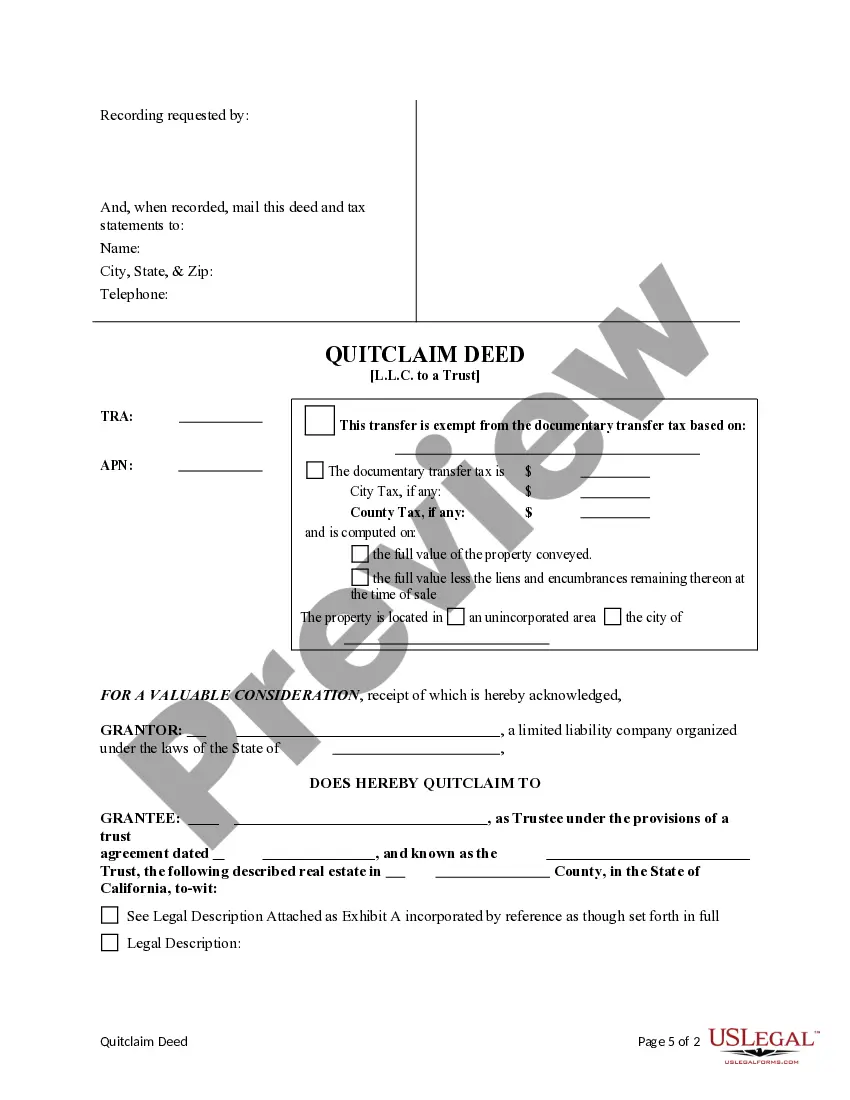

This form is a Quitclaim Deed where the Grantor is an LLC and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A Corona California Quitclaim Deed from a Limited Liability Company to a Trust refers to the legal transfer of property ownership from an LLC to a trust without any guarantee or warranty. This type of transaction is commonly used when an LLC wants to transfer a property to a trust without providing any assurances about the property title or condition. A quitclaim deed is a legal document that allows the transfer of property rights, interests, or claims from one party (in this case, the LLC) to another party (the trust). In this context, the Corona California Quitclaim Deed specifically pertains to properties located within the city of Corona, California. The use of a Limited Liability Company (LLC) as a granter (the transferring party) provides liability protection to the property owner(s), as an LLC separate from individual owners shields personal assets from potential lawsuits or debts associated with the property. Transferring property ownership from an LLC to a trust can offer the trust's beneficiaries certain tax benefits, asset protection, and streamline estate planning. It's worth noting that while there are no specific types of Corona California Quitclaim Deeds from an LLC to a Trust, individuals may come across different variations or scenarios associated with this kind of transfer. Some specific examples could include: 1. Single-Member LLC to Trust Transfer: This occurs when a sole member of an LLC decides to transfer the property owned by the LLC to a trust in order to ensure the seamless transfer of ownership and potential estate planning advantages. 2. Multi-Member LLC to Trust Transfer: If an LLC has multiple members, each with their own percentage of ownership in the LLC, a quitclaim deed might be used to transfer the property to a trust. In this scenario, the trust's beneficiaries may vary based on the terms set forth in the trust agreement. 3. LLC Dissolution and Trust Transfer: If an LLC decides to dissolve, the property owned by the LLC can be transferred to a trust through a quitclaim deed. This type of transfer may be done for estate planning purposes or as a means of winding down the LLC's affairs. In conclusion, a Corona California Quitclaim Deed from a Limited Liability Company to a Trust involves transferring property ownership from an LLC to a trust without providing any warranty or guarantee on the property. While there may not be specific variations of this type of deed, different scenarios can involve single-member or multi-member LLC transfers, as well as transfers related to LLC dissolution.