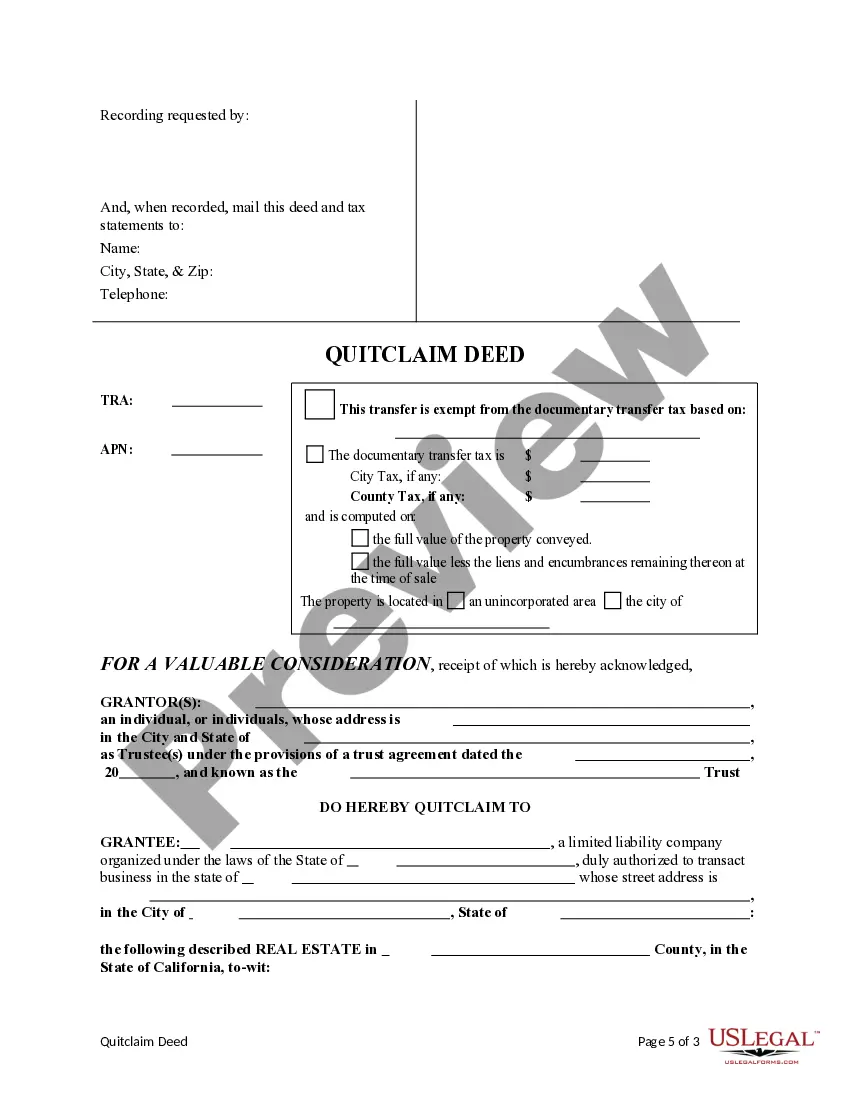

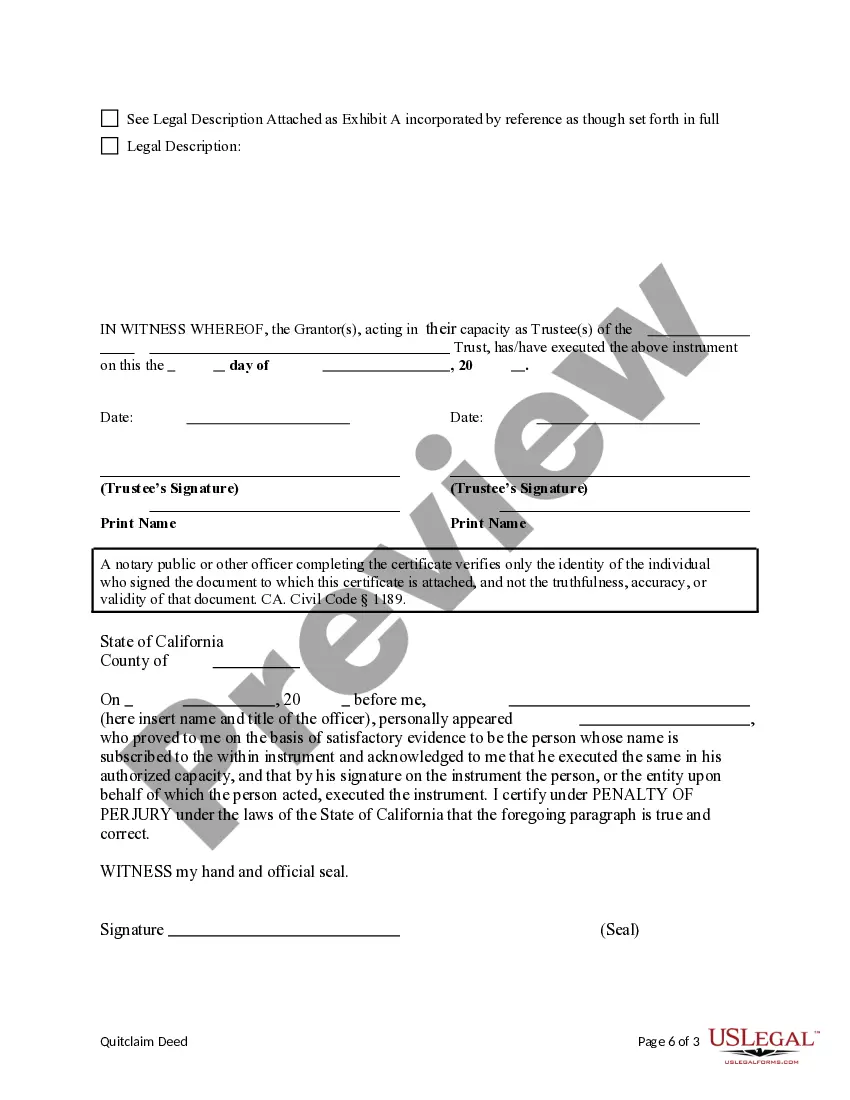

This form is a Quitclaim Deed where the Grantor is a trust and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A Santa Clara California Quitclaim Deed from a Trust to a Limited Liability Company is a legal document used to transfer the ownership of a property from a trust to a limited liability company (LLC) in Santa Clara, California. This type of deed is commonly used when a property held in a trust needs to be transferred to an LLC for various reasons, such as asset protection, tax benefits, or business purposes. A Quitclaim Deed is a legal instrument that allows the transfer of ownership rights from one party (granter) to another (grantee). In this case, the granter is the trust and the grantee is the LLC. Unlike a Warranty Deed that provides a guarantee of clear ownership, a Quitclaim Deed only transfers the interest or rights the granter has in the property, without any warranties or guarantees. There are different types of Santa Clara California Quitclaim Deeds from a Trust to an LLC, such as: 1. Trust-to-LLC Transfer for Asset Protection: This type of quitclaim deed is often used when a trust wants to transfer a property to an LLC for asset protection purposes. By transferring the property to an LLC, the trust can shield it from potential liabilities and creditors. This can be particularly beneficial for individuals or families with substantial assets at risk. 2. Trust-to-LLC Transfer for Tax Benefits: Some property owners may utilize a trust-to-LLC transfer to take advantage of certain tax benefits. By placing a property held in a trust under the ownership of an LLC, the property can potentially qualify for favorable tax treatment, such as pass-through taxation, where the LLC's income and expenses are reported on the individual tax return of the LLC members rather than the entity itself. 3. Trust-to-LLC Transfer for Business Purposes: In some cases, a property held in a trust may be transferred to an LLC for business purposes. This could include using the property as an investment or rental property, or to conduct business activities. Transferring the property to an LLC allows for more flexible management, liability protection, and the potential to raise capital through additional LLC members or investors. It is essential to consult with legal professionals, such as attorneys or real estate experts, to ensure compliance with Santa Clara County and California state laws when executing a Santa Clara California Quitclaim Deed from a Trust to a Limited Liability Company.A Santa Clara California Quitclaim Deed from a Trust to a Limited Liability Company is a legal document used to transfer the ownership of a property from a trust to a limited liability company (LLC) in Santa Clara, California. This type of deed is commonly used when a property held in a trust needs to be transferred to an LLC for various reasons, such as asset protection, tax benefits, or business purposes. A Quitclaim Deed is a legal instrument that allows the transfer of ownership rights from one party (granter) to another (grantee). In this case, the granter is the trust and the grantee is the LLC. Unlike a Warranty Deed that provides a guarantee of clear ownership, a Quitclaim Deed only transfers the interest or rights the granter has in the property, without any warranties or guarantees. There are different types of Santa Clara California Quitclaim Deeds from a Trust to an LLC, such as: 1. Trust-to-LLC Transfer for Asset Protection: This type of quitclaim deed is often used when a trust wants to transfer a property to an LLC for asset protection purposes. By transferring the property to an LLC, the trust can shield it from potential liabilities and creditors. This can be particularly beneficial for individuals or families with substantial assets at risk. 2. Trust-to-LLC Transfer for Tax Benefits: Some property owners may utilize a trust-to-LLC transfer to take advantage of certain tax benefits. By placing a property held in a trust under the ownership of an LLC, the property can potentially qualify for favorable tax treatment, such as pass-through taxation, where the LLC's income and expenses are reported on the individual tax return of the LLC members rather than the entity itself. 3. Trust-to-LLC Transfer for Business Purposes: In some cases, a property held in a trust may be transferred to an LLC for business purposes. This could include using the property as an investment or rental property, or to conduct business activities. Transferring the property to an LLC allows for more flexible management, liability protection, and the potential to raise capital through additional LLC members or investors. It is essential to consult with legal professionals, such as attorneys or real estate experts, to ensure compliance with Santa Clara County and California state laws when executing a Santa Clara California Quitclaim Deed from a Trust to a Limited Liability Company.