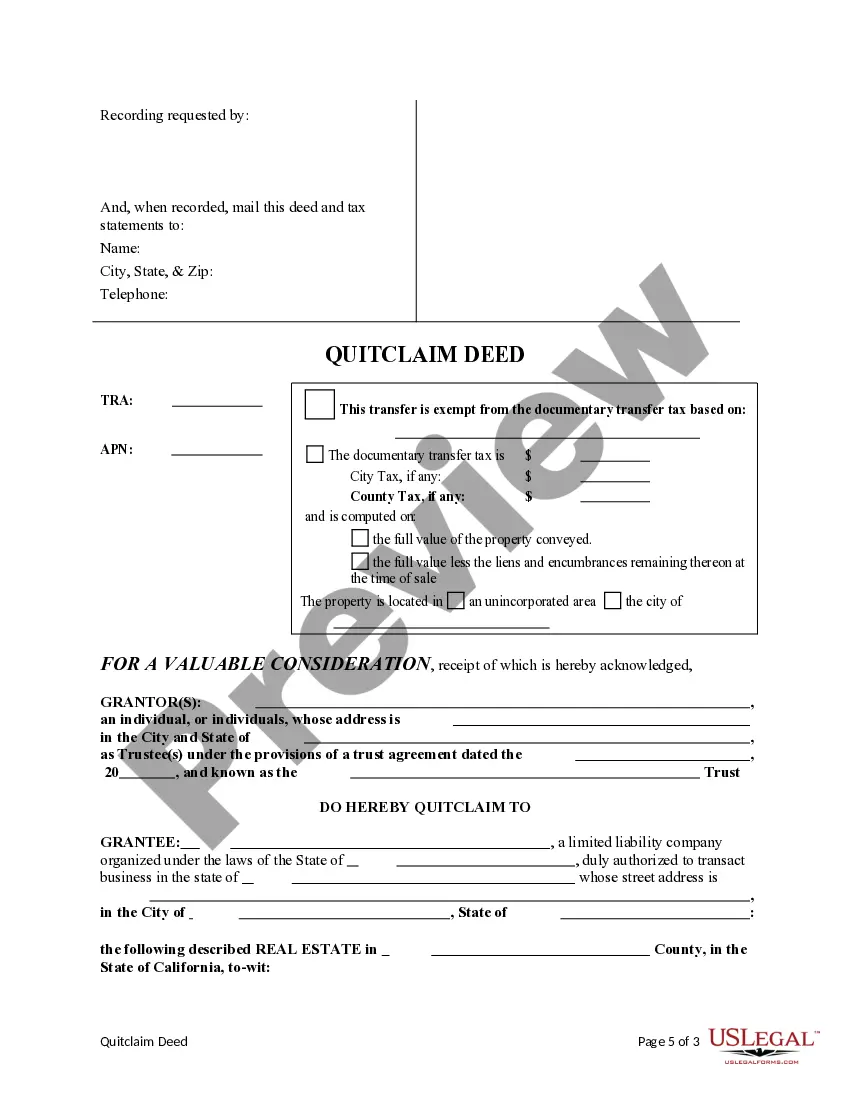

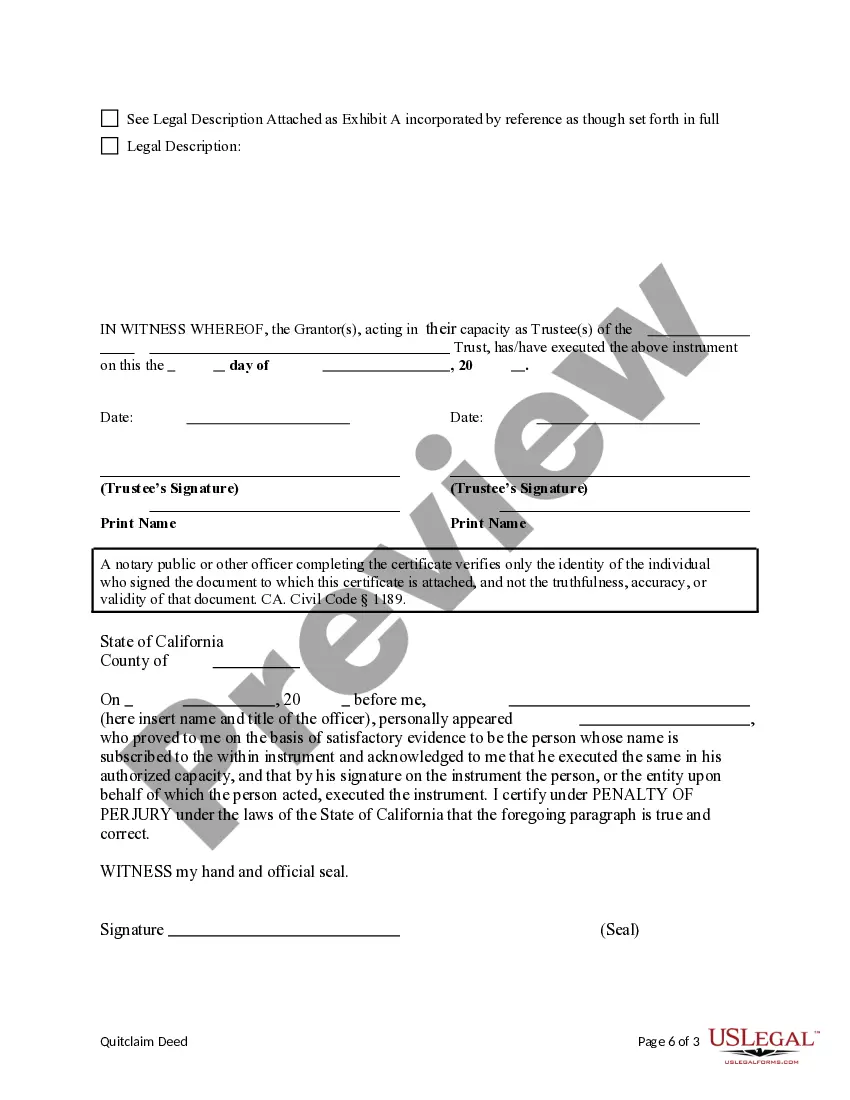

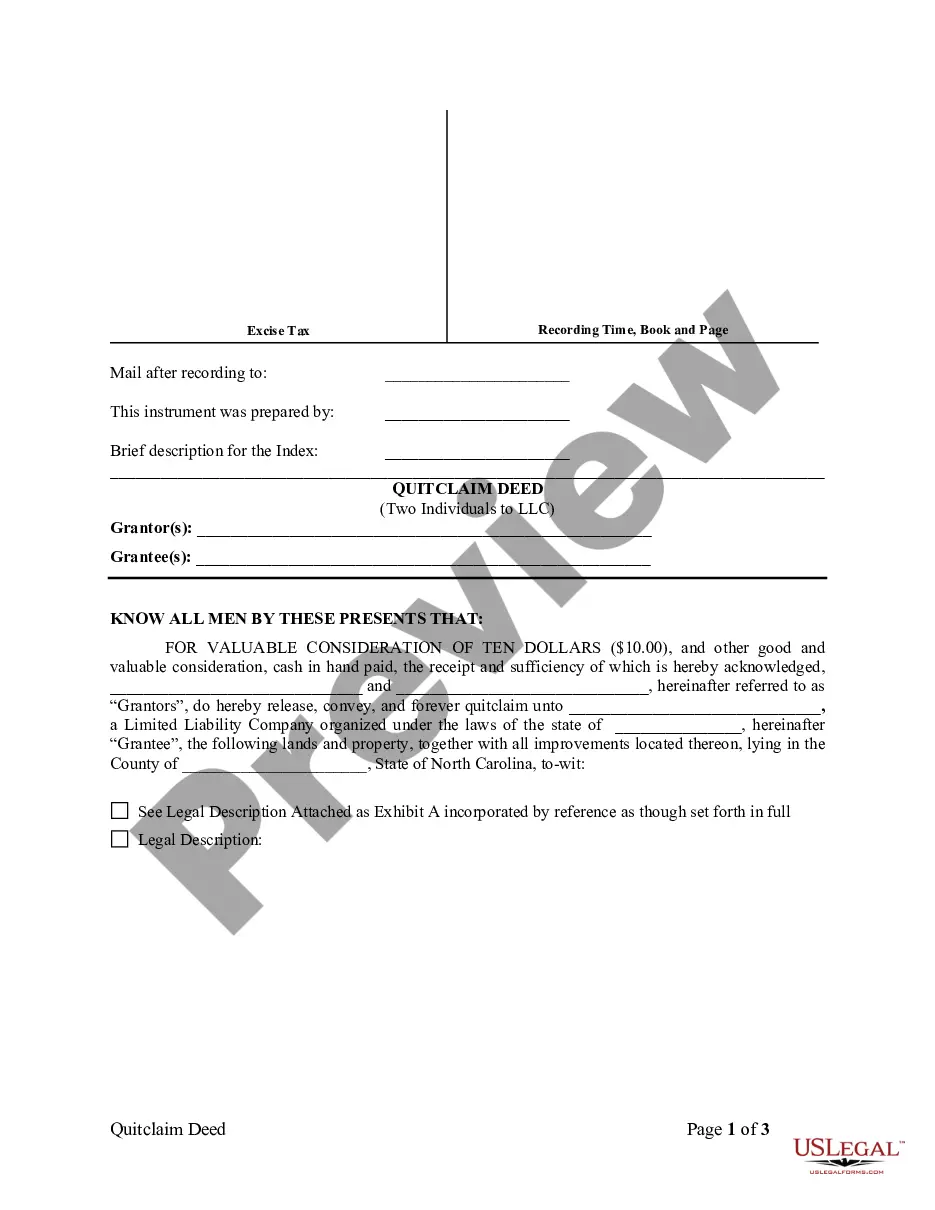

This form is a Quitclaim Deed where the Grantor is a trust and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Vista California Quitclaim Deed from a Trust to a Limited Liability Company

Description

How to fill out California Quitclaim Deed From A Trust To A Limited Liability Company?

If you have previously employed our service, sign in to your account and retrieve the Vista California Quitclaim Deed from a Trust to a Limited Liability Company on your device by clicking the Download button. Ensure your subscription is active. If it is not, renew it according to your payment plan.

Should this be your initial experience with our service, follow these straightforward steps to acquire your document.

You have ongoing access to all the documents you have acquired: you can locate them in your profile within the My documents menu whenever you wish to use them again. Leverage the US Legal Forms service to effortlessly find and store any template for your personal or professional requirements!

- Ensure you have found a suitable document. Browse the description and utilize the Preview feature, if accessible, to verify it aligns with your requirements. If it does not fit, use the Search tab above to find the right one.

- Purchase the template. Hit the Buy Now button and select a monthly or yearly subscription option.

- Create an account and process your payment. Enter your credit card information or utilize the PayPal option to finalize the purchase.

- Retrieve your Vista California Quitclaim Deed from a Trust to a Limited Liability Company. Choose the file format for your document and store it on your device.

- Complete your form. Print it out or use professional online editors to fill it in and sign it electronically.

Form popularity

FAQ

You can indeed execute a quitclaim deed on your own, including a Vista California Quitclaim Deed from a Trust to a Limited Liability Company. Just ensure all parties involved understand their rights and responsibilities. To simplify the process, you might find it beneficial to use services like uslegalforms that guide you through the necessary steps, enhancing clarity and efficiency in transferring property.

You can draft a Vista California Quitclaim Deed from a Trust to a Limited Liability Company yourself; however, it requires careful attention to detail. Ensure you include all necessary information, such as legal descriptions and signatures. Mistakes can lead to complications down the line, so consider using uslegalforms for reliable templates and guidance. A correctly drafted deed will streamline the transfer process and protect your investment.

A quitclaim deed can be rendered invalid for several reasons, such as lack of proper signatures or failure to meet state requirements. If the property description is vague or the grantor does not have the right to transfer ownership, the deed may not hold up in court. It's important to ensure that all legal standards are met for a Vista California Quitclaim Deed from a Trust to a Limited Liability Company to be valid. Consulting resources like uslegalforms can help clarify these requirements.

While a quitclaim deed offers an easy way to transfer ownership, it does come with risks. It provides no guarantee of clear title, which can lead to disputes. If the property has outstanding liens or claims, the new owner could face financial responsibilities. It's essential to weigh these factors carefully against the benefits of using a Vista California Quitclaim Deed from a Trust to a Limited Liability Company.

A quitclaim deed is often used for transferring property between family members or dissolving partnerships. It is also suitable for transferring property into or out of a limited liability company. If you want to quickly transfer ownership and avoid lengthy processes, a Vista California Quitclaim Deed from a Trust to a Limited Liability Company serves as a beneficial solution. Always ensure that the circumstances align with the quitclaim deed's intended use.

A quitclaim deed is not appropriate in situations involving liens or disputes, as it transfers ownership without warranty. It also cannot be used when the property is subject to certain restrictions, such as foreclosure or bankruptcy. In contexts where clear title is crucial, such as a sale, a quitclaim deed may not suffice. Thus, understanding when to use a Vista California Quitclaim Deed from a Trust to a Limited Liability Company is essential for effective property management.

Choosing between a trust and a quitclaim deed largely depends on your specific needs. A trust provides more protection and can manage assets over time, while a Vista California Quitclaim Deed from a Trust to a Limited Liability Company offers a quick transfer of property ownership. If you seek simplicity and speed in transferring real estate, the quitclaim deed may be more appropriate. However, if you want to ensure a more secure management of assets, consider establishing a trust.

In California, a quitclaim deed can be prepared by any person who is knowledgeable about the process, including the property owner or a legal professional. For a Vista California Quitclaim Deed from a Trust to a Limited Liability Company, it is often wise to seek assistance from an attorney or a qualified professional to ensure accuracy and compliance with state laws. You can also utilize platforms like US Legal Forms, which provide templates and guidance for preparing legal documents, ensuring your deed is correctly formatted and filed.

Yes, transferring property from a trust to an individual is possible using a quit claim deed. This process involves the trustee executing the deed to assign ownership rights to the individual. A Vista California Quitclaim Deed from a Trust to a Limited Liability Company simplifies this transfer, making it a feasible solution for many property owners. Remember to record the deed for it to be legally effective.

Yes, a quit claim deed can effectively transfer property from a trust. The trustee signs the deed, which enables the property to be conveyed to a new owner, such as a Limited Liability Company. In the case of utilizing a Vista California Quitclaim Deed from a Trust to a Limited Liability Company, the process remains efficient and relatively simple. Just make sure to record the deed with the appropriate county office.