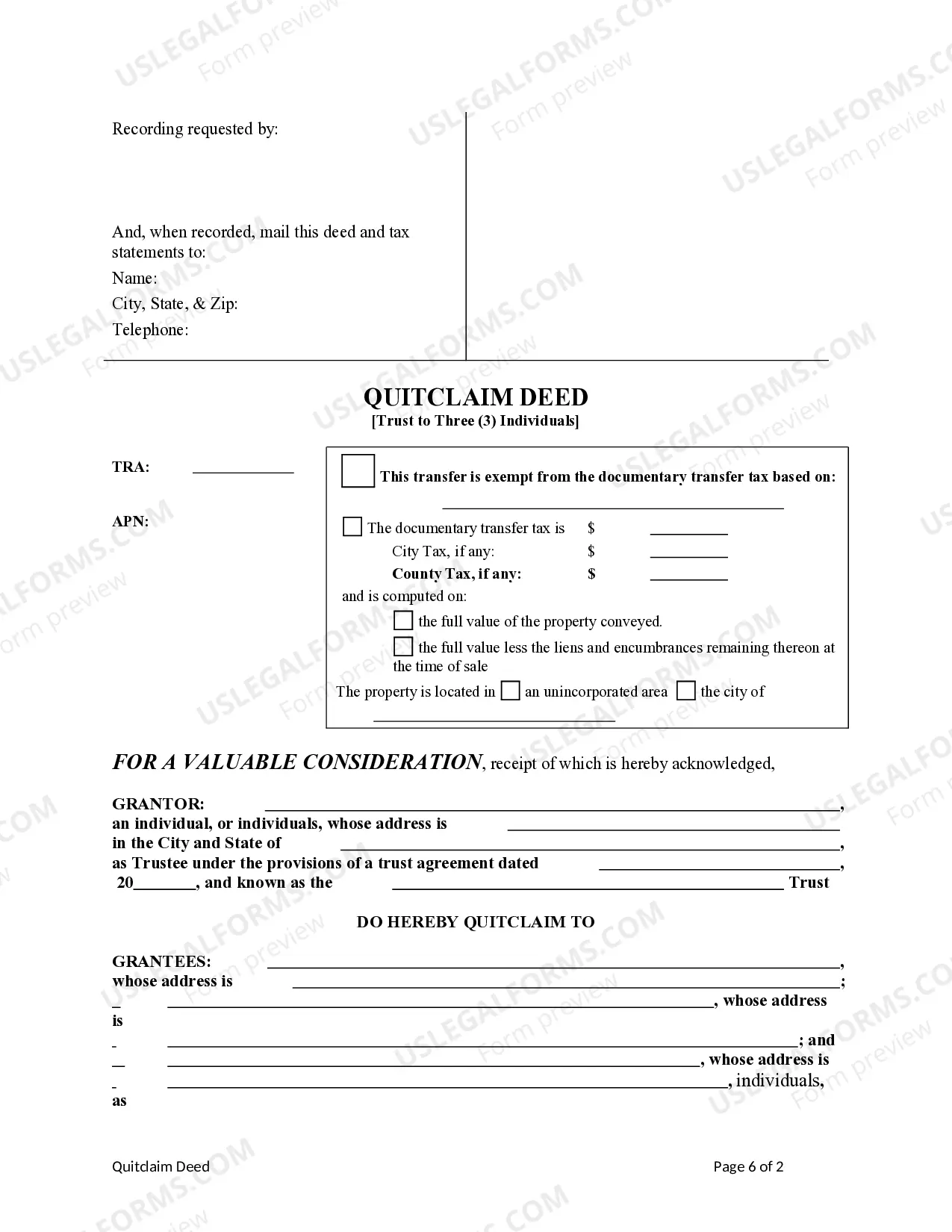

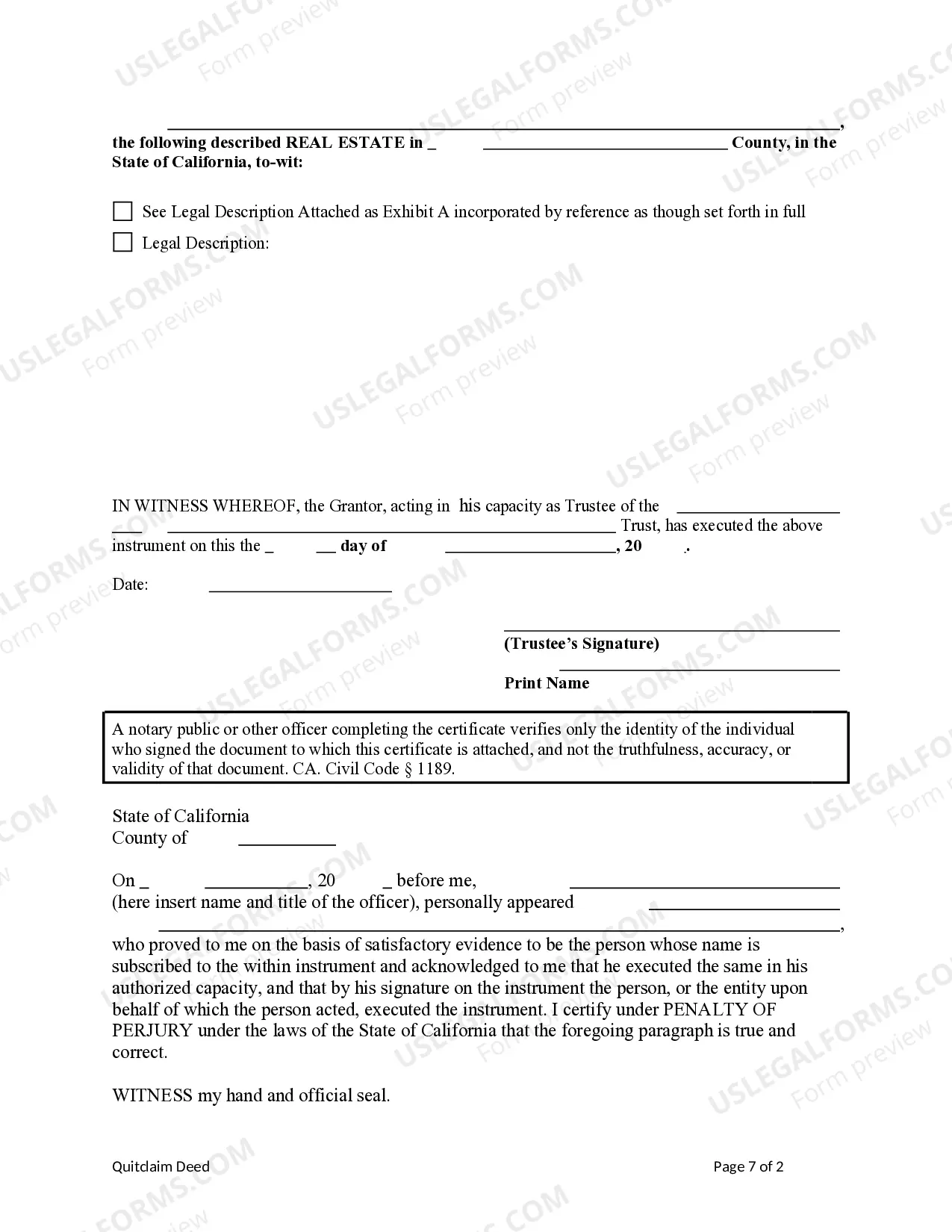

This form is a Quitclaim Deed where the Grantor is a trust and the Grantees are three (3) individuals. Grantor conveys and quitclaims any interest Grantor might have in the described property to Grantee. This deed complies with all state statutory laws.

A Hayward California quitclaim deed — trust to three individuals is a legal instrument used to transfer ownership of real estate from a trust to three individuals. This type of deed is commonly used in estate planning and asset distribution scenarios, allowing the trust or to transfer their property interests to specific beneficiaries. The Hayward California quitclaim deed — trust to three individuals effectively releases any claim or interest the trust has in the property, guaranteeing that the property is transferred to the named individuals without warranty or guarantee. It is essential to consult with a legal professional or attorney to ensure compliance with California state laws and to understand the specific requirements for executing this type of deed. There are different variations of the Hayward California quitclaim deed — trust to three individuals, including: 1. Joint Tenancy with Right of Survivorship (TWOS): In this type of deed, the three individuals hold an equal share of the property, and in the event of the death of one individual, the ownership automatically transfers to the surviving individuals. 2. Tenants in Common: With tenants in common, the three individuals can hold unequal shares of the property. If one individual passes away, their share of the property is distributed according to their will or state laws, rather than automatically transferring to the surviving owners. 3. Life Estate Deed: This type of Hayward California quitclaim deed — trust to three individuals grants the individuals the right to use, enjoy, and possess the property for the duration of their lives. Once all three individuals pass away, the property is then distributed according to the trust or will. It is important to note that executing a Hayward California quitclaim deed — trust to three individuals requires thorough understanding of the legal implications and potential tax consequences. Seeking professional legal advice is highly recommended ensuring a smooth and valid transfer of property ownership.A Hayward California quitclaim deed — trust to three individuals is a legal instrument used to transfer ownership of real estate from a trust to three individuals. This type of deed is commonly used in estate planning and asset distribution scenarios, allowing the trust or to transfer their property interests to specific beneficiaries. The Hayward California quitclaim deed — trust to three individuals effectively releases any claim or interest the trust has in the property, guaranteeing that the property is transferred to the named individuals without warranty or guarantee. It is essential to consult with a legal professional or attorney to ensure compliance with California state laws and to understand the specific requirements for executing this type of deed. There are different variations of the Hayward California quitclaim deed — trust to three individuals, including: 1. Joint Tenancy with Right of Survivorship (TWOS): In this type of deed, the three individuals hold an equal share of the property, and in the event of the death of one individual, the ownership automatically transfers to the surviving individuals. 2. Tenants in Common: With tenants in common, the three individuals can hold unequal shares of the property. If one individual passes away, their share of the property is distributed according to their will or state laws, rather than automatically transferring to the surviving owners. 3. Life Estate Deed: This type of Hayward California quitclaim deed — trust to three individuals grants the individuals the right to use, enjoy, and possess the property for the duration of their lives. Once all three individuals pass away, the property is then distributed according to the trust or will. It is important to note that executing a Hayward California quitclaim deed — trust to three individuals requires thorough understanding of the legal implications and potential tax consequences. Seeking professional legal advice is highly recommended ensuring a smooth and valid transfer of property ownership.