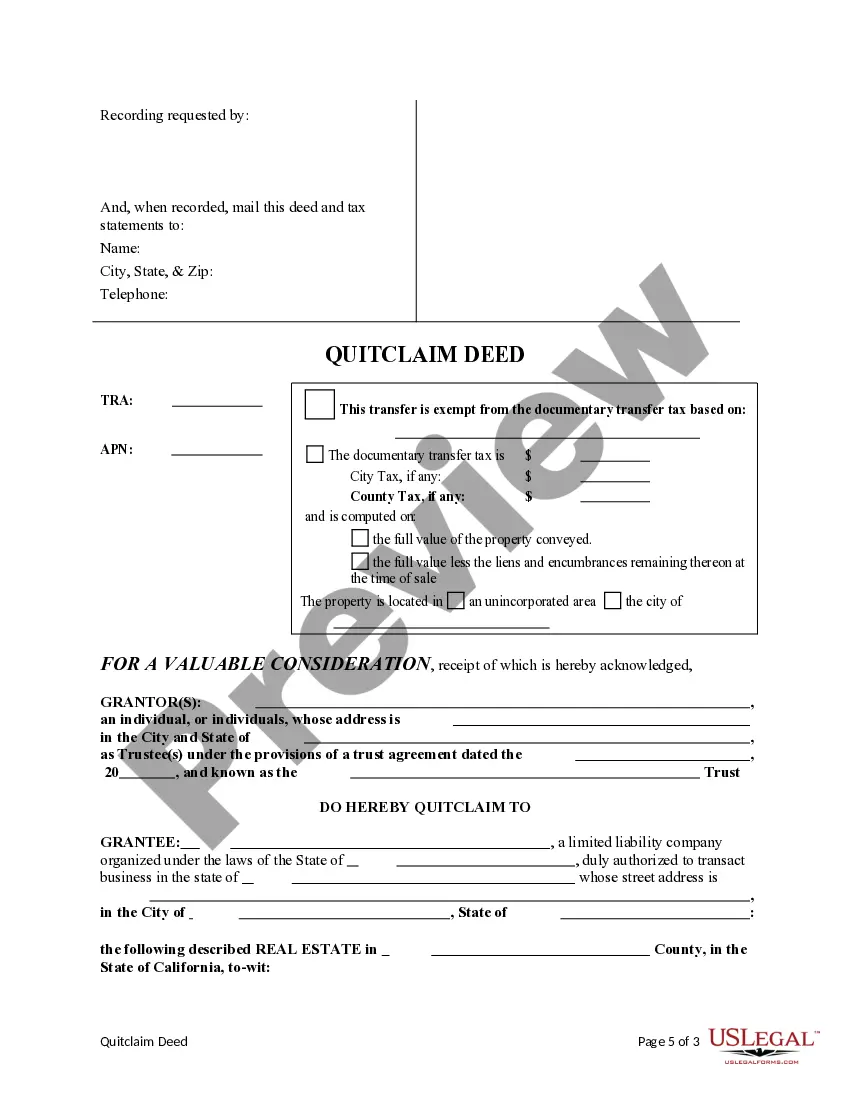

This form is a Quitclaim Deed where the Grantor is a trust and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

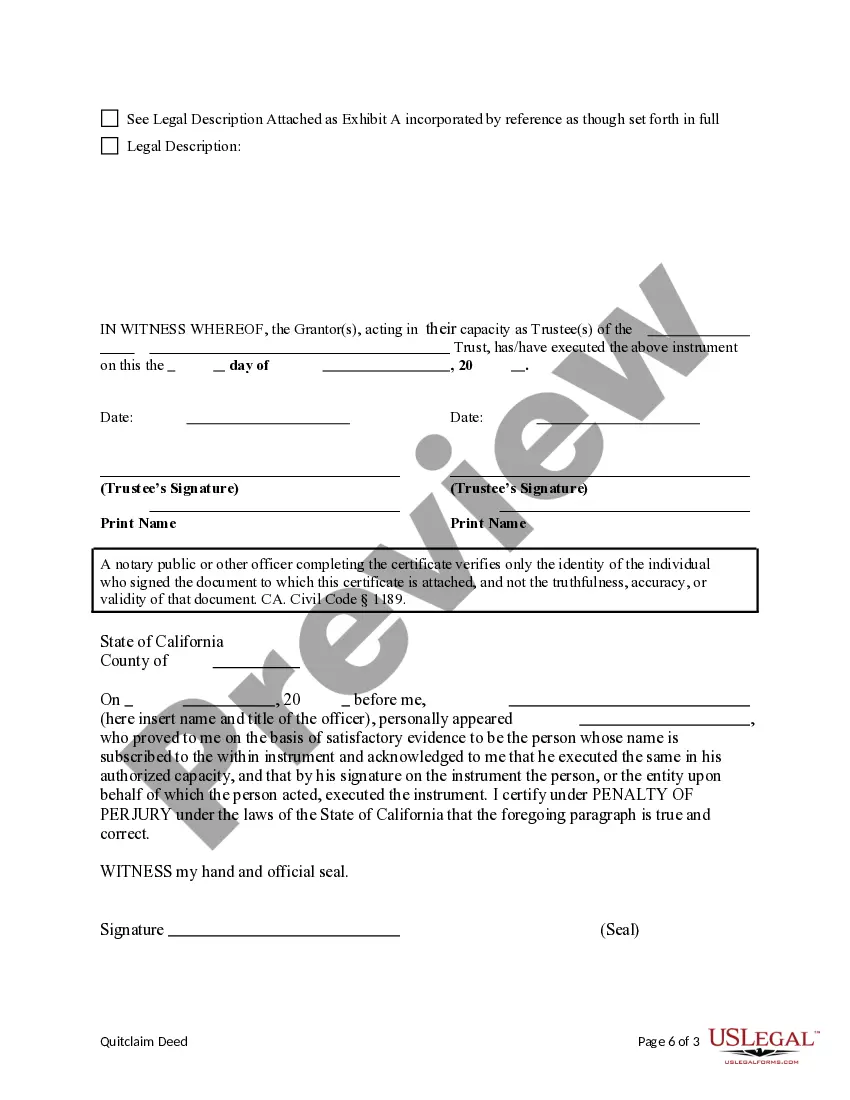

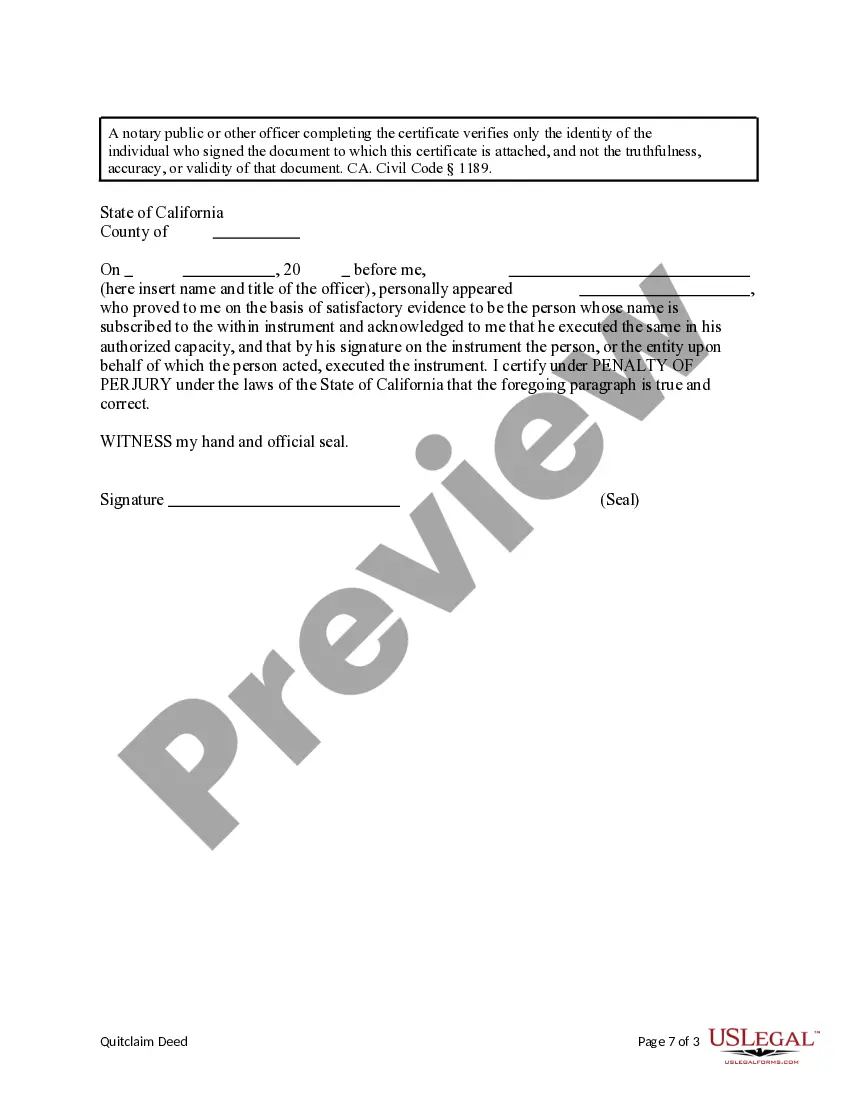

A quitclaim deed is a legal document used to transfer ownership of real estate from one party to another. In the context of Santa Maria, California, a quitclaim deed from a trust to a limited liability company (LLC) involves transferring the ownership of property held in a trust to an LLC. This transfer offers benefits such as liability protection and flexibility in managing real estate assets. Santa Maria, California Quitclaim Deed from a Trust to a Limited Liability Company: A quitclaim deed transfers the ownership rights of property from a trust to a limited liability company. This process is commonly utilized by individuals or families who hold their properties within a trust structure and wish to transfer them to an LLC for various reasons. By transferring the property to an LLC, the owners gain additional asset protection, potential tax advantages, and easier management of real estate holdings. The Santa Maria, California quitclaim deed from a trust to an LLC follows specific legal procedures to ensure the proper transfer of ownership. The details may vary depending on the specific circumstances, but the key steps involved are: 1. Preparation of the Quitclaim Deed: The trustee of the trust initiates the process by preparing a quitclaim deed. This document includes essential information such as the names of the trust and LLC, the legal description of the property, and any relevant restrictions or encumbrances. 2. Notarization: Once the quitclaim deed is prepared, it needs to be notarized by a licensed notary public. This step ensures the authenticity of the document and acknowledges the signatures of the parties involved. 3. Filing the Deed: The notarized quitclaim deed must be filed with the Santa Maria County Recorder's Office. This filing officially records the transfer of ownership from the trust to the LLC and provides a public record of the transaction. 4. Potential Title Insurance: Before or after filing the quitclaim deed, the LLC acquiring the property may choose to purchase title insurance. This insurance protects the LLC from any unforeseen issues or claims related to the property's ownership history. Different types of Santa Maria, California Quitclaim Deed from a Trust to a Limited Liability Company: While the concept of a quitclaim deed from a trust to an LLC remains the same, there are different variations of this type of transfer that may be relevant. These variations can be based on factors such as the purpose of the transfer, the number of co-owners, or other legal arrangements. Some common types of quitclaim deeds from a trust to an LLC in Santa Maria, California, include: 1. Single-owner trust to single-member LLC quitclaim deed. 2. Joint trust to multi-member LLC quitclaim deed. 3. Testamentary trust to LLC quitclaim deed. 4. Revocable living trust to LLC quitclaim deed. Regardless of the specific type, a Santa Maria, California quitclaim deed from a trust to an LLC is a legal mechanism representing the transfer of ownership rights of a property from a trust to a limited liability company. It is recommended to consult with a qualified attorney or legal professional for guidance tailored to your unique situation.