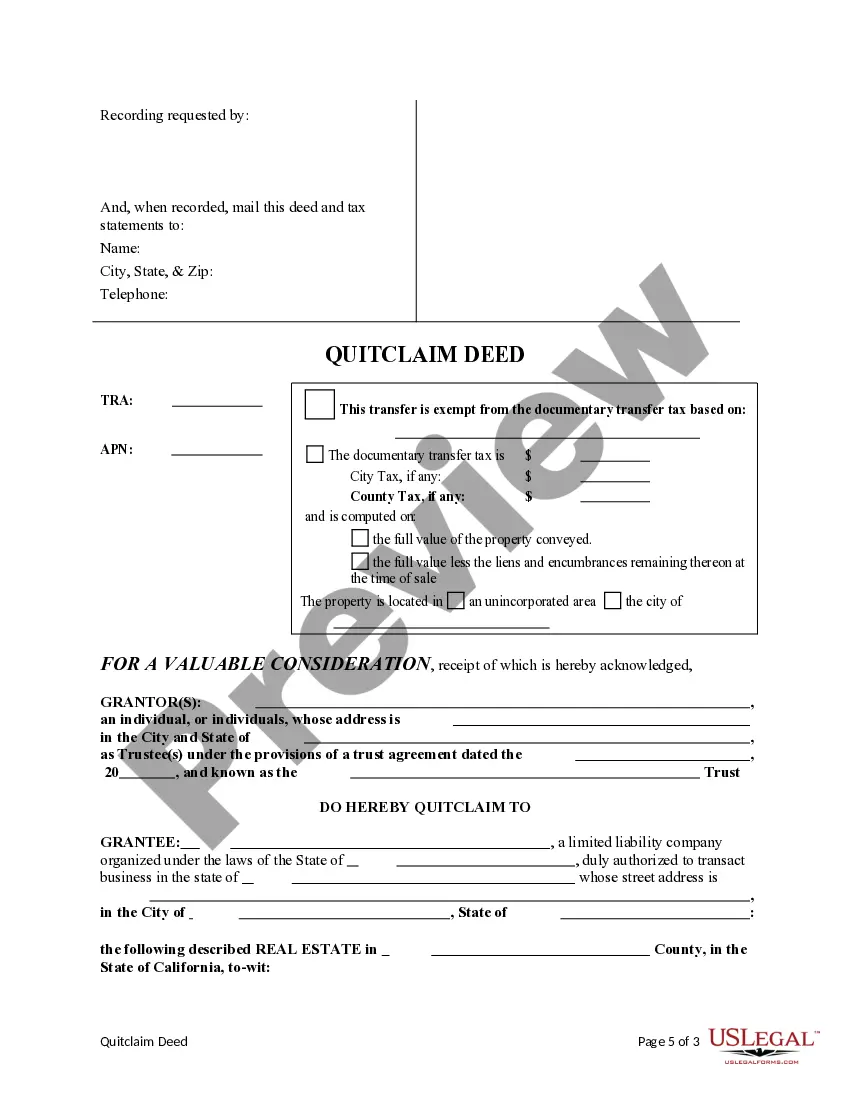

This form is a Quitclaim Deed where the Grantor is a trust and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Sacramento California Quitclaim Deed from a Trust to a Limited Liability Company

Description

How to fill out California Quitclaim Deed From A Trust To A Limited Liability Company?

Take advantage of the US Legal Forms and gain immediate access to any document you require.

Our user-friendly website with numerous templates streamlines the process of locating and obtaining nearly any document sample you need.

You can export, complete, and authorize the Sacramento California Quitclaim Deed from a Trust to a Limited Liability Company in just a few minutes instead of spending hours online searching for a suitable template.

Using our collection is a fantastic way to enhance the security of your record submissions. Our knowledgeable attorneys routinely review all records to ensure that the forms are suitable for a specific state and comply with new laws and regulations.

US Legal Forms is among the most comprehensive and trustworthy document libraries online. We are always here to assist you with virtually any legal process, even if it is just downloading the Sacramento California Quitclaim Deed from a Trust to a Limited Liability Company.

Don't hesitate to utilize our platform and make your document experience as effortless as possible!

- How can you retrieve the Sacramento California Quitclaim Deed from a Trust to a Limited Liability Company.

- If you possess a profile, simply Log In to your account. The Download option will be visible on all the templates you examine. Moreover, you can access all your previously saved documents in the My documents section.

- If you currently do not have a profile, follow the steps below.

- Access the page with the form you require. Confirm that it is the template you were looking for: verify its title and description, and utilize the Preview feature when it is available. Alternatively, use the Search field to find the right one.

- Initiate the saving process. Click Buy Now and choose the pricing plan that suits you best. Then, create an account and pay for your order via credit card or PayPal.

- Download the document. Specify the format to obtain the Sacramento California Quitclaim Deed from a Trust to a Limited Liability Company and modify and complete, or sign it as needed.

Form popularity

FAQ

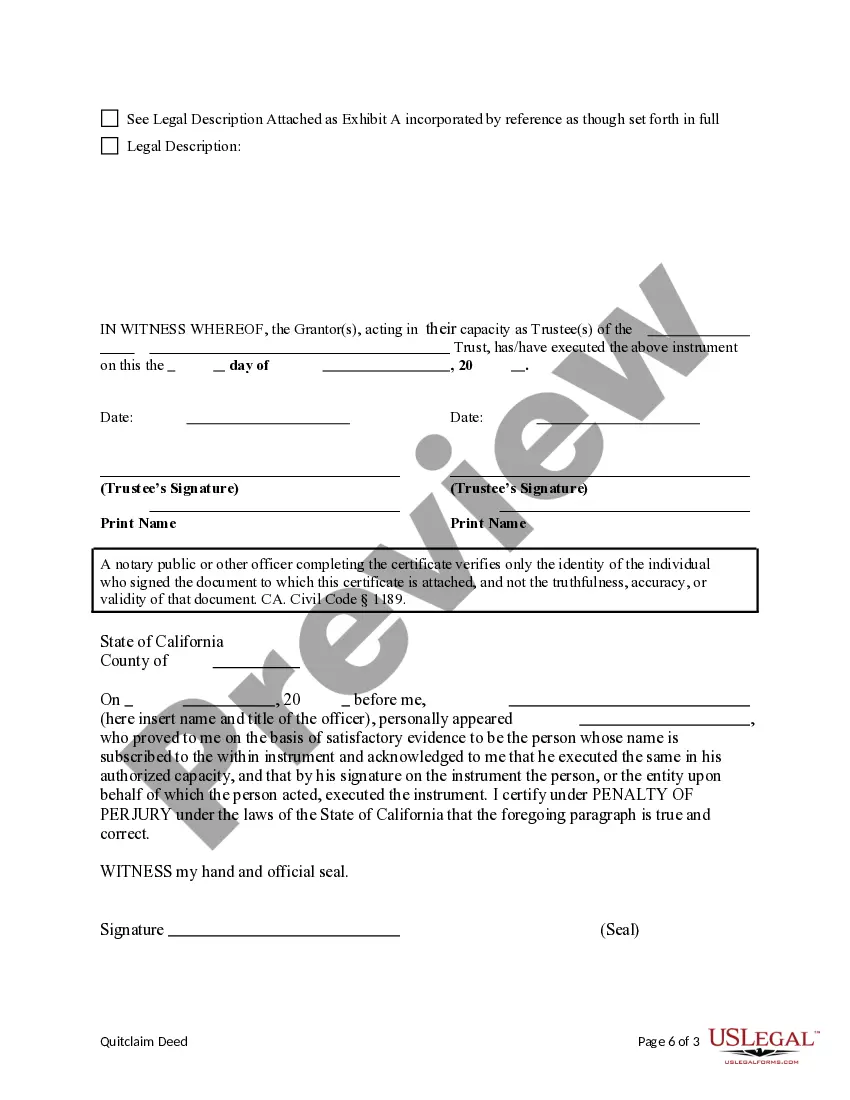

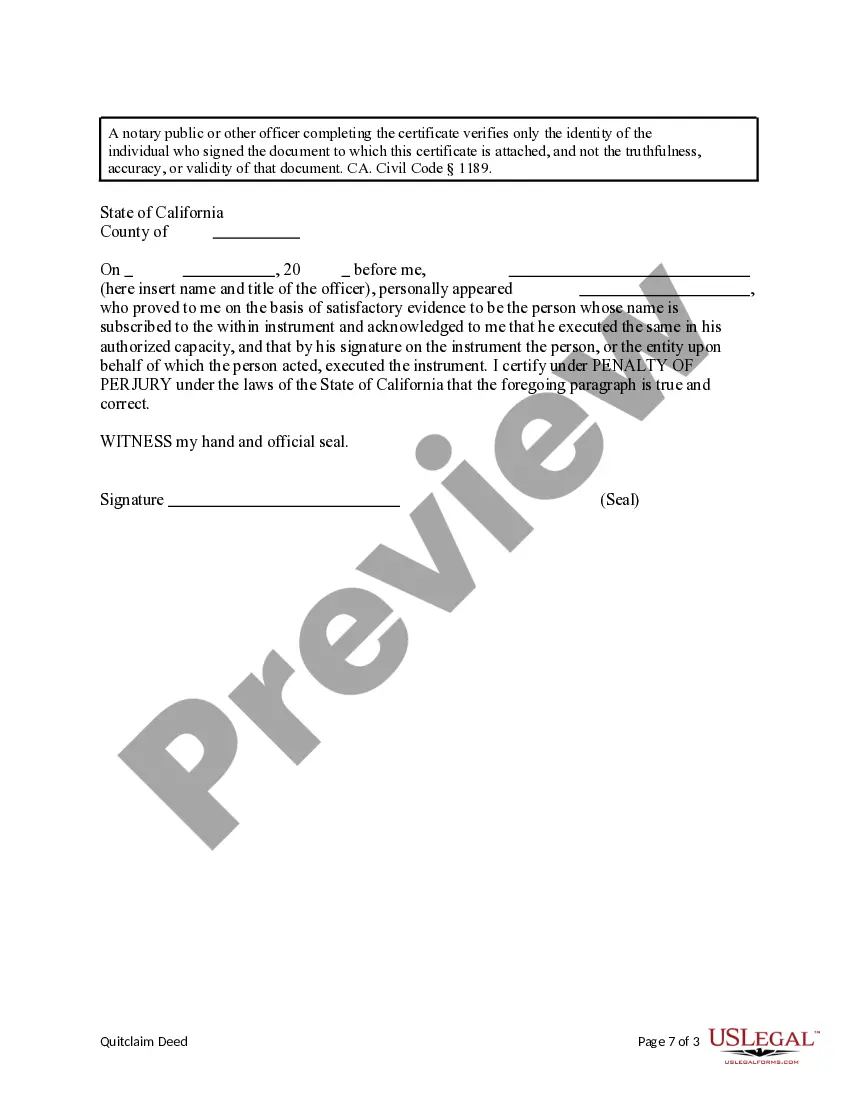

Filing a quitclaim deed in California involves a few straightforward steps. First, ensure the quitclaim deed form is completed accurately, specifically for a Sacramento California Quitclaim Deed from a Trust to a Limited Liability Company. Next, you must sign the document in front of a notary public, and then submit it to your local county recorder's office for recording. US Legal Forms provides easy access to the required forms and guidance on this procedure, making the process much simpler.

The time it takes to record a quitclaim deed in California can vary based on the county's processing speed. Generally, it takes between a few days to several weeks for a quitclaim deed to be officially recorded. When dealing with a Sacramento California Quitclaim Deed from a Trust to a Limited Liability Company, you may experience delays during busy periods. Using services like US Legal Forms can help streamline the process, ensuring you have everything correctly filed without unnecessary hold-ups.

The individual who holds the title to the property typically initiates a quitclaim deed. This person, known as the grantor, voluntarily transfers their interest in the property to another party, known as the grantee. For those looking to execute a Sacramento California Quitclaim Deed from a Trust to a Limited Liability Company, it's essential to follow the correct procedures, which can be facilitated by using services like USLegalForms.

To quitclaim your property to an LLC, you first need to obtain the proper quitclaim deed form. After filling out the form with the required details, you must sign it in the presence of a notary. Completing a Sacramento California Quitclaim Deed from a Trust to a Limited Liability Company can be simplified through USLegalForms, which provides guidance and resources throughout the process.

You can prepare a deed yourself, especially if you have a clear understanding of the necessary components and procedures. Many individuals choose to handle this task to maintain control over their property transactions. For accurate preparation of your Sacramento California Quitclaim Deed from a Trust to a Limited Liability Company, USLegalForms offers helpful tools and templates.

Certainly, you can perform a quitclaim deed by yourself. This option allows you to save on legal fees, but it requires careful attention to detail. To correctly execute a Sacramento California Quitclaim Deed from a Trust to a Limited Liability Company, using resources from platforms like USLegalForms can provide you with guidance and essential forms.

Yes, you can fill out a quitclaim deed yourself in California. If you understand the legal requirements and have the correct forms, it is entirely possible to complete the process independently. However, to ensure accuracy and compliance with local laws when transferring property using a Sacramento California Quitclaim Deed from a Trust to a Limited Liability Company, you may want to consider using online legal services like USLegalForms.

A quitclaim deed cannot be used for properties with liens or when a warranty of title is required. It is also not advisable for transferring property where valuation disputes exist or when legal disclaimers are involved. For scenarios requiring more security, using a formal deed might be a better choice rather than a Sacramento California Quitclaim Deed from a Trust to a Limited Liability Company.

Yes, a quitclaim deed can effectively transfer property from a trust. This method is often utilized to simplify ownership changes without the complexities of other deeds. If you are working with a Sacramento California Quitclaim Deed from a Trust to a Limited Liability Company, it's essential to follow all legal protocols for a valid transfer.

To quitclaim property to an LLC, you must draft a quitclaim deed that names the LLC as the new owner. Include a description of the property and ensure proper execution according to state laws. For those using a Sacramento California Quitclaim Deed from a Trust to a Limited Liability Company, consider consulting professionals who can guide you through the process to avoid potential pitfalls.