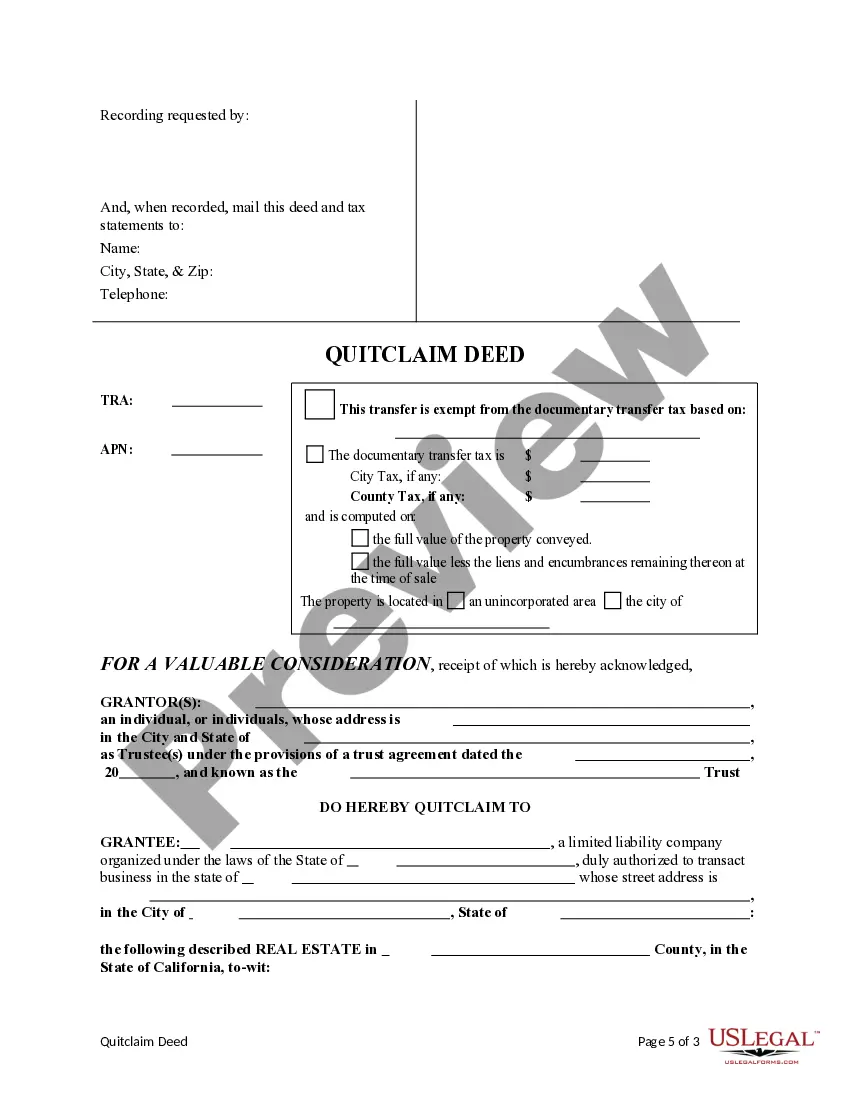

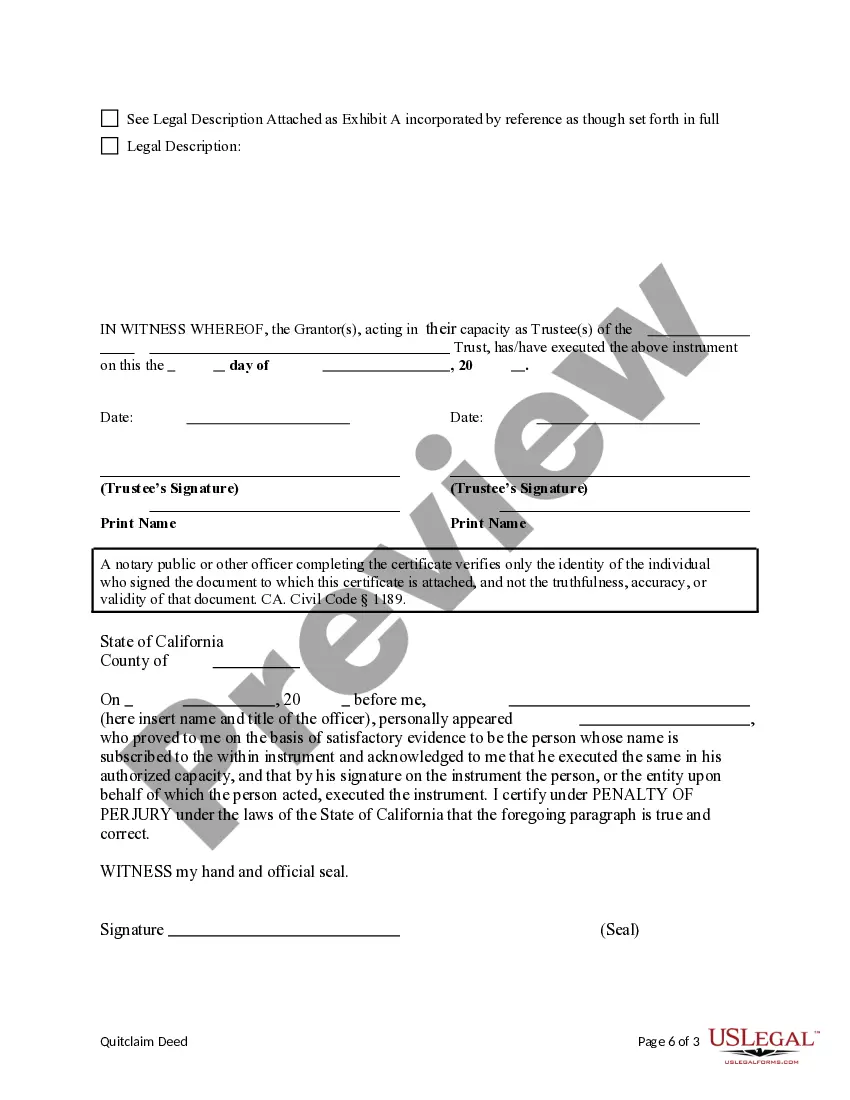

This form is a Quitclaim Deed where the Grantor is a trust and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

San Bernardino California Quitclaim Deed from a Trust to a Limited Liability Company

Description

How to fill out California Quitclaim Deed From A Trust To A Limited Liability Company?

Obtaining validated templates particular to your regional regulations can be difficult unless you utilize the US Legal Forms repository.

It’s a digital collection of over 85,000 legal documents for both individual and business requirements as well as any real-world circumstances.

All the files are appropriately sorted by usage area and jurisdiction, making it simple and quick to find the San Bernardino California Quitclaim Deed from a Trust to a Limited Liability Company.

Maintaining documents organized and compliant with legal standards is critically important. Take advantage of the US Legal Forms library to continuously have vital document templates for any requirements readily accessible!

- Examine the Preview mode and document description.

- Ensure you have chosen the correct one that fulfills your necessities and aligns with your local jurisdiction stipulations.

- Search for an alternative template, if necessary.

- If you detect any discrepancies, utilize the Search tab above to find the appropriate one.

- If it meets your needs, proceed to the next step.

Form popularity

FAQ

In California, anyone can prepare a quitclaim deed, but it is often advisable to engage a qualified professional, especially for transactions involving a trust and a limited liability company. Utilizing US Legal Forms provides easy access to resources and templates, guiding you through the preparation process while ensuring compliance with state laws. This approach allows you to confidently manage your property transfer.

Yes, a quitclaim deed can transfer property out of a trust to a limited liability company in San Bernardino, California. This legal mechanism allows for a straightforward transfer of ownership without the complexities of a traditional sale. Just make sure all parties understand their rights and obligations, and consider using US Legal Forms to streamline the documentation and ensure you meet all legal requirements.

Yes, you can complete a quitclaim deed yourself, particularly in San Bernardino, California. However, it is important to understand the legal implications involved in transferring property from a trust to a limited liability company. Using US Legal Forms can simplify this process, providing you with templates that ensure compliance with local regulations and ease the filing process.

To quitclaim property to an LLC, you need to prepare a quitclaim deed that identifies the property and the LLC as the new owner. Ensure that the current owner and the LLC name are accurately stated, and then sign the deed in front of a notary. After completing the deed, file it with the appropriate county office in San Bernardino to officially record the transfer. Using USLegalForms can simplify this process as they provide templates and guidance for executing a San Bernardino California quitclaim deed from a trust to a limited liability company.

You can absolutely transfer property from a trust to an individual. The process typically involves preparing and executing a quitclaim deed that specifies the change in ownership. This method not only legitimizes the transfer but also adheres to legal requirements in California. Utilizing the San Bernardino California Quitclaim Deed from a Trust to a Limited Liability Company enhances this process, ensuring clarity and compliance.

Yes, a quitclaim deed can effectively transfer property from a trust. The trust must first have the legal authority to convey the property. By executing the quitclaim deed, you establish a legal framework for the transfer, which simplifies the process and reflects the wishes laid out in the trust documentation. This is particularly relevant when dealing with a San Bernardino California Quitclaim Deed from a Trust to a Limited Liability Company.

To quitclaim your property to an LLC, begin by preparing a quitclaim deed that accurately describes the property. Next, list the LLC as the grantee on the deed. Once completed, sign and notarize the deed, then file it with the appropriate county office. This action creates a formal transfer under the San Bernardino California Quitclaim Deed from a Trust to a Limited Liability Company, ensuring legal recognition of the new ownership.

To transfer property out of a trust in California, follow these steps to ensure a smooth process. First, identify the property you wish to transfer and determine who will receive it. Next, utilize a quitclaim deed to convey the property from the trust to the recipient. This action facilitates the San Bernardino California Quitclaim Deed from a Trust to a Limited Liability Company, making it straightforward to formalize the change of ownership.

One of the biggest mistakes parents make when establishing a trust fund is failing to properly fund the trust. This oversight can lead to complications in asset distribution later. It's essential to transfer all intended assets into the trust at the outset to avoid any issues. This ensures a smooth transition of ownership and aligns with the process of a San Bernardino California Quitclaim Deed from a Trust to a Limited Liability Company.

To transfer property from a trust to an individual in California, you need to execute a simple process. First, locate the trust document and identify the specific property involved. Then, use a quitclaim deed to officially transfer the property to the individual. Make sure to file this deed with the county, which helps establish the new ownership under the San Bernardino California Quitclaim Deed from a Trust to a Limited Liability Company.