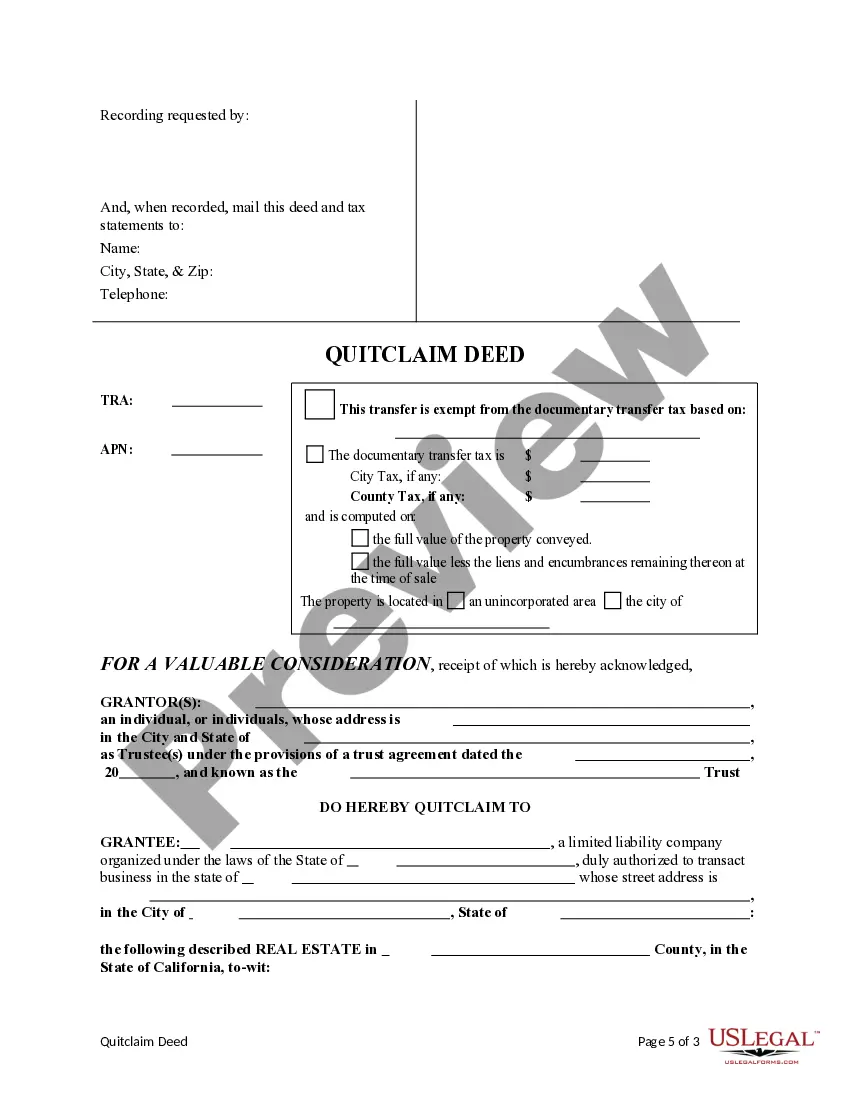

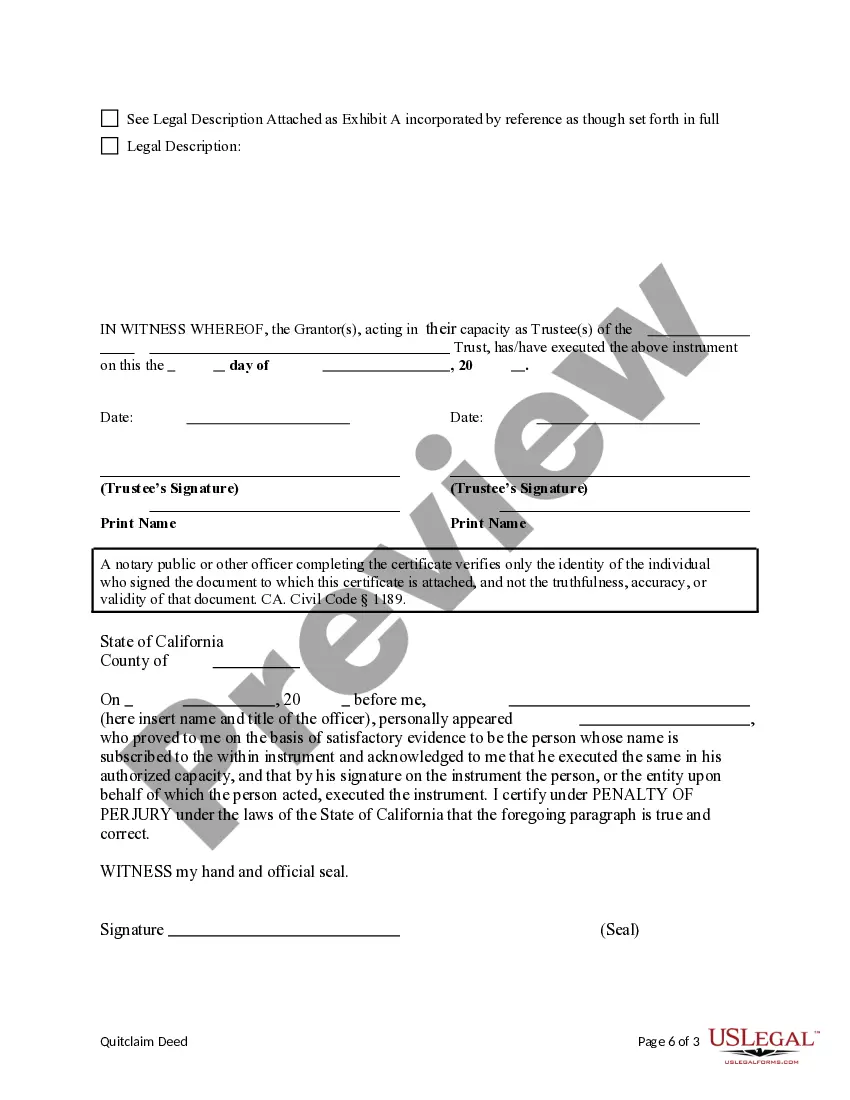

This form is a Quitclaim Deed where the Grantor is a trust and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Simi Valley California Quitclaim Deed from a Trust to a Limited Liability Company

Description

How to fill out California Quitclaim Deed From A Trust To A Limited Liability Company?

Obtaining authenticated templates that are tailored to your regional regulations can be challenging unless you utilize the US Legal Forms database.

This is an online repository of over 85,000 legal documents for both personal and business requirements and various real-world situations.

All the files are properly categorized by field of application and jurisdictional areas, making it simple and straightforward to locate the Simi Valley California Quitclaim Deed from a Trust to a Limited Liability Company.

Confirm your payment through credit card details or your PayPal account to acquire the service.

- Check the Preview mode and form description.

- Ensure you’ve selected the right one that fits your needs and fully aligns with your local jurisdiction requirements.

- Look for another template if required.

- If you notice any discrepancies, use the Search tab above to find the accurate one. If it fits your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

In the quitclaim deed, the owner of the property will be designated the ?grantor,? and the LLC will be designated the ?grantee.? Have the deed notarized once it is completed. Submit the new deed, with the title and the Declaration of Value, to the county office where the property is located in Florida.

While recording a deed does not affect its validity, it is extremely important to record since recordation protects the grantee. If a grantee fails to record, and another deed or any other document encumbering or affecting the title is recorded, the first grantee is in jeopardy.

Transferring your property to an LLC is usually achieved by filing a quitclaim deed, a general warranty deed, or some other kind of deed to facilitate a transfer of the property from you to your LLC. Otherwise, as you acquire property, it can be directly purchased in the name of your LLC.

Recording. Once the quitclaim deed is signed and notarized, it is a valid legal document. But the grantee must also have the quitclaim deed recorded in the county recorder's office, or with the county clerk -- whoever has the authority to record deeds and property transfers.

Avoiding Personal Liability This is the major advantage of an LLC. You want the best option for limiting your personal liability should an unforeseen circumstance arise relating to your property. LLCs provide that protection.

Thus, an unrecorded deed is valid as between the parties and as to all those who have notice thereof. (Cal. Civ.

Here are eight steps on how to transfer property title to an LLC: Contact Your Lender.Form an LLC.Obtain a Tax ID Number and Open an LLC Bank Account.Obtain a Form for a Deed.Fill out the Warranty or Quitclaim Deed Form.Sign the Deed to Transfer Property to the LLC.Record the Deed.Change Your Lease.

California mainly uses two types of deeds: the ?grant deed? and the ?quitclaim deed.? Most other deeds you will see, such as the common ?interspousal transfer deed,? are versions of grant or quitclaim deeds customized for specific circumstances.

A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

First, you need to make sure you fill out the quitclaim deed properly and get it notarized. Next, take the quitclaim deed to the County Recorder's Office. Make sure to file a Preliminary Change of Ownership Report and a Documentary of Transfer Tax or a Notice of Exempt Transaction.