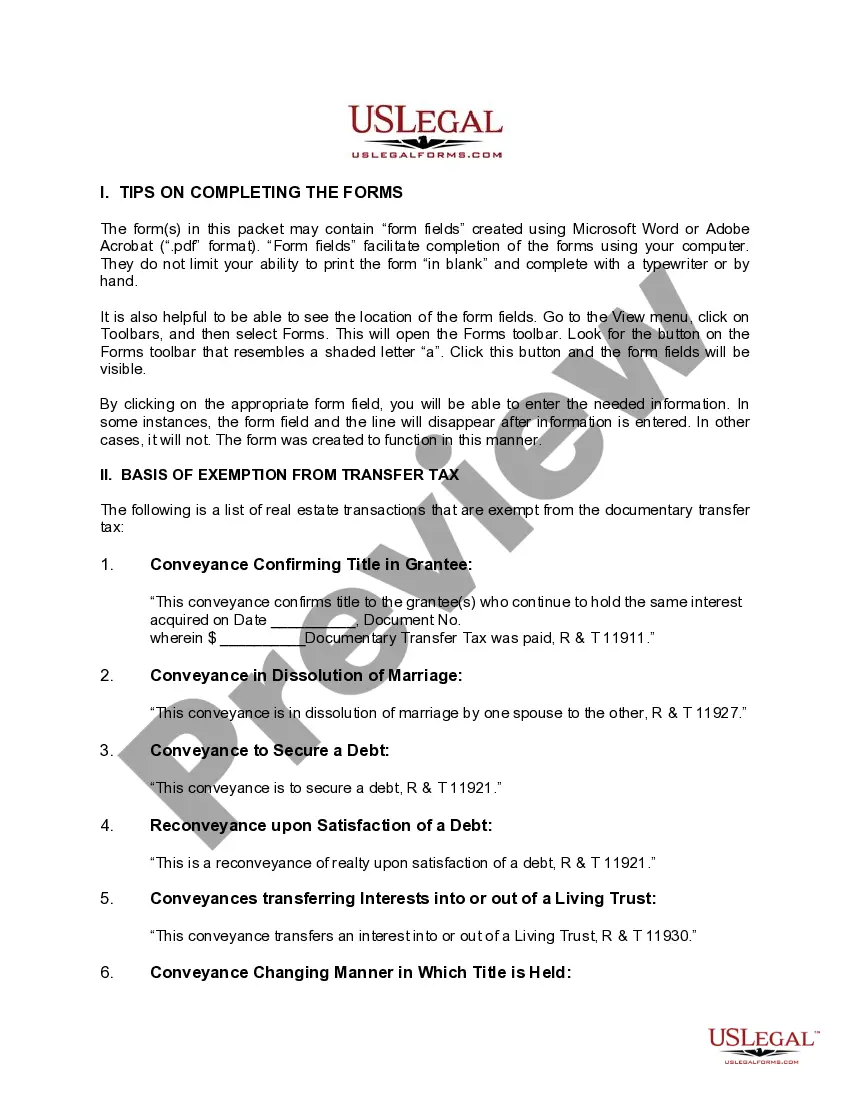

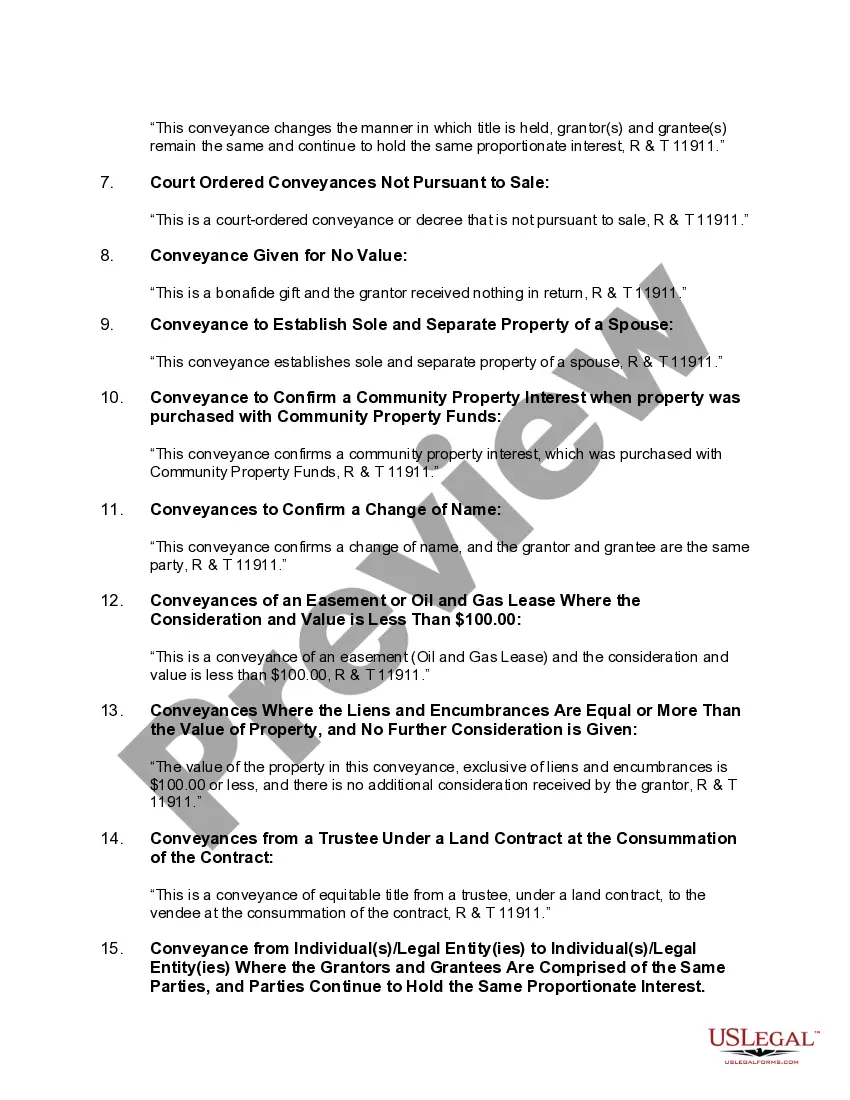

A Riverside California Quitclaim Deed from a Trust to a Limited Liability Company is a legal document that allows for the transfer of ownership or interest in a property from a trust to a limited liability company (LLC). This type of transaction is commonly used when property is held within a trust and the trustees wish to transfer ownership to an LLC for various reasons, such as asset protection, tax advantages, or business planning purposes. It is important to note that consult with legal professionals is recommended when dealing with such legal matters. Different types of Riverside California Quitclaim Deeds from a Trust to a Limited Liability Company may include: 1. General Quitclaim Deed: This is a straightforward transfer of ownership from a trust to an LLC, where the trust relinquishes any claims or interest it has in the property to the LLC. This type of deed is commonly used when there are no outstanding encumbrances or potential disputes regarding the property. 2. Warranty Quitclaim Deed: This type of deed provides additional assurances to the LLC by warranting that the granter (trust) has clear title to the property and has the right to transfer it. It guarantees that there are no undisclosed claims, liens, or other legal issues that may affect the property's ownership. 3. Trustee's Deed: In some cases, the trust may specifically name a trustee who is authorized to execute the transfer of ownership. A Trustee's Deed is used in these situations to legally document the transfer from the trust to the LLC. This type of deed typically contains specific language confirming the trustee's authority to act on behalf of the trust. 4. Trust Transfer Deed: This deed is used when the property held within the trust is being transferred to the LLC as a result of a broader reorganization or restructuring plan. It is commonly used in business scenarios where the transfer is part of strategic planning or to align the property with the operational needs of the LLC. In all cases, it is highly recommended seeking professional legal advice when dealing with Riverside California Quitclaim Deeds from a Trust to a Limited Liability Company. The specifics of each transaction may vary depending on the unique circumstances, property, and goals of the parties involved.A Riverside California Quitclaim Deed from a Trust to a Limited Liability Company is a legal document that allows for the transfer of ownership or interest in a property from a trust to a limited liability company (LLC). This type of transaction is commonly used when property is held within a trust and the trustees wish to transfer ownership to an LLC for various reasons, such as asset protection, tax advantages, or business planning purposes. It is important to note that consult with legal professionals is recommended when dealing with such legal matters. Different types of Riverside California Quitclaim Deeds from a Trust to a Limited Liability Company may include: 1. General Quitclaim Deed: This is a straightforward transfer of ownership from a trust to an LLC, where the trust relinquishes any claims or interest it has in the property to the LLC. This type of deed is commonly used when there are no outstanding encumbrances or potential disputes regarding the property. 2. Warranty Quitclaim Deed: This type of deed provides additional assurances to the LLC by warranting that the granter (trust) has clear title to the property and has the right to transfer it. It guarantees that there are no undisclosed claims, liens, or other legal issues that may affect the property's ownership. 3. Trustee's Deed: In some cases, the trust may specifically name a trustee who is authorized to execute the transfer of ownership. A Trustee's Deed is used in these situations to legally document the transfer from the trust to the LLC. This type of deed typically contains specific language confirming the trustee's authority to act on behalf of the trust. 4. Trust Transfer Deed: This deed is used when the property held within the trust is being transferred to the LLC as a result of a broader reorganization or restructuring plan. It is commonly used in business scenarios where the transfer is part of strategic planning or to align the property with the operational needs of the LLC. In all cases, it is highly recommended seeking professional legal advice when dealing with Riverside California Quitclaim Deeds from a Trust to a Limited Liability Company. The specifics of each transaction may vary depending on the unique circumstances, property, and goals of the parties involved.