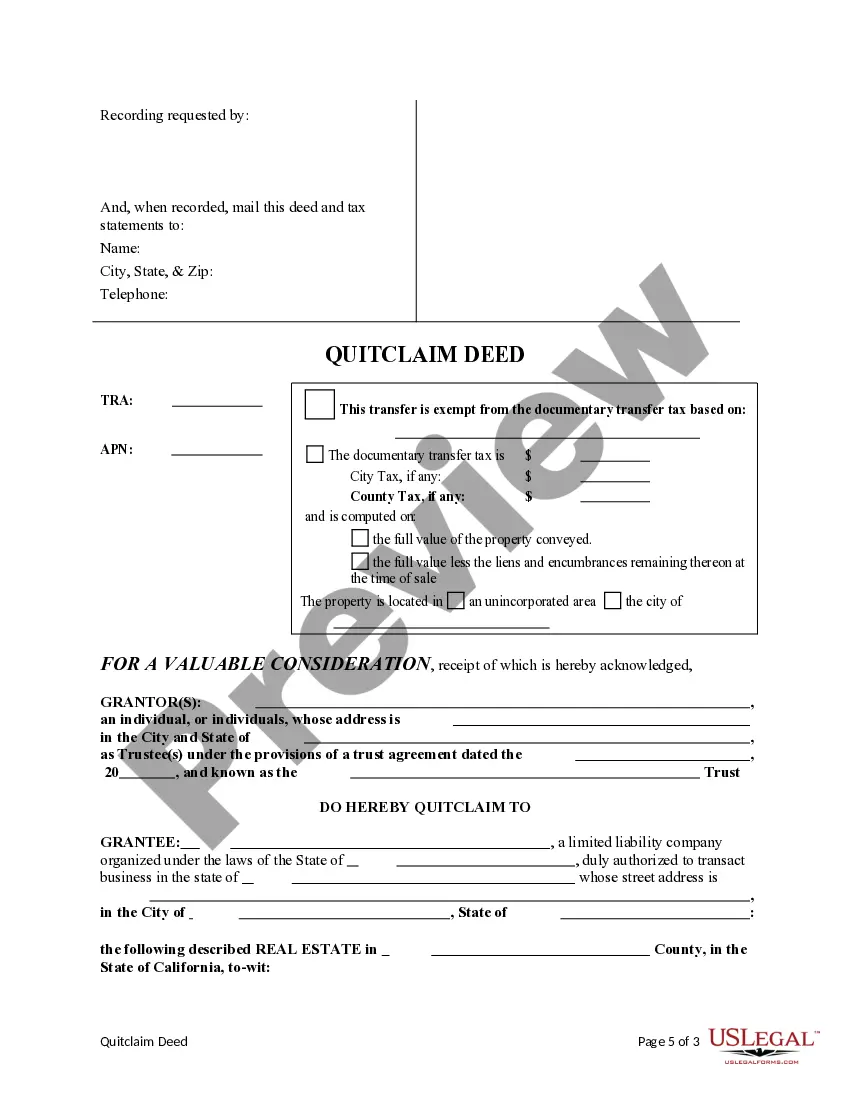

This form is a Quitclaim Deed where the Grantor is a trust and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Thousand Oaks California Quitclaim Deed from a Trust to a Limited Liability Company

Description

How to fill out California Quitclaim Deed From A Trust To A Limited Liability Company?

If you are looking for an appropriate form template, it’s incredibly challenging to locate a more user-friendly platform than the US Legal Forms website – likely one of the largest collections on the web.

With this collection, you can access a vast array of templates for business and personal use categorized by type and location, or keywords.

Utilizing our sophisticated search feature, locating the most recent Thousand Oaks California Quitclaim Deed from a Trust to a Limited Liability Company is as simple as 1-2-3.

Obtain the document. Specify the format and download it to your computer.

Make changes. Complete, edit, print, and sign the obtained Thousand Oaks California Quitclaim Deed from a Trust to a Limited Liability Company.

- If you are already familiar with our platform and have an account, all you need to obtain the Thousand Oaks California Quitclaim Deed from a Trust to a Limited Liability Company is to Log In to your profile and select the Download option.

- If this is your first time using US Legal Forms, just follow the instructions below.

- Ensure you have opened the form you require. Review its details and use the Preview feature (if accessible) to examine its contents. If it doesn’t match your requirements, use the Search bar at the top of the page to find the necessary document.

- Confirm your selection. Click on the Buy now option. Then, select your desired pricing plan and provide the necessary information to create an account.

- Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

One disadvantage of placing property in an LLC is the potential for increased administrative responsibilities. You may have to file annual reports and maintain compliance with state regulations. Additionally, using a Thousand Oaks California Quitclaim Deed from a Trust to a Limited Liability Company could limit certain tax benefits, making it essential to evaluate your specific situation before proceeding.

While you do not always need a lawyer to transfer a deed, consulting one can be beneficial, especially for complex situations. A Thousand Oaks California Quitclaim Deed from a Trust to a Limited Liability Company may have specific legal nuances. A lawyer can guide you through the process and ensure all necessary steps are correctly followed, providing peace of mind.

Transferring the deed of a house to an LLC typically involves using a Thousand Oaks California Quitclaim Deed. You will need to complete the deed, specifying the LLC as the new owner. After signing, you must file it with the local county recorder. This ensures the transfer is legally recognized and protects your ownership.

Many people choose to place their property in an LLC for liability protection and to streamline tax benefits. This structure helps separate personal assets from business liabilities, shielding your personal finances in case of legal issues. Additionally, using a Thousand Oaks California Quitclaim Deed from a Trust to a Limited Liability Company can further simplify this transfer process.

To transfer a deed from an individual to a Limited Liability Company, you can utilize a Thousand Oaks California Quitclaim Deed. This document allows the property owner to convey interests to the LLC without warranties against defects. Ensure that you fill out the deed correctly, sign it, and file it with the appropriate county recorder’s office to make the transfer official.

Yes, a quitclaim deed can indeed transfer property from a trust. This method allows for a seamless transition of ownership from the trust to a limited liability company, streamlining the process for the beneficiaries. When dealing with a Thousand Oaks California quitclaim deed from a trust to a limited liability company, it is advisable to ensure all documentation is properly completed to avoid future issues. Utilizing trusted resources like uslegalforms can provide you with the necessary tools to accomplish this effectively.

Quitclaim deeds are often viewed with caution because they do not guarantee property rights. This means the recipient may not receive clear title or may be exposed to claims from others. Furthermore, using a Thousand Oaks California quitclaim deed from a trust to a limited liability company may lead to complexities if the property has existing liens or disputes. Therefore, it is crucial to conduct thorough due diligence and understand the risks before proceeding with this type of transaction.

It ultimately depends on your individual needs and circumstances. A quitclaim deed provides a quick transfer of property rights without warranties, which can be suitable for straightforward situations like family transactions. In contrast, a trust offers more protection and control over property assets, especially for those looking to manage long-term estate planning. Thus, if you need a Thousand Oaks California quitclaim deed from a trust to a limited liability company, consider your goals and consult with an expert to determine the best option.

Yes, you can execute a quitclaim deed from a trust to a limited liability company. This process involves transferring ownership of the trust’s property efficiently while ensuring that the title reflects the current holder accurately. Using a Thousand Oaks California quitclaim deed from a trust to a limited liability company simplifies the transition of assets, making it smoother for all parties involved. Working with legal professionals or utilizing platforms like uslegalforms can further aid in navigating this process.

A quitclaim deed cannot be used to transfer property rights that one does not possess. For example, if the grantor does not own the property or possesses limited rights, a quitclaim deed from a trust to a limited liability company in Thousand Oaks, California, would not be valid. Additionally, a quitclaim deed cannot be used for properties under mortgage due to potential outstanding debts. It is crucial to understand these limitations to avoid complications in your property transactions.