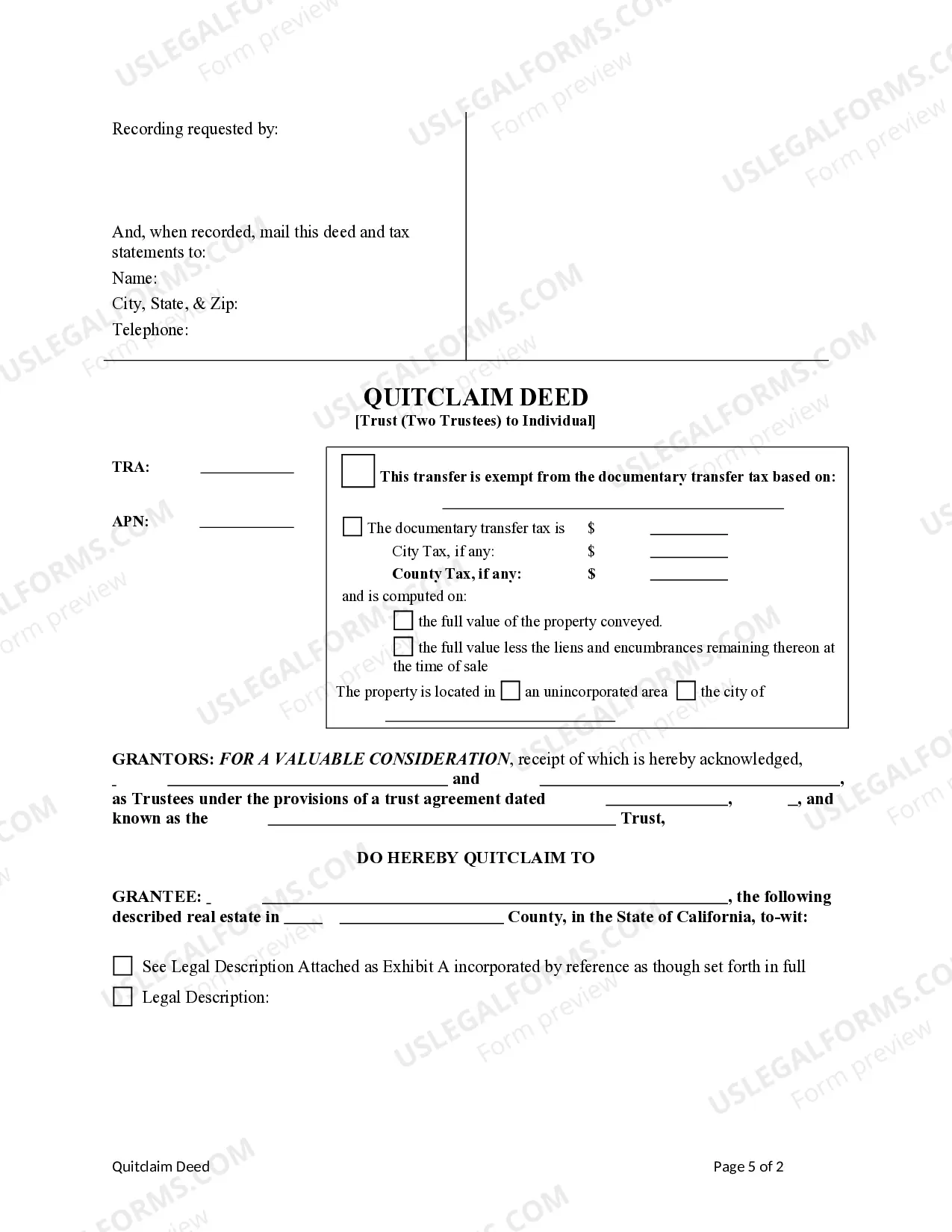

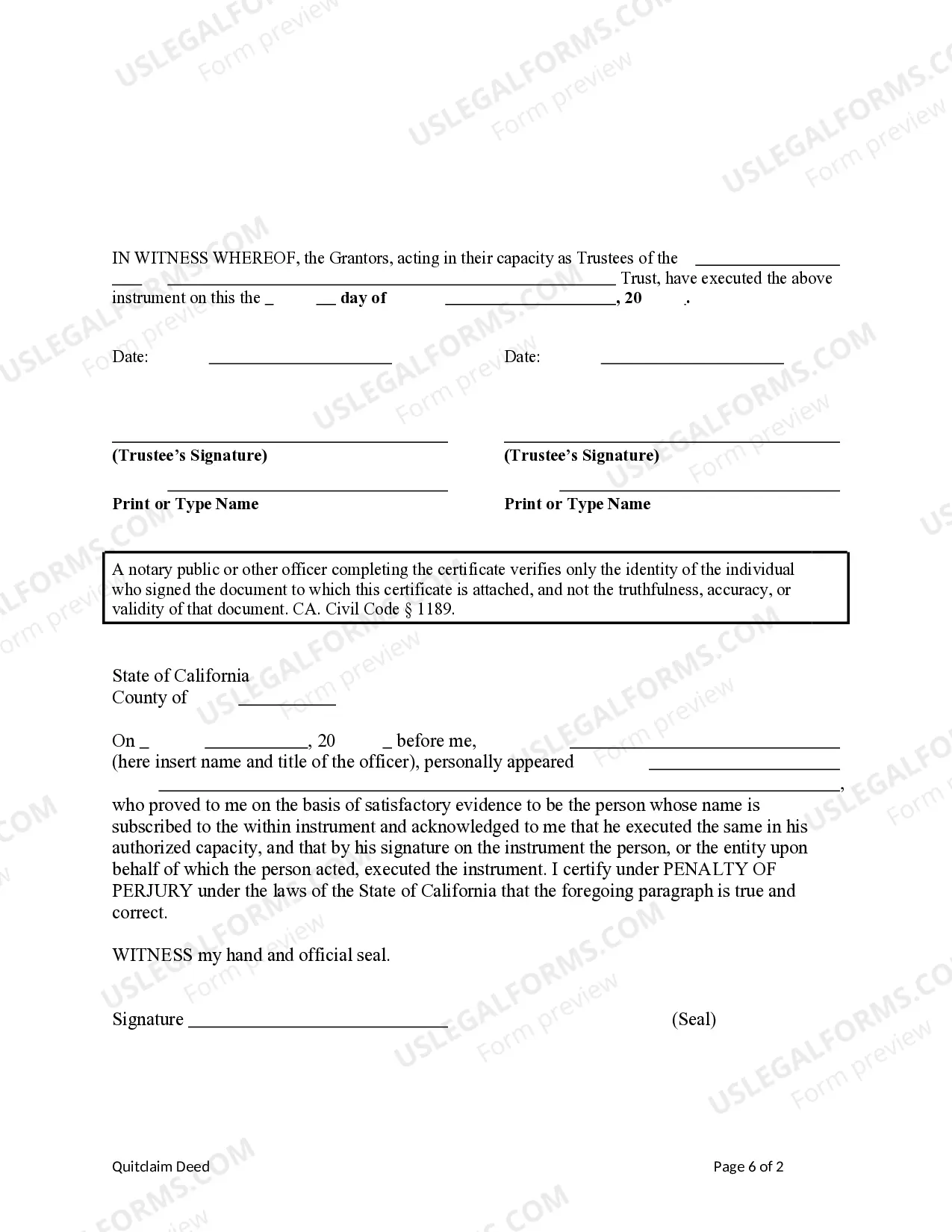

This form is a Quitclaim Deed where the Grantor is Trust, acting by and through two Trustees, to an individual Grantee. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

The Alameda California Quitclaim Deed — Trust (Two Trustees) to an Individual is a legal document that allows the transfer of real property ownership from a trust, with two trustees, to an individual. This type of deed is commonly used in Alameda County, California, and ensures a smooth and transparent transition of property ownership. Reasons for using a quitclaim deed — trust (two trustees) can vary but often include estate planning, asset protection, or transferring property to a beneficiary. This method provides flexibility and control, as the trustees have the authority to manage and distribute the property as directed by the trust. Different types of Alameda California Quitclaim Deed — Trust (Two Trustees) to an Individual may include: 1. Revocable Living Trust Quitclaim Deed — This allows for property transfer while the trust remains revocable, meaning it can be modified or revoked by the granter at any time. This type of trust offers flexibility and control during the granter's lifetime. 2. Testamentary Trust Quitclaim Deed — This type of deed becomes effective upon the granter's death as outlined in their will or testamentary trust. It ensures the smooth transition of the property to the designated beneficiary or beneficiaries, as specified in the granter's estate plan. 3. Special Needs Trust Quitclaim Deed — Often used when an individual has special needs or disabilities, this type of deed allows for the transfer of property to a trust to ensure ongoing financial support and eligibility for government benefits. Trustees manage the property on behalf of the beneficiary to provide for their specific needs. 4. Charitable Remainder Trust Quitclaim Deed — This type of trust allows property owners to transfer real estate to a trust, receive income from it during their lifetime, and then donate the remaining value to a designated charity upon their death. It offers tax advantages for the owner and charitable donation benefits. When preparing an Alameda California Quitclaim Deed — Trust (Two Trustees) to an Individual, it is crucial to consult an experienced attorney familiar with the laws and regulations of Alameda County and California to ensure proper execution and adherence to legal requirements. Accuracy and compliance in documenting real estate transfers are essential to safeguarding the interests of all parties involved. Keywords: Alameda California, Quitclaim Deed, Trust, Two Trustees, Individual, Revocable Living Trust, Testamentary Trust, Special Needs Trust, Charitable Remainder Trust, property transfer, estate planning.The Alameda California Quitclaim Deed — Trust (Two Trustees) to an Individual is a legal document that allows the transfer of real property ownership from a trust, with two trustees, to an individual. This type of deed is commonly used in Alameda County, California, and ensures a smooth and transparent transition of property ownership. Reasons for using a quitclaim deed — trust (two trustees) can vary but often include estate planning, asset protection, or transferring property to a beneficiary. This method provides flexibility and control, as the trustees have the authority to manage and distribute the property as directed by the trust. Different types of Alameda California Quitclaim Deed — Trust (Two Trustees) to an Individual may include: 1. Revocable Living Trust Quitclaim Deed — This allows for property transfer while the trust remains revocable, meaning it can be modified or revoked by the granter at any time. This type of trust offers flexibility and control during the granter's lifetime. 2. Testamentary Trust Quitclaim Deed — This type of deed becomes effective upon the granter's death as outlined in their will or testamentary trust. It ensures the smooth transition of the property to the designated beneficiary or beneficiaries, as specified in the granter's estate plan. 3. Special Needs Trust Quitclaim Deed — Often used when an individual has special needs or disabilities, this type of deed allows for the transfer of property to a trust to ensure ongoing financial support and eligibility for government benefits. Trustees manage the property on behalf of the beneficiary to provide for their specific needs. 4. Charitable Remainder Trust Quitclaim Deed — This type of trust allows property owners to transfer real estate to a trust, receive income from it during their lifetime, and then donate the remaining value to a designated charity upon their death. It offers tax advantages for the owner and charitable donation benefits. When preparing an Alameda California Quitclaim Deed — Trust (Two Trustees) to an Individual, it is crucial to consult an experienced attorney familiar with the laws and regulations of Alameda County and California to ensure proper execution and adherence to legal requirements. Accuracy and compliance in documenting real estate transfers are essential to safeguarding the interests of all parties involved. Keywords: Alameda California, Quitclaim Deed, Trust, Two Trustees, Individual, Revocable Living Trust, Testamentary Trust, Special Needs Trust, Charitable Remainder Trust, property transfer, estate planning.